Expert view: China signals the end of rock‑bottom solar prices

1 day ago· China''s solar industry has entered a new phase. After years of cut‑price competition and unchecked capacity expansion, the market now faces higher costs, explains Gerard

Get a quote

Renewables helping China to halve power prices

The massive increase in solar module production capacity and PV installations in China is helping the country to maintain relatively low, stable

Get a quote

Why are solar panels and batteries from China so cheap?

This raises the question: Why are solar panels and batteries so much cheaper in China? The reactionary answer is that they''re only cheap because of unfair subsidies and

Get a quote

Cheap solar panels from China are all over Europe

Europe is installing more solar panels than ever before, thanks to a flood of cheap Chinese solar panels, driving installations by 40% last year. But it comes at a hefty cost: Local...

Get a quote

How China came to dominate the world in solar energy

BEIJING – China unleashed the full might of its solar energy industry in 2023. It installed more solar panels than the United States has in its history. It cut the wholesale price

Get a quote

Solar Energy Cost Per kW by Country

Solar Energy Cost depends of Several Factors – Cost of Solar Modules and other Hardware, Cost of Solar Inverter and Battery, Installation Cost etc. Though cost of Solar

Get a quote

Renewables helping China to halve power prices compared to US, Europe

The massive increase in solar module production capacity and PV installations in China is helping the country to maintain relatively low, stable power prices compared to

Get a quote

Why are solar panels and batteries from China so

This raises the question: Why are solar panels and batteries so much cheaper in China? The reactionary answer is that they''re only cheap

Get a quote

China Achieves 50% Reduction in Power Prices Through

The substantial surge in solar module production capacity and PV installations within China plays a pivotal role in maintaining comparatively low and stable power prices,

Get a quote

Commission imposes provisional anti-dumping tariffs on Chinese solar panels

Brussels, 4 June– The European Commission today announced a provisional tariff on imports of solar panels, cells and wafers from China. The measure comes following a nine

Get a quote

China''s PV Industry Restructuring Begins: Europe Sees a Return

In 2025, China launches a photovoltaic industry restructuring, stabilizing module prices and prompting European developers to adjust their procurement strategies.

Get a quote

The solar duel: China vs. the United States | MIT Energy Initiative

Over the last decade, manufacturing of PV cells and panels expanded in China, boosting supply globally. The flood of solar panels, combined with a slipping subsidized

Get a quote

Chinese competition poses ''existential threat'' to

They say the influx of China-made solar panels, whose price is artificially lowered through generous state aid, into the EU market is to blame

Get a quote

Outshone By China, Can Europe Make A Solar Comeback Before

While China''s dominance of solar manufacturing is undisputed, a growing chorus of investors, innovators, and policymakers believes Europe can still rebound—if it acts decisively.

Get a quote

Cheap solar panels from China are all over Europe

Europe is installing more solar panels than ever before, thanks to a flood of cheap Chinese solar panels, driving installations by 40% last year. But

Get a quote

EU snubs dying solar manufacturers as China poised

EU snubs dying solar manufacturers as China poised to swallow market The industry asked the European Commission for urgent help to keep

Get a quote

The U.S. and Europe have a choice to make between cutting off

Doing so could compromise Europe''s ability to install enough solar capacity, with most of Europe''s solar panels and parts imported from China. According to the International

Get a quote

Europe''s solar goals caught up in high prices—and

The European Union wants to ally with the sun to boost energy security and meet climate goals but soaring prices for essential raw materials

Get a quote

Global Market Outlook for Solar Power 2025-2029

Structural solar growth continues to be fuelled by China and solar''s unmatched competitiveness due to its record low prices, unique versatility, and further decreasing cost.

Get a quote

Europe''s solar goals caught up in high prices—and China

The European Union wants to ally with the sun to boost energy security and meet climate goals but soaring prices for essential raw materials could thwart those plans.

Get a quote

China dominates EU solar photovoltaic (PV) market:

According to Eurostat data, a staggering 98% of solar panels imported into the EU in 2023 came from China. In monetary terms, the EU

Get a quote

Solar Panels Made in the USA vs. China

Truthfully, the future of solar power is here and now. However, which country is ruling the solar energy industry? Which country''s solar panel

Get a quote

Cost of solar panel manufacturing

Currently, the vast majority of solar panels are manufactured in China where production is cheap others the low cost of utilities and labor Bringing (a share of) solar panel manufacturing

Get a quote

China''s solar industry remains in red as trade war

The company''s sales of solar products, including silicon wafer, solar cells and modules, fell 12.68% year-on-year to 19,130 megawatts in the

Get a quote

China dominates EU solar photovoltaic (PV) market: 98% of solar panels

According to Eurostat data, a staggering 98% of solar panels imported into the EU in 2023 came from China. In monetary terms, the EU imported €19.7 billion worth of solar PV

Get a quote

Clean Energy Costs Expected to Drop 2-11% in 2025,

According to a new report from BloombergNEF, global clean power costs could fall between 2% and 11% this year, despite tariffs. Even with

Get a quote

6 FAQs about [China and Europe produce solar power home prices]

Why is China a good place to buy solar power?

The massive increase in solar module production capacity and PV installations in China is helping the country to maintain relatively low, stable power prices compared to Europe and the United States, which suffer from rising PV curtailment and high inflation, according to Wood Mackenzie.

Does China have a solar power market?

In contrast, China charted a deliberate industrial course, pouring more than $50 billion into scaling its solar PV capacity—ten times more than all EU countries combined. It vertically integrated its supply chains, slashed costs through massive economies of scale, and captured the market.

Is Europe installing more solar panels than ever before?

Europe is installing more solar panels than ever before, thanks to a flood of cheap Chinese solar panels. But it comes at a hefty cost.

Is China doing the same thing with solar panels?

Meanwhile, the US and Europe are tightening their rules on Chinese cars and EV parts being sold in their countries, with tariffs so high in the US that China has turned its focus on other areas, namely South America, Asia, and Europe. Meanwhile, some European panel makers are saying that China has been doing the same thing with solar panels.

Can Europe compete with China's solar industry?

“The solar industry in China has been strategically subsidized with hundreds of billions of dollars for years,” Gunter Erfurt, CEO of Swiss PV maker Meyer Burger, told Reuters. Europe, for now, just can’t compete – and at least needs to buy some more time to catch up. To reduce your carbon footprint and live more sustainably, consider going solar.

Why is China booming in solar?

Analyst Sharon Feng attributes China's rapid expansion in solar manufacturing and reduction in solar module costs to its large domestic scale and robust export growth, effectively overcoming cost inflation challenges observed in other markets.

Guess what you want to know

-

Latest solar power prices for home use in Mauritania

Latest solar power prices for home use in Mauritania

-

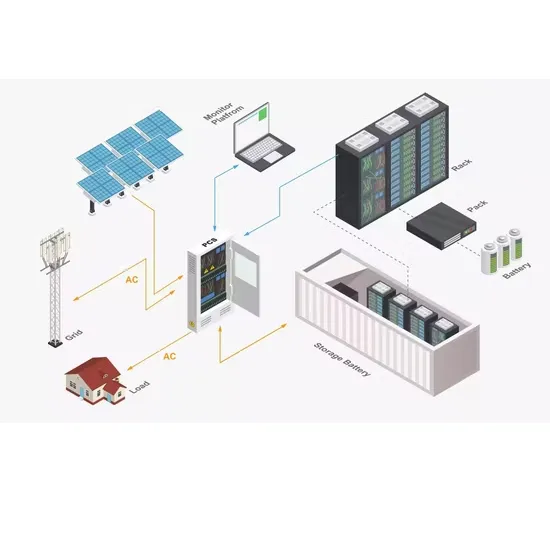

Solar power generation and storage system for home use complete set

Solar power generation and storage system for home use complete set

-

West Asia Solar Power Generation for Home Use

West Asia Solar Power Generation for Home Use

-

Japanese high solar power generation home recommendation

Japanese high solar power generation home recommendation

-

Home solar integrated wind power generation

Home solar integrated wind power generation

-

Temporary solar power generation for home use

Temporary solar power generation for home use

-

What is the power of a home solar water pump inverter

What is the power of a home solar water pump inverter

-

Wholesale prices for solar power generation and energy storage

Wholesale prices for solar power generation and energy storage

-

Can solar power be installed for home use in Asia

Can solar power be installed for home use in Asia

-

Sanda solar power generation for home use

Sanda solar power generation for home use

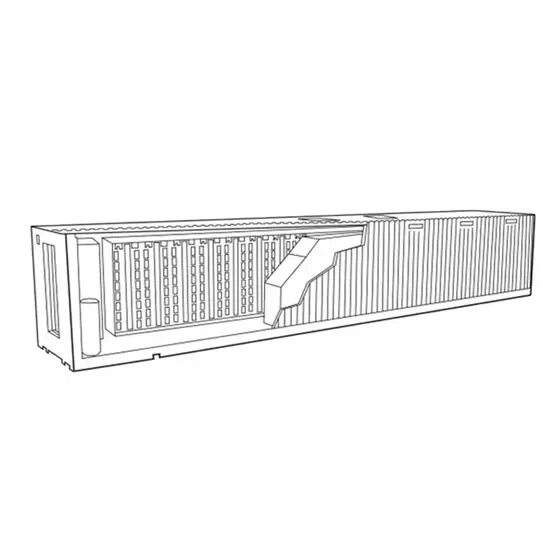

Industrial & Commercial Energy Storage Market Growth

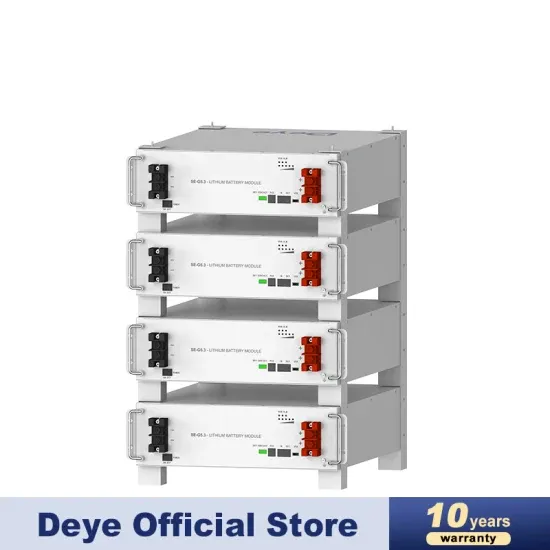

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

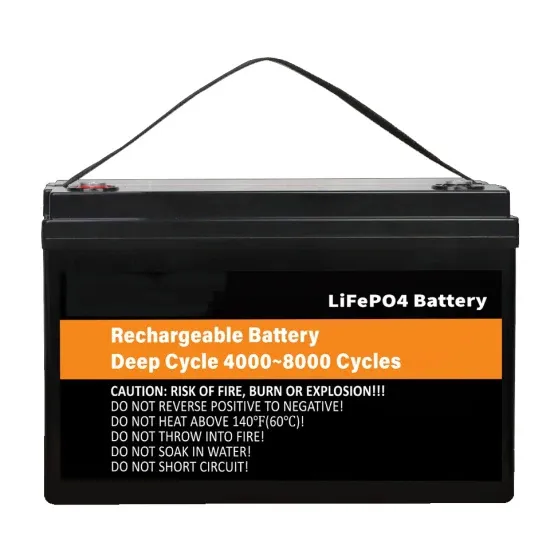

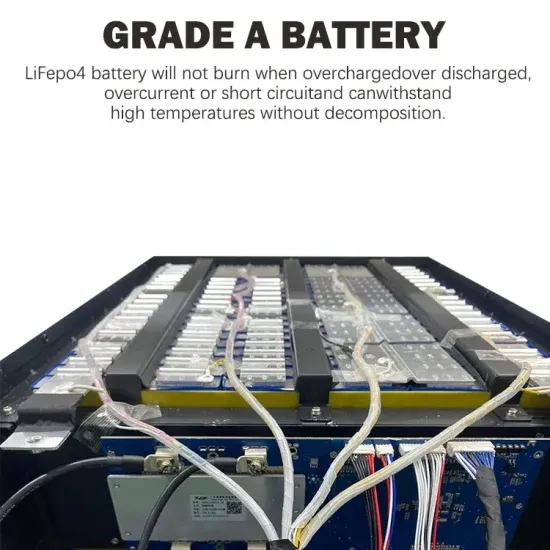

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.