Solar Maps for South America | AltE Store

Maps of insolation and solar PV potential across South America. Above is an insolation map for South America showing the estimated daily and yearly solar

Get a quote

Latin America on track to harness solar power potential

Countries in Latin America and the Caribbean have the largest solar power development pipeline outside Eastern Asia and North America,

Get a quote

South America Solar Photovoltaic Market Size,

Crystalline silicon solar panels dominate the South American solar photovoltaic market, owing to their high efficiency, reliability, and established technology.

Get a quote

Solar Resource Data, Tools, and Maps

Solar Resource Maps and Data Find and download resource map images and data for North America, the contiguous United States, Canada, Mexico, and Central America.

Get a quote

Top five solar power producers of South America

Brazil, Chile, Argentina, Peru and Uruguay currently lead the solar power parade in the continent, as the climatic conditions in these countries

Get a quote

South America Solar Panel Industry Report 2025 | Market Size

In 2023, the Photovoltaic Systems segment accounted for noticeable share of global South America Solar Panel Market and is projected to experience significant growth in

Get a quote

South America Solar Panel Industry Report 2025 | Market Size

In 2023, the Photovoltaic Systems segment accounted for noticeable share of global South America Solar Panel Market and is projected to experience significant growth in the near future.

Get a quote

South America solar PV market outlook 2024

This regional report assesses the 10-year outlook for solar PV power development in South America. It consolidates key drivers and barriers impacting new solar PV capacity

Get a quote

South America Solar Photovoltaic Market Analysis

The South America Solar Photovoltaic Market has witnessed remarkable growth over the past decade, driven by increasing environmental concerns,

Get a quote

Adaptation of solar energy in the Global South: Prospects,

First, it seeks to assess the potential of solar energy as a viable remedy for the range of challenges prevalent in the Global South. From diminishing the energy access gap to

Get a quote

Solar energy in Latin America

Aligned with global trends, the installed solar photovoltaic capacity in Latin America and the Caribbean has greatly increased in the last decade, surpassing 85 gigawatts

Get a quote

Solar Maps for South America | AltE Store

Maps of insolation and solar PV potential across South America. Above is an insolation map for South America showing the estimated daily and yearly solar energy available for energy

Get a quote

South America Solar Growth in 2024: Achievements and Challenges

Latin America receives some of the highest solar radiation in the world, making it a hub for solar energy and photovoltaic systems. In fact, the Atacama Desert in Chile, which has

Get a quote

Top 10 Solar Developers in Latin America and Caribbean

Solar PV is the technology of choice for developers of utility-scale solar farms, commercial and industrial rooftop projects, and residential installations. As an emissions-free

Get a quote

Top 7 Solar Panel Manufacturers in Brazil

Brazil, with its abundant sunshine and favorable government policies, is at the forefront of solar energy production in South America. In this article, we will

Get a quote

South America Solar Photovoltaic Industry 2025-2033 Trends:

The solar photovoltaic (PV) sector in South America is witnessing significant expansion, propelled by the region''s advantageous solar conditions and a strong commitment

Get a quote

Cauchari Solar Project, Puna plateau, Jujuy,

Cauchari Solar Project, Jujuy The Cauchari solar project in Argentina''s northernmost province Jujuy is one of the biggest photovoltaic

Get a quote

South America will add 160 GW of solar capacity by 2034

South America is set to add 160 GW of solar photovoltaic capacity between 2025 and 2034, driven by energy diversification, growing electricity demand, and favourable system

Get a quote

South America Solar Photovoltaic Market Analysis

The South America Solar Photovoltaic Market has witnessed remarkable growth over the past decade, driven by increasing environmental concerns, supportive government policies,

Get a quote

Latin America and Caribbean on the Brink of Massive Solar Power

By that time, solar PV would represent the second-largest power source behind wind, generating a quarter of the world''s power, " Future of Solar Photovoltaic " launched

Get a quote

South America Solar Growth in 2024: Achievements

Latin America receives some of the highest solar radiation in the world, making it a hub for solar energy and photovoltaic systems. In fact, the

Get a quote

South America solar PV market outlook 2025

This report is an updated and segmented version of our previous South America solar PV outlooks, offering clients a deeper understanding of the factors influencing solar

Get a quote

Solar power in the United States

Solar power includes solar farms as well as local distributed generation, mostly on rooftops and increasingly from community solar arrays. In 2024, utility-scale

Get a quote

Top five solar power producers of South America

Brazil, Chile, Argentina, Peru and Uruguay currently lead the solar power parade in the continent, as the climatic conditions in these countries support high irradiation, which is

Get a quote

South America Solar Photovoltaic Market Size,

South America Solar Photovoltaic Market Valuation – 2024-2031 The growing emphasis on renewable energy sources and environmental sustainability is

Get a quote

South America Solar Photovoltaic Market Size | Mordor Intelligence

The South America Solar Photovoltaic Market is growing at a CAGR of greater than 11% over the next 5 years. Enel Green Power S.p.A., Trina Solar Limited, Atlas Renewable

Get a quote

South America Solar Photovoltaic Market Size, & Forecast 2031

Crystalline silicon solar panels dominate the South American solar photovoltaic market, owing to their high efficiency, reliability, and established technology. These panels account for between

Get a quote

Top five renewable energy producers of South America

A significant part of South America''s renewable energy is generated by hydropower facilities in the likes of Brazil and Venezuela. Wind

Get a quote

South America to Add 160 GW of Solar PV Capacity by 2034

Wood Mackenzie''s latest report on the South American solar PV market reveals that the region will add 160 GWdc of solar capacity between 2025 and 2034, driven by

Get a quote

6 FAQs about [South America solar panels photovoltaic panels]

Who owns the South America solar photovoltaic market?

The South America solar photovoltaic market is fragmented. Some of the major players in the market include Enel Green Power S.p.A., Trina Solar Limited, Atlas Renewable Energy, Sonnedix Power Holdings Ltd, and Canadian Solar Inc.

Which segment is the largest market for solar photovoltaic in South America?

Moreover, owing the a large number of upcoming solar PV projects, ground mounted segment is expected largest share in the South America solar photovoltaic market over the forecast period. Brazil is one of the largest markets for renewable energy in South America. Solar was the most competitive energy source among all renewables featured in 2019.

What are the key drivers of South America solar photovoltaic market?

South America solar photovoltaic market is expected to grow at a CAGR of more than 11% during the forecast period. The primary drivers of the market include supportive government policies, rising demand for renewable energy, efforts to reduce GHG emissions, and the declining cost of solar PV systems.

Will Brazil dominate the South America solar PV market?

Overall, Brazil’s solar power sector is set to experience a decent growth, and is likely to dominate the South America solar PV market during the forecast period. The South America solar photovoltaic market is fragmented.

Which country has the most solar energy in South America?

Brazil is the leader in solar energy in South America as it surpassed 50 GW of installed capacity in 2024. South America continued its steady solar growth over the last half-decade in particular, and overall renewable energy capacity additions in general, through the year 2024.

Why is solar energy important in South America?

The region has a large amount of sun, wind, water, and other natural resources that can be harnessed to generate clean energy. Solar energy, which is at the helm of global energy transition goals, is a crucial energy source powering the transition for the South American continent as well.

Guess what you want to know

-

South America solar panels photovoltaic panels

South America solar panels photovoltaic panels

-

Photovoltaic solar panels in South Ossetia

Photovoltaic solar panels in South Ossetia

-

One square meter of photovoltaic solar panels

One square meter of photovoltaic solar panels

-

Selection of thickness of photovoltaic solar panels

Selection of thickness of photovoltaic solar panels

-

Solar photovoltaic panels installed in Italy

Solar photovoltaic panels installed in Italy

-

Lunji Photovoltaic Solar Panels

Lunji Photovoltaic Solar Panels

-

Senegal Yuanxian Solar Photovoltaic Panels

Senegal Yuanxian Solar Photovoltaic Panels

-

Will the photovoltaic industry affect the price of solar panels

Will the photovoltaic industry affect the price of solar panels

-

The most efficient solar photovoltaic panels

The most efficient solar photovoltaic panels

-

Double-layer solar panel photovoltaic panels

Double-layer solar panel photovoltaic panels

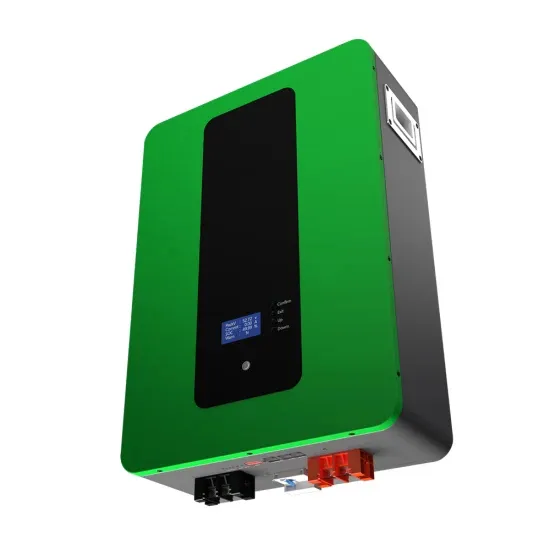

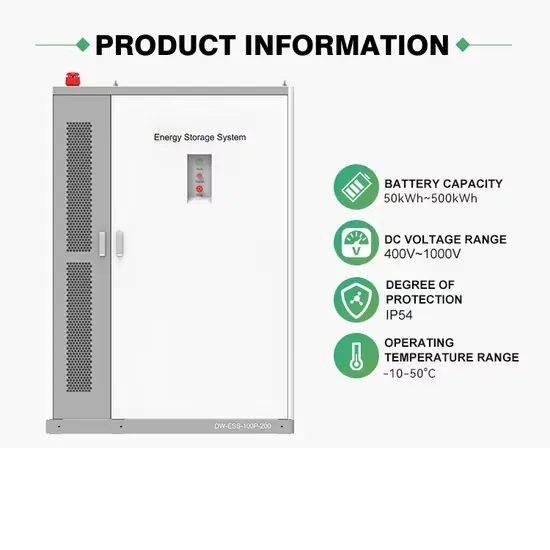

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

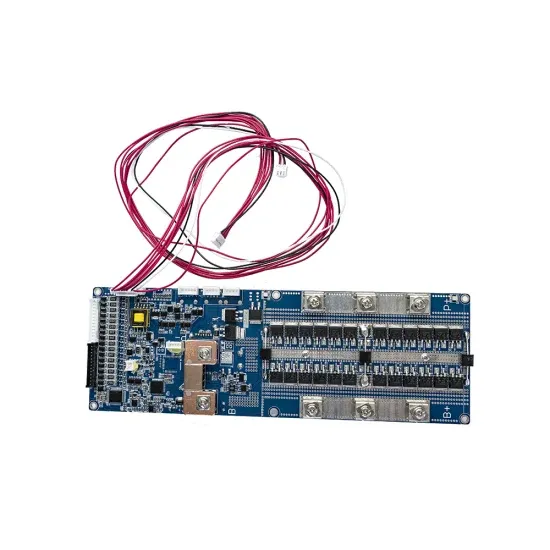

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.