Wind, Solar, Storage Heat Up in 2025

Dozens of large-scale solar, wind, and storage projects will come online worldwide in 2025, representing several gigawatts of new capacity. The Oasis de Atacama in Chile will

Get a quote

In 12 months the renewables market has moved but

In the IEA Net Zero Scenario, over 90% of the renewable capacity growth by 2030 is expected to be from solar and wind, with the former

Get a quote

What''s Next for the Solar Energy Storage Industry?

The cost of battery energy storage systems for grid applications also fell by 93%, supported by an abundance of renewable energy technology manufacturing capacity in China.

Get a quote

Energy storage on the rise as world bets on wind and solar

Energy storage is set to become one of the fastest growing markets in the global power industry over the next decade to support the continued steep rise of wind and solar,

Get a quote

Integrated Wind Solar And Energy Storage Market: Trends

• With an expected CAGR of 9.5% from 2025 to 2035, the Integrated Wind Solar and Energy Storage Market is set for significant growth, fueled by increasing investments in

Get a quote

Hybrid Solar Wind Energy Storage Market Size,

Growing concerns about energy security, increasing demands for sustainable energies and government support of sustainability programs are the main

Get a quote

Renewables and storage are better together | Energy Global

In each market, there are more planned solar-plus-storage projects than wind-plus-storage. For example, of the 365 GW of hybrid renewables that will be installed in

Get a quote

The Economic Impact of Renewable Energy and Energy

Executive Summary This analysis assesses many aspects of utility-scale wind, solar, and energy storage investments in Texas, including local tax collections, landowner payments, and the

Get a quote

Hybrid Solar Wind Energy Storage Market Size, Growth, Trends

Growing concerns about energy security, increasing demands for sustainable energies and government support of sustainability programs are the main characteristics of global hybrid

Get a quote

Mind the gap: Comparing the net value of geothermal, wind, solar

Looking ahead through 2026, continued growth in the market share of wind, solar, and storage should improve geothermal''s relative market value, yet likely not by enough to overcome the

Get a quote

Mind the gap: Comparing the net value of geothermal, wind, solar

Looking ahead through 2026, continued growth in the market share of wind, solar, and storage should improve geothermal''s relative market value, yet likely not by enough to

Get a quote

OB3 and market uncertainty has put more pressure than ever on

4 days ago· Recorded live at RE+ 2025, this Interchange Recharged episode explores clean energy asset optimization, wind and solar performance gains, grid utilisation and energy

Get a quote

Hybrid Solar Wind Energy Storage Market

In 2024 and 2025, hybrid solar-wind systems became increasingly popular for off-grid and remote areas where access to reliable power is limited. These systems provide a stable and

Get a quote

Operation Strategy of Integrated Wind-Solar-Hydrogen-Storage

With the continuous construction of China''s electricity market, promoting renewable energy into electricity market is the general trend. Scaled hydrogen production using renewable energy is

Get a quote

Hybrid Solar Wind Energy Storage Market is expected to Grow

Growing demand for reliable, sustainable energy solutions and increasing adoption of renewable power sources drive the hybrid solar wind energy storage market, enabling efficient energy

Get a quote

Hybrid Solar-Wind and Energy Storage Market Size ($3.56

Renewable energy sources are projected to contribute more than 80% of the energy capacity increases globally by 2030, and thus, integration of solar, wind, and energy storage resources

Get a quote

What''s Ahead for Solar and Wind in 2025: Insights from Infocast

What role will solar, wind and storage technologies play in addressing the pending "energy emergency" in the United States, and how is the industry responding to heightened

Get a quote

Solar Market Insight Report Q3 2025

6 days ago· 1. Key Figures The US solar industry installed 7.5 gigawatts direct current (GW dc) of capacity in Q2 2025, a 24% decline from Q2 2024 and a 28% decrease since Q1 2025. Solar

Get a quote

Wind and Solar Hybrid Power Plants for Energy Resilience

Wind-solar-storage hybrid power plants represent a significant and growing share of new proposed projects in the United States (U.S.). Their uptake is supported by increasing

Get a quote

Grid connection backlog grows by 30% in 2023, dominated by

"Pairing electric generation with co-located storage can add market value and flexibility, especially in regions with a lot of solar and wind like California," said co-author Will

Get a quote

Frontiers | Optimal revenue sharing model of a

This paper proposes an optimal revenue sharing model of wind-solar-storage hybrid energy plant under medium and long-term green power

Get a quote

Wind Energy Market Size, Growth Outlook 2025-2034

The wind energy market size crossed USD 174.5 billion in 2024 and is expected to grow at a CAGR of over 11.1% from 2025 to 2034, driven by the growing adoption of off grid &

Get a quote

Report reveals impressive change in massive energy

The Canadian Renewable Energy Association announced that the country''s wind, solar, and energy storage markets had grown 46% over five

Get a quote

Here comes the boom: Wood Mackenzie forecasts

Fellow Virginia utility Dominion Energy''s Scott Solar facility in Powhatan County, Virginia. Courtesy: Dominion Energy We are living in the

Get a quote

Integrated Wind Solar and Energy Storage Market

Governments worldwide are accelerating integrated wind-solar-storage (IWSS) adoption through **renewable energy mandates**, **grid modernization incentives**, and **storage-specific

Get a quote

5 FAQs about [Wind Solar and Storage Market]

What are the biggest solar and storage projects in the US?

One of the biggest solar and storage projects underway in the U.S. is Longroad Energy’s Sun Streams Complex in Arizona, totaling 973 MW of solar and 600 MW/2.4 GWh of battery storage capacity. After the first two phases began operations in 2021 and 2024, the fourth and largest project is underway with 377 MW of solar and 300 MW/1.2 GWh of storage.

How does wind and solar integration affect battery development?

Voltage instability and decreasing grid inertia have emerged as significant side effects of growing wind and solar integration, shifting the market towards grid-scale storage solutions to balance supply and demand. Last year, the EIA estimated that developers would bring more than 300 utility-scale battery projects online by 2025 (9 GW).

Are land-based and offshore wind projects in demand?

Land-based wind projects are in demand in the U.S., while offshore wind is gaining traction in the U.K. and Europe. The latest projects incorporate next-generation solar and wind components as manufacturers expand their performance and efficiency to meet market demand.

How many homes can a wind turbine power?

When it becomes operational in August 2025, it will deliver enough power for 83,000 homes. The company has assembled all 88 turbines, and operations are expected to begin in August 2025. A future phase could add more wind units and a lithium-ion battery storage installation.

How many solar projects are under construction?

In the U.S., more than 112 GW of large-scale solar projects are under construction or development, according to a database from the Solar Energy Industries Association. Most utility-scale and commercial solar projects slated to come online in the next few years have already secured an interconnection agreement or started construction.

Guess what you want to know

-

Wind solar energy storage and other power supply solutions

Wind solar energy storage and other power supply solutions

-

Jordan Wind Solar and Energy Storage Project

Jordan Wind Solar and Energy Storage Project

-

What is wind and solar energy storage power supply

What is wind and solar energy storage power supply

-

Swiss wind solar storage and transmission integration

Swiss wind solar storage and transmission integration

-

Proportion of wind solar and energy storage

Proportion of wind solar and energy storage

-

Belgian wind solar and energy storage project

Belgian wind solar and energy storage project

-

New energy storage is mainly based on wind and solar power

New energy storage is mainly based on wind and solar power

-

KW wind solar and storage

KW wind solar and storage

-

Andorra wind solar storage and transmission integration

Andorra wind solar storage and transmission integration

-

Nigeria Wind Solar and Storage

Nigeria Wind Solar and Storage

Industrial & Commercial Energy Storage Market Growth

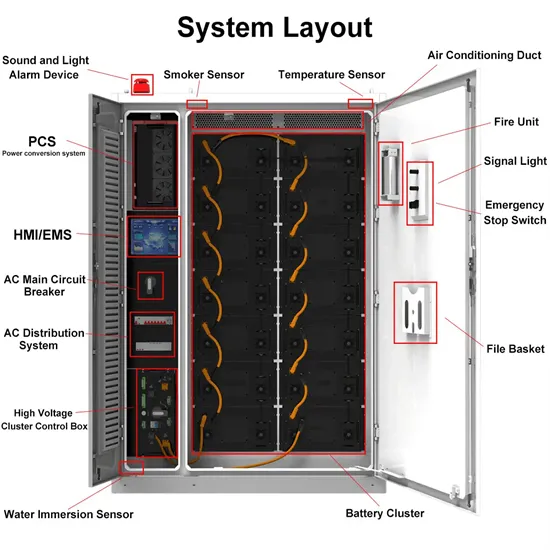

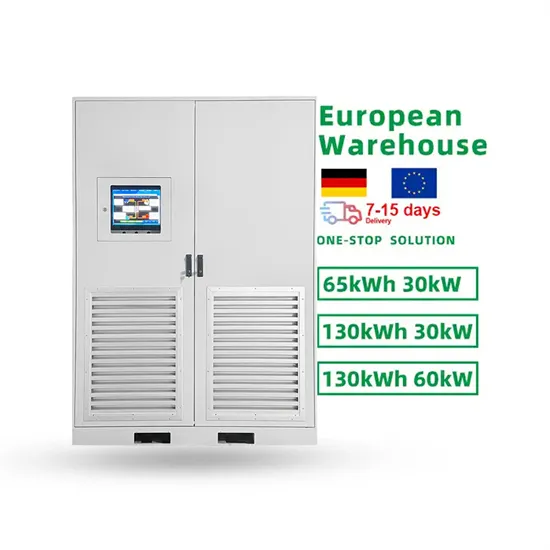

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.