in Cambodia

The Partner Organizations Supporting this Paper "Rooftop solar is essential for us in order to attract new, more modern suppliers and to grow production in Cambodia. This is a competitive

Get a quote

Cambodia Approves $5.79 Billion in Clean Energy Projects to Boost Power

The projects include 12 solar power plants, 6 wind power projects, a combined solar-biomass plant, a gas-fired (LNG) power station, a hydropower project, and 2 large-scale

Get a quote

Cambodia Greenlights $5.79B Investment in 23 Energy Projects

The 23 approved energy development projects include 12 solar power projects, 6 wind power projects, 1 combined solar-biomass project, 1 gas-fired (LNG) power plant, 1

Get a quote

Renewable Energy in Cambodia – Opportunities and

The future of renewable energy in Cambodia is one of solar, wind and hydropower. And those who get behind it today, will be well rewarded.

Get a quote

Cambodia Approves $5.79 Billion in Clean Energy Projects to

The projects include 12 solar power plants, 6 wind power projects, a combined solar-biomass plant, a gas-fired (LNG) power station, a hydropower project, and 2 large-scale

Get a quote

Wind energy in Cambodia: deal for first wind farm with

The government and French-owned The Blue Circle (Cambodia) Co Ltd will soon sign an agreement to build a wind farm in Kampot province – the first of its

Get a quote

Cambodia Issues $50 Million Green Bond to Fund 60MW Solar Power

Key Points: 📈 $50M Bond for Solar Plant: SchneiTec Dynamic issues a 15-year green bond, listed on CSX, to finance a 60MW solar project in Kampong Chhnang province. 🌱

Get a quote

Cambodian government approves 23 power investment projects

The planned 23 projects included 12 solar power projects, six wind power projects, one hybrid combined biomass and solar power project, one LNG-gas-fired project, one

Get a quote

ADB, EDC Sign Mandate for 2 GW Solar and Battery Storage Power

ADB signed a transaction advisory services mandate with Cambodia''s national utility company Électricité du Cambodge to support the development of 2 gigawatts of solar

Get a quote

ADB-supported National Solar Park in Cambodia

A partnership between ADB and Electricite du Cambodge to develop a National Solar Park reached a milestone with the park''s first 60 MW

Get a quote

Cambodia approves 23 power sector projects, including 2 energy

These projects will significantly boost Cambodia''s domestic power supply capacity, providing more reliable and affordable electricity, effectively addressing domestic power

Get a quote

The Cambodian Cabinet approved 23 power

These projects cover a wide range of energy sectors, including: 12 solar projects, 6 wind projects, 1 biomass and solar combined project, 1

Get a quote

Cambodia approves $5.79B investment in 23 Energy

The Cambodian Council of Ministers has approved 23 new energy investment projects for 2024-2029, totaling $5.79 billion. These projects

Get a quote

Cambodia to Embrace Wind Power in Mondulkiri and

Renewable or clean energy used in Cambodia has accounted for more than 62 percent of the country''s total consumption, according to the

Get a quote

Cambodian gov''t approves 23 power investment projects for next

The planned 23 projects included 12 solar power projects, six wind power projects, one hybrid combined biomass and solar power project, one LNG-gas-fired project, one

Get a quote

Cambodian government approves 23 power

The planned 23 projects included 12 solar power projects, six wind power projects, one hybrid combined biomass and solar power project, one

Get a quote

Cambodia Approves USD 5.79 Billion Investment in 23

These 23 projects will include 12 solar energy ventures, 6 wind energy developments, a biomass-solar hybrid project, an LNG power plant, a hydropower project, and

Get a quote

Cambodia approves $5.79B investment in 23 Energy Projects to

The Cambodian Council of Ministers has approved 23 new energy investment projects for 2024-2029, totaling $5.79 billion. These projects include solar, wind, biomass, and

Get a quote

Renewable Energy in Cambodia – Opportunities and Challenges

The future of renewable energy in Cambodia is one of solar, wind and hydropower. And those who get behind it today, will be well rewarded.

Get a quote

Cambodia to integrate wind power into national grid by 2026

Wind power is set to be connected to Cambodia''s national grid by 2026, adding a new clean energy source to diversify and strengthen the country''s energy supply, supporting

Get a quote

50248-001: Cambodia Solar Power Project | Asian

The project is the first utility-scale solar power plant in Cambodia, and the first competitively tendered renewable energy IPP project in the country. ADB''s

Get a quote

The Cambodian Cabinet approved 23 power investment plans

These projects cover a wide range of energy sectors, including: 12 solar projects, 6 wind projects, 1 biomass and solar combined project, 1 liquefied natural gas project, 1

Get a quote

Cambodia approves 23 power sector projects, including 2 energy storage

These projects will significantly boost Cambodia''s domestic power supply capacity, providing more reliable and affordable electricity, effectively addressing domestic power

Get a quote

Cambodia Approves USD 5.79 Billion Investment in 23 Renewable Energy

These 23 projects will include 12 solar energy ventures, 6 wind energy developments, a biomass-solar hybrid project, an LNG power plant, a hydropower project, and

Get a quote

Power Development Masterplan 2022-2040

The PDP is developed with three main objectives: Firstly, to fulfill the future demand for power adequacy with the supply of reliable and affordable electricity across all sectors in Cambodia.

Get a quote

Energy Outlook and Energy-Saving Potential in East Asia

The share of solar and wind energy is projected to increase by 14.2% in 2050 to comply with the policy on renewable energy, which promotes utilising clean energy to the maximum extent

Get a quote

Cambodian Gov''t Approves 23 Power Investment Projects for

"Of the 23 projects, there are 21 power generation projects with a total capacity of 3,950 megawatts, and two energy storage station projects that are capable of storing the

Get a quote

Cambodia Greenlights $5.79B Investment in 23

The 23 approved energy development projects include 12 solar power projects, 6 wind power projects, 1 combined solar-biomass project, 1

Get a quote

Cambodian gov''t approves 23 power investment projects for

The planned 23 projects included 12 solar power projects, six wind power projects, one hybrid combined biomass and solar power project, one LNG-gas-fired project, one

Get a quote

Cambodia Approves USD 5.79 Billion Investment in 23 Renewable Energy

The total output from these 21 power stations is projected to reach 3,950 MW, while the two storage stations will add a capacity of 2,000 MW. Together, these projects represent a

Get a quote

6 FAQs about [Cambodia Wind and Solar Energy Storage Power Station]

How many solar projects does Cambodia approve?

Cambodia approves 23 power sector projects, including 2 energy storage plants, 12 solar projects. - EnergyTrend Cambodia approves 23 power sector projects, including 2 energy storage plants, 12 solar projects.

How will Cambodia's energy projects improve energy security?

These projects will generate a combined capacity of 3,950 MW, while the energy storage facilities will provide an additional 2,000 MW. With a total investment of $5.79 billion, the projects aim to ensure a stable and affordable power supply, enhancing Cambodia’s energy security by reducing reliance on energy imports.

How many solar projects are approved in Khmer?

According to the Khmer Times, the approved projects include 12 solar projects, 6 wind projects, 1 biomass and solar combined project, 1 LNG power generation project, 1 hydropower project, and 2 energy storage stations.

Why is Cambodia investing $579 billion in energy projects?

With a total investment of $5.79 billion, the projects aim to ensure a stable and affordable power supply, enhancing Cambodia’s energy security by reducing reliance on energy imports. The initiative also supports Cambodia’s goal of achieving 70% clean energy by 2030, contributing to global greenhouse gas reduction targets.

Where are solar power plants located in Cambodia?

Currently, solar power plants providing a total of 160 mW are located in Bavet city, Svay Rieng province, Kampong Speu province, and Kampong Chhnang province. Cambodia’s existing solar power stations are already generating energy and linked to the grids.

Does Cambodia have wind power?

Wind power also remains untapped and among the least explored renewable energy resources. In terms of total annual electrical capacity, the potential for wind power reaches up to 3,665 GWh. Fortunately, these opportunities aren’t likely to merely remain on paper. Cambodia, through experience, has shown that its energy system is highly adaptable.

Guess what you want to know

-

Wind solar and energy storage power station operation

Wind solar and energy storage power station operation

-

Solomon Islands Wind and Solar Energy Storage Power Station

Solomon Islands Wind and Solar Energy Storage Power Station

-

New Zealand Wind and Solar Energy Storage Power Station

New Zealand Wind and Solar Energy Storage Power Station

-

Build a wind and solar energy storage power station

Build a wind and solar energy storage power station

-

Albania Wind Solar Energy Storage Power Station Project

Albania Wind Solar Energy Storage Power Station Project

-

Somalia has approved a wind solar and energy storage power station

Somalia has approved a wind solar and energy storage power station

-

How much land does the wind and solar energy storage power station occupy

How much land does the wind and solar energy storage power station occupy

-

Malta Wind Solar Energy Storage Power Station Project

Malta Wind Solar Energy Storage Power Station Project

-

Malaysia Wind and Solar Energy Storage Power Station Project

Malaysia Wind and Solar Energy Storage Power Station Project

-

Wind solar energy storage and other power supply solutions

Wind solar energy storage and other power supply solutions

Industrial & Commercial Energy Storage Market Growth

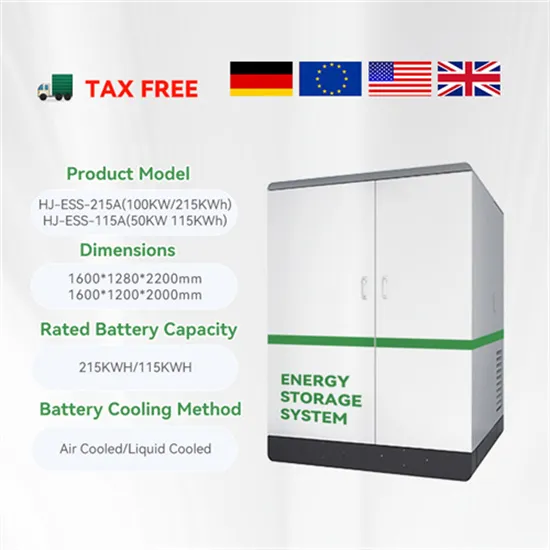

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.