Colombia''s Minister of Mines and Energy discusses

Mesa recounted the history of solar PV adoption in his country and provided details on the most recent developments, including the construction

Get a quote

Thermal management design of battery compartments of outdoor

The life of a battery is directly related to the load applied, proper recharging and, most of all, the ambient temperature of the battery which must be kept at optimum conditions. Batteries for

Get a quote

TELECOMMUNICATION AND PROFESSIONAL USES OF

ABSTRACT. PV-Systems are widely used in telecommunications in Colombia. TELECOM, the national telecomunications company, has installed and ope rated 1939 systems since 1980.

Get a quote

Comprehensive Guide to Telecom Batteries

Telecom batteries play a crucial role in powering equipment, supporting backup systems, and facilitating smooth operations. This comprehensive guide will delve into the

Get a quote

Photovoltaic energy in Colombia: Current status, inventory,

The study presents the projects that have been executed and the ones in execution during the last decade, and the capacity that has been installed up to the present day in both

Get a quote

2 pager

In Colombia, the expansion of electric metres, particularly smart metres, is ongoing. As of March 2024, there are approximately 450,000 smart metres installed across the country.

Get a quote

Colombia''s large-scale PV capacity additions hit 207

Colombia deployed around 207 MW of new utility-scale PV capacity across 25 projects in 2023, according to a report by the operator of

Get a quote

3.4 Colombia Telecommunications | Digital Logistics Capacity

The telecommunications sector has been experiencing an increase in mobile phone services and broadband connections while landline phone service coverage has declined over the last

Get a quote

Colombia''s first-ever battery storage tender won by Canadian Solar

Battery storage has been gradually gaining a foothold in the wider Latin America region, with potential for greater renewables integration and also adding reliability to often very

Get a quote

Colombia''s Utility PV Potential

When asked about the opportunities for PV in the country, Esteban Uauy, Global Head of Structured Finance at Atlas Renewable Energy, described the growing interest around

Get a quote

Optimum sizing and configuration of electrical system for

This research aims to develop a mathematical model and investigates an optimization approach for optimal sizing and configuration of solar photovoltaic (PV), battery

Get a quote

H. RODRIGUEZ-MURCIA Solar Energy Group National

ABSTRACT. PV-Systems are widely used in telecommunications in Colombia. TELECOM, the national telecomunications company, has installed and ope rated 1939 systems since 1980.

Get a quote

Engie, Canadian Solar among bidders in Colombia''s

Local subsidiaries of international energy companies Engie and Canadian Solar have been among the bidders in a tender for battery storage

Get a quote

Leading telecommunication companies Colombia 2021| Statista

Leading telecommunication companies in Colombia 2021 Pay TV market distribution in Colombia 2022, by share of subscribers Colombia: leading telecom brands on Twitter 2019

Get a quote

Colombia''s first solar energy storage system operational

Colombian energy company Celsia has announced the launch of what it described as the first solar energy storage system in the country, at the Celsia Solar Palmira 2 PV farm,

Get a quote

Do you know how Solar can empower the telecom

When we talk about off-grid solar applications, one of the industries with massive power requirements is the telecom Industry. India is

Get a quote

Canadian Solar Wins the First Energy Storage Project in Colombia

It is a leading manufacturer of solar photovoltaic modules, provider of solar energy and battery storage solutions, and developer of utility-scale solar power and battery storage

Get a quote

Colombia''s large-scale PV capacity additions hit 207 MW in 2023

Colombia deployed around 207 MW of new utility-scale PV capacity across 25 projects in 2023, according to a report by the operator of the national grid network, XM Colombia.

Get a quote

Colombia

This has serious negative consequences on health and the environment, including contributing to millions of deaths annually from air pollution, and is targeted for phase-out in international

Get a quote

Solar and Wind Power Assessment in Colombia: Report

The analysis reveals that Colombia has strong potential for solar PV (1 604.9 GW) and onshore wind (31.5 GW), with priority zones identified in

Get a quote

Photovoltaic energy in Colombia: Current status, inventory, policies

The study presents the projects that have been executed and the ones in execution during the last decade, and the capacity that has been installed up to the present day in both

Get a quote

Engie, Canadian Solar among bidders in Colombia''s first-ever battery

Local subsidiaries of international energy companies Engie and Canadian Solar have been among the bidders in a tender for battery storage systems in Colombia.

Get a quote

Colombia''s first-ever battery storage tender won by

Battery storage has been gradually gaining a foothold in the wider Latin America region, with potential for greater renewables integration and

Get a quote

Latin American Battery Recycling Markets, 2020-2028

The deployment of solar power generation infrastructure will drive the demand for batteries, over the next few years, which will push the demand for battery recycling market in

Get a quote

6 FAQs about [Colombia has the largest number of photovoltaic and telecommunication battery cabinets]

Why are photovoltaic systems important in Colombia?

The implementation of photovoltaic systems in Colombia has enabled 2% of the population in areas that do not have access to electric energy to meet their lighting, refrigeration and leisure needs, allowing them to expand their capacities and improve their quality of life. The systems that have been installed are mainly focused on the rural sector.

How much electricity does Colombia produce?

Colombia’s installed electric power generation capacity currently stands at 17,771 MW, with hydro accounting for 68 percent, gas and coal-fired power plants accounting for 31 percent, and the remaining one percent from wind and solar units. The country’s energy matrix is clean but highly dependent on climatic conditions to generate hydro power.

What is the solar energy potential in Colombia?

The potential of solar energy at a global level in Colombia is 4.5 kW h/m 2 /day and the area with an optimal solar resource is the Península de la Guajira, with 6 kW h/m 2 /day of radiation, surpassing the world average of 3.9 kW h/m 2 /day. In the referenced link , there is an interactive map of the radiation indices in Colombia by IDEAM.

Is solar energy a problem in Colombia?

Taking into account that Colombia is mostly a desert area, what was presented above confirms the deficit of photovoltaic development in the ZNIs, that underutilize the solar resource and the great territorial extension. 4. Future picture of the solar energy

Will Colombia build a hydrogen value chain?

With abundant natural gas reserves and the largest coal producer in Latin America, Colombia is focusing on blue hydrogen production as a base from which to start building the hydrogen value chain. In 2022, Colombia published its roadmap for offshore wind development, part of a broader plan to wean the country off hydropower and fossil fuels.

How much hydrogen will Colombia produce in 2021?

In 2021, Colombia’s Ministry of Mines and Energy presented its Hydrogen Roadmap. Its stated goals were to reach between 1 and 3GW of electrolysis capacity in 2030 and produce 50 kilotonnes of blue hydrogen from new methane steam reforming plants and the capture and storage of carbon in existing facilities.

Guess what you want to know

-

Palau has the largest number of photovoltaic communication battery cabinets

Palau has the largest number of photovoltaic communication battery cabinets

-

Which site cabinets are included in the Colombia lithium battery site cabinet

Which site cabinets are included in the Colombia lithium battery site cabinet

-

Are there any photovoltaic communication battery cabinets in Slovenia

Are there any photovoltaic communication battery cabinets in Slovenia

-

Where to replace photovoltaic communication battery cabinets in Honduras

Where to replace photovoltaic communication battery cabinets in Honduras

-

Photovoltaic Site Cabinet for Battery Cabinets

Photovoltaic Site Cabinet for Battery Cabinets

-

Is photovoltaic communication in battery cabinets safe

Is photovoltaic communication in battery cabinets safe

-

Battery cabinets with batteries include photovoltaic

Battery cabinets with batteries include photovoltaic

-

Features of photovoltaic energy storage battery cabinets

Features of photovoltaic energy storage battery cabinets

-

Outdoor photovoltaic communication battery cabinets

Outdoor photovoltaic communication battery cabinets

-

Paraguay s top ten photovoltaic communication battery cabinets

Paraguay s top ten photovoltaic communication battery cabinets

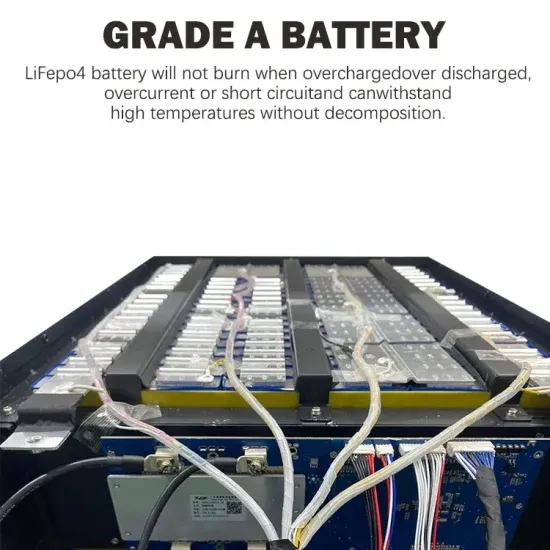

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.