India Solar PV Power Plant Report

A practical and comprehensive guide for developers and investors for implementing solar PV power plants in India details provided on potential, governmental regulations and feed-in-tariff,

Get a quote

Performance evaluation and financial viability analysis of grid

The main aim of this simulation work is to assess the financial possibility analysis of 10 MWP grid-associated solar photovoltaic (PV) power plants in seven cities i.e. Lucknow,

Get a quote

PV Solar Energy ROI Calculation

PVCalc allows you to calculate the ROI of PV solar energy projects - viewed as financial investments. The results are presented graphically, divided into four sub-categories: Results,

Get a quote

IRR

The internal rate of return is the percentage number that makes the sum of the discounted cash flows equal to the purchase price. Often it is also called ROI, return on investment. PVCalc

Get a quote

Investment cost and rate of return of distributed photovoltaics?

The investment cost and rate of return of distributed photovoltaics can vary due to factors such as project scale, location, type of photovoltaic modules, installation method, and electricity price

Get a quote

Reflections on 15 Years of PV Module and System Price

Pro Forma Analysis Internal Rate of Return (IRR) Metric Any applicable incentives FIT or PPA Revenues Residual Value (+/-) Years Any preventative and routine O&M, including

Get a quote

Investor''s Guide to Solar IRR: Calculating Returns for

Learn how to calculate IRR for solar PV projects. Discover key elements to calculate to make informed investment decisions in the renewable

Get a quote

Internal Rate of Return (IRR): Formulas, Examples and Implications

What is the Internal Rate of Return? Internal rate of return (IRR) is the compound average rate of return in a set of cash flows. You might also see it as the discount rate where

Get a quote

LCOE & IRR of PV Projects (Text Version) | NREL

This is the text version for a video—Levelized Cost of Electricity (LCOE) and Internal Rate of Return for Photovoltaic (PV) Projects—about how NREL conducts such pro forma analysis.

Get a quote

Quantifying the value of a solar installation: some helpful metrics

What is the internal rate of return? The internal rate of return (IRR) is similar to NPV in that it accounts for discounted future cash flows over the lifetime of the project.

Get a quote

Impact of Different Economic Performance Metrics on the

For example, a PV system may generate an internal rate of return (IRR) greater than 50%, giving a potential commercial customer the perception of a high return on investment, while an

Get a quote

Solar Farm Economics: Analyzing ROI & IRR Trends | Education

Internal Rate of Return (IRR), on the other hand, estimates the annualized efficiency of an investment. It solves for the discount rate that sets the net present value (NPV)

Get a quote

Solar Financial Analysis – EcoSmart Sun

Solar Financial Analysis The most common benchmarks of a solar installation profitability are: Levelized Cost of Energy (LCOE), Internal rate of Return

Get a quote

Internal Rate of Return Explained for Real Estate

Gain an in depth understanding of the internal rate of return as it applies to commercial real estate. This article covers key calculation methods,

Get a quote

Internal Rate of Return | Managerial Accounting

The IRR is the actual rate of return or Return on Investment (ROI) of the project. If our hurdle rate is 15%, then this project at 13% does not rise to the level of an acceptable endeavor. Before

Get a quote

Calculating Incremental Internal Rate of Return

Unlock investment value with Incremental Internal Rate of Return, a key metric for evaluating project cash flows and informed decision-making.

Get a quote

Tables for the estimation of the internal rate of return of

This paper is intended to ease the estimation of the Internal Rate of Return (IRR) of a PVGCS-a meaningful profitability index for the possible owner-using classical analysis of

Get a quote

Solar Farm Economics: Analyzing ROI & IRR Trends

Internal Rate of Return (IRR), on the other hand, estimates the annualized efficiency of an investment. It solves for the discount rate that sets

Get a quote

Internal Rate of Return (IRR) of a Photovoltaic Solar

This return rate is called the Internal Rate of Return or IRR. When you invest in a solar system, you receive non-taxable dividends each year in the form of the

Get a quote

Quantifying the value of a solar installation: some

What is the internal rate of return? The internal rate of return (IRR) is similar to NPV in that it accounts for discounted future cash flows over the lifetime of the

Get a quote

Solar Energy Systems Internal Rate of Return

To facilitate decision-making, and determine the best option from a financial perspective, use the Internal Rate of Return (IRR) to help identify if a

Get a quote

Investor''s Guide to Solar IRR: Calculating Returns for Solar PV

Learn how to calculate IRR for solar PV projects. Discover key elements to calculate to make informed investment decisions in the renewable energy sector.

Get a quote

Solar Energy Systems Internal Rate of Return

To facilitate decision-making, and determine the best option from a financial perspective, use the Internal Rate of Return (IRR) to help identify if a long-term investment in a

Get a quote

Internal Rate of Return (IRR) of a Photovoltaic Solar System

This return rate is called the Internal Rate of Return or IRR. When you invest in a solar system, you receive non-taxable dividends each year in the form of the cash that is no longer being

Get a quote

A comparison of the cost and financial returns for solar photovoltaic

The IRR method provides a rate of return from an investment, rather than using a cost of capital in the calculation, and it is defined as the rate of return, or discount rate, that

Get a quote

Economics of Solar Photovoltaic Systems

Internal rate of return is the rate of growth a project is supposed to generate. These can be calculated with Microsoft Excel® or with online financial calculators. The mathematical

Get a quote

Tables for the estimation of the internal rate of return of

Abstract A continuous decrease trend in PV costs together with a wide variety of supporting measures have turned photovoltaic grid-connected systems (PVGCS) into a

Get a quote

The importance of internal rate of return (IRR) in solar plant design

What is internal rate of return (IRR) and how does it affect design and investment decisions for solar projects? Read on to find out.

Get a quote

NPV, IRR and Payback Period Calculator for Solar C&I Businesses

Quickly calculate NPV, IRR, and payback for solar commercial projects with easy tools designed for smarter business decisions.

Get a quote

6 FAQs about [Photovoltaic module project internal rate of return]

What is the internal rate of return (IRR) of a solar system?

Subsidies or grants received from the secondary market enhance the internal rate of return. The IRR links the present value oaf a photovoltaic system cost with the electricity or heat generated over the life of the solar energy system. It gives the owner a of he financial behavior of the over the life cycle of the PV system.

What is the internal rate of return for a PV system?

The formula for the internal rate of return for a PV system includes the following components/definitions: PV system cost, First cost subsidies, PV energy cost and Secondary Market Characteristics and PV energy price. PV system cost (PVsys) equals the installed cost of the photovoltaic system.

How do solar developers calculate IRR?

By inputting all projected costs and electricity sale revenues into the IRR calculation, solar developers can rank competing PV projects by profitability to select the best investments. Tracking actual IRR over time verifies that positive returns meet targets.

What is IRR & how does it affect NPV?

With regards to installing a solar panel system, the IRR is a criterion that indicates the returns that your installation is expected to generate for you as an investor and serves as a benchmark for future projects. Hence the discount rate has an impact on the NPV of a project.

What is PV energy cost?

PV energy cost (EPVc) entails the PV system’s installed cost minus the value of First Cost Subsidies, plus the net present value of maintenance and repairs, over the life of the PV system. This equals the total cost of the energy generated by the PV system. Source: André Karwath aka Aka

What is a detailed PV model?

If we look at PV, there’s a detailed PV model, PV watts which is only PV watts and then high-concentration PV. Click on the Detailed PV Model, which is what we use most frequently, and you can see you can look at different types of systems, power purchase agreements, or distributive systems with different ownership models and classes.

Guess what you want to know

-

Huawei Barbados photovoltaic module project

Huawei Barbados photovoltaic module project

-

Colombia Photovoltaic Module Project

Colombia Photovoltaic Module Project

-

Danish photovoltaic module project

Danish photovoltaic module project

-

Egypt photovoltaic module project

Egypt photovoltaic module project

-

Photovoltaic module project supporting projects

Photovoltaic module project supporting projects

-

Pvb double-glass photovoltaic module project

Pvb double-glass photovoltaic module project

-

Belarus photovoltaic module project

Belarus photovoltaic module project

-

2GW high-efficiency photovoltaic module intelligent manufacturing project

2GW high-efficiency photovoltaic module intelligent manufacturing project

-

Huawei Niger photovoltaic module project

Huawei Niger photovoltaic module project

-

Morocco Casablanca Photovoltaic Module Project

Morocco Casablanca Photovoltaic Module Project

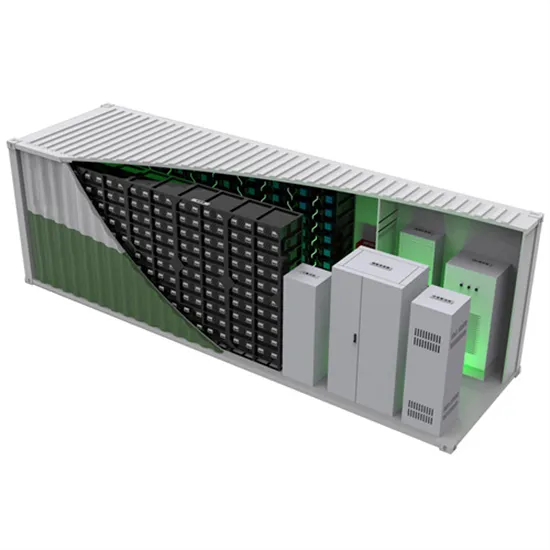

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

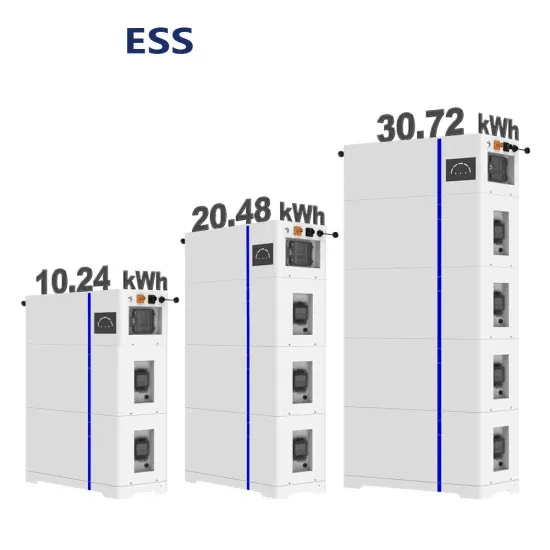

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.