Central Asia''s – The Leading Solar Magazine In India

4 days ago· In Short : The Asian Development Bank (ADB) and ACWA Power have joined hands to build Central Asia''s first wind power plant with battery energy storage. This pioneering

Get a quote

What are the energy storage companies in Asia? | NenPower

The energy storage landscape in Asia is characterized by a myriad of companies engaged in various aspects of energy storage technologies. The region, home to some of the

Get a quote

Using tools for impact: LEAP and NEMO

At the levels currently being considered in national plans and regional studies, increased trading of electricity and low-carbon fuels between Central Asia and other regions could have an

Get a quote

ADB, ACWA Power sign $51mn loan to build Nukus 2 wind and

3 days ago· ADB and ACWA Power have signed a $51mn financing deal to build Uzbekistan''s Nukus 2 Wind and Battery Energy Storage project, Central Asia''s first wind power plant with a

Get a quote

Ranking of energy storage companies exporting to Central Asia

Which Chinese energy storage manufacturers are the best for 2023? In a highly anticipated release, Black Hawk PV has disclosed the top ten rankings of Chinese energy storage

Get a quote

Top 10 battery energy storage manufacturers in China

This article will focus on top 10 battery energy storage manufacturers in China including SUNWODA, CATL, GOTION HIGH TECH, EVE, Svolt, FEB, Long T Tech, DYNAVOLT, Guo

Get a quote

Sungrow and CEEC Complete Central Asia''s Largest Energy Storage

Sungrow, the global leading PV inverter and energy storage system (ESS) provider, in partnership with China Energy Engineering Corporation (CEEC), are proud to

Get a quote

Ranking of Southeast Asian energy storage power brands

Which Chinese energy storage manufacturers are the best for 2023? In a highly anticipated release, Black Hawk PV has disclosed the top ten rankings of Chinese energy storage

Get a quote

ADB, ACWA Power to Build Central Asia''s First Wind Power

3 days ago· The Asian Development Bank (ADB) and ACWA Power Company (ACWA Power) signed a $51 million loan package to build the Nukus 2 Wind and Battery Energy Storage

Get a quote

Energy Storage Suppliers In Asia & Middle East

Find the top Energy Storage suppliers & manufacturers in Asia & Middle East from a list including SunSource Energy Pvt. Ltd., Briggs & Stratton Corporation & PJP Eye LTD.

Get a quote

China energy storage project pipeline grows by 140 GWh in July

According to data from China''s Energy Storage Application Branch (CESA), mainland China has seen a surge in energy storage activity, with 1,468 new project

Get a quote

Top 10 Solar Inverter Manufacturers in 2025: Global

Discover the top 10 solar inverter manufacturers in 2025, offering an in-depth review of each global brand. We also examine the global supply

Get a quote

What are the energy storage companies in Asia?

The energy storage landscape in Asia is characterized by a myriad of companies engaged in various aspects of energy storage technologies. The

Get a quote

INTEC Energy Solutions

INTEC is leading the way in the future of renewable energy by pioneering innovative solutions. With over a decade of success, INTEC has evolved into a global leader in

Get a quote

Top 10 Energy Storage Companies in Asia

Discover the current state of energy storage companies in Asia, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

List of Central Asian Industrial and Commercial Energy

This article will focus on the top 10 industrial and commercial energy storage manufacturers in China including BYD, JD Energy, Great Power, SERMATEC, NR Electric, HOENERGY,

Get a quote

Ranking of central asian energy storage companies

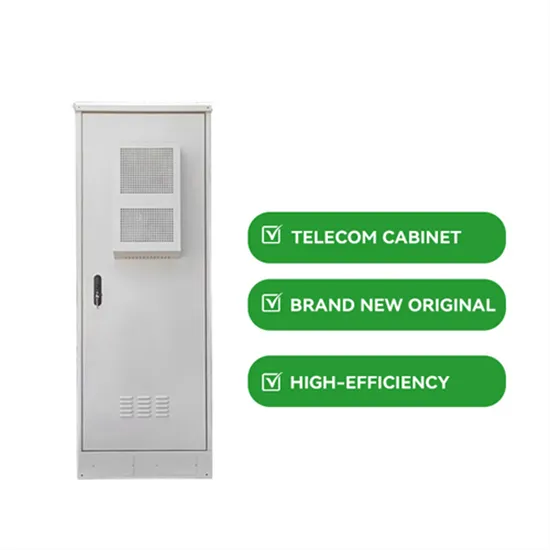

Energy Storage Companies in Telecom sector. The energy storage market for telecom witnessed a stable growth in 2019, with the market size standing at 2.2GWh. In the lead-acid battery

Get a quote

List of Central Asian energy storage companies

Empowering Your Future with Solar Energy At EK Solar Solutions, we are at the forefront of the solar energy revolution. With over a decade of expertise in the renewable energy industry, we

Get a quote

Green energy corridors for Central Asia and the

About This study analyses the current electricity mix, untapped renewable energy potential and energy transition commitments across Central

Get a quote

Top 10 energy storage companies in Canada

Canada''s energy storage market is on the brink of substantial expansion, driven by increasing demand for electricity from electric vehicles, hydrogen

Get a quote

Sungrow Leads Central Asia''s Largest Energy Storage Project

Sungrow, the global leader in PV inverter and energy storage system solutions, is spearheading the energy transition in Central Asia with its cutting-edge energy storage system.

Get a quote

Sungrow and CEEC Complete Central Asia''s Largest Energy Storage

Installed with Sungrow''s cutting-edge liquid-cooled ESS PowerTitan 2.0, this facility marks Uzbekistan''s first energy storage project and stands as the largest of its kind in Central

Get a quote

Energy Transition in Central Asia

Transparent legal and regulatory frameworks (RE Laws, secondary regulations) Capable agency with clear mandate Stable investment environment for private sector financing Planning for

Get a quote

Siemens Energy – A global leader in energy technology

Learn more about a career with Siemens Energy, and how you can make tomorrow different, today. We support companies and countries to reduce emissions across the energy landscape

Get a quote

Guess what you want to know

-

Central Asian energy storage lithium battery manufacturer

Central Asian energy storage lithium battery manufacturer

-

Central Asian Power Grid Energy Storage

Central Asian Power Grid Energy Storage

-

Albanian wind power energy storage system manufacturer

Albanian wind power energy storage system manufacturer

-

Djibouti Power Station Energy Storage Equipment Manufacturer

Djibouti Power Station Energy Storage Equipment Manufacturer

-

Djibouti energy storage power supply manufacturer

Djibouti energy storage power supply manufacturer

-

Lesotho mobile energy storage power supply manufacturer

Lesotho mobile energy storage power supply manufacturer

-

Malawi lithium energy storage power supply custom manufacturer

Malawi lithium energy storage power supply custom manufacturer

-

Singapore portable energy storage power supply manufacturer

Singapore portable energy storage power supply manufacturer

-

Estonia Huijue Energy Storage Power Supply Manufacturer

Estonia Huijue Energy Storage Power Supply Manufacturer

-

British lithium energy storage power supply custom manufacturer

British lithium energy storage power supply custom manufacturer

Industrial & Commercial Energy Storage Market Growth

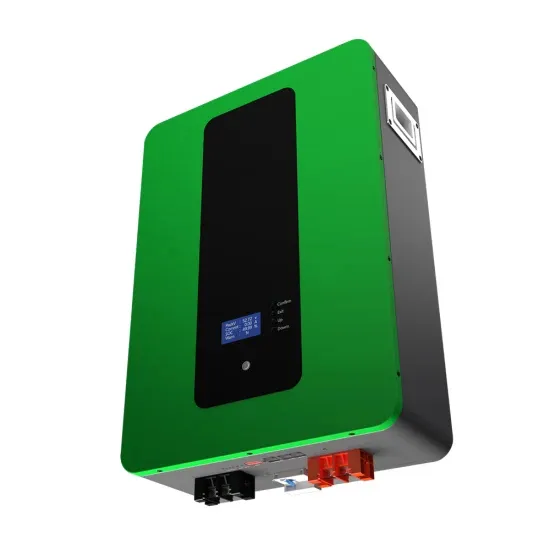

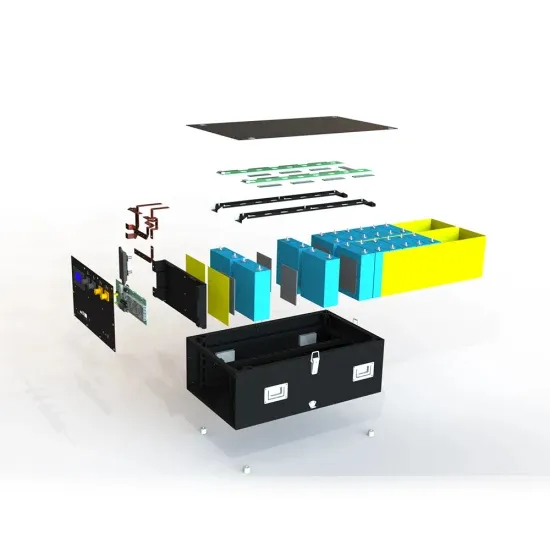

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

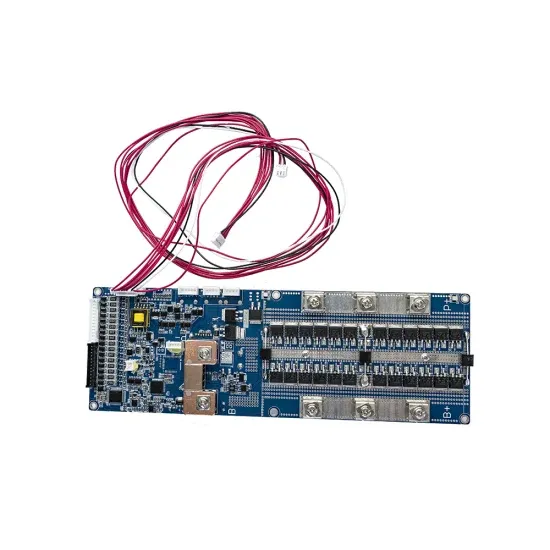

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.