Top 18 lithium ion battery manufacturers in 2025

Samsung SDI Samsung SDI: A Global Leader in Lithium-Ion Battery Innovation Samsung SDI Co., Ltd., founded in 1970, is a core subsidiary of the Samsung Group and a

Get a quote

Top 17 Lithium-ion Battery Companies/Manufacturers

In the dynamic landscape of the lithium-ion battery market, manufacturers hold a pivotal position, with several key industry players

Get a quote

The Top 10 Battery and Storage Companies

CATL stands out for its emphasis on lithium-ion batteries and their suitability for a range of energy storage applications. Their innovations in

Get a quote

Ranking of central asian energy storage companies

EVE Energy has taken second place in InfoLink Consulting''''s 1Q 24 energy storage cell shipment rankings, having achieved an impressive 60GWh. Central, Southwest and Northeast China,

Get a quote

Top 10 Energy Storage Companies in Asia

Discover the current state of energy storage companies in Asia, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

Top Lithium Ion Battery Manufacturers in Thailand

As the global shift toward clean energy accelerates, Thailand is emerging as a key player in the lithium-ion battery market, driven by its strategic position in

Get a quote

Asia-Pacific Battery Energy Storage System Market

The Asia-Pacific Battery Energy Storage System Market is growing at a CAGR of greater than 15% over the next 5 years. BYD Company Limited, LG Chem Ltd, Contemporary

Get a quote

Ranking of central asian energy storage companies

Energy Storage Companies in Telecom sector. The energy storage market for telecom witnessed a stable growth in 2019, with the market size standing at 2.2GWh. In the lead-acid battery

Get a quote

What are the energy storage companies in Asia? | NenPower

Companies in Asia are exploring new flow battery chemistries that can provide longer durations of energy storage, crucial for balancing intermittent renewables like solar and

Get a quote

Who Are the Top 10 Lithium Battery Manufacturers in 2025?

The top lithium battery manufacturers in 2025 include CATL, BYD, LG Energy Solution, Panasonic, Samsung SDI, SK Innovation, Tesla, EVE Energy, CALB, and BAK Battery.

Get a quote

Top 10 Energy Storage Battery Manufacturers (2025)

Below are ten of the most influential energy storage battery manufacturers worldwide, covering a wide range of applications from residential to commercial and grid-level

Get a quote

Southeast Asia''s biggest BESS officially opened in

Singapore has surpassed its 2025 energy storage deployment target three years early, with the official opening of the biggest battery storage

Get a quote

What are the energy storage companies in Asia?

Companies in Asia are exploring new flow battery chemistries that can provide longer durations of energy storage, crucial for balancing

Get a quote

Top 10 Leading Lithium Ion Battery Manufacturers Shaping the Energy

Discover the 10 leading lithium ion battery manufacturers shaping the 2025 energy storage industry. Up-to-date, expert ranking for business leaders. Read now!

Get a quote

Lithium-Ion Battery Market | Global Market Analysis Report

2 days ago· The lithium-ion battery market is influenced by several upstream sectors. Electric vehicle (EV) manufacturers account for approximately 42%, integrating lithium-ion cells into

Get a quote

Asia-Pacific Rack Battery Makers: Key Players and Capacities

Asia-Pacific rack battery manufacturers dominate global production, with China (CATL, BYD), South Korea (LG Energy Solution, Samsung SDI), and Japan (Panasonic)

Get a quote

Top Lithium Battery Manufacturers in 2025: Who Leads the Charge?

In 2025, a mix of Chinese, South Korean, and Japanese giants dominate the lithium battery landscape. Companies like CATL, BYD, LG Energy Solution, and Panasonic

Get a quote

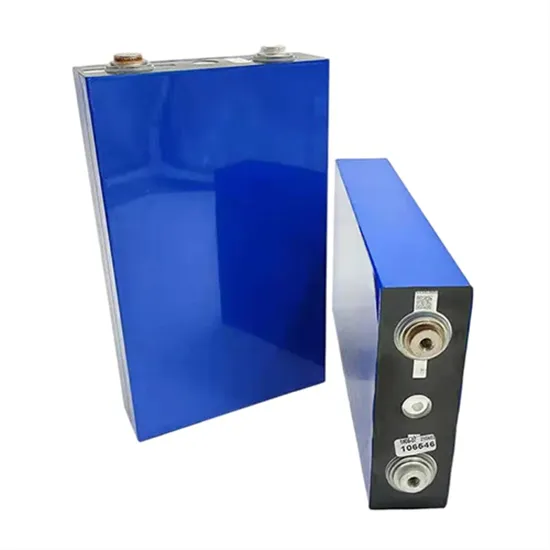

Asian lithium-ion energy storage battery companies

The report covers Asia-Pacific Lithium-ion Battery Manufacturers and the market is segmented by Application (Automotive Batteries, Industrial Batteries, Consumer Electronics Batteries, and

Get a quote

10 Best Battery Energy Storage Companies in 2025

Discover the top 10 best Battery Energy Storage Companies of 2025, leading the way with innovative technologies and global market presence.

Get a quote

Top 10 Energy Storage Companies in 2025

Discover the top 10 energy storage companies and how Dawnice, with 14 years of experience, provides high-quality lithium batteries and solar solutions for residential and

Get a quote

Ranking of lithium battery energy storage companies in Central Asia

China''''s lithium battery shipments exceeded TWh for the first time, and the power and energy storage lithium battery market grew by more than 25%. In 2024, China''''s lithium battery market

Get a quote

Top 10 energy storage manufacturers in the world

CATL is a global leader in energy technology and one of China TOP 10 energy storage system integrator, focusing on lithium-ion batteries for electric vehicles

Get a quote

Battery storage in Asia Pacific: 5 things to know

Battery storage delivers the flexibility renewables desperately need, giving it the potential to transform power markets. So, what does the future hold for the development of the

Get a quote

Top 10 Lithium Battery Manufacturers in China

With the growing global demand for green energy, lithium batteries have become a core technology for energy storage and powering electric devices. As the largest lithium

Get a quote

6 FAQs about [Central Asian energy storage lithium battery manufacturer]

What are the top lithium battery manufacturers in 2025?

The top lithium battery manufacturers in 2025 include CATL, BYD, LG Energy Solution, Panasonic, Samsung SDI, SK Innovation, Tesla, EVE Energy, CALB, and BAK Battery. These companies dominate due to their technological innovation, production capacity, and market share in automotive, energy storage, and consumer electronics sectors.

Where are lithium batteries made?

Asia-Pacific holds 80% of production capacity, driven by China and South Korea. North America and Europe are expanding via policies like the U.S. Inflation Reduction Act and EU Battery Alliance. Lithium Battery Manufacturer

Who makes energy storage batteries?

Below are ten of the most influential energy storage battery manufacturers worldwide, covering a wide range of applications from residential to commercial and grid-level storage. The list is in no particular order: 1. CATL (Contemporary Amperex Technology Co., Limited) – China One of the largest manufacturers of lithium-ion batteries globally.

What makes a good lithium battery manufacturer?

The top lithium battery manufacturers combine scale, innovation, and strategic partnerships. As demand for EVs and renewable energy storage grows, sustainability and regional policies will reshape the competitive landscape. Who is the largest lithium battery manufacturer? CATL is the largest, with a 35% global market share.

What makes CATL the world's largest lithium battery producer?

Let's break down what makes CATL the undisputed leader: World's largest lithium battery producer, capturing around one-third of the global EV battery market. Major supplier to Tesla, BMW, Volkswagen, and numerous Chinese EV brands. Manufactures both LFP and NMC batteries in various formats.

Who makes lithium forklift batteries?

Lithium Forklift Battery Manufacturer CATL’s dominance is reinforced by its strategic partnerships with European automakers, including a recent $2 billion deal to supply batteries for BMW’s next-generation EVs. BYD has expanded its global footprint by opening factories in Brazil and Thailand, targeting emerging EV markets.

Guess what you want to know

-

Grenada lithium energy storage battery manufacturer

Grenada lithium energy storage battery manufacturer

-

Palau energy storage lithium battery manufacturer supply

Palau energy storage lithium battery manufacturer supply

-

Botswana lithium battery energy storage cabinet manufacturer

Botswana lithium battery energy storage cabinet manufacturer

-

Somalia energy storage lithium battery manufacturer

Somalia energy storage lithium battery manufacturer

-

Barbados energy storage lithium battery energy storage cabinet manufacturer

Barbados energy storage lithium battery energy storage cabinet manufacturer

-

North Asia Energy Storage Lithium Battery Manufacturer

North Asia Energy Storage Lithium Battery Manufacturer

-

Lebanese lithium battery energy storage battery manufacturer

Lebanese lithium battery energy storage battery manufacturer

-

Cape Verde energy storage system lithium battery manufacturer

Cape Verde energy storage system lithium battery manufacturer

-

Indian lithium battery energy storage battery manufacturer

Indian lithium battery energy storage battery manufacturer

-

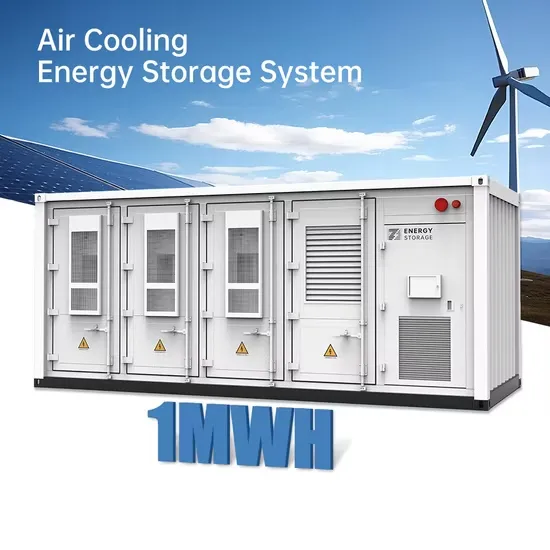

Container energy storage system lithium battery pack manufacturer

Container energy storage system lithium battery pack manufacturer

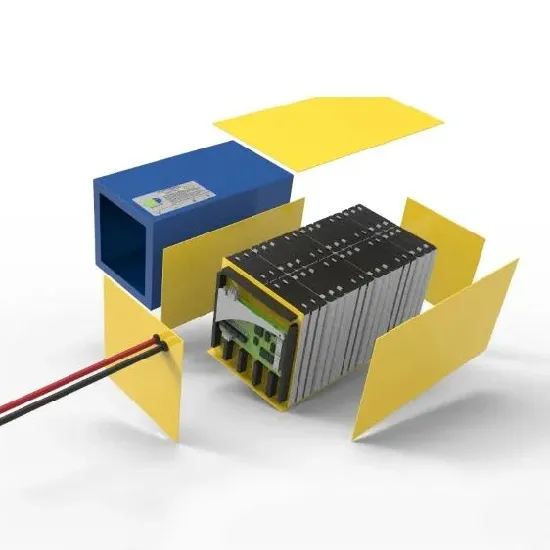

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.