Design and Development of Stand-Alone Renewable Energy

Hybrid renewable power systems for mobile telephony base stations in developing countries. Renewable Energy. 51, 419-425. Anayochukwu, A. V., and Ndubueze, N. A. 2013. Potentials

Get a quote

Base Station (BS) Transmitter Power Level by Cell Radius

In this paper we collaborate with Ooredoo mobile company in Kuwait to see the effect of cell radius on the power can the base station to supply the user by using the path loss and the

Get a quote

Mobile base station solar power generation

Are solar powered cellular base stations a viable solution? Cellular base stations powered by renewable energy sources such as solar power have emerged as one of the

Get a quote

Mobile phone and base stations radiation and its effects on

A review of the impact of mobile phone and base station radiation on human health and the environment has been presented here. Cell phone is an import

Get a quote

Powering Mobile Base Stations

Yet, despite these increased costs of operation, various forces including market driven demands for new subscriptions are causing mobile network operators

Get a quote

Machine learning for base transceiver stations power failure

Mobile network operators (MNOs) face frequent power supply failures at BTS sites, leading to revenue loss and increased operational expenditure (OPEX). Despite their critical

Get a quote

Rules on new mobile phone base stations

The decision on who approves a base station depends on several planning factors, including: the type of base station if it is a low-impact facility or not the classification/zoning of the land. To

Get a quote

TELECOM SITES POWER CONTROL & MANAGEMENT

Effective monitoring of various power-related sub-systems (AC meters, generators, DC rectifiers, batteries, fuel cells, solar arrays, or other newer hybrid power systems) can give a complete

Get a quote

Backup Battery Analysis and Allocation against Power Outage for

Base stations have been widely deployed to satisfy the service coverage and explosive demand increase in today''s cellular networks. Their reliability and availability heavily

Get a quote

(PDF) Design of Solar System for LTE Networks

Rapid growth in mobile networks and the increase of the number of cellular base stations requires more energy sources, but the traditional

Get a quote

Analysis of Electromagnetic Radiation of Mobile Base

This paper presents the analysis of electromagnetic radiation of mobile base stations co-located with high-voltage transmission towers.

Get a quote

Backup Battery Analysis and Allocation against Power Outage for

In this paper, we closely examine the base station features and backup battery features from a 1.5-year dataset of a major cellular service provider, including 4,206 base

Get a quote

Different Power Supply Planning Options Available for A BTS Site

This paper discusses various power supply planning options available for Base Transceiver Station (BTS) sites, emphasizing the importance of integrating power planning into the broader

Get a quote

Measurements and Modelling of Base Station Power

Therefore, this paper investigates changes in the instantaneous power consumption of GSM (Global System for Mobile Communications) and UMTS (Universal Mobile

Get a quote

5G Base Station Deployments; Open-RAN Competition & HUGE 5G BS Power

Selected 5G base stations in China are being powered off every day from 21:00 to next day 9:00 to reduce energy consumption and lower electricity bills. 5G base stations are

Get a quote

Power consumption of the base station components

The power consumption of wireless access networks will become an important issue in the coming years. In this study, the power consumption of base

Get a quote

ASSESSMENT OF THE STATE OF DISRUPTIONS IN THE POWER

This study provides an in-depth analysis of power supply interruptions at mobile communication base stations (BS) operated by the Khorezm branch of Uzbekistan''s Uzmobile

Get a quote

ASSESSMENT OF THE STATE OF DISRUPTIONS IN THE

This study provides an in-depth analysis of power supply interruptions at mobile communication base stations (BS) operated by the Khorezm branch of Uzbekistan''s Uzmobile

Get a quote

Powering Mobile Base Stations

Yet, despite these increased costs of operation, various forces including market driven demands for new subscriptions are causing mobile network operators to out-pace government programs

Get a quote

What Powers Telecom Base Stations During Outages?

Telecom batteries for base stations are backup power systems using valve-regulated lead-acid (VRLA) or lithium-ion batteries. They ensure uninterrupted connectivity

Get a quote

Cell Phone Towers — EITC

- Cell Site (Cellular Base Station or Cell Tower) A cell site, cell tower, or cellular base station is a cellular-enabled mobile device site where antennae and electronic

Get a quote

Power consumption based on 5G communication

At present, 5G mobile traffic base stations in energy consumption accounted for 60% ~ 80%, compared with 4G energy consumption increased three times. In the future, high-density

Get a quote

Evaluating Power Quality Issues at Base Transceiver Stations in

A Base Transceiver Station (BTS) plays a critical role in mobile networks by acting as a fixed radio transceiver that connects mobile devices to the network. The BTS is

Get a quote

Measurements and Modelling of Base Station Power Consumption under Real

Therefore, this paper investigates changes in the instantaneous power consumption of GSM (Global System for Mobile Communications) and UMTS (Universal Mobile

Get a quote

6 FAQs about [Power issue of a mobile base station]

How do base stations affect mobile cellular network power consumption?

Base stations represent the main contributor to the energy consumption of a mobile cellular network. Since traffic load in mobile networks significantly varies during a working or weekend day, it is important to quantify the influence of these variations on the base station power consumption.

What are the primary sources of power for a mobile base-station?

The primary sources of power for these mobile base-station vary by region and can generally be categorized into 3 buckets: Reliable grid power: AC mains or grid power can reliably serve as the primary power supply.

Why do mobile network operators face frequent power supply failures at BTS sites?

Mobile network operators (MNOs) face frequent power supply failures at BTS sites, leading to revenue loss and increased operational expenditure (OPEX). Despite their critical role, BTSs face significant operational challenges due to vulnerabilities in their power supply. These disruptions can arise from various external and internal sources .

Why are 5G base stations being powered off every day?

Selected 5G base stations in China are being powered off every day from 21:00 to next day 9:00 to reduce energy consumption and lower electricity bills. 5G base stations are truly large consumers of energy such that electricity bills have become one of the biggest costs for 5G network operators.

Why do cellular networks need a base transceiver station?

The widespread deployment of cellular networks has improved communication access, driving economic growth and enhancing social connections across diverse regions. Base Transceiver Stations (BTSs), are foundational to mobile networks but are vulnerable to power failures, disrupting service delivery and causing user inconvenience.

What is the main source of power for a base station?

In the case of base stations situated in regions with bad-grid or off-grid power availability, the predominant source of power for the base stations is diesel generators. [4,6] Diesel generation is costly in both the procurement of fuel and travel required to maintain adequate fuel levels at the base stations.

Guess what you want to know

-

Mobile Base Station Solar Power Generation Project

Mobile Base Station Solar Power Generation Project

-

Brazil Mobile Communication Wind Power Base Station Photovoltaic Power Generation System

Brazil Mobile Communication Wind Power Base Station Photovoltaic Power Generation System

-

Mobile base station power module replacement

Mobile base station power module replacement

-

Increase the power supply of mobile base station equipment

Increase the power supply of mobile base station equipment

-

Mobile base station power supply wind power generation

Mobile base station power supply wind power generation

-

Mobile base station inverter communication power supply

Mobile base station inverter communication power supply

-

Sao Tome and Principe mobile communication wind power base station photovoltaic power generation system

Sao Tome and Principe mobile communication wind power base station photovoltaic power generation system

-

Huawei Mobile Base Station Wind Power Supply

Huawei Mobile Base Station Wind Power Supply

-

Power supply method for mobile base station equipment

Power supply method for mobile base station equipment

-

How to use the Vaduz mobile communication wind power base station

How to use the Vaduz mobile communication wind power base station

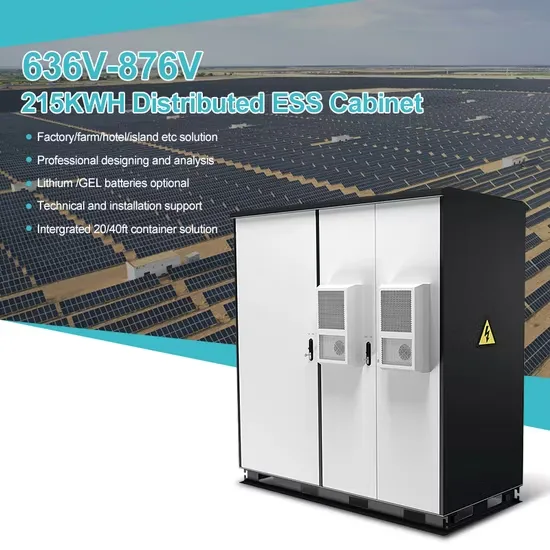

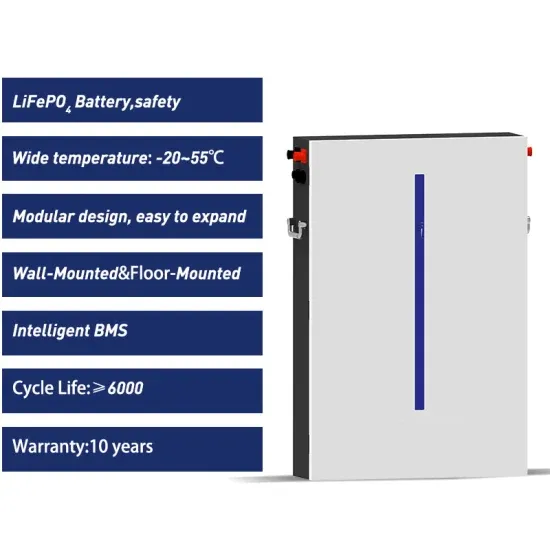

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.