Brazil power storage sector seeks support | Latest Market News

Lower battery prices and increases to intermittent power generation could boost battery energy storage systems (BESS) in Brazil, reaching roughly 7.2GW of installed capacity by 2040 or

Get a quote

Portable Power Station Market Size | Industry Report,

The global portable power station market size was estimated at USD 0.69 billion in 2024 and is projected to reach USD 1.74 billion by 2030, growing at a

Get a quote

What is energy storage power station? | NenPower

1. Energy storage power stations are critical infrastructure designed to store energy for later use, particularly from intermittent renewable

Get a quote

PowerPoint Presentation

Spot market: market in which surpluses or shortfalls of energy, in regard to the contracted volumes, are cleared and settled (at the Spot Price). This market is managed and operated by

Get a quote

Energy price and tariffs (Brazil)

The price of energy on the free market, for a contract lasting a few years, is around R$135/MWh for conventional energy. The incentivized energy results in the same price considering the

Get a quote

Terminal Gas Sul LNG Project, Brazil

Terminal Gas Sul LNG Project, Brazil Terminal Gas Sul (Southern Gas Terminal or TGS) Project is an offshore Liquefied Natural Gas (LNG) import terminal in Santa Catarina,

Get a quote

Batteries cheaper than new thermal plants for Brazil''s

Aurora has estimated battery energy storage systems (BESS) now cost 10% less to provide reserve capacity for Brazil''s grid than new combined

Get a quote

The Energy Storage Market in Germany

This makes the use of new storage technologies and smart grids imperative. Energy storage systems – from small and large-scale batteries to power-to-gas technologies – will play a

Get a quote

The impact of the hourly spot market price (PLD) recently adopted in Brazil

For this purpose, Brazil''s Power Sector Agency (ANEEL) is currently discussing regulatory changes to allow for the procurement of energy storage services. Those are usually

Get a quote

Brazil Invests 26 Billion in Energy Storage

However, with economic development and increasing power demand, especially the decline in lithium-ion battery prices and the reduction in energy storage equipment costs,

Get a quote

Brazilians think storage amid rising energy bills, falling battery prices

With global battery prices having fallen 85% between 2010 and 2018 – and further since – Brazilian home, business, and industrial electricity users are considering energy

Get a quote

Brazilians ready to embrace storage amid rising

With global battery prices having fallen 85% between 2010 and 2018 – and further since – Brazilian home, business, and industrial electricity

Get a quote

What is an energy storage power station? | NenPower

Energy storage power stations are indispensable for stabilizing power networks with the growing penetration of renewable energy such as

Get a quote

What is an energy storage power station explained?

Energy storage power stations are facilities designed to store energy for later use, consisting of several key components, such as 1.

Get a quote

Brazil Energy Storage Power Station Won the Bid: What This

With solar irradiance levels that could make a desert jealous and a government pushing hard for energy transition, Brazil is fast becoming a laboratory for cutting-edge battery energy storage

Get a quote

Brazil''s Solar Boom: Why Energy Storage is Key for Businesses

Brazil''s new 2025 energy storage regulations create urgent opportunities for businesses to pair solar with lithium batteries. Here''s why: Overloaded grids cause

Get a quote

Pumped Hydro Storage in the Brazilian Power Industry: A

Market data, such as energy prices and the Settlement Price of Differences (PLD), were obtained from the Electric Energy Trading Chamber (CCEE), responsible for managing

Get a quote

Brazilians ready to embrace storage amid rising energy bills,

With global battery prices having fallen 85% between 2010 and 2018 – and further since – Brazilian home, business, and industrial electricity users are considering energy

Get a quote

Brazil''s energy storage auction to attract $450m in investments

The auction will enhance Brazil''s power grid reliability by integrating energy storage solutions for electricity generated from renewable sources such as wind and solar.

Get a quote

Battery energy storage systems in Brazil: current regulatory and

Explore Brazil''s battery energy storage systems, focusing on current regulations, investment opportunities, and the role of these systems in the energy transition.

Get a quote

Brazilians think storage amid rising energy bills, falling

With global battery prices having fallen 85% between 2010 and 2018 – and further since – Brazilian home, business, and industrial electricity

Get a quote

Brazil''s recent photovoltaic and energy storage market

According to market intelligence consulting company Greener, the cost of a typical 4kW household photovoltaic system will increase by 13%, and the investment payback period

Get a quote

China Energy Transition Review 2025

China Energy Transition Review 2025 China''s surge in renewables and whole-economy electrification is rapidly reshaping energy choices for the rest of the world, creating the

Get a quote

Brazil Pumped Storage Power Station Market Size 2026-2033

Brazil''s pumped storage power station market is poised for growth, driven by increasing demand for grid stability and renewable integration amid rising energy consumption.

Get a quote

6 FAQs about [Power prices for energy storage power stations in Brazil]

What is the energy supply in Brazil?

According to the Brazilian Energy Balance Summary Report 2024 issued by the EPE, the internal energy supply is divided between: Oil and its derivatives: 35.1%. Sugar cane biomass: 16.9%. Natural gas: 9.6%. Hydraulic energy: 12.1%. Coal: 4.4%. Firewood and Charcoal: 8.6%. Black liquor and other renewables: 7.2%. Wind power: 2.6%. Solar power: 1.7%.

Are energy storage products coming to Brazil?

Holu’s Costa observed batteries were prominent during the Intersolar South America trade show held in São Paulo at the end of August 2024. She added, hundreds of manufacturers are bringing energy storage products to Brazil.

Can foreigners invest in battery storage businesses in Brazil?

Investment, incentives and taxation scenarios According to Brazilian law, there are no legal restrictions on direct foreign investment in the battery storage businesses or in the power sector (except in very specific segments or sectors of the economy).

Will Brazil's energy auction improve power grid reliability?

Interest in the auction has been expressed by power companies such as Portugal’s EDP and Brazil’s ISA Energia. The auction will enhance Brazil’s power grid reliability by integrating energy storage solutions for electricity generated from renewable sources such as wind and solar. US Tariffs are shifting - will you react or anticipate?

Could pumped hydro be the missing piece in Brazil's energy system?

Conclusion Although energy storage solutions have yet to be widely deployed in Brazil, generation flexibility remains a scarce commodity. Therefore, storage projects, including pumped hydro, could be the missing piece needed to enhance the country’s energy system.

Are battery energy storage systems at a premium in the future?

Flexible generation and correlated solutions, including battery energy storage systems (BESS), are therefore likely to be at a premium in the future.

Guess what you want to know

-

Charging and discharging prices of energy storage power stations in Argentina

Charging and discharging prices of energy storage power stations in Argentina

-

Energy storage prices for energy storage power stations in North America

Energy storage prices for energy storage power stations in North America

-

How many companies are there in Brazil that produce energy storage power stations

How many companies are there in Brazil that produce energy storage power stations

-

Dangerous factors of energy storage batteries in power stations

Dangerous factors of energy storage batteries in power stations

-

How much carbon can be reduced by building energy storage power stations

How much carbon can be reduced by building energy storage power stations

-

Energy storage batteries as energy storage power stations

Energy storage batteries as energy storage power stations

-

Energy storage power stations of various companies

Energy storage power stations of various companies

-

Operational characteristics of energy storage power stations

Operational characteristics of energy storage power stations

-

Energy storage methods for power stations

Energy storage methods for power stations

-

Which companies have energy storage power stations in Peru

Which companies have energy storage power stations in Peru

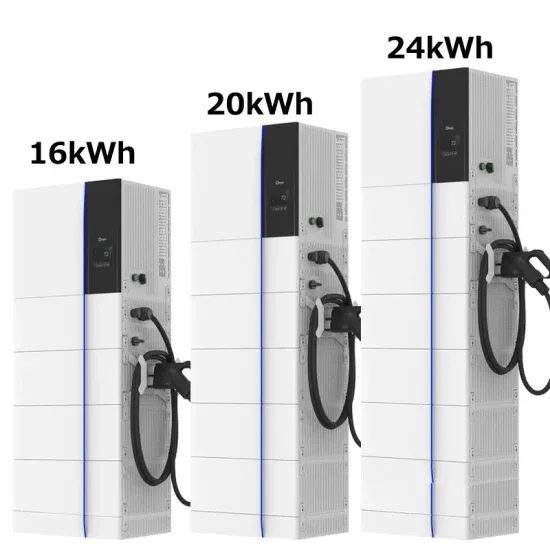

Industrial & Commercial Energy Storage Market Growth

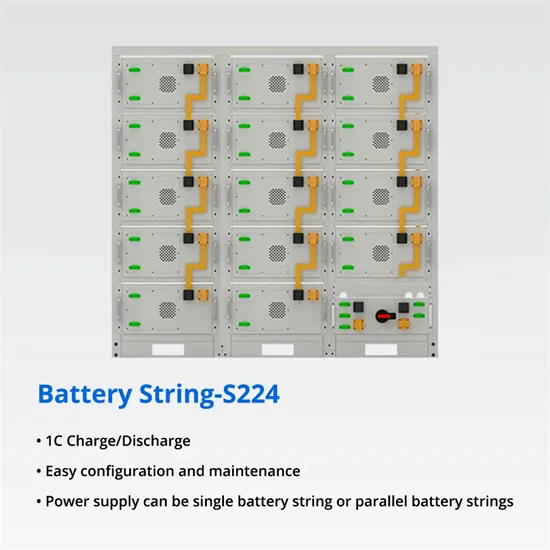

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

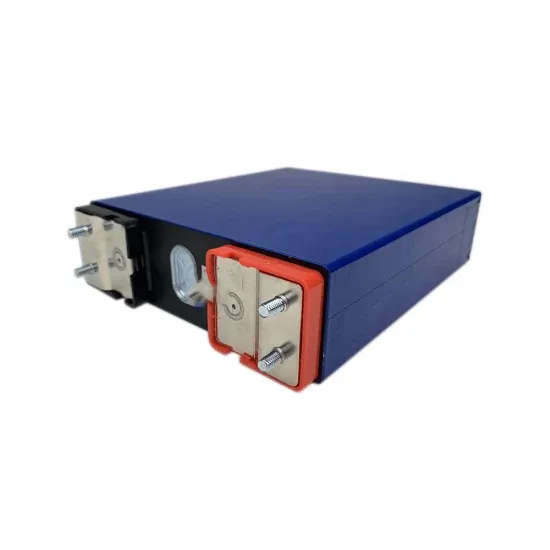

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.