Solar-Plus-Storage: Fastest, Cheapest Way To Meet Surging Power

U.S. power demand is surging as data centers plug in. The cheapest, fastest way to keep the lights on? Solar-plus-storage, not gas generation.

Get a quote

Battery Storage 101 | Enel North America

06 05, 2023 Battery storage 101: everything you need to know In this introduction to battery storage, find out how installing a battery energy storage system at

Get a quote

2022 Grid Energy Storage Technology Cost and

The 2022 Cost and Performance Assessment provides the levelized cost of storage (LCOS). The two metrics determine the average price that a unit of

Get a quote

What are the energy storage power station markets?

Energy storage power station markets are witnessing rapid expansion due to increasing demand for renewable energy integration, energy security, and grid stability. 1.

Get a quote

U.S. Hydropower Market Report

Forty-three PSH plants with a total power capacity of 21.9 GW and estimated energy storage capacity of 553 GWh accounted for 93% of utility-scale storage power capacity (GW) and

Get a quote

U.S. Energy Storage Monitor | ACP

Energy storage was the second most deployed resource in Q1 2025, demonstrating critical reliability value The report also includes key quarterly trends and

Get a quote

What is the electricity price of energy storage power station?

The price of electricity generated by energy storage power stations can significantly vary based on several key factors, including 1. geographical location, regional

Get a quote

The State Of The US Energy Storage Market

Annual storage installations are growing faster than wind and solar as the sector races to keep up with the growing need to balance renewables

Get a quote

North America Energy Storage Market Size | Mordor

The North America Energy Storage Market is segmented by Type (Batteries, Pumped-Storage Hydroelectricity (PSH), Thermal Energy Storage

Get a quote

US Energy Storage Monitor | Wood Mackenzie

The US energy storage monitor is a quarterly publication of Wood Mackenzie Power & Renewables and the American Clean Power Association. Each quarter, we gather data on US

Get a quote

2022 Grid Energy Storage Technology Cost and Performance

The 2022 Cost and Performance Assessment provides the levelized cost of storage (LCOS). The two metrics determine the average price that a unit of energy output would need to be sold at

Get a quote

Energy Storage Cost and Performance Database

DOE''s Energy Storage Grand Challenge supports detailed cost and performance analysis for a variety of energy storage technologies to accelerate their development and deployment.

Get a quote

Economic Benefits of Energy Storage

Energy storage economic benefits Storage lowers costs and saves money for businesses and consumers by storing energy when the price of electricity is low and later discharging that

Get a quote

North America Energy Storage Systems Market Size, 2032 Report

The North America energy storage systems market size crossed USD 68.9 billion in 2023 and is expected to observe around 16.1% CAGR from 2024 to 2032, driven by the rising need for

Get a quote

North American Clean Energy

Anza ''s inaugural quarterly Energy Storage Pricing Insights Report provides an overview of median list-price trends for battery energy storage systems based on recent data

Get a quote

US Energy Storage Market Size & Industry Trends 2030

By technology, batteries led with 82% of the United States energy storage market share in 2024, while hydrogen storage is projected to expand

Get a quote

Energy Storage Power Station Costs: Breakdown & Key Factors

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get a quote

What is the charging price of energy storage power station?

1. The charging price of energy storage power stations is influenced by several factors: demand for energy, technology employed, operational costs, and regulatory

Get a quote

The State Of The US Energy Storage Market

Annual storage installations are growing faster than wind and solar as the sector races to keep up with the growing need to balance renewables and support grid resiliency.

Get a quote

What is the unit price of energy storage power station

The unit price of energy storage power station construction can be understood through several critical factors. 1. The overall cost per megawatt varies significantly depending

Get a quote

Opportunities in Emerging Containerized Energy Storage Power Station

Significant regional variations exist within the containerized energy storage power station market. North America, particularly the United States, is a key market due to substantial investments in

Get a quote

Photovoltaic Energy Storage Power Station Market''s Decade

The global Photovoltaic Energy Storage Power Station market is experiencing robust growth, driven by the increasing demand for renewable energy sources and the need

Get a quote

US Energy Storage Market Size & Industry Trends 2030

By technology, batteries led with 82% of the United States energy storage market share in 2024, while hydrogen storage is projected to expand at a 28.5% CAGR through 2030.

Get a quote

Photovoltaic Energy Storage Power Station Market Disruption

The photovoltaic energy storage power station market is experiencing robust growth, driven by the increasing adoption of renewable energy sources and the need for grid stability. The market''s

Get a quote

What is the current unit price of energy storage power stations?

Market dynamics, encapsulating supply and demand forces, heavily impact the unit pricing of energy storage power stations. As renewable energy adoption accelerates, the

Get a quote

US Energy Storage Monitor | Wood Mackenzie

The US energy storage monitor is a quarterly publication of Wood Mackenzie Power & Renewables and the American Clean Power Association. Each

Get a quote

Breaking Down the Basic Cost of Energy Storage Power Stations:

The answer lies in energy storage – the unsung hero of renewable energy systems. As of 2024, the global energy storage market has grown 40% year-over-year, with lithium-ion battery

Get a quote

6 FAQs about [Energy storage prices for energy storage power stations in North America]

Which energy storage technologies are included in the 2020 cost and performance assessment?

The 2020 Cost and Performance Assessment provided installed costs for six energy storage technologies: lithium-ion (Li-ion) batteries, lead-acid batteries, vanadium redox flow batteries, pumped storage hydro, compressed-air energy storage, and hydrogen energy storage.

What is the market share of energy storage in 2024?

By technology, batteries led with 82% of the United States energy storage market share in 2024, while hydrogen storage is projected to expand at a 28.5% CAGR through 2030.

What is the future of energy storage?

Renewable penetration and state policies supporting energy storage growth Grid-scale storage continues to dominate the US market, with ERCOT and CAISO making up nearly half of all grid-scale installations over the next five years.

What is the US energy storage monitor?

The US Energy Storage Monitor is offered quarterly in two versions– the executive summary and the full report. The executive summary is free, and provides a bird's eye view of the U.S. energy storage market and the trends shaping it.

Why is California a good place to buy a storage system?

In California, the big Investor Owned Utilities (IOUs) are contracting for energy and resource adequacy, leaving the merchant upside as an opportunity for owner-operators. Elsewhere, state policies supporting renewables and energy storage and utility long-term planning for balancing and reliability, are driving procurement of storage systems.

Will energy storage grow in 2024?

Allison Weis, Global Head of Energy Storage at Wood Mackenzie Another record-breaking year is expected for energy storage in the United States (US), with Wood Mackenzie forecasting 45% growth in 2024 after 100% growth from 2022 to 2023.

Guess what you want to know

-

How many energy storage power stations are there in North Macedonia

How many energy storage power stations are there in North Macedonia

-

Charging and discharging prices of energy storage power stations in Argentina

Charging and discharging prices of energy storage power stations in Argentina

-

Main prices of energy storage power stations

Main prices of energy storage power stations

-

South America Energy Storage Mobile Power Supply

South America Energy Storage Mobile Power Supply

-

North Africa Energy Storage Power Station New Energy Engineering Design

North Africa Energy Storage Power Station New Energy Engineering Design

-

How many companies are involved in Algeria s energy storage power stations

How many companies are involved in Algeria s energy storage power stations

-

What are the gravity energy storage power stations in Vietnam

What are the gravity energy storage power stations in Vietnam

-

How many companies are involved in energy storage power stations in Papua New Guinea

How many companies are involved in energy storage power stations in Papua New Guinea

-

The role of energy storage batteries in photovoltaic power stations

The role of energy storage batteries in photovoltaic power stations

-

What are India s modern energy storage power stations

What are India s modern energy storage power stations

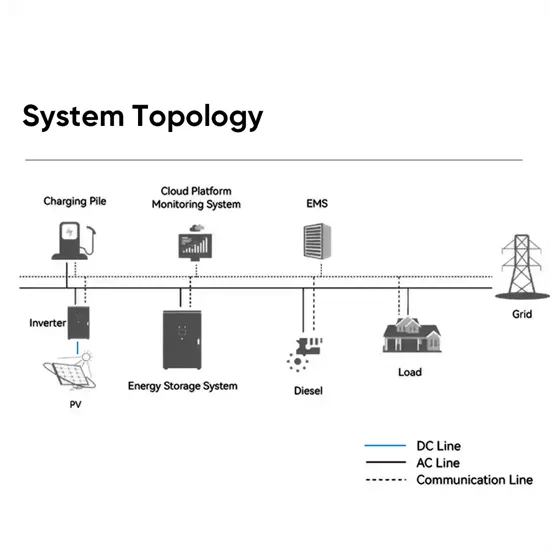

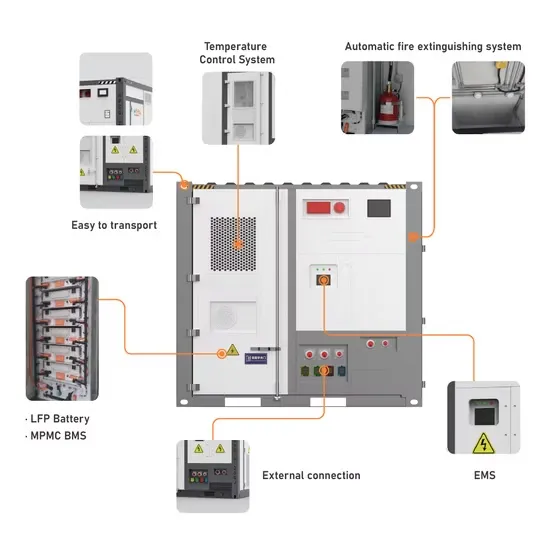

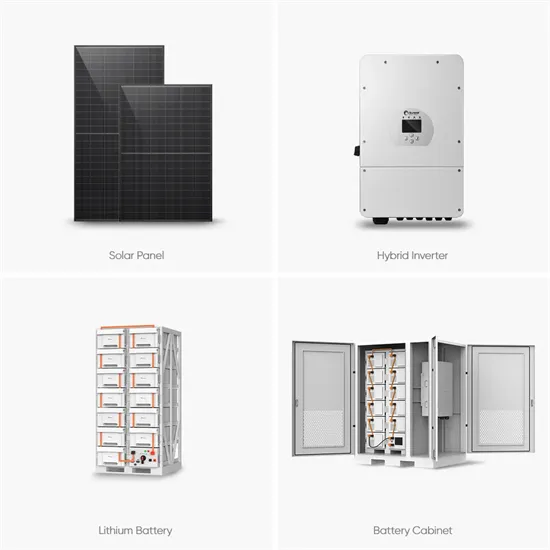

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

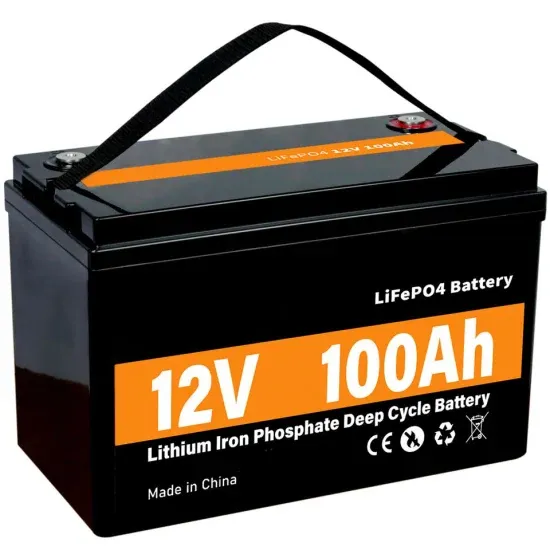

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.