Achieving the Promise of Low-Cost Long Duration Energy Storage

Executive Summary Long Duration Energy Storage (LDES) provides flexibility and reliability in a future decarbonized power system. A variety of mature and nascent LDES technologies hold

Get a quote

Energy Storage Cost and Performance Database

Additional storage technologies will be added as representative cost and performance metrics are verified. The interactive figure below presents results on the total installed ESS cost ranges by

Get a quote

Gravity Energy Storage

Gravity Energy Storage Introduction Gravity energy storage technology, a new form of mechanical energy storage, converts various forms of energy such as wind and solar energy into

Get a quote

Large Scale Gravity Energy Storage Market

In the U.S., the Inflation Reduction Act (IRA) introduced a 30% investment tax credit for standalone energy storage systems, including gravitational technologies, effectively reducing

Get a quote

Gravity Batteries: Stacking the Future of Energy Storage

Gravity energy storage, or gravity batteries, is an emerging technology that utilizes gravitational potential energy for large-scale, sustainable energy storage. This system

Get a quote

Gravity Energy Storage: A Review on System Types,

Considering the potential relevance of GES in the future power market, this review focuses on different types of GES, their techno-economic assessment, and integration with

Get a quote

Lithium-Ion Batteries are set to Face Competition from

Study shows that long-duration energy storage technologies are now mature enough to understand costs as deployment gets under way New

Get a quote

Steel-Based Gravity Energy Storage: A Two-Stage Planning

Although the integration of large-scale energy storage with renewable energy can significantly reduce electricity costs for steel enterprises, existing energy storage technologies

Get a quote

Gravitation

Based on the given data, Gravity Storage is the most cost-effective bulk electricity storage technology for systems larger than 1 GWh, followed by compressed air and pumped hydro.

Get a quote

2022 Grid Energy Storage Technology Cost and

The 2022 Cost and Performance Assessment provides the levelized cost of storage (LCOS). The two metrics determine the average price that a unit of

Get a quote

Investment strategy of gravity energy storage

Weekly blogs and videos with the latest investment strategies and ideas, market updates, and educational content. arrow_forward. Energy Vault. The economics of gravity storage are

Get a quote

European Investment Bank supports thermal, gravity

The EU''s European Investment Bank has pledged support for a long-duration thermal energy storage project and a gravity-based energy

Get a quote

Large Scale Gravity Energy Storage Market

The gravity energy storage market is emerging as a cost-effective solution for grid-scale energy storage, and its business models are evolving to capitalize on its unique value proposition:

Get a quote

Gravity Energy Storage: A Review on System Types,

Considering the potential relevance of GES in the future power market, this review focuses on different types of GES, their techno-economic

Get a quote

depth could provide energy storage for 1.3 USD/kWh with a

3 Batteries are a more practical and cheaper alternative to provide energy storage cycles shorter than 12 hours. Gravity energy storage technologies should focus on weekly, monthly, and

Get a quote

Gravity Energy Storage Project Costs: Breaking Down the

While lithium-ion batteries dominate headlines, gravity energy storage projects are quietly achieving price points that could reshape grid economics. Let''s dig into the numbers.

Get a quote

Cost

The initial investment for gravity energy storage systems is relatively high. Building the necessary infrastructure, such as the large - scale towers or pumped - hydro - like facilities, requires

Get a quote

Financial and economic modeling of large-scale gravity energy storage

This work models and assesses the financial performance of a novel energy storage system known as gravity energy storage. It also compares its performance with alternative

Get a quote

operation and maintenance costs of gravity energy storage

The utilization of innovative gravity energy storage (GES) has increased in the power system in the past few years, with no geographical restrictions and reduced investment costs.

Get a quote

2022 Grid Energy Storage Technology Cost and Performance

The 2022 Cost and Performance Assessment provides the levelized cost of storage (LCOS). The two metrics determine the average price that a unit of energy output would need to be sold at

Get a quote

Levelized Cost of Storage Gravity Storage

Gravity Storage is more than 50% more cost-effective than lithium-ion and sodium-sulfur battery storage, because of significantly longer lifetime and lack of depth-of-discharge limitation and

Get a quote

Analytical and quantitative assessment of capital expenditures for

The capital expenditures to energy capacity ratio (capex) stands as a key competitive metric for energy storage systems. This paper presents an evaluation of this

Get a quote

Energy Storage Cost and Performance Database

Additional storage technologies will be added as representative cost and performance metrics are verified. The interactive figure below presents results

Get a quote

Why Energy Vault went from disrupting batteries to

But that didn''t stop Energy Vault from raising what was then the largest equity investment in a grid storage hardware startup, $ 110 million from

Get a quote

Levelised cost of storage comparison of energy storage systems

The intermittent nature of renewable energy sources brings about fluctuations in both voltage and frequency on the power network. Energy storage systems have been utilised

Get a quote

6 FAQs about [Gravity energy storage investment costs]

Is gravity energy storage a good investment?

The results reveal that GES has resulted in good performance metrics including IRR and NPV of project and Equity, as well as ADSCR, and LLCR. In addition, for a 1 GW power capacity and 125 MWh energy capacity system, gravity energy storage has an attractive LCOS of 202 $/MWh.

How much does gravity storage cost?

For Gravity Storage systems, the levelized cost of storage decreases as the system size increases. Based on the system cost, GES with an energy storage capacity of 1 GWh, 5 GWh, and 10 GWh has an LCOS of 202 US$/MWh, 111 US$/MWh, 92 US$/MWh, respectively. This can be explained by the fact that the system CAPEX decreases with an increased capacity.

What are the advantages of gravity storage?

Low specific energy investment costs represent the key advantage for these technologies at the required discharge duration of 8 hours. Gravity Storage further benefits from moderate specific power investment costs and more significant scale effects with increasing system size.

What is gravity energy storage?

Gravity energy storage (GES) technology relies on the vertical movement of heavy objects in the gravity field to store or release potential energy which can be easily coupled to electricity conversion. GES can be matched with renewable energy such as photovoltaic and wind power.

Is a project investment in energy storage a viable investment?

The project investment in all the studied energy storage systems is demonstrated viable to both project sponsors and lenders since the IRRs of the project for all systems in their last year of operation are larger than the projected WACC and the IRR of equity in their maturity year are better than the return on equity. 5. Financial analysis

Is GES a good energy storage system?

It also compares its performance with alternative energy storage systems used in large-scale application such as PHES, CAES, NAS, and Li-ion batteries. The results reveal that GES has resulted in good performance metrics including IRR and NPV of project and Equity, as well as ADSCR, and LLCR.

Guess what you want to know

-

Burundi energy storage investment costs

Burundi energy storage investment costs

-

Energy storage project investment and operating costs

Energy storage project investment and operating costs

-

Industrial Park Energy Storage Investment Costs

Industrial Park Energy Storage Investment Costs

-

Uganda s investment in energy storage power station projects

Uganda s investment in energy storage power station projects

-

Total investment in energy storage batteries

Total investment in energy storage batteries

-

Energy storage power station investment entities

Energy storage power station investment entities

-

Sao Tome and Principe photovoltaic power station energy storage investment

Sao Tome and Principe photovoltaic power station energy storage investment

-

Charging costs of energy storage power stations

Charging costs of energy storage power stations

-

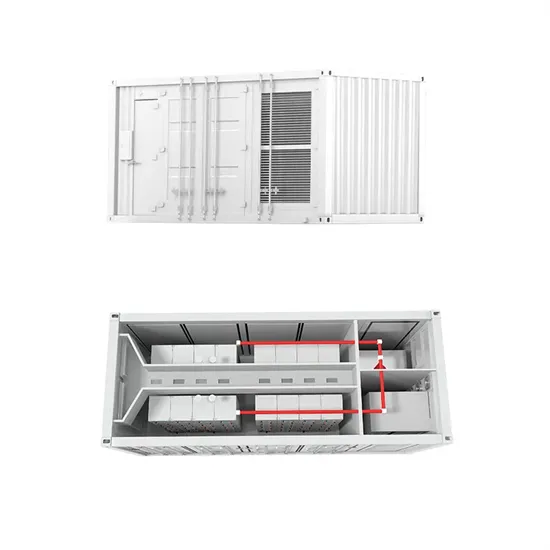

Containerized energy storage investment

Containerized energy storage investment

-

Energy storage equipment investment per kilowatt-hour

Energy storage equipment investment per kilowatt-hour

Industrial & Commercial Energy Storage Market Growth

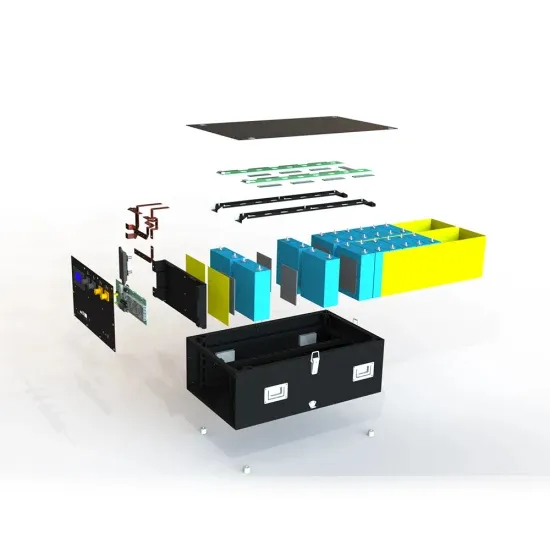

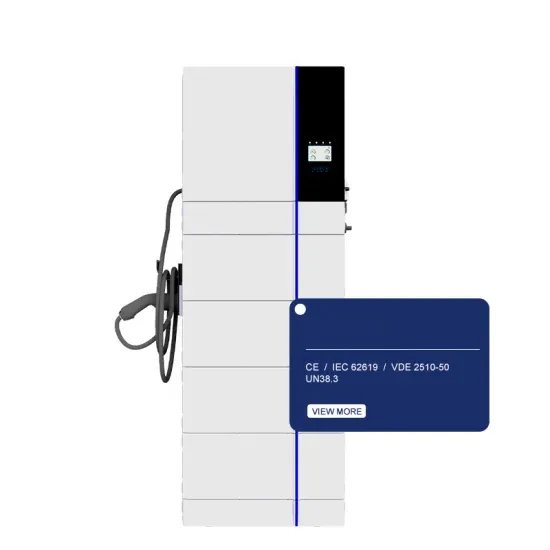

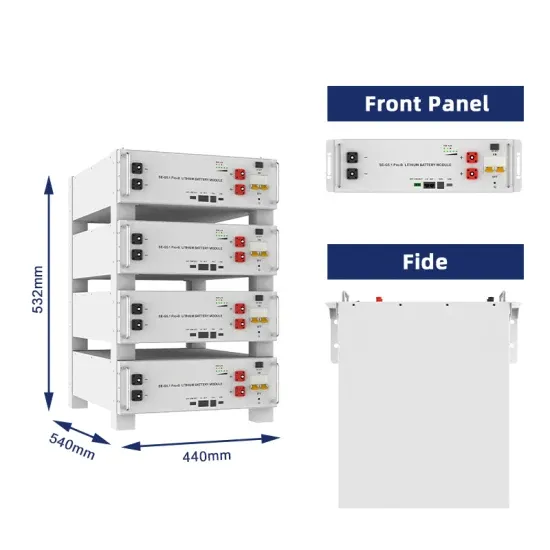

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

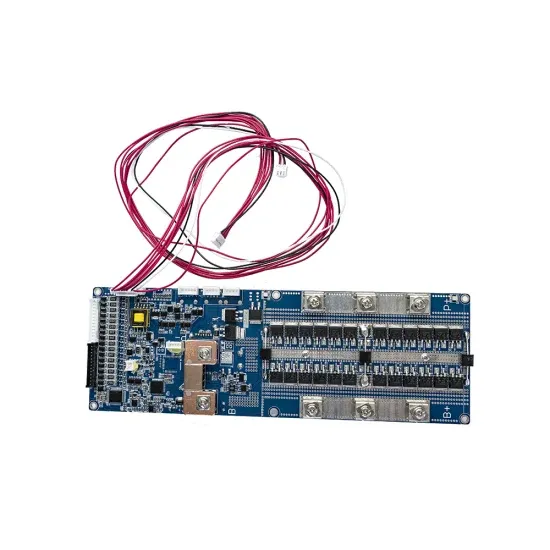

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.