Uztelecom Launches 5G and Prepares for 5.5G in Uzbekistan

Uztelecom Launches 5G and Prepares for 5.5G in Uzbekistan Uztelecom, the state-owned telecom operator, has officially launched its non-standalone (NSA) 5G network across all

Get a quote

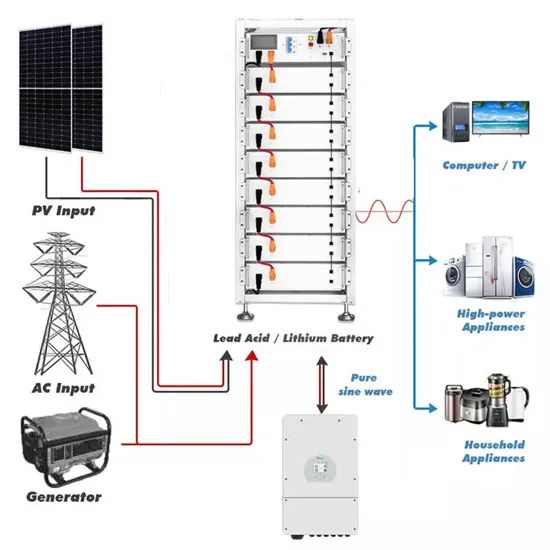

Telecom Station Power System Upgrade Project in Uzbekistan

Project Background In recent years, 5G coverage has been expanding in major cities and tourist centers across Uzbekistan. In response, the client (a telecom operator in

Get a quote

Uztelecom Expands 5G To All Regions In Uzbekistan

Uztelecom enhances its 5G network, now covering every regional center in Uzbekistan, paving the way for nationwide digital transformation.

Get a quote

China reaches over 4 million 5G base stations

China had surpassed 4.04 million 5G base stations as of the end of August, according to data released by the country''s Ministry of Industry and Information Technology.

Get a quote

Uztelecom expands 5G rollout across Uzbekistan

Uztelecom has expanded its 5G rollout to cover all regional centers across Uzbekistan. The carrier, which launched 5G in the capital city of Tashkent in 2022, revealed

Get a quote

5G Network Launched in Uzbekistan – Global Validity

In April 2023, a 5G trial was successfully launched in the capital city of Tashkent, using more than 60 newly installed 5G base stations. At the upcoming ICTWeek exhibition in

Get a quote

5G Network Launched Across Uzbekistan

Uztelecom''s launch makes it the first operator in Uzbekistan to deploy NSA 5G. However, its recently privatized competitor, Rubicon Wireless Communications, known as

Get a quote

5G Technology Metrics Explained: Base Station, Uplink, and User

Explore in-depth technology metrics for 5G systems, comparing key specifications across base stations, uplink CPEs, and user devices to understand network design and

Get a quote

Central Asia Embarks on 5G While 4G is Still Lacking

Uzbekistan and Kazakhstan, in particular, invest in digital infrastructure to stimulate all facets of the digital economy. We used Speedtest Intelligence ® data to compare

Get a quote

Operator Watch Blog: Uzbekistan is Toying with 5G

Uzbekistan''s state operator Mobiuz has embarked on a wide-reaching modernisation of its network in order to boost capacity and quality of service. Mobiuz has

Get a quote

Evaluating Mobile Network Performance Across

By June 2024, they had installed 1,144 base stations across 20 cities, with ongoing efforts to extend 5G coverage further. Uzbekistan also

Get a quote

Uztelecom launches 5G across Uzbekistan

Thursday''s launch makes Uztelecom the first telco in Uzbekistan to launch NSA 5G. However, recently-privatised rival telco Rubicon Wireless Communications, a.k.a. Perfectum, aims to be

Get a quote

Kazakhstan''s mobile performance shows

As of mid-November 2023, Kazakhtelecom announced that the 5G network is operational in 15 cities, with over 1,000 live 5G base stations. Tele2

Get a quote

Uzbekistan introducing 5G technology

The first stage of the project provides for full coverage of the city of Tashkent with a 5G network, as well as partial coverage of regional centers. After completion of the work, the

Get a quote

5g base station architecture

5G (fifth generation) base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more

Get a quote

Uzbekistan: Regional position & Operator experience

4 days ago· Market context Uzbekistan''s mobile market is rapidly evolving, driven by accelerating network deployments, early 5G rollouts, and sweeping regulatory reform. This transformation

Get a quote

Top 5G Base Station gNodeB Manufacturers & Vendors

Explore the leading manufacturers of 5G gNodeB base stations, including Nokia, Ericsson, Huawei, Samsung, and ZTE, and their contributions to the telecom industry.

Get a quote

Operator Watch Blog: Uzbekistan is Toying with 5G

The operator also has16 5G base stations operational in test mode in the city of Samarkand. In Samarkand, Mobiuz''s 5G base stations were initially installed at the ''Silk Road

Get a quote

5G Network Launched in Uzbekistan – Global Validity

In April 2023, a 5G trial was successfully launched in the capital city of Tashkent, using more than 60 newly installed 5G base stations. At the

Get a quote

Central Asia Embarks on 5G While 4G is Still Lacking

Uzbekistan and Kazakhstan, in particular, invest in digital infrastructure to stimulate all facets of the digital economy. We used Speedtest

Get a quote

Quick guide: components for 5G base stations and antennas

Base stations A 5G network base-station connects other wireless devices to a central hub. A look at 5G base-station architecture includes various equipment, such as a 5G

Get a quote

6 FAQs about [Which 5G base station is best in Uzbekistan ]

Does Tashkent have a 5G network?

The first stage of the project provides for full coverage of the city of Tashkent with a 5G network, as well as partial coverage of regional centers.

When will 5G technology be introduced in Uzbek?

Since March 2023, the process of increasing the speed of mobile Internet and introducing 5G technology throughout the country has begun, the head of the Uzbektelecom press service Timur Mamajonov reported.

When will 5G start in Kazakhstan?

The state-owned operator, Kazakhtelecom, already outlined its plans concerning the 5G services launch, with the first 486 base stations scheduled to be launched in Astana, Almaty, and Shymkent in 2023, ahead of a wider rollout of over 7,000 5G cell sites across the Kcell and Tele2-Altel networks by the end of 2025.

How many base stations will be modernized in Uzbekistan?

As part of the project, more than 3,000 existing base stations across Uzbekistan will be modernized using the latest technologies, and more than 2,000 new base stations will be built and put into operation. The process of upgrading base stations to the 5G standard is an important stage of the project.

Is Kyrgyzstan launching 5G in 2022?

Operators in Kyrgyzstan are piloting 5G as well. In September 2022, MegaCom, in partnership with Huawei and the Ministry of Digital Development, launched a 5G showcase zone in Bishkek. Nur Telecom (O!) opened a second demo zone in October 2022 in the city of Osh, in addition to the one in Bishkek.

Which country has the most 4G available in Q4 2022?

Kyrgyzstan also came first in terms of 4G at 88.8%, up from 81.9% in Q2 2021. Tajikistan made the most progress with regard to 4G Availability — increasing by 12.8 ppt from 59.5% in Q4 2021 to 72.3% in Q4 2022, followed by Uzbekistan, which increased from 67.1% 4G Availability in Q4 2021 to 75.4% in Q4 2022.

Guess what you want to know

-

Which German 5G base station power supply manufacturers are there

Which German 5G base station power supply manufacturers are there

-

Which is better a 5G base station or a container communication base station

Which is better a 5G base station or a container communication base station

-

Which communication base station in Georgia has the best energy storage

Which communication base station in Georgia has the best energy storage

-

Which company will build the inverter for Kiribati s 5G communication base station

Which company will build the inverter for Kiribati s 5G communication base station

-

Which communication base station energy storage system is best

Which communication base station energy storage system is best

-

Which 5G base station power supply manufacturers are there

Which 5G base station power supply manufacturers are there

-

5G communication base station wind power cost structure

5G communication base station wind power cost structure

-

5G base station weak current

5G base station weak current

-

Base Station Energy Company 5G

Base Station Energy Company 5G

-

Maldives 5G communication base station energy storage system construction plan

Maldives 5G communication base station energy storage system construction plan

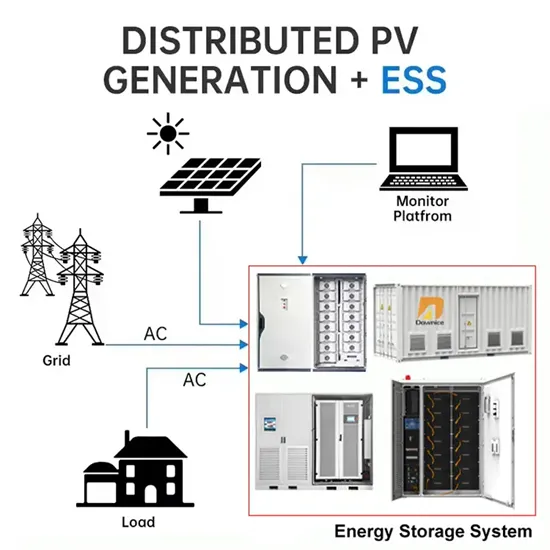

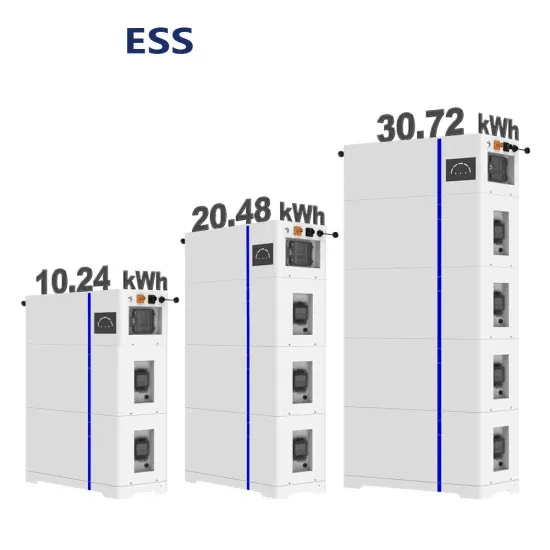

Industrial & Commercial Energy Storage Market Growth

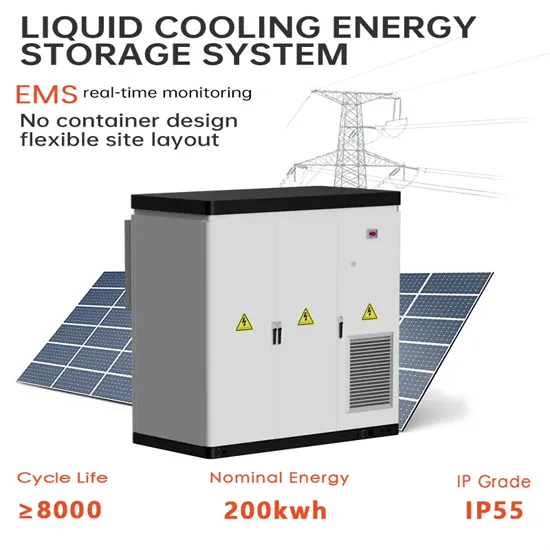

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

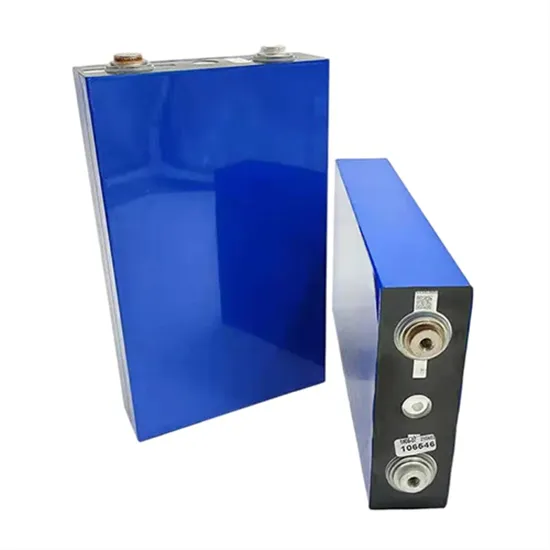

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.