5g Base Station Market Size & Share Analysis

The industry is seeing innovations in both small cell and macro cell technologies, with vendors focusing on developing more efficient, compact,

Get a quote

Modeling and aggregated control of large-scale 5G base stations

A significant number of 5G base stations (gNBs) and their backup energy storage systems (BESSs) are redundantly configured, possessing surplus capacit

Get a quote

Lockheed Martin to demonstrate space-based 5G network

The test included five hybrid base stations with 5G, tactical datalinks and space backhaul. Potential customers The company is considering several options to market this

Get a quote

Why 5G Base Station Energy Storage is the Backbone of Next

Spoiler: it''s not magic – it''s 5G base station energy storage systems working overtime. As 5G networks multiply faster than coffee shops in a hipster neighborhood, these invisible power

Get a quote

5G Communication Base Stations Participating in Demand

The 5th generation mobile networks (5G) is in the ascendant. The 5G development needs to deploy millions of 5G base stations, which will become considerable

Get a quote

Distribution network restoration supply method considers 5G base

This paper proposes a distribution network fault emergency power supply recovery strategy based on 5G base station energy storage. This strategy introduces Theil''s entropy

Get a quote

Modelling the 5G Energy Consumption using Real-world

This paper proposes a novel 5G base stations energy con-sumption modelling method by learning from a real-world dataset used in the ITU 5G Base Station Energy Consumption Modelling

Get a quote

The business model of 5G base station energy storage

However, pumped storage power stations and grid-side energy storage facilities, which are flexible peak-shaving resources, have relatively high investment and operation costs. 5G base

Get a quote

Energy-efficient 5G for a greener future

Compared to earlier generations of communication networks, the 5G network will require more antennas, much larger bandwidths and a higher density of base stations. As a

Get a quote

5G Energy Efficiency Overview

Base station resources are generally unused 75 - 90% of the time, even in highly loaded networks. 5G can make better use of power-saving techniques in the base station part,

Get a quote

5G Base Station Companies

Get access to the business profiles of top 10 5G Base Station companies, providing in-depth details on their company overview, key products and services, financials, recent developments

Get a quote

5G Base Station Market Size to Surpass USD 832.42 Billion by

The global 5G base station market size is accounted to hit around USD 832.42 billion by 2034 increasing from USD 44.86 billion in 2024, with a CAGR of 33.92%.

Get a quote

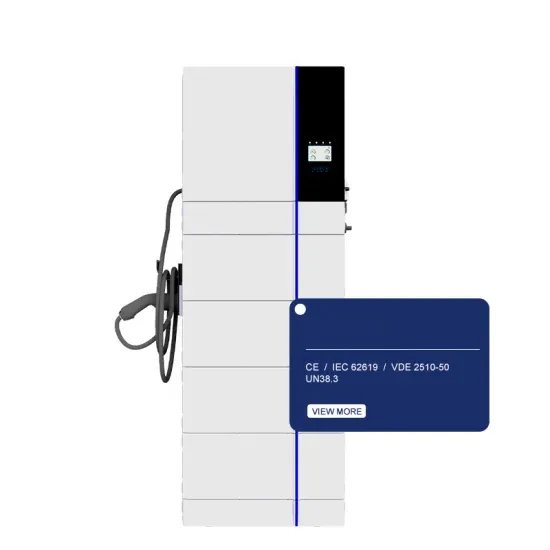

Revolutionising Connectivity with Reliable Base Station Energy

Discover how base station energy storage empowers reliable telecom connectivity, reduces OPEX, and supports hybrid energy.

Get a quote

Ericsson powers 5G base station with wireless energy

Ericsson has successfully tested the world''s first wirelessly powered 5G base station, a development that could dramatically change the model for 5G network building in the

Get a quote

Energy-efficiency schemes for base stations in 5G heterogeneous

In today''s 5G era, the energy efficiency (EE) of cellular base stations is crucial for sustainable communication. Recognizing this, Mobile Network Operators are actively prioritizing EE for

Get a quote

What is a 5G Base Station?

Central to this transformation are 5G base stations, the backbone of the next-generation network. These base stations are pivotal in delivering the high-speed, low-latency

Get a quote

5g Base Station Market Size & Share Analysis

The industry is seeing innovations in both small cell and macro cell technologies, with vendors focusing on developing more efficient, compact, and powerful base station

Get a quote

Global 5G Base Station Energy Storage Supply, Demand and

This report is a detailed and comprehensive analysis of the world market for 5G Base Station Energy Storage and provides market size (US$ million) and Year-over-Year

Get a quote

Power Consumption Modeling of 5G Multi-Carrier Base

Importantly, this study item indicates that new 5G power consumption models are needed to accurately develop and optimize new energy saving solutions, while also considering the

Get a quote

The 5G Revolution: How Base Stations Are Powering the Future

The 5G base station market is not just a technological frontier—it''s the backbone of a connected future. As industries evolve and consumer demands escalate, the sector''s growth

Get a quote

6 FAQs about [Base Station Energy Company 5G]

What is a 5G base station?

As the world continues its transition into the era of 5G, the demand for faster and more reliable wireless communication is skyrocketing. Central to this transformation are 5G base stations, the backbone of the next-generation network. These base stations are pivotal in delivering the high-speed, low-latency connectivity that 5G promises.

Will Ericsson's new 5G base station change the future?

Ericsson has successfully tested the world’s first wirelessly powered 5G base station, a development that could dramatically change the model for 5G network building in the future.

Which region dominates the 5G base station market?

The Asia-Pacific region continues to dominate the global 5G base station market, with a projected CAGR of approximately 38% from 2024 to 2029. This region represents the most dynamic and fastest-growing market, led by significant deployments in China, Japan, South Korea, and India.

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

How many 5G base stations does Ericsson have?

Recently, it has partnered with operators such as MTN and Rain in South Africa to build more than 2,500 5G base stations. Ericsson has extended its reach to the UK, Saudi Arabia, Spain, Belgium, Luxembourg, and Lithuania, providing 5G private network solutions for BT and Saudi Telecommunication.

How many 5G base stations are there in China?

The market is witnessing significant developments in base station technology and deployment strategies. By September 2023, China had built 3.189 million 5G base stations, with 22.6 5G stations per 10,000 people, demonstrating the scale of infrastructure deployment possible.

Guess what you want to know

-

Base Station Energy Company 5G

Base Station Energy Company 5G

-

5g base station energy storage battery price

5g base station energy storage battery price

-

Hybrid energy 5G base station energy method

Hybrid energy 5G base station energy method

-

Myanmar 5G base station communication energy

Myanmar 5G base station communication energy

-

Yemen 5g base station power distribution photovoltaic bidding company

Yemen 5g base station power distribution photovoltaic bidding company

-

New 5G base station integrated energy cabinet

New 5G base station integrated energy cabinet

-

Kenya 5G communication base station energy storage system

Kenya 5G communication base station energy storage system

-

5 5G communication base station hybrid energy equipment

5 5G communication base station hybrid energy equipment

-

5G base station solar energy

5G base station solar energy

-

Congo Brazzaville 5G hybrid energy base station

Congo Brazzaville 5G hybrid energy base station

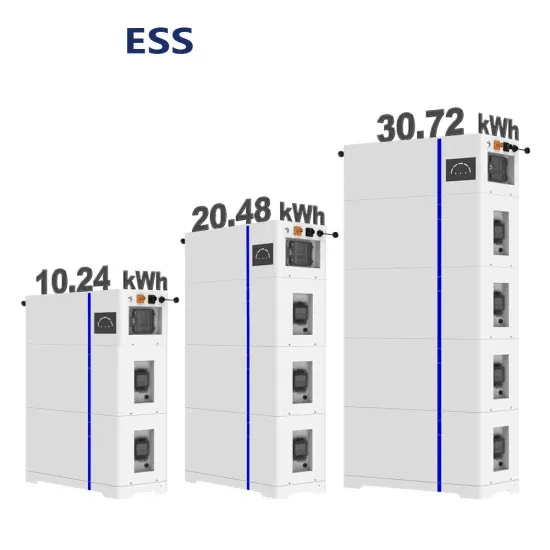

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.