GECOL signs EPC contract for Zliten power station in Libya

General Electricity Company of Libya (GECOL) has signed a €1.19bn ($1.3bn) contract with an Egyptian-Qatari consortium for the construction of the Zliten power station.

Get a quote

Libya Launches 2025 Bid Round, Paving the Way for Oil & Gas

In the Ghadames Basin, bp is advancing a multi-well drilling campaign targeting multiple oil and gas formations, leveraging existing seismic data as well as exploring

Get a quote

Libya Launches 2025 Bid Round, Paving the Way for

Libya''s renewed push for oil and gas investment will take center stage at African Energy Week: Invest in African Energies 2025, where global

Get a quote

Libya: Oil and gas infrastructure map and production data

The main map provides an overview of Libya''s main oil and gas production areas and power generation sites. Fields are marked alongside associated mid- and downstream

Get a quote

Department of Energy Philippines

The Department of Energy (DOE) ensures a continuous, adequate, and economic supply of energy to keep pace with the countrys growth and economic development with the end view of

Get a quote

Libya Launches 20 Strategic Power Projects to Bolster Energy

These projects, supported by the Libyan government, aim to address critical challenges such as low voltage, grid bottlenecks and power fluctuations. Key efforts include

Get a quote

Libya''s Mega 2025 Bid Round 2025: 22 Blocks,

After finally launching a long-awaited oil and gas bid round, Libya''s NOC has laid out the details of the 22 concessions on offer, hoping the ''promising'' onshore

Get a quote

ENKA_IN LIBYA

The project is based on a power island configuration for 4x SGT5-PAC 2000E Siemens gas turbines and turbine generators (CTG) units. CTGs will be dual-fuel fired with natural gas and

Get a quote

GECOL: Work resumes on the West Tripoli power station project

The General Electricity Company of Libya (GECOL) announced the arrival of materials for the implementation of the West Tripoli steam power station project after work on

Get a quote

Libya Launches 2025 Bid Round, Paving the Way for

In the Ghadames Basin, bp is advancing a multi-well drilling campaign targeting multiple oil and gas formations, leveraging existing seismic

Get a quote

Top Three Planned Oil & Gas Projects in Libya

In 2022, Libya is advancing several strategic oil and gas megaprojects aimed at monetizing domestic gas resources, boosting crude output and increasing in

Get a quote

TRIPOLI WEST 671 MW SIMPLE CYCLE POWER PLANT

In 2017, ENKA in consortium with Siemens signed the contract for the construction of the fast-track project of Tripoli West 671 MW Simple Cycle Power Plant in Libya.

Get a quote

Sarir power station

Sarir power station (محطة السرير الغربي، محطة توليد كهرباء السرير الغازية) is an operating power station of at least 855-megawatts (MW) in Sarir Oil Field, Kufra, Libya. It is also known as Al

Get a quote

A Comprehensive Guide to Libya''s 2025 Licensing

Contract signings under the EPSA framework are scheduled for November 22-30, 2025. Libya''s 2025 licensing round is expected to be a

Get a quote

The commencement of the Zliten Power Plant Project

This strategic project will deliver a 1,044 MW power generation facility equipped with advanced turbines, high-voltage transmission lines, and an integrated fuel supply system,

Get a quote

Libya power Tenders, Bids and RFP

Latest Libya power Tenders, Government Bids, RFP and other public procurement notices related to power from Libya. Users can register and get updated information on Libya

Get a quote

Libya Looks To Boost Oil Production Amid Soaring Geopolitical Risk

The country serves as a critical power base for Russia''s interests and operations in Africa. Libyan ports and military bases in border regions with the Sahel are being assessed or

Get a quote

A Comprehensive Guide to Libya''s 2025 Licensing Round

Contract signings under the EPSA framework are scheduled for November 22-30, 2025. Libya''s 2025 licensing round is expected to be a major focus at the upcoming LEES in

Get a quote

Libya Licensing

We are pleased to announce the launch of Libya''s First International Exploration and Development Bid Round in 18 years, following the last EPSA Bid Round in 2007. This

Get a quote

Libya Projects, Projects from Libya, Libya Online Projects, Libya

Libya Project Tenders - Get 100% accurate Project Details and Projects information in Libya along with Public Tenders, International Bidding opportunities, and more. Tendersinfo is your 1-Stop

Get a quote

General Electricity Company of Libya

Bid details 2023/04/16 Call for Open Tendering (Tender No 2023/77) (Supply new engines for the desalination plant at Al Khums station) General Electricity Company of Libya (GECOL) hereby

Get a quote

Libya''s Mega 2025 Bid Round 2025: 22 Blocks, 235,000 km2...

After finally launching a long-awaited oil and gas bid round, Libya''s NOC has laid out the details of the 22 concessions on offer, hoping the ''promising'' onshore and offshore acreages will renew

Get a quote

More than 40 firms bid for Libya''s oil licensing round

More than 40 energy companies have expressed interest in Libya''s latest upstream licensing round, marking a notable shift in the country''s return to the global energy

Get a quote

Al Khums power station

Al Khums power station (مجمع الخمس لمحطات إنتاج الطاقة الكهربائية, محطة كهرباء الخمس بخارية تحلية غازيه، محطة كهرباء الخمس) is an operating power station of at least 1610-megawatts (MW) in Khoms, Murqub, Libya.

Get a quote

Key Takeaways from London and Istanbul – Libya Bidding

Recent roadshows in London and Istanbul provided pivotal insights into Libya''s evolving Exploration and Production Sharing Agreement ("EPSA") framework and upcoming

Get a quote

GECOL signs EPC contract for Zliten power station in

General Electricity Company of Libya (GECOL) has signed a €1.19bn ($1.3bn) contract with an Egyptian-Qatari consortium for the

Get a quote

6 FAQs about [Libya power base station project bidding]

How many acreages are in Libya's Mega 2025 bid round?

Libya’s Mega 2025 Bid Round 2025: 22 Blocks, 235,000 km2... After finally launching a long-awaited oil and gas bid round, Libya’s NOC has laid out the details of the 22 concessions on offer, hoping the ‘promising’ onshore and offshore acreages will renew international interest in the country’s turbulent sector.

What is Libya's first international exploration & development bid round?

We are pleased to announce the launch of Libya's First International Exploration and Development Bid Round in 18 years, following the last EPSA Bid Round in 2007. This milestone presents a significant investment opportunity aimed at enhancing Libya's oil and gas reserves and production potential.

Why is Libya launching a bid for oil exploration in 2025?

The Libyan government has officially launched the 2025 bid round for oil exploration, a long-anticipated move that marks a significant milestone in the country’s efforts to revitalize its energy industry.

Will Libya's Oil & Gas bid round'revitalize' its hydrocarbon sector?

Libya’s oil ministry on 7 March published the details of its long-awaited oil and gas bid round (MEES, 7 March), offering 22 onshore and offshore concessions in a bid to “revitalize” the country’s battered hydrocarbon sector “through increased and focused foreign investments,” according to the official website.

Will Libya's renewed push for oil and gas investment take center stage?

Libya’s renewed push for oil and gas investment will take center stage at African Energy Week: Invest in African Energies 2025, where global stakeholders will explore opportunities in the country’s newly launched bid round, advancing projects and emerging energy partnerships.

What is the NOC Libya bid round?

The NOC Libya Bid Round welcomes technically and financially qualified companies that adhere to industry best practices and regulatory standards. Eligible participants must showcase proven expertise in oil and gas exploration, development, and operations, along with a strong commitment to environmental responsibility and sustainability.

Guess what you want to know

-

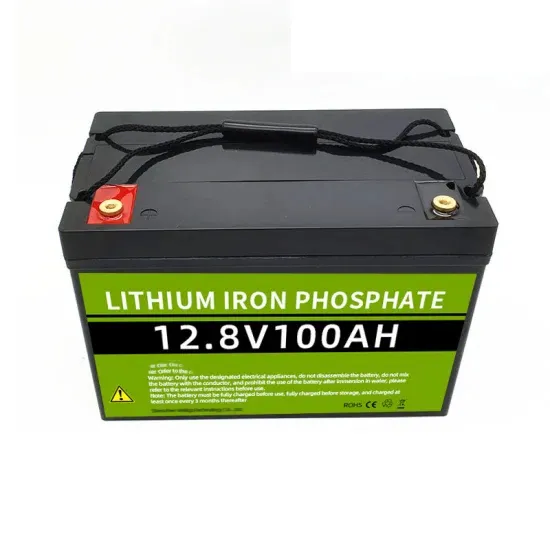

Libya communication base station battery project bidding

Libya communication base station battery project bidding

-

North Macedonia communication base station power supply cabinet bidding

North Macedonia communication base station power supply cabinet bidding

-

Libya communication base station photovoltaic power generation parameters

Libya communication base station photovoltaic power generation parameters

-

Kazakhstan communication base station power supply construction project

Kazakhstan communication base station power supply construction project

-

Communication base station power supply renovation project

Communication base station power supply renovation project

-

State Power Investment Corporation 5g base station project

State Power Investment Corporation 5g base station project

-

Yemen 5g base station power distribution photovoltaic bidding company

Yemen 5g base station power distribution photovoltaic bidding company

-

Afghanistan communication base station power supply cabinet bidding

Afghanistan communication base station power supply cabinet bidding

-

West Africa Base Station Room Uninterruptible Power Supply Project

West Africa Base Station Room Uninterruptible Power Supply Project

-

How to build a wind power project for a communication base station

How to build a wind power project for a communication base station

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.