Topband Won the Bid for China Mobile''s Lithium iron

This bid is the cooperation between Topband and China Mobile after winning the bid of "China Mobile''s Centralized Procurement Project of

Get a quote

Libya battery project bidding information

Search all the announced and upcoming battery energy storage system (BESS) projects, bids, RFPs, ICBs, tenders, government contracts, and awards in Libya with our comprehensive

Get a quote

Battery for Telecom Base Station Market

Battery procurement for telecom base stations faces multifaceted supply chain challenges driven by material scarcity, geopolitical tensions, and unpredictable logistics.

Get a quote

Libya Battery Tenders, Bids and RFP

Latest Libya Battery Tenders, Government Bids, RFP and other public procurement notices related to Battery from Libya. Users can register and get updated information on Libya

Get a quote

Optimization of Communication Base Station Battery

In the communication power supply field, base station interruptions may occur due to sudden natural disasters or unstable power supplies. This work studies the optimization of

Get a quote

Aldabaiba follows up on 52 projects in 2025 – including in

Tripoli based Libyan prime minister Abdel Hamid Aldabaiba followed up yesterday on the plan to open or launch 52 projects in 2025. These include 43 projects ready for opening

Get a quote

Topband Wins Consecutive Bids for China Tower''s

Previously, Topband has won multiple orders for communication base station backup power, including those from China Tower and China Mobile. This consecutive win

Get a quote

Libya power Tenders, Bids and RFP

TendersOnTime, the best online tenders portal, provides latest Libya Power tenders, RFP, Bids and eprocurement notices from various states and counties in Libya.

Get a quote

A Comprehensive Guide to Libya''s 2025 Licensing Round

Serving as part of Libya''s 25-year strategy to add 8 billion barrels of crude oil to its proven reserves, the 2025 licensing round features newly selected blocks based on geological

Get a quote

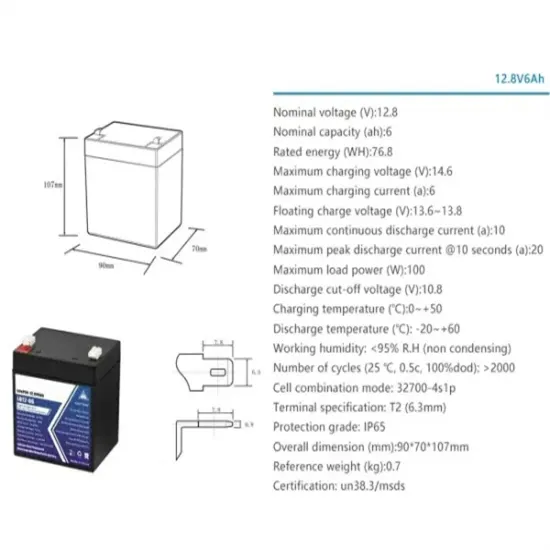

Communication Base Station Energy Storage Lithium Battery

Dominant Lithium Battery Suppliers in the Global Communication Base Station Energy Storage Market The global market for lithium batteries in communication base station energy storage is

Get a quote

List of Upcoming Battery Energy Storage System (BESS) Projects in Libya

Search all the announced and upcoming battery energy storage system (BESS) projects, bids, RFPs, ICBs, tenders, government contracts, and awards in Libya with our comprehensive

Get a quote

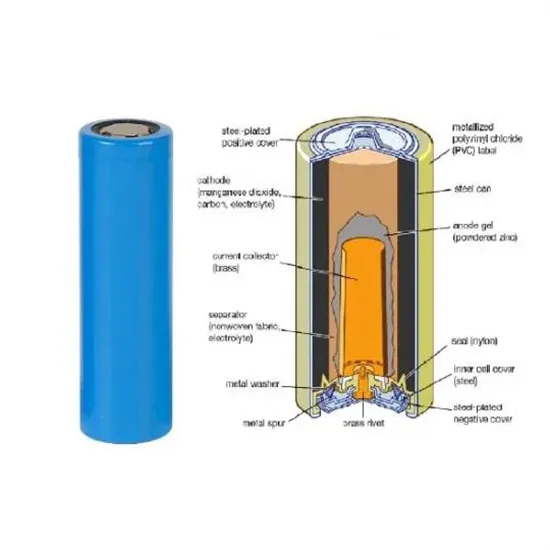

Communication base station backup power supply why use

1."For a long time, the communication backup power supply mainly uses lead-acid batteries, but lead-acid batteries have always had shortcomings such as short service life, frequent daily

Get a quote

Analyzing Communication Base Station Li-ion Battery:

The Communication Base Station Li-ion Battery market is experiencing robust growth, driven by the expanding global network infrastructure and the increasing demand for reliable power

Get a quote

List of Upcoming Battery Energy Storage System (BESS)

Search all the announced and upcoming battery energy storage system (BESS) projects, bids, RFPs, ICBs, tenders, government contracts, and awards in Libya with our comprehensive

Get a quote

Libyan Tenders

Our simple and intuitive online search system provides members with quick and easy access to real-time procurement opportunities from across Libya, spanning diverse industry segments.

Get a quote

Contract Opportunities

Contract opportunities are procurement notices from federal contracting offices. Anyone interested in doing business with the government can use this system to search

Get a quote

A Comprehensive Guide to Libya''s 2025 Licensing

Serving as part of Libya''s 25-year strategy to add 8 billion barrels of crude oil to its proven reserves, the 2025 licensing round features newly

Get a quote

Lithium battery for communication base station

In this paper, we closely examine the base station features and backup battery features from a 1.5-year dataset of a major cellular service provider, including 4,206 base stations distributed

Get a quote

Optimization of Communication Base Station Battery

In the communication power supply field, base station interruptions may occur due to sudden natural disasters or unstable power supplies. This

Get a quote

Latest Tenders Notices in Libya Bid & Tender Information – Bid

Through Bid Detail you can access multiple kinds of tenders including construction, IT, healthcare, infrastructure and service-based opportunities. Experience maximum

Get a quote

Libya Projects, Projects from Libya, Libya Online Projects, Libya

Advance Search to Find 100% relevant Projects in Libya. Tendersinfo is a powerful, searchable database that provides its users with the best opportunities from Projects published in Libya.

Get a quote

Libya Licensing

We are pleased to announce the launch of Libya''s First International Exploration and Development Bid Round in 18 years, following the last EPSA Bid Round in 2007. This

Get a quote

6 FAQs about [Libya communication base station battery project bidding]

What is the procurement scene like in Libya?

Libya's procurement scene offers opportunities for international businesses, particularly in sectors like infrastructure, healthcare, and energy. Find all government tenders from Libya with 100% accuracy. Government of Libya tenders are covered from all departments including -

What is Libya's first international exploration & development bid round?

We are pleased to announce the launch of Libya's First International Exploration and Development Bid Round in 18 years, following the last EPSA Bid Round in 2007. This milestone presents a significant investment opportunity aimed at enhancing Libya's oil and gas reserves and production potential.

What are Libya government tenders?

Government of Libya tenders are covered from all departments including - Libya government awards contracts for goods and services across all industries. The most popular categories for Libya government procurement are - Libya Government releases various kinds of tenders -

What is a project in Libya?

Libya Projects - Projects come much before tenders in the project life-cycle. Projects are "broad" notices indicating the sector in which the buyer will procure goods or services in future. This helps manufacturers/suppliers to get ready and arrange for resources for the future big orders by Libya's government.

What are the different types of Libya government procurement?

The most popular categories for Libya government procurement are - Libya Government releases various kinds of tenders - Libya RFP - A document outlining the Libya government's requirements for a proposed project or service, inviting vendors to submit detailed proposals.

What is the NOC Libya bid round?

The NOC Libya Bid Round welcomes technically and financially qualified companies that adhere to industry best practices and regulatory standards. Eligible participants must showcase proven expertise in oil and gas exploration, development, and operations, along with a strong commitment to environmental responsibility and sustainability.

Guess what you want to know

-

Huijue Communication 5G Base Station Project Bidding

Huijue Communication 5G Base Station Project Bidding

-

Liechtenstein communication base station energy storage battery bidding

Liechtenstein communication base station energy storage battery bidding

-

Libya power base station project bidding

Libya power base station project bidding

-

Belgian communication base station lead-acid battery bidding

Belgian communication base station lead-acid battery bidding

-

South Sudan 5G Communication Base Station Flow Battery Construction Project

South Sudan 5G Communication Base Station Flow Battery Construction Project

-

Burkina Faso communication base station lead-acid battery bidding

Burkina Faso communication base station lead-acid battery bidding

-

Chile Huijue Communication 5G communication base station flow battery project

Chile Huijue Communication 5G communication base station flow battery project

-

Romania communication base station battery replacement process

Romania communication base station battery replacement process

-

Communication base station outdoor communication site lithium iron phosphate battery

Communication base station outdoor communication site lithium iron phosphate battery

-

Communication base station flow battery cabinet module

Communication base station flow battery cabinet module

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.