Vanadium Redox Flow Batteries

Introduction Vanadium redox flow battery (VRFB) technology is a leading energy storage option. Although lithium-ion (Li-ion) still leads the industry in deployed capacity, VRFBs offer new

Get a quote

Vanadium Flow Batteries: Industry Growth & Potential

Explore the rise of vanadium flow batteries in energy storage, their advantages, and future potential as discussed by Vanitec CEO John Hilbert.

Get a quote

Electrolyte for All-Vanadium Redox Flow Battery Market: Trends

Electrolyte for All-Vanadium Redox Flow Battery Market size was valued at USD XX Billion in 2022 and is projected to reach USD XX Billion by 2032, growing at a CAGR of

Get a quote

Vanadium Redox Flow Battery Market Size & Growth

The growing trend to achieve zero-emission microgrids to supply clean and carbon-free energy in adverse weather conditions is projected to create

Get a quote

Vanadium Redox Flow Battery Market Size, Growth, Trends 2032

Opportunities in the Vanadium Redox Flow Battery market lie in the development of large-scale systems, increased energy density, and reduced costs. The trend towards modular and

Get a quote

Vanadium Redox Flow Battery (VRFB) 2025 Trends and

This report provides comprehensive coverage of the Vanadium Redox Flow Battery (VRFB) market, offering insights into key trends, drivers, challenges, and growth catalysts.

Get a quote

Redox Flow Battery Market Size, Share, Trends, Report 2033

The global redox flow battery market size reached USD 284.3 Million in 2024, projected to reach USD 1,086.6 Million, CAGR of 15.26% during forecast 2025-2033.

Get a quote

One-pot prepared highly interface-compatible and ion-selective

4 days ago· Vanadium flow battery (VFB) requires efficient proton exchange membrane (PEM) toward realistic utilization. Although sulfonated covalent organic frame

Get a quote

Flow Battery Market By Size ($2.32 Billion) 2030

The Flow Battery Market is projected to experience a significant growth spurt, with its size estimated at USD 0.88 billion in 2024 and reaching USD 2.32 billion by 2030, growing at a

Get a quote

Vanadium Redox Flow Battery Market | Industry

The growing awareness of the environmental and economic benefits of renewable energy storage solutions, combined with supportive government policies and

Get a quote

Vanadium Redox Flow Batteries

This white paper provides an overview of the state of the global flow battery market, including market trends around deployments, supply chain issues, and partnerships for VRFB

Get a quote

Vanadium Redox Flow Battery Market Size, Growth,

Opportunities in the Vanadium Redox Flow Battery market lie in the development of large-scale systems, increased energy density, and reduced costs. The

Get a quote

Vanadium Flow Battery Market Size, Trends, Industry Outlook

Get actionable insights on the Vanadium Flow Battery Market, projected to rise from 1.2 billion USD in 2024 to 4.5 billion USD by 2033 at a CAGR of 16.5%. The analysis highlights

Get a quote

How to trump the flow battery doubters – pv magazine USA

Quino produces what is effectively a vanadium flow battery (VFB) but using a quinone-based electrolyte instead of vanadium. With China producing 68,000 metric tons (MT)

Get a quote

Asia Pacific Vanadium Flow Battery Market Outlook 2024–2033: Trends

The Asia Pacific vanadium flow battery market is witnessing robust growth driven by increasing demand for large-scale energy storage solutions. Rapid industrialization and the

Get a quote

Vanadium Flow Battery Market|Future Outlook, Trends, and

The vanadium flow battery market is witnessing significant growth due to increasing demand for reliable and scalable energy storage solutions. As renewable energy

Get a quote

Vanadium Redox Battery Market

By component type, the electrolyte segment accounted for 43% of the vanadium redox flow battery market size in 2024, while membranes are advancing at an 18.6% CAGR

Get a quote

Vanadium Redox Flow Battery Market Size & Growth Forecast

The growing trend to achieve zero-emission microgrids to supply clean and carbon-free energy in adverse weather conditions is projected to create potential opportunities for the growth of the

Get a quote

Techno-economic assessment of future vanadium flow batteries

This paper presents a techno-economic model based on experimental and market data able to evaluate the profitability of vanadium flow batteries, which

Get a quote

All Vanadium Redox Flow Battery Growth Projections: Trends to

The all-vanadium redox flow battery (VRFB) market is experiencing robust growth, projected to reach $23.4 million in 2025 and expand significantly over the forecast period

Get a quote

Vanadium Redox Battery Market Size, Share | CAGR

Report Overview Global Vanadium Redox Battery Market is expected to be worth around USD 4,971.8 million by 2034, up from USD 809.7 million in 2024, and

Get a quote

Top 10 Companies in the All-Vanadium Redox Flow Batteries

As global energy systems transition toward sustainability, vanadium redox flow batteries (VRFBs) are emerging as a critical technology due to their scalability, 20+ year

Get a quote

Technological Advances in All-Vanadium Redox Flow Battery

Comprehensive Coverage All-Vanadium Redox Flow Battery Energy Storage Systems Report This report offers a comprehensive analysis of the all-vanadium redox flow

Get a quote

Vanadium Redox Flow Battery Market | Industry Report, 2030

The growing awareness of the environmental and economic benefits of renewable energy storage solutions, combined with supportive government policies and decreasing costs, is expected to

Get a quote

Vanadium Flow Battery Unlocking Growth Potential: Analysis and

Comprehensive Coverage Vanadium Flow Battery Report This report provides a comprehensive analysis of the vanadium flow battery market, encompassing market size

Get a quote

Flow Battery Market: Solutions, Growth & Trends | 2025-2035

The latest 2025 Flow Battery Market Research Unveils Breakthrough Trends And Opportunities. Access Real-Time Industry Data, Pricing Analysis, And Expert Forecasts Before

Get a quote

6 FAQs about [Vanadium Flow Battery Trend]

How can vanadium redox flow batteries increase their share in energy storage?

Overcoming the barriers related to high capital costs, new supply chains, and limited deployments will allow VRFBs to increase their share in the energy storage market. Guidehouse Insights has prepared this white paper, commissioned by Vanitec, to provide an overview of vanadium redox flow batteries (VRFBs) and their market drivers and barriers.

Will flow battery suppliers compete with metal alloy production to secure vanadium supply?

Traditionally, much of the global vanadium supply has been used to strengthen metal alloys such as steel. Because this vanadium application is still the leading driver for its production, it’s possible that flow battery suppliers will also have to compete with metal alloy production to secure vanadium supply.

Why are vanadium batteries so expensive?

Vanadium makes up a significantly higher percentage of the overall system cost compared with any single metal in other battery technologies and in addition to large fluctuations in price historically, its supply chain is less developed and can be more constrained than that of materials used in other battery technologies.

What is vanitec redox flow battery (VRFB)?

Confidential information for the sole benefit and use of Vanitec. Vanadium redox flow battery (VRFB) technology is a leading energy storage option. Although lithium-ion (Li-ion) still leads the industry in deployed capacity, VRFBs offer new capabilities that enable a new wave of industry growth.

How efficient are flow batteries compared to Li-ion batteries?

Flow batteries average between 70%-85% round-trip efficiency, compared with 90%-95% average for Li-ion batteries, potentially affecting the economics of projects based around bulk shifting of energy.

Why are flow batteries accelerating in deployment capacity?

However, as demand for long-duration storage capability grows, flow batteries and especially VRFBs are poised to accelerate in deployment capacity. This is important not only to build confidence in the commercial performance of VRFBs but also to achieve economies of scale and become more cost-effective.

Guess what you want to know

-

Vanadium redox flow battery equipment manufacturing

Vanadium redox flow battery equipment manufacturing

-

Vanadium titanium all-vanadium liquid flow energy storage battery

Vanadium titanium all-vanadium liquid flow energy storage battery

-

Huawei vanadium flow battery energy storage industry

Huawei vanadium flow battery energy storage industry

-

Paraguayan vanadium redox flow battery

Paraguayan vanadium redox flow battery

-

Vanadium flow battery industry

Vanadium flow battery industry

-

Yaounde Vanadium Flow Battery Company

Yaounde Vanadium Flow Battery Company

-

Vanadium flow battery reaction

Vanadium flow battery reaction

-

Bulgarian vanadium flow battery

Bulgarian vanadium flow battery

-

Vanadium flow battery outdoor

Vanadium flow battery outdoor

-

Albania Vanadium Flow Battery Energy Storage Station

Albania Vanadium Flow Battery Energy Storage Station

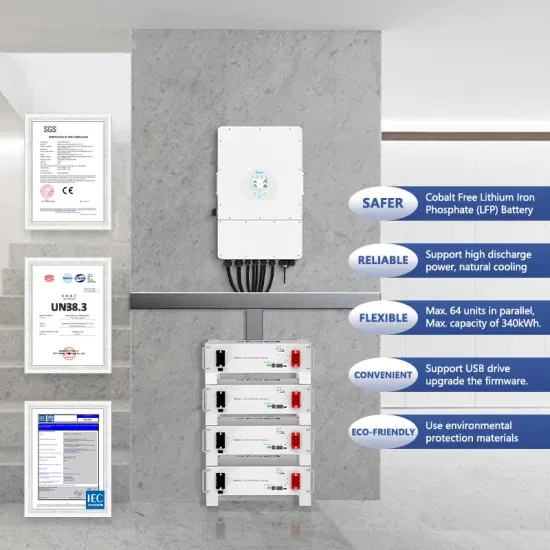

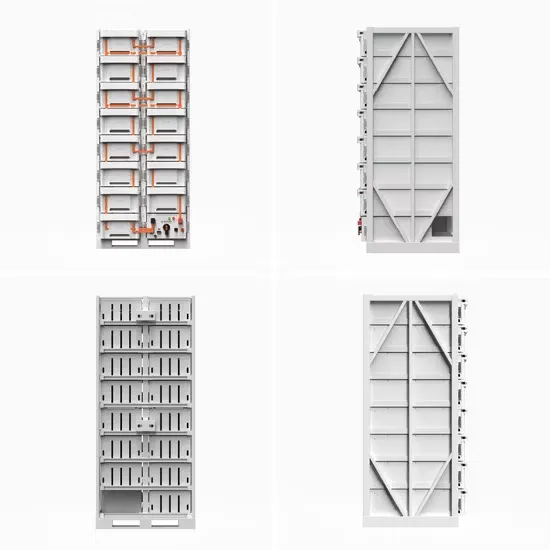

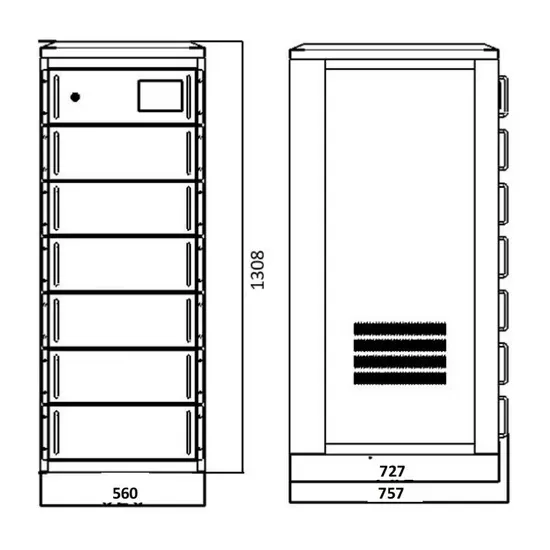

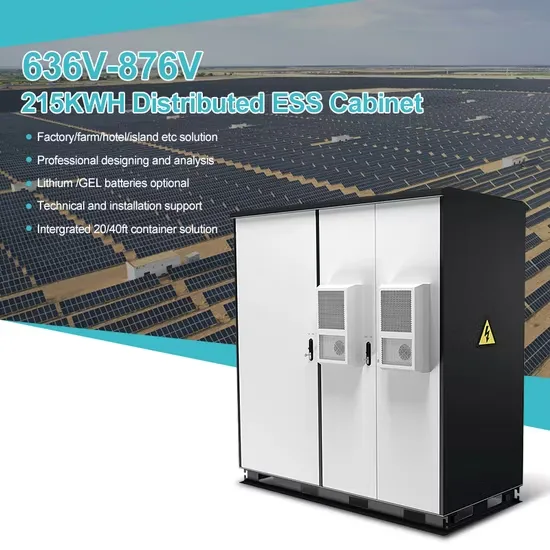

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.