2H 2023 Energy Storage Market Outlook

Residential batteries are now the largest source of storage demand in the region and will remain so until 2025. Separately, over €1 billion ($1.1

Get a quote

The Northern Lights Carbon Capture and Storage facilities in

In Canada, the federal government is offering a tax credit to support carbon capture and storage projects, projected to cost taxpayers up to $5.7 billion until 2028. The U.S. and

Get a quote

Eos'' energy storage pipeline grows by $1.3B amid shift to larger

Eos'' project pipeline is up $1.3 billion from the last quarter and about half of the pipeline was refreshed this year, at higher prices, with utility customers bringing in larger

Get a quote

OCED Announces $1.3 Billion in New Funding to

The U.S. Department of Energy (DOE) Office of Clean Energy Demonstrations (OCED) today opened applications for up to $1.3 billion in funding to catalyze investments in

Get a quote

Analysis of Large-Scale Energy Storage Market in the United

Despite a lower-than-anticipated installed capacity of large-scale energy storage in the first quarter of 2023, the United States remains poised for substantial growth, thanks to the

Get a quote

Overview and key findings – World Energy Investment

Some 20 commercial-scale carbon capture utilisation and storage (CCUS) projects in seven countries reached final investment decision (FID) in 2023;

Get a quote

Global Investment in the Energy Transition Exceeded

Along with investment in the low-carbon energy transition, BNEF''s report also tracks investment in the clean energy supply chain, including the

Get a quote

Battery Storage Unlocked: Lessons Learned From Emerging

The initiative supports countries around the world in co-creating strategies that enhance policy, regulation, supply chain, manufacturing, and financing solutions for battery energy storage

Get a quote

Why we''re investing $15 billion in a lower-carbon future

At ExxonMobil, we develop and deploy solutions that meet society''s needs. Today, that means taking a leading role in providing the products that enable modern life, reducing

Get a quote

Eos'' energy storage pipeline grows by $1.3B amid shift to larger

Eos'' energy storage pipeline grows by $1.3B amid shift to larger, longer-duration projects More than half of Eos Energy''s $12.9 billion project pipeline comes from proposals

Get a quote

OCED Announces Notice of Intent to Fund $1.3 Billion for

OCED issued a Notice of Intent (NOI) to fund up to $1.3 billion to catalyze investments in transformative carbon capture, utilization, and storage (CCUS) technologies.

Get a quote

Two massive solar and storage projects under review

Intersect Power subsidiaries have proposed two projects that each feature 1.15 GW solar arrays and up to 1.15 GW of battery energy storage.

Get a quote

Energy Storage in the UK

The landmark EFR contracts (see full list in new Annex C) has kick started the large scale end of the market and turned the eyes of the world on UK energy storage providers.

Get a quote

Two massive solar and storage projects under review in

Intersect Power subsidiaries have proposed two projects that each feature 1.15 GW solar arrays and up to 1.15 GW of battery energy storage.

Get a quote

DOE to Offer Up to $1.3B to Advance CCUS Technologies | Hart

The U.S. Department of Energy (DOE) has set aside up to $1.3 billion to foster investment in carbon capture, utilization and storage (CCUS) technologies.

Get a quote

Analysis of Large-Scale Energy Storage Market in the

Despite a lower-than-anticipated installed capacity of large-scale energy storage in the first quarter of 2023, the United States remains poised

Get a quote

5 Large-Scale Clean Energy Projects Announced in Oct;

In all, at least 354 major clean energy projects have been announced in 40 states and Puerto Rico since the IRA became law, according to E2''s analysis. Companies have said

Get a quote

Microsoft Word

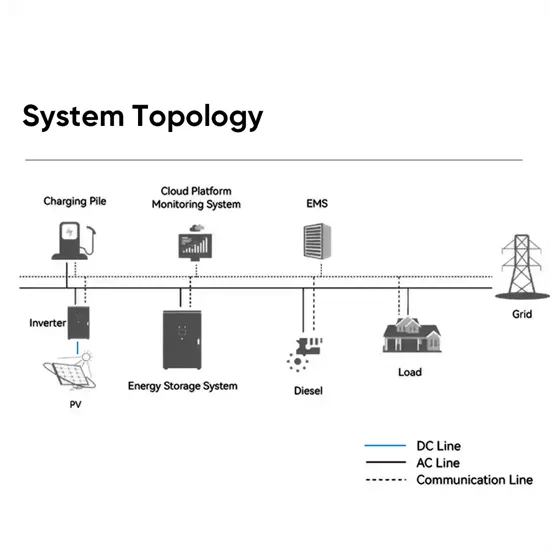

Energy storage technologies—such as pumped hydro, compressed air energy storage, various types of batteries, flywheels, electrochemical capacitors, etc., provide for multiple applications:

Get a quote

Battery Energy Storage Market Size, Share, Growth

The global battery energy storage market size is projected to be worth $32.63 billion in 2025 & is expected to reach $114.05 billion by 2032

Get a quote

Battery Storage Unlocked: Lessons Learned From Emerging

Lessons Learned from Emerging Economies The Supercharging Battery Storage Initiative would like to thank all authors and organizations for their submissions to support this publication.

Get a quote

Large Scale, Long Duration Energy Storage, and the Future

Summary of results for three wind farms in SPP, operating with and without a storage asset (whose specifications correspond to a pumped-hydro like storage technology), demonstrating

Get a quote

5 Large-Scale Clean Energy Projects Announced in

In all, at least 354 major clean energy projects have been announced in 40 states and Puerto Rico since the IRA became law, according

Get a quote

1 3 billion investment in large-scale energy storage projects

WASHINGTON - Companies in October announced more than $1.2 billion in investments to build five new large-scale clean energy projects that are expected to create at least 912 permanent

Get a quote

Carbon Capture Utilisation and Storage

The United States announced important opportunities in 2023 that are expected to boost CCUS project development, including USD 1.7 billion for carbon

Get a quote

DOE to Offer Up to $1.3B to Advance CCUS Technologies | Hart Energy

The U.S. Department of Energy (DOE) has set aside up to $1.3 billion to foster investment in carbon capture, utilization and storage (CCUS) technologies.

Get a quote

A giant 1.3 GWh Tesla Megapack project is going

A massive Tesla Megapack project with 1.3 GWh of energy storage capacity is coming online in Arizona – making it one of the largest

Get a quote

OCED Announces Notice of Intent to Fund $1.3 Billion

OCED issued a Notice of Intent (NOI) to fund up to $1.3 billion to catalyze investments in transformative carbon capture, utilization, and storage

Get a quote

3 FAQs about [1 3 billion investment in large-scale energy storage projects]

Why do we need a large energy storage system?

Record-breaking deployments of wind and solar in the U.S. are creating a need for large, long-duration energy storage so that they can perform like baseload resources and compete with traditional fossil fuels, Chapin said. Projects over 1 GWh now represent $8.7 billion — or two-thirds — of the company’s total pipeline.

What is the largest solar & energy storage project in California?

The California Energy Commission (CEC) is reviewing a pair of enormous solar + storage projects proposed by Intersect Power subsidiaries that, if constructed, would each become the largest in the United States. The top spot is currently held by Edwards & Sanborn Solar + Energy Storage, which fired up in Kern County, CA earlier this year.

Which solar projects generate the most energy?

The top spot is currently held by Edwards & Sanborn Solar + Energy Storage, which fired up in Kern County, CA earlier this year. That project generates 875 MW of solar energy alongside 3,287 MWh of energy storage, boasting a total interconnection capacity of 1,300 MW.

Guess what you want to know

-

Investment in small energy storage projects

Investment in small energy storage projects

-

What are large-scale independent energy storage projects

What are large-scale independent energy storage projects

-

Investment in energy storage projects in industrial parks

Investment in energy storage projects in industrial parks

-

Large-scale clean energy storage projects

Large-scale clean energy storage projects

-

7 billion bid for large-scale energy storage project

7 billion bid for large-scale energy storage project

-

1 3 billion large-scale energy storage project

1 3 billion large-scale energy storage project

-

The average investment cost of energy storage projects includes

The average investment cost of energy storage projects includes

-

Gigawatt-hour energy storage projects

Gigawatt-hour energy storage projects

-

Southeast Asia Industrial and Commercial Energy Storage Projects

Southeast Asia Industrial and Commercial Energy Storage Projects

-

Wind solar and energy storage projects to be built in Venezuela

Wind solar and energy storage projects to be built in Venezuela

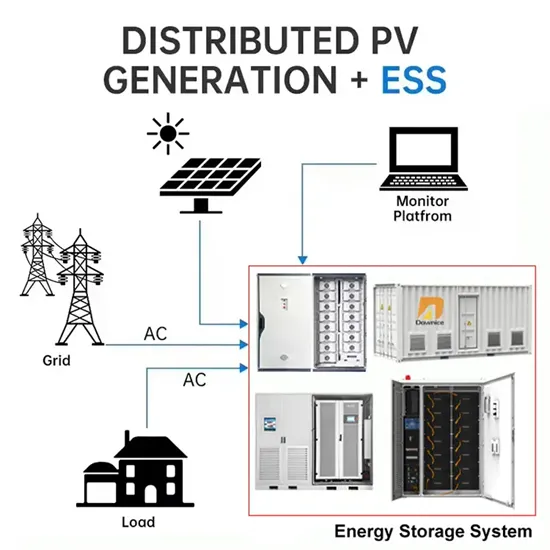

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.