Top 10: Energy Storage Companies | Energy Magazine

When it comes to solar storage, its battery systems offer flexible storage options to support the powering of ever-increasingly power-reliant

Get a quote

Financing Battery Energy Storage Systems – Meeting the

Battery energy storage systems represent a keystone for the transition towards a more sustainable energy generation and utilisation. Despite the value and advantages that

Get a quote

Top 19 Energy Storage Investors in the US

With federal incentives and increasing investments, the sector is poised for growth, targeting not only commercial applications but also residential energy savings, making clean energy more

Get a quote

Clean Energy Tax Incentives for Businesses

These facilities or property will be treated as a 5-year property for purposes of cost recovery, leaving them with lower taxable income in the earlier years of a clean energy investment.

Get a quote

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S.

Investors interested in grid-scale storage with low risk may want to consider this utility stock instead of more direct and volatile plays on lithium

Get a quote

Battery Storage Projects Boost Southern California''s Energy

For immediate release: March 17, 2025 Los Angeles, Calif. – Clean Power Alliance (CPA), the nation''s leading green power provider and California''s largest community choice

Get a quote

Hydropower Investment Opportunities Remain Untapped

With the Bipartisan Infrastructure Law and the Inflation Reduction Act offering many types of financial support for clean energy projects, new hydropower and PSH projects could

Get a quote

The Energy Storage Market in Germany

This makes the use of new storage technologies and smart grids imperative. Energy storage systems – from small and large-scale batteries to power-to-gas technologies – will play a

Get a quote

Project Developers Are Bullish On The Thermal Energy Storage

2 days ago· The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

Get a quote

The 10 most attractive energy storage investment

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is

Get a quote

Energy Storage Investments – Publications

Estimates indicate that global energy storage installations rose over 75% (measured by MWhs) year over year in 2024 and are expected to go beyond the terawatt-hour

Get a quote

Investment Models for Energy Storage Projects: Which One

If you''re a factory owner sweating over electricity bills, an investor hunting for the next green energy gem, or a project manager trying to decode terms like "virtual power plants,"

Get a quote

Battery Storage Unlocked: Lessons Learned From Emerging

Lessons Learned from Emerging Economies The Supercharging Battery Storage Initiative would like to thank all authors and organizations for their submissions to support this publication.

Get a quote

The 10 most attractive energy storage investment markets

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is complex, so which markets offer the

Get a quote

Energy storage in Mexico: fertile ground for

With Mexico''s president-elect having announced an intent to attract renewables investment, energy storage was the subject of much discussion at

Get a quote

7 Energy Storage Stocks to Invest In | Investing | U.S. News

Investors interested in grid-scale storage with low risk may want to consider this utility stock instead of more direct and volatile plays on lithium and battery technology. A

Get a quote

What are the investment models for energy storage projects?

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through different financial mechanisms,

Get a quote

Right on Energy: Section 48 Investment Tax Credit for

Investment tax credits are designed to reduce the cost of technologies and practices and incentivize private investment, resulting in

Get a quote

Considerations For Investing In Renewable Energy

Among the main challenges in renewable energy investments is the potentially higher upfront cost in comparison to projects that are fossil-fuel

Get a quote

Energy transition investment outlook: 2025 and beyond

While individual projects in renewables, storage or grids often hit the headlines with high dollar-value or gigawatt capacity, energy efficiency investments are often less visible and encompass

Get a quote

Battery storage capacity in the UK: the state of the

The UK''s total battery storage project pipeline currently contains a total of 127GW of capacity. Figure 1 demonstrates the amount of capacity at

Get a quote

Poland''s PGE to invest about $4.7 billion in battery

Polish utility PGE plans to invest about 18 billion zlotys ($4.7 billion) in battery storage projects, CEO Dariusz Marzec said on Monday.

Get a quote

What are the investment models for energy storage

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through

Get a quote

6 FAQs about [Investment in small energy storage projects]

Can LPO finance energy storage projects?

LPO can finance short and long duration energy storage projects to increase flexibility, stability, resilience, and reliability on a renewables-heavy grid. Why Energy Storage?

What is energy storage?

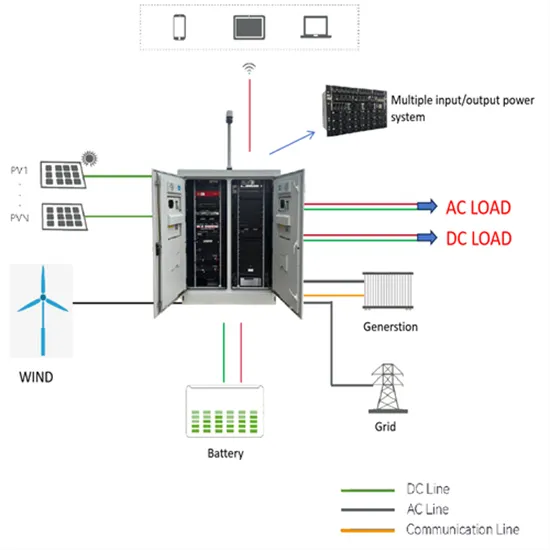

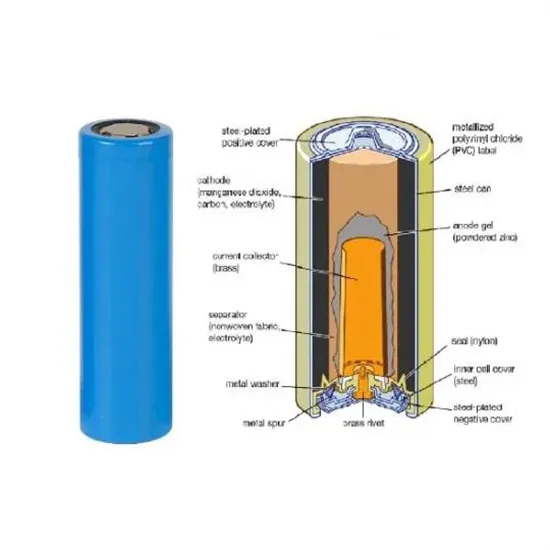

Energy storage encompasses an array of technologies that enable energy produced at one time, such as during daylight or windy hours, to be stored for later use. LPO can finance commercially ready projects across storage technologies, including flywheels, mechanical technologies, electrochemical technologies, thermal storage, and chemical storage.

Why is energy storage important?

Energy storage serves important grid functions, including time-shifting energy across hours, days, weeks, or months; regulating grid frequency; and ensuring flexibility to balance supply and demand.

Are thermal energy storage project developers transforming the TES industry?

The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

How will energy storage help a net-zero economy by 2050?

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals across the public and private sectors, energy storage will play a key role in the shift to a net-zero economy by 2050.

Guess what you want to know

-

Investment cost per kilowatt for small energy storage

Investment cost per kilowatt for small energy storage

-

Investment in energy storage projects in industrial parks

Investment in energy storage projects in industrial parks

-

Huawei Small Investment Energy Storage Project

Huawei Small Investment Energy Storage Project

-

Small investment energy storage project

Small investment energy storage project

-

1 3 billion investment in large-scale energy storage projects

1 3 billion investment in large-scale energy storage projects

-

The average investment cost of energy storage projects includes

The average investment cost of energy storage projects includes

-

New energy projects equipped with energy storage

New energy projects equipped with energy storage

-

Annual output of energy storage projects

Annual output of energy storage projects

-

What are key energy storage projects

What are key energy storage projects

-

Future plans for energy storage projects

Future plans for energy storage projects

Industrial & Commercial Energy Storage Market Growth

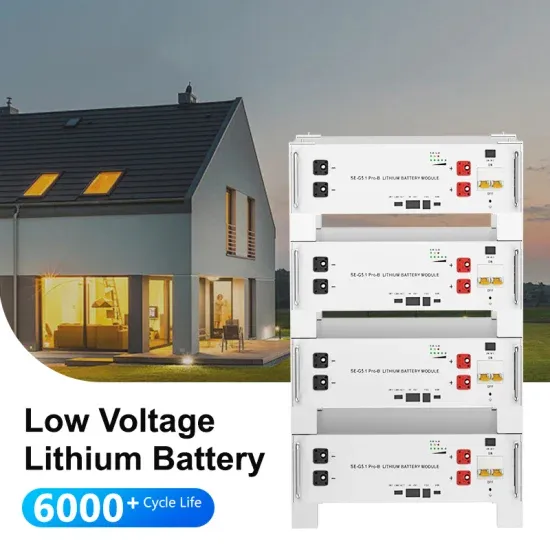

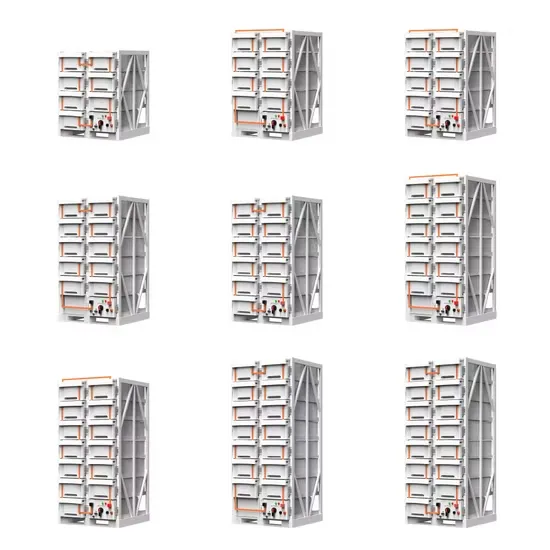

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.