Trump''s Middle East Trip: Here Are All The Major

The $600 billion investment also includes $20 billion from Saudi firm DataVolt for AI data centers and energy infrastructure in the U.S., and $80

Get a quote

Navigating Renewable Energy Challenges

Saudi Arabia invests in energy storage infrastructure, with projects like ACWA Power''s 1.2 GWh system at the Red Sea Project and plans for a 600 GWh BESS in Neom.

Get a quote

Saudi Arabia Emerges as Global Energy Storage Leader with Major Projects

3 days ago· Projections indicate that Saudi Arabia aims to operate 8 GWh of energy storage projects by 2025 and 22 GWh by 2026, positioning the nation as the third-largest global

Get a quote

The UAE makes a giant leap into the energy storage

The UAE has launched what it says is the world''s first and largest 24-hour power project, combining solar photovoltaic with battery storage to

Get a quote

The Middle East''s Solar Shift: From Oil to Energy

The Middle East, long defined by its oil wealth, is now emerging as a global leader in solar power. Once considered an afterthought in a region

Get a quote

The Future of Battery Market in the Middle East & Africa

In Abu Dhabi, Masdar has announced a $6 billion project combining 5 GW of solar capacity with 19 GWh of battery storage, aiming to provide 1 GW of continuous power output, making it the

Get a quote

Middle East: Energy Transition Unlocks Huge Market Potential for Energy

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East. The advantages of leading

Get a quote

Middle East energy storage project invests 2 billion

That''s the scale of the Middle East''s largest energy storage project, currently under construction in the UAE. Designed to tackle the region''s infamous "sun-soaked but storage

Get a quote

Middle East Energy Storage Sites: Powering the Renewable

You know, the Middle East''s energy landscape isn''t just about oil rigs and gas fields anymore. With solar farms sprawling across deserts and wind turbines rising near coastal areas, the

Get a quote

Middle East and North Africa

Instead of bringing the oil era to a halt, Middle East producers would prefer to see greater emphasis on carbon capture and storage, to create a ''circular carbon economy''. At the same

Get a quote

Battery Storage in the Middle East: Powering the Energy Shift

As the Middle East intensifies its shift to renewable energy, battery storage is becoming a vital part of its infrastructure. Countries like Saudi Arabia and the United Arab

Get a quote

UAE''s Masdar to invest $1.2B in UK battery storage

Emirati renewables company Masdar is planning a major investment of about £1 billion ($1.2 billion) in battery storage projects across

Get a quote

Why battery storage investment is vital to the Middle East''s clean

Investing in battery storage is crucial for a successful energy transition in the Middle East, as it enables the realisation of the full benefits of renewable energy.

Get a quote

Sungrow and Algihaz Join Forces for 7.8 GW Energy

The Kingdom is investing heavily in renewable energy. The $500 billion NEOM city will run entirely on renewable energy. The Sakaka Solar

Get a quote

Middle East Energy 2025 in Dubai spotlights energy

Middle East Energy (MEE) 2025 launched at the Dubai World Trade Centre (DWTC), showcasing the future of energy storage and battery

Get a quote

Saudi Arabia Emerges as Global Energy Storage

3 days ago· Projections indicate that Saudi Arabia aims to operate 8 GWh of energy storage projects by 2025 and 22 GWh by 2026, positioning the nation

Get a quote

Middle East''s Largest Energy Storage Project: Powering the

That''s the scale of the Middle East''s largest energy storage project, currently under construction in the UAE. Designed to tackle the region''s infamous "sun-soaked but storage

Get a quote

Chinese PV giants, Saudi Arabia sign big deals to expand solar

The total investment in the project is expected to be approximately $2.08 billion. TCL Zhonghuan, through its wholly owned subsidiary in Singapore, holds 40 percent of the

Get a quote

Middle east energy storage project investment

Macquarie''''s Green Investment Group (GIG) is investing an unspecified sum into US energy storage developer esVolta. esVolta has had a successful past few years, with a number of

Get a quote

Why battery storage investment is vital to the Middle

With the global solar energy and battery storage market size projected to reach $26.08 billion by 2030, growing at a CAGR of 16.15 percent

Get a quote

Middle East and North Africa 2024 Energy Industry Outlook

The region is home to 52% of global oil reserves and 36% of worldwide production. It is also well placed with natural gas, with 43% of reserves and 22% of global output, according to data from

Get a quote

Middle East: Energy Transition Unlocks Huge Market

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East.

Get a quote

10 Exciting Up-and-Coming Renewable Energy Projects in the Middle East

Explore 10 renewable energy projects in the Middle East, showcasing solar, wind, and battery storage advancements set for 2025. Read more here.

Get a quote

The UAE makes a giant leap into the energy storage space

The UAE has launched what it says is the world''s first and largest 24-hour power project, combining solar photovoltaic with battery storage

Get a quote

Why battery storage investment is vital to the Middle

Investing in battery storage is crucial for a successful energy transition in the Middle East, as it enables the realisation of the full benefits of

Get a quote

ENGIE invests $12 billion in UAE energy and green

Recognising the UAE market as a key player in the Middle East and a hub for business growth, ENGIE aims to bolster its presence and

Get a quote

Guess what you want to know

-

Seychelles invests $2 billion in energy storage project

Seychelles invests $2 billion in energy storage project

-

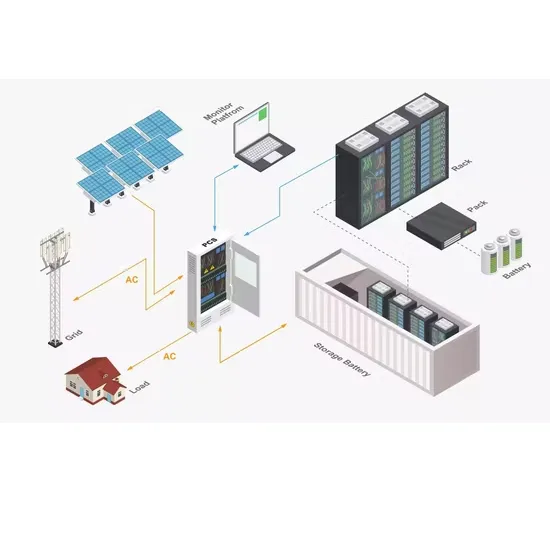

Middle East Hybrid Energy Storage Power Generation Project

Middle East Hybrid Energy Storage Power Generation Project

-

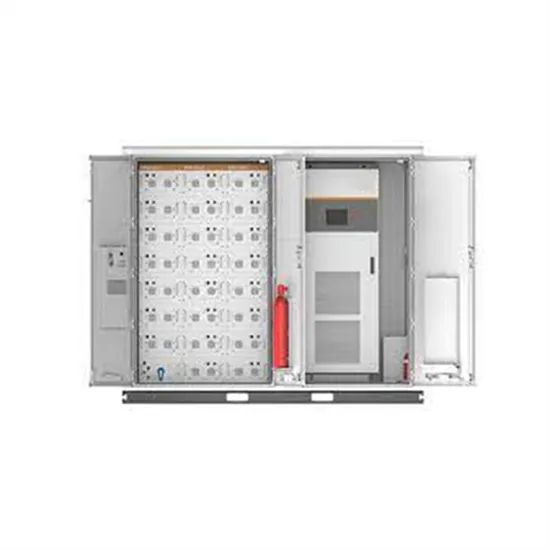

Middle East 30kw energy storage

Middle East 30kw energy storage

-

Middle East high power energy storage equipment prices

Middle East high power energy storage equipment prices

-

Middle East New Energy Storage Equipment

Middle East New Energy Storage Equipment

-

1 3 billion large-scale energy storage project

1 3 billion large-scale energy storage project

-

Where is the best containerized energy storage cabinet in the Middle East

Where is the best containerized energy storage cabinet in the Middle East

-

East Asia Home Photovoltaic Energy Storage Project

East Asia Home Photovoltaic Energy Storage Project

-

Photovoltaic energy storage power generation in the Middle East

Photovoltaic energy storage power generation in the Middle East

-

Middle East Energy Storage Power Station Installation

Middle East Energy Storage Power Station Installation

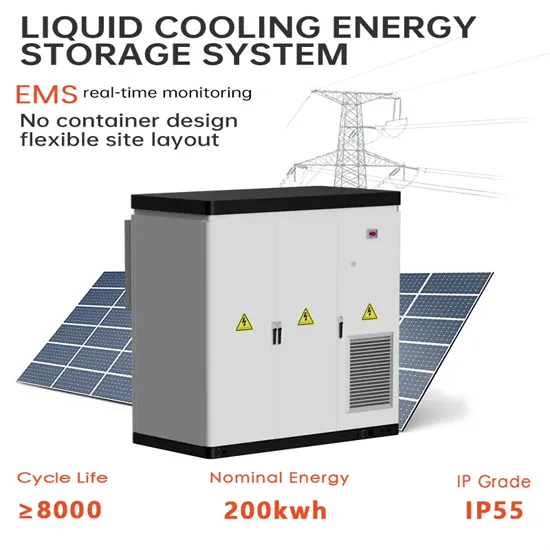

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.