Middle East Energy | Global Energy Event | 7

Renowned for its role in driving the energy industry forward for over four decades, Middle East Energy is uniting the world''s foremost energy professionals, innovators, and stakeholders to

Get a quote

Role of Energy Storage

The energy storage market in Oman and Kuwait, including batteries, is expected to grow in the coming years due to the increasing demand for renewable energy and the need for backup

Get a quote

Saudi Electricity Company Awards Multiple Contracts For

The contracts are for a 2,500 MW/10,500 MWh battery energy storage system across five key locations. Saudi Electricity Company awards multiple contracts for 10,500MWh

Get a quote

Storage Projects in MENA Region | Synergy Consulting

MEMR received proposals from 10 firms in January 2019 to develop an electrical storage project under a BOO framework. The following are the key challenges/risks that may be applicable to

Get a quote

Middle East: Energy Transition Unlocks Huge Market Potential for

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East. The advantages of leading

Get a quote

Saudi Arabia Plans to Deploy 48GWh of Battery Storage by 2030

The list of successful bidders includes prominent companies from the Middle East and abroad, such as Masdar, headquartered in Dubai, Saudi Arabia''s ACWA Power, and

Get a quote

Storage Projects in MENA Region | Synergy Consulting

Ten key regulatory, financial, and market policy action steps are suggested to achieve the objective of successfully integrating energy storage systems in the power markets in MENA

Get a quote

A new energy storage solution installed at UAE''s solar

Leveraging an innovative energy storage solution from Azelio, combined with 300 kW of solar PV, the system delivers power to the facility,

Get a quote

Liquid-Cooled 125kW / 418kWh Energy Storage System

As part of our ongoing commitment to delivering scalable, high-efficiency power solutions in the Middle East, GSL Energy successfully deployed a Liquid-Cooled 125kW /

Get a quote

Hamriyah Independent Power Project, Sharjah, UAE

The Hamriyah IPP is the most efficient gas-fired power station in the Middle East and Africa region and is expected to contribute to a reduction

Get a quote

A new energy storage solution installed at UAE''s solar power station

Leveraging an innovative energy storage solution from Azelio, combined with 300 kW of solar PV, the system delivers power to the facility, reducing the need for conventional

Get a quote

Doha Energy Storage Power Station Case: A Game-Changer for Middle East

The Doha energy storage power station case isn''t just another green tech experiment – it''s Middle East''s first major leap into grid-scale battery storage, proving even oil

Get a quote

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Ten key regulatory, financial, and market policy action steps are suggested to achieve the objective of successfully integrating energy storage systems in the power markets in MENA

Get a quote

Middle East Power Station Energy Storage

Middle East Power Station Energy Storage In the Middle East, significant developments in energy storage power stations are underway, particularly in Saudi Arabia ngrow is set to build a 7.8

Get a quote

Battery and eMobility Integration

Introduction The rapid transition towards a more sustainable energy future is reshaping industries worldwide, with eMobility and advanced battery technologies playing a central role in the

Get a quote

Sungrow signs contract for world''s largest energy storage project

In addition, this project is equipped with nearly 7.8 million battery cells. In order to solve the huge challenges of operation and maintenance, Sungrow uses intelligent EMS and

Get a quote

Doha Energy Storage Power Station Case: A Game-Changer for

The Doha energy storage power station case isn''t just another green tech experiment – it''s Middle East''s first major leap into grid-scale battery storage, proving even oil

Get a quote

Scaling Energy Storage in the MENA Region Amidst Renewables

With renewable energy projects expanding across the region, energy storage has started gaining traction. Unlike Europe, North America, and Asia, where renewable energy and

Get a quote

Middle East Investments Surge as Global Energy

This rapid growth positions the Middle East as a leading contributor to global energy storage expansion in 2025, with new installations anticipated

Get a quote

Middle East Energy 2025 in Dubai spotlights energy

Middle East Energy (MEE) 2025 launched at the Dubai World Trade Centre (DWTC), showcasing the future of energy storage and battery

Get a quote

CATL and Masdar Establish Partnership for World''s

On January 17, CATL and Masdar, the United Arab Emirates'' clean energy powerhouse, announced a partnership for the world''s first large

Get a quote

10 Exciting Up-and-Coming Renewable Energy Projects in the Middle East

Explore 10 renewable energy projects in the Middle East, showcasing solar, wind, and battery storage advancements set for 2025. Read more here.

Get a quote

The case for utility-scale storage in the Middle East

Saudi Arabia''s large scale energy storage market is expected to developed at an unprecedented pace in the years to come, according to

Get a quote

Middle East Energy Storage Pumping Photovoltaic Power Station

The Middle East is rapidly advancing in energy storage and photovoltaic (PV) power projects:A notable project in Saudi Arabia features a 400MW solar PV system paired with a 1.3GWh

Get a quote

Middle East Investments Surge as Global Energy Storage Market

This rapid growth positions the Middle East as a leading contributor to global energy storage expansion in 2025, with new installations anticipated to reach 20 GWh, a

Get a quote

Middle East: Energy Transition Unlocks Huge Market Potential for Energy

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East. The advantages of leading

Get a quote

6 FAQs about [Middle East Energy Storage Power Station Installation]

Is large-scale energy storage a viable option in the Middle East?

Until recently, large-scale energy storage was barely a consideration in the Middle East, where fossil fuels have long dominated power generation. With renewable energy projects expanding across the region, energy storage has started gaining traction.

Is energy storage gaining traction in the Middle East?

With renewable energy projects expanding across the region, energy storage has started gaining traction. Unlike Europe, North America, and Asia, where renewable energy and storage technologies are well-established, the Middle East remains in the early stages of development.

What is energy storage system deployment in MENA?

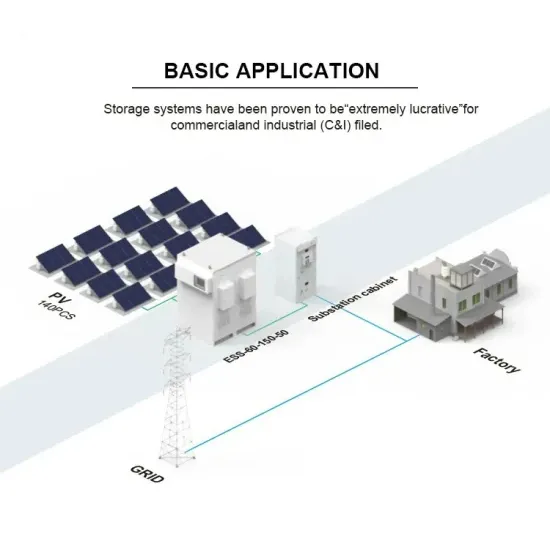

Energy Storage System deployment in MENA Energy Storage Systems (ESS) play a critical role in the integration of VRE into the power grid, as these systems manage the intermittencies of renewable energy resources and mitigate potential power supply disruptions.

Which energy storage solutions will be the leading energy storage solution in MENA?

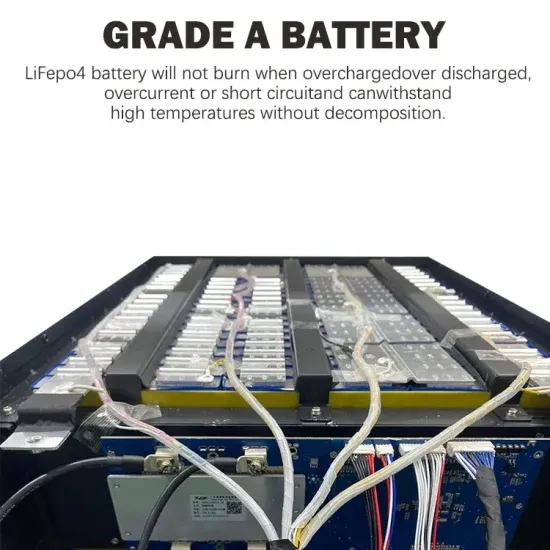

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

What is an energy storage system?

An energy storage system is charged from the grid or by on-site generation to be used at a later time to take advantage of price diferentials. Energy storage is used instead of upgrading the transmission network infrastructure. The storage system provides the grid with the necessary output to ensure the voltage level on the network remains steady.

Why do we need energy storage systems?

This necessitates reinforcing the power network, firming capacities, and enhancing the grids’ stability and flexibility. Increasing the deployment of intermittent energy sources without integrating energy storage systems may jeopardize the power system stability and security of supply.

Guess what you want to know

-

Middle East centralized energy storage power station

Middle East centralized energy storage power station

-

Middle East Power Station Energy Storage

Middle East Power Station Energy Storage

-

Wind power energy storage station installation

Wind power energy storage station installation

-

Middle East energy storage high power supply brand

Middle East energy storage high power supply brand

-

Modular energy storage power station battery compartment installation

Modular energy storage power station battery compartment installation

-

Middle East Hybrid Energy Storage Power Generation Project

Middle East Hybrid Energy Storage Power Generation Project

-

Container energy storage power station installation and construction

Container energy storage power station installation and construction

-

East Africa 100kv Energy Storage Power Station

East Africa 100kv Energy Storage Power Station

-

Photovoltaic energy storage power generation in the Middle East

Photovoltaic energy storage power generation in the Middle East

-

Middle East high power energy storage equipment prices

Middle East high power energy storage equipment prices

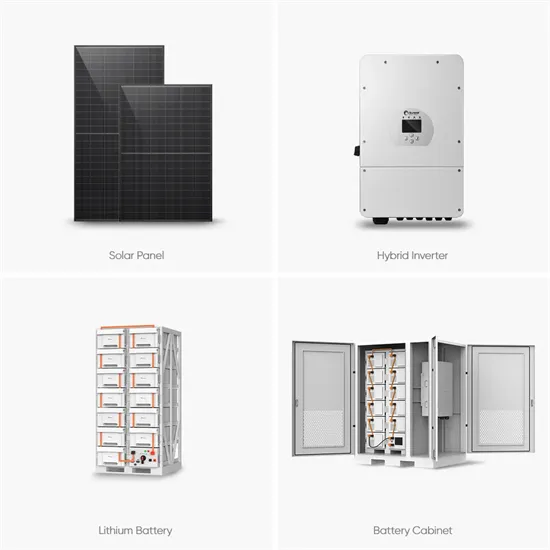

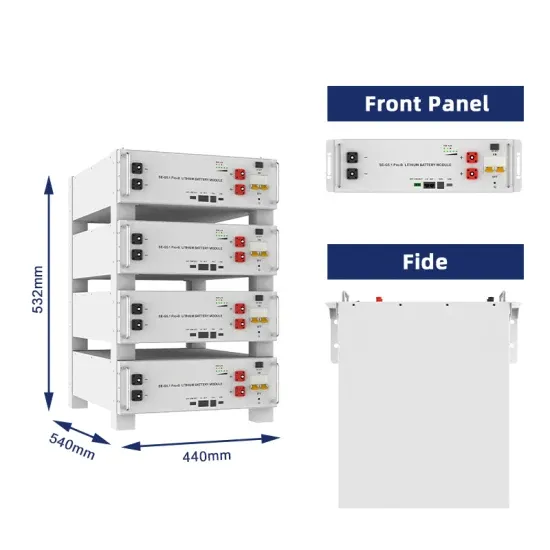

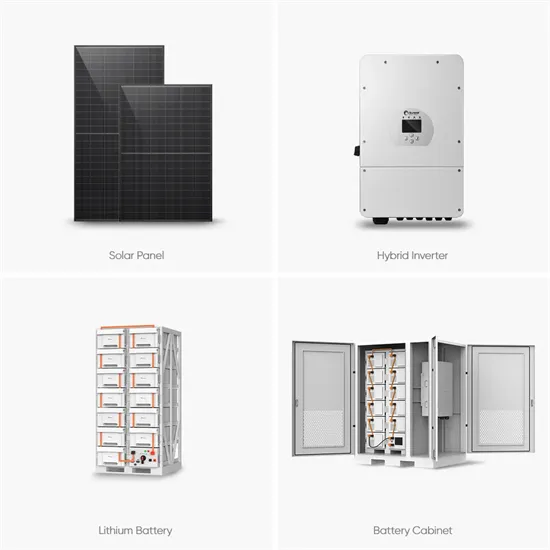

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.