Powering the Future: Energy Storage Solutions in the Middle East

The horizon of energy storage in the Middle East is radiant with possibilities. Innovations in long-duration energy storage solutions, like those being explored by Highview

Get a quote

LEVERAGING ENERGY STORAGE SYSTEMS IN MENA

Ten key regulatory, financial, and market policy action steps are suggested to achieve the objective of successfully integrating energy storage systems in the power markets in MENA

Get a quote

Middle East and Africa Outlook Report 2022

The Middle East starts to turn green The oil-rich countries of the Middle East region have long been used to cheap electricity, but a need to face up to the challenges of climate change

Get a quote

Why battery storage investment is vital to the Middle

With the global solar energy and battery storage market size projected to reach $26.08 billion by 2030, growing at a CAGR of 16.15 percent

Get a quote

Unlocking the Potential of the Solar Photovoltaic (PV) Market

Connect with global industry leaders and explore solutions across the full energy value chain, including renewable & clean energy, smart solutions, transmission & distribution, critical and

Get a quote

UAE: Masdar picks suppliers to world biggest solar-storage

Masdar and CATL executives at the supply partnership announcement in Abu Dhabi, UAE. Image: Masdar Masdar has announced preferred suppliers and contractors for its

Get a quote

Storage Projects in MENA Region | Synergy Consulting

Worldwide expansion of intermittent renewable energy sources, such as solar and wind power, has placed electricity storage systems on the verge of global expansion as energy storage

Get a quote

The case for utility-scale storage in the Middle East –

In a recent chat with <b>pv magazine</b>, Yasser Zaidan, senior sales manager for the Middle East at JinkoSolar, described the trajectory of

Get a quote

Harnessing the Sun: The Middle East''s Shift to Solar

In this article, PTR''s CPO, Saqib Saeed, and Research Analyst, Siddiqa Batool, explain how the Middle East is accelerating its transition toward renewable

Get a quote

Solar photovoltaics manufacturing attraction in the Middle East

Explore how the Middle East is accelerating its role in the global energy transition by localizing solar PV manufacturing. This paper examines national strategies, industrial policy,

Get a quote

UAE: Masdar picks suppliers to world biggest solar-storage

Utility-scale renewable energy developer-operator Masdar said on Friday (17 January) that it has selected CATL to supply battery energy storage system (BESS)

Get a quote

Middle East Renewable Energy Market Size Report, 2033

The Middle East renewable energy market size was valued at USD 52.03 billion in 2024 and is projected to reach USD 109.56 billion by 2033, growing at a CAGR of 9.5% from 2025 to 2033

Get a quote

VSG Technology Applied to the Middle East Solar BESS DG

For remote areas in the Middle East, power supply is still a problem that needs to be solved urgently. In the face of this challenge, SCU uses the advanced logic of "solar energy

Get a quote

Middle East and Africa energy storage outlook 2025

The report includes scenario analyses for Saudi Arabia, UAE, Israel, and South Africa and a broader overview of trends across the rest of the MEA region.

Get a quote

Harnessing the Sun: The Middle East''s Shift to Solar Power and Storage

In this article, PTR''s CPO, Saqib Saeed, and Research Analyst, Siddiqa Batool, explain how the Middle East is accelerating its transition toward renewable energy—particularly solar

Get a quote

Solar photovoltaics manufacturing attraction in the

Explore how the Middle East is accelerating its role in the global energy transition by localizing solar PV manufacturing. This paper examines

Get a quote

Middle East: Energy Transition Unlocks Huge Market Potential for

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East. The advantages of leading

Get a quote

Saudi Arabia household energy storage power supply customization

Explore cutting-edge energy storage solutions in grid-connected systems. Learn how advanced battery technologies and energy management systems are transforming renewable energy

Get a quote

Middle East and Africa energy storage outlook 2025

The report includes scenario analyses for Saudi Arabia, UAE, Israel, and South Africa and a broader overview of trends across the rest of

Get a quote

Photovoltaic Energy Storage Power Supply Market Dynamics and

The photovoltaic (PV) energy storage power supply market is experiencing robust growth, driven by the increasing adoption of renewable energy sources and the need for grid stability. The

Get a quote

The UAE makes a giant leap into the energy storage

The UAE has launched what it says is the world''s first and largest 24-hour power project, combining solar photovoltaic with battery storage to

Get a quote

Top 5: Largest Solar Projects in the Middle East Region

Here is a list of the top 5 largest solar power projects in the Middle East that are in partial or full operation today. #1 Mohammed Bin Rashid Al

Get a quote

The Middle East Is Bracing for a Solar Energy Boom

Solar PV is expected to contribute over half of the Middle East''s power supply by 2050, driven by increasing power demand and government initiatives to diversify energy sources.

Get a quote

2 sets of Elecod energy storage inverters project in Middle East

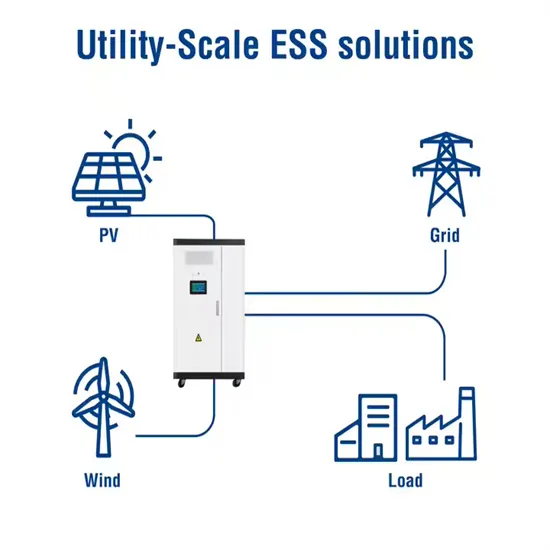

This solution is designed to meet the development needs of renewable energy and new energy vehicles, that is, photovoltaic + energy storage + EV charging mode, using photovoltaic power

Get a quote

VSG Technology Applied to the Middle East Solar

For remote areas in the Middle East, power supply is still a problem that needs to be solved urgently. In the face of this challenge, SCU

Get a quote

Middle East: Energy Transition Unlocks Huge Market Potential for Energy

At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for the construction of energy storage projects in the Middle East. The advantages of leading

Get a quote

6 FAQs about [Middle East Photovoltaic Energy Storage Power Supply Customization]

Is the Middle East accelerating its solar ambitions?

ctricity, has emerged as a cornerstone of renewable energy strategies worldwide.With global solar PV capacity surpassing 1,600 GW in 2023 and projections of even greater rowth in the years to come, the Middle East is accelerating its solar ambitions. From large-scale utility projects to innovative PV technologies and smart grid i

How much does a solar PV plant cost in MENA?

In the UAE, the world’s largest single-site solar PV farm, Abu Dhabi’s 2 GW Al Dhafra plant, was awarded at a tarif of 1.35 cents/kWh. 14 Details of MENA electricity utilities business models are listed in Annex IV. 15 APICORP (2021), MENA Energy Investment Outlook 2021-2025.

Who will supply battery energy storage system (BESS) equipment?

Utility-scale renewable energy developer-operator Masdar said on Friday (17 January) that it has selected CATL to supply battery energy storage system (BESS) equipment alongside fellow Chinese companies Jinko Solar and JA Solar as solar PV module suppliers.

Which energy storage solutions will be the leading energy storage solution in MENA?

Electrochemical storage (batteries) will be the leading energy storage solution in MENA in the short to medium terms, led by sodium-sulfur (NaS) and lithium-ion (Li-Ion) batteries.

What is PV moduletech USA?

PV ModuleTech USA, on 17-18 June 2025, will be our fourth PV ModulelTech conference dedicated to the U.S. utility scale solar sector. The event will gather the key stakeholders from solar developers, solar asset owners and investors, PV manufacturing, policy-making and and all interested downstream channels and third-party entities.

Which energy storage technology has the most installed capacity in MENA?

Pumped hydro storage (PHS) has the largest share of installed capacity in MENA at 55%, as compared to a global share of 90%. Pumped hydro storage is one of the oldest energy storage technologies, which explains its dominance in the global ESS market.

Guess what you want to know

-

Middle East energy storage high power supply brand

Middle East energy storage high power supply brand

-

Photovoltaic energy storage power generation in the Middle East

Photovoltaic energy storage power generation in the Middle East

-

East Asia Energy Storage Power Supply Customization

East Asia Energy Storage Power Supply Customization

-

Sri Lanka energy storage power supply customization

Sri Lanka energy storage power supply customization

-

Huawei Middle East energy storage battery customization

Huawei Middle East energy storage battery customization

-

Timor-Leste portable energy storage power supply customization

Timor-Leste portable energy storage power supply customization

-

Huawei East Africa Portable Energy Storage Power Supply

Huawei East Africa Portable Energy Storage Power Supply

-

Price of photovoltaic energy storage power supply in Democratic Republic of Congo

Price of photovoltaic energy storage power supply in Democratic Republic of Congo

-

British photovoltaic energy storage power supply manufacturer

British photovoltaic energy storage power supply manufacturer

-

Home energy storage photovoltaic power supply

Home energy storage photovoltaic power supply

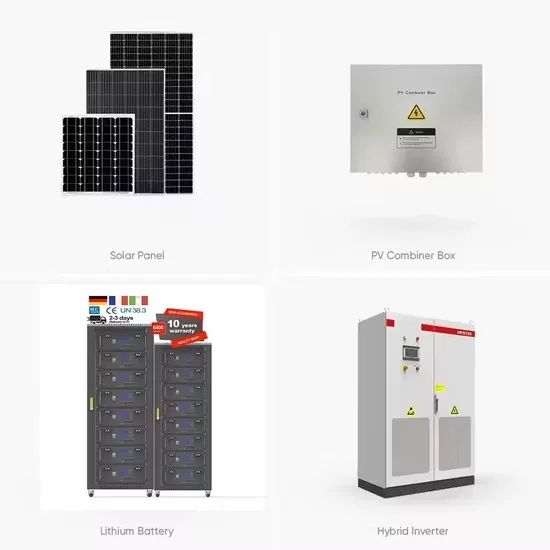

Industrial & Commercial Energy Storage Market Growth

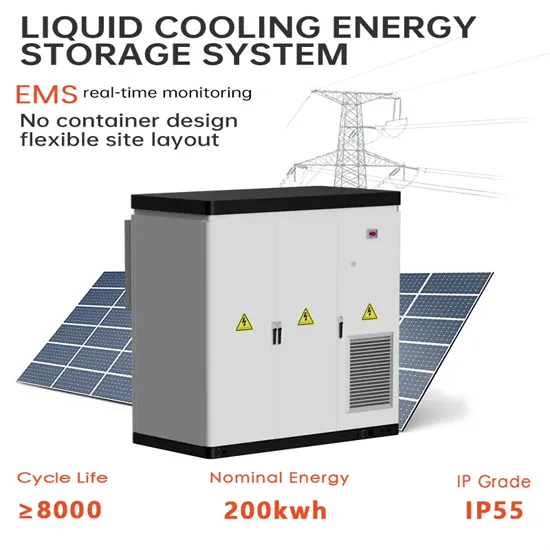

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.