Energy Storage Power Station Profit Analysis: Where Electrons

Let''s face it – when most people hear "energy storage," they picture clunky car batteries or that forgotten power bank in their junk drawer. But energy storage power station profit analysis is

Get a quote

Energy storage power station profit plan

Factory energy storage power stations generate profit by 1. optimizing operating costs, 2. providing ancillary services, and 3. capitalizing on dynamic pricing. The profitability hinges on

Get a quote

Analysis and Comparison for The Profit Model of Energy Storage Power

The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the deepening of

Get a quote

Optimal scheduling strategies for electrochemical energy

This paper constructs a revenue model for an independent electrochemical energy storage (EES) power station with the aim of analyzing its full life-cycle economic benefits under the electricity

Get a quote

How is the profit model of energy storage power station

The profit model of energy storage power stations operates primarily through: 1) frequency regulation, 2) capacity arbitrage, 3) ancillary market services, and 4) participation in

Get a quote

Analysis and Comparison for The Profit Model of Energy Storage Power

Analysis and Comparison for The Profit Model of Energy Storage Power Station Published in: 2020 4th International Conference on Electronics, Communication and Aerospace Technology

Get a quote

A comprehensive review of large-scale energy storage

2 days ago· Moreover, two service modes of independent and shared energy storage participation in power market transactions are analyzed, and the challenges faced by the large

Get a quote

How to get the highest profit from independent energy

This article provides a comprehensive guide on battery storage power station (also known as energy storage power stations). These facilities play a crucial role in modern power grids by

Get a quote

Energy storage station profit

Keywords: electricity spot market, electrochemical energy storage, profit model, energy arbitrage, economic end of life. Citation: Li Y, Zhang S, Yang L, Gong Q, Li X and Fan B (2024) Optimal

Get a quote

Analysis on the development trend of user-side energy storage

As the price of industrial and commercial energy storage equipment continues to decline and its technical performance improves, the industrial and commercial user-side

Get a quote

How is the profit of energy storage power station? | NenPower

In summary, addressing the profitability of energy storage power stations entails a multifaceted exploration of investment strategies, market dynamics, and regulatory landscapes.

Get a quote

How is the profit of energy storage power station?

In summary, addressing the profitability of energy storage power stations entails a multifaceted exploration of investment strategies, market

Get a quote

Profit model and application prospects of energy storage

The model actively monitored the state of charge (SOC) of charging station batteries, optimizing the utilization of energy storage systems to ensure a reliable power supply for vehicle charging.

Get a quote

(PDF) Optimal Configuration of User-Side Energy Storage for

In recent years, installing energy storage for new on-grid energy power stations has become a basic requirement in China, but there is still a lack of relevant assessment

Get a quote

Analysis and Comparison for The Profit Model of Energy Storage

Analysis and Comparison for The Profit Model of Energy Storage Power Station Published in: 2020 4th International Conference on Electronics, Communication and Aerospace Technology

Get a quote

How is the profit of energy storage power station?

Delving deeper, energy storage power stations play a pivotal role in stabilizing the grid and balancing supply and demand. Their capacity to

Get a quote

Profit model of power grid energy storage power station project

In this paper, the life model of the energy storage power station, the load model of the edge data center and charging station, and the energy storage transaction model are constructed.

Get a quote

Profit analysis of energy storage power stations

In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three aspects of

Get a quote

How much profit does a shared energy storage power station make?

The economic viability of shared energy storage power stations rests upon a multifaceted amalgamation of factors contributing to their profit models. A nuanced

Get a quote

Capacity investment decisions of energy storage power stations

To this end, this paper constructs a decision-making model for the capacity investment of energy storage power stations under time-of-use pricing, which is intended to

Get a quote

Research on the optimization strategy for shared energy storage

A cooperative investment model accommodates various energy storage technologies, reducing costs and enhancing efficiency. Case studies show the model

Get a quote

Several profit models of energy storage stations

In this paper, an optimization method for energy storage is proposed to solve the energy storage configuration problem in new energy stations throughout battery entire life cycle.

Get a quote

Business Models and Profitability of Energy Storage

Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the

Get a quote

How is the profit of Shandong energy storage power station?

The strategic role of energy storage facilities, especially in the context of Shandong, cannot be overstated. By balancing supply and demand, these power stations can

Get a quote

Guess what you want to know

-

Morocco energy storage power station profit model

Morocco energy storage power station profit model

-

Profit model of Latvian energy storage power station

Profit model of Latvian energy storage power station

-

Energy storage power station profit

Energy storage power station profit

-

Revenue model of Côte d Ivoire energy storage power station

Revenue model of Côte d Ivoire energy storage power station

-

Profit model of wind solar and energy storage power stations

Profit model of wind solar and energy storage power stations

-

Nicaragua Distributed Energy Storage Power Station Model

Nicaragua Distributed Energy Storage Power Station Model

-

How is the profit of energy storage container power station

How is the profit of energy storage container power station

-

Netherlands Mobile Energy Storage Power Station

Netherlands Mobile Energy Storage Power Station

-

Is the German energy storage power station safe

Is the German energy storage power station safe

-

How many companies are involved in Belize s energy storage power station

How many companies are involved in Belize s energy storage power station

Industrial & Commercial Energy Storage Market Growth

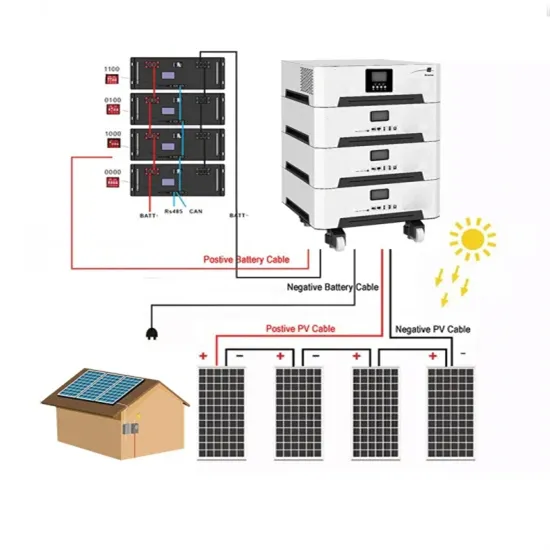

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

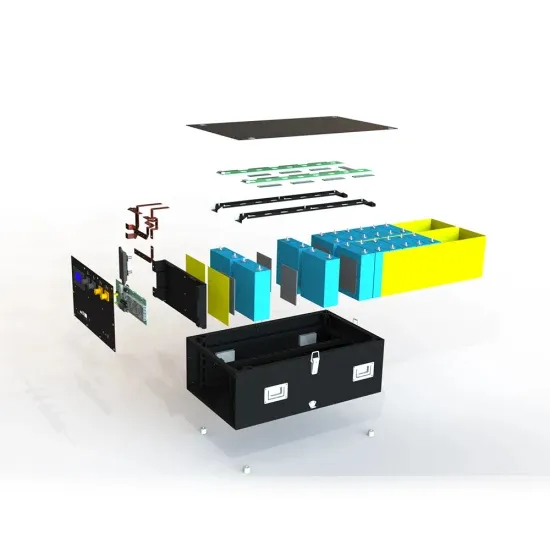

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.