Energy Storage Power Station Costs: Breakdown & Key Factors

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get a quote

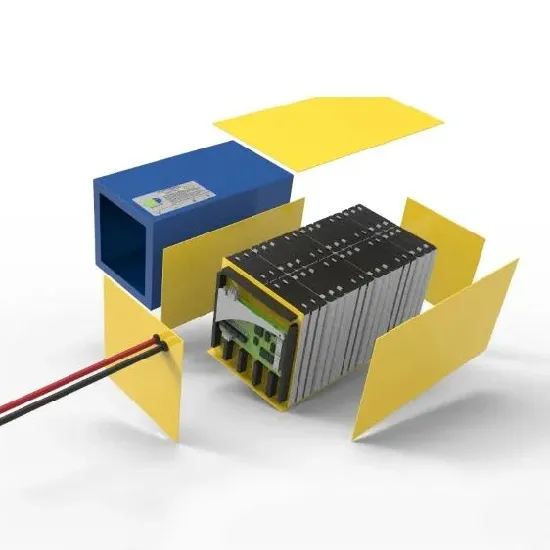

ESS Series – Energy Storage Systems

LiFePO4 Technology – Energy Storage Power Station The energy storage system has the feature of high energy density and flexible configuration and can be applied for user-side energy

Get a quote

Analysis and Comparison for The Profit Model of Energy Storage Power

Analysis and Comparison for The Profit Model of Energy Storage Power Station Published in: 2020 4th International Conference on Electronics, Communication and Aerospace Technology

Get a quote

A comprehensive review of large-scale energy storage

2 days ago· Moreover, two service modes of independent and shared energy storage participation in power market transactions are analyzed, and the challenges faced by the large

Get a quote

How is the profit of energy storage power station? | NenPower

By prioritizing sustainability alongside profitability, operators can ensure that energy storage power stations deliver value not only to shareholders but also to society at

Get a quote

How is the profit of large energy storage power station?

The profit of large energy storage power stations can be elucidated through several core aspects: 1. Revenue Generation Methods, 2. Cost Dynamics, 3. Market Demand

Get a quote

How is the profit of Hunan energy storage power station?

The profit of Hunan energy storage power station can be analyzed through several key aspects: 1. Revenue generation from energy sales, 2. Operational cost efficiencies, 3.

Get a quote

Containerized Energy Storage System Complete battery

What is containerized ESS? ABB''s containerized energy storage system is a complete, self-contained battery solution for large-scale marine energy storage. The batteries and all control,

Get a quote

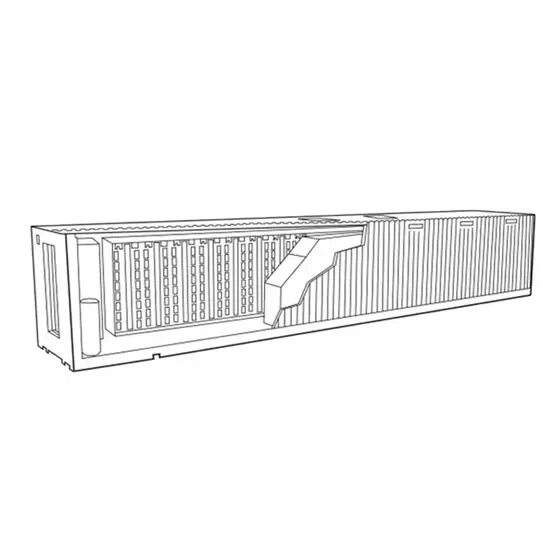

CONTAINER POWER STATION

Energy storage power station container structure A battery energy storage system (BESS) or battery storage power station is a type of technology that uses a group of to store . Battery

Get a quote

How is the profit of Beijing energy storage power station?

The profit generated by energy storage power stations in Beijing primarily hinges on 1. operational efficiency, 2. market dynamics, 3. policy incentives, 4. technological

Get a quote

Energy Storage Power Station Profit Analysis: Where Electrons

Let''s face it – when most people hear "energy storage," they picture clunky car batteries or that forgotten power bank in their junk drawer. But energy storage power station profit analysis is

Get a quote

Analysis and Comparison for The Profit Model of Energy Storage

Analysis and Comparison for The Profit Model of Energy Storage Power Station Published in: 2020 4th International Conference on Electronics, Communication and Aerospace Technology

Get a quote

Solar Container | Large Mobile Solar Power Systems

Why choose LZY''s solar container power systems Our solar containers ensure fast deployment, scalability, customization, cost savings, reliability, and sustainability for efficient energy anywhere.

Get a quote

Containerized Battery Energy Storage Systems

ALL-IN-ONE BATTERY ENERGY STORAGE SYSTEMS (BESS) With over 55 years of innovation in batteries and power systems, EVESCO''s all-in-one

Get a quote

How does an air energy storage power station make a profit?

1. The profitability of an air energy storage power station hinges on several mechanisms: 1) The sale of stored energy during peak demand periods, 2) Participation in

Get a quote

Hybrid Microgrid Technology Platform | BoxPower

The BoxPower MiniBox is a pre-engineered solar power station, prefabricated inside a 4′ x 8′ palletized enclosure. All energy systems are equipped with a

Get a quote

What Profit Analysis Does Energy Storage Include? A 2025 Deep

Let''s crack open the profit pizza of energy storage - where every slice represents a different revenue stream. From California''s solar farms to Guangdong''s factories, energy

Get a quote

Energy Storage Power Station Profit Sharing: The Future of

Energy storage isn''t just about keeping the lights on anymore—it''s about lighting up profit potential across the renewable value chain. The projects that''ll thrive are those cracking the code on

Get a quote

Container energy storage profit model

The main profit model of industrial and commercial energy storage is self-use + peak-valley price difference arbitrage or use as a backup power supply.

Get a quote

How is the profit model of energy storage power station

The profit model of energy storage power stations operates primarily through: 1) frequency regulation, 2) capacity arbitrage, 3) ancillary market services, and 4) participation in

Get a quote

Zinc-Iodide Battery Tech Disrupts $293B Energy Storage Market

3 days ago· Renewable energy and stationary storage at scale: Joley Michaelson''s woman-owned public benefit corporation deploys zinc-iodide flow batteries and microgrids.

Get a quote

How is the profit of energy storage power station construction?

The emergence of energy storage power stations represents a pivotal advancement in the energy sector. These facilities are designed to capture and store energy

Get a quote

Business Models and Profitability of Energy Storage

Their examination over the coming years will be essential to reach a detailed and conclusive evaluation of the profitability of energy storage. To conclude, we summarize the

Get a quote

Profit distribution through blockchain solution from battery energy

The implementation of Virtual Power Plants (VPPs) with appropriate energy management can provide consumer units (CUs) with a significant reduction in energy

Get a quote

How is the profit of industrial energy storage power station?

The profit of industrial energy storage power stations is influenced by various factors, including 1. the scale of deployment, 2. the types and prices of stored energy, 3.

Get a quote

6 FAQs about [How is the profit of energy storage container power station]

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

What is a power storage facility?

In the first three applications (i.e., provide frequency containment, short-/long-term frequency restoration, and voltage control), a storage facility would provide either power supply or power demand for certain periods of time to support the stable operation of the power grid.

Is lithium ion the future of stationary energy storage?

The second gap involved technology. "I didn't believe lithium ion was the future of stationary energy storage," Michaelson says, referring to fixed-location energy storage systems for homes, businesses, and industrial facilities—distinct from mobile applications like electric vehicles. The third gap went deeper than business fundamentals.

Guess what you want to know

-

How much does a West Asian energy storage container power station cost

How much does a West Asian energy storage container power station cost

-

How much does a mobile energy storage power station container cost

How much does a mobile energy storage power station container cost

-

Belize Energy Storage Container Power Station System

Belize Energy Storage Container Power Station System

-

How much does the electricity price of the Irish energy storage power station cost

How much does the electricity price of the Irish energy storage power station cost

-

Timor-Leste energy storage container power station price

Timor-Leste energy storage container power station price

-

How many plants are there in the Pretoria Energy Storage Power Station

How many plants are there in the Pretoria Energy Storage Power Station

-

How much does a 100kw wind power energy storage battery container cost

How much does a 100kw wind power energy storage battery container cost

-

How much energy storage should a 1 MW power station require

How much energy storage should a 1 MW power station require

-

How much does a 1mw energy storage power station cost

How much does a 1mw energy storage power station cost

-

How much does a square meter of container cost for an Ethiopian energy storage station

How much does a square meter of container cost for an Ethiopian energy storage station

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.