Spring 2024 Solar Industry Update

China continues to dominate the global market, representing ~60% of 2023 installs, up 120% y/y. The rest of the world was up 30% y/y. The U.S. was the second-largest market in terms of

Get a quote

The State of the Solar Industry

A significant portion of the increase came from China, which deployed around 250 GWdc of solar. Overall, analysts expect the industry to continue to grow, however the range of near-term

Get a quote

Winter 2024 Solar Industry Update

Global Solar Deployment • Analysts estimate 350 GWdc of PV was installed globally in 2023 (though recent data have indicated that number could be more like 440 GWdc); global

Get a quote

Solar Energy for Developing Countries: Empowering

Solar panels, which capture sunlight and convert it into power, are installed on roofs, in public areas, or solar farms. Notably, solar energy is

Get a quote

Solar industry posts record Q1 growth but projects longer-term

Despite the strong first quarter figures, Wood Mackenzie expects the solar industry to contract about 2% annually between 2025-2030, adding an average 43 GW of new solar

Get a quote

Solar Market Insight Report 2024 Year in Review – SEIA

The industry remains optimistic about the role of solar in achieving energy dominance and meeting rising electricity demand. State-level initiatives and corporate demand

Get a quote

Solar Energy Industry Outlook 2024 | StartUs Insights

Detailed firmographic data, investment patterns, and regional hubs show emerging trends such as photovoltaics, electrification, and distributed solar power generation impacting

Get a quote

Solar Energy Industry Outlook 2024 | StartUs Insights

The 2024 Solar Energy Industry Report presents an analysis of the current trends, investments, and tech advancements shaping the global solar market.

Get a quote

Solar PV Panels Market Size, Share & Trends Report, 2030

Growing demand for renewables-based clean electricity coupled with government policies, tax rebates, and incentives to install solar panels is expected to drive the growth of solar PV

Get a quote

Solar industry posts record Q1 growth but projects

Despite the strong first quarter figures, Wood Mackenzie expects the solar industry to contract about 2% annually between 2025-2030, adding

Get a quote

Solar Energy Industry Outlook 2024 | StartUs Insights

Detailed firmographic data, investment patterns, and regional hubs show emerging trends such as photovoltaics, electrification, and distributed

Get a quote

Solar Photovoltaic (PV) Market Size, Growth Outlook

The solar photovoltaic market size exceeded USD 289.6 billion in 2023 and is set to expand at more than 8.3% CAGR from 2024 to 2032 driven by increasing

Get a quote

The Future of Solar Energy | Solar Energy

As costs decrease and efficiency increase, the future of the solar industry looks more hopeful than ever. This article explores the future of solar

Get a quote

Global PV Module Market Analysis and 2025 Outlook

PV modules are the central component of the solar industry. This analysis reviews market conditions that affect solar panel pricing and availability.

Get a quote

The Outlook for Global Solar Energy Continues to Be Bright

China and the US may be reducing policy support for the solar power sector, but Goldman Sachs Research still expects rapid growth, with solar installations set to rise by 57%

Get a quote

Solar PV Panels Market Size, Share & Trends Report,

Growing demand for renewables-based clean electricity coupled with government policies, tax rebates, and incentives to install solar panels is expected to drive

Get a quote

solar revolution is shaking up the global energy game

3 days ago· China''s $625 billion clean energy boom pushes wind and solar past fossil fuels, reshaping global markets and fossil fuel demand outlook.

Get a quote

Solar PV module market outlook 2025: emerging

The solar industry''s rapid expansion has directly benefitted the market for key components such as PV modules, which make up solar panels

Get a quote

Solar Panel: A Sustainable Development Alternative

The discussions address the solar industry''s fundamental ideas, the global energy scenario, the highlights of research conducted to improve the solar industry,

Get a quote

The Future of Solar Energy | Solar Energy Development 2025

As costs decrease and efficiency increase, the future of the solar industry looks more hopeful than ever. This article explores the future of solar panels, key industry trends,

Get a quote

Solar Market Insight Report Q4 2023

The quarterly SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report shows the major trends in the U.S. solar industry. Learn more about the U.S.

Get a quote

Global Market Outlook for Solar Power 2025-2029

In our most realistic scenario, we anticipate a 10% increase in installations to 655 GW in 2025, with annual growth rates remaining in the low double digits between 2027-2029,

Get a quote

The Future of Solar: Top Industry Trends for 2024

The growth of the solar industry is also a significant driver of job creation, with roles spanning manufacturing, installation, maintenance, and

Get a quote

6 FAQs about [Solar panel industry development]

What will drive the growth of solar PV panels industry?

Growing demand for renewables-based clean electricity coupled with government policies, tax rebates, and incentives to install solar panels is expected to drive the growth of solar PV panels industry in the coming years. Asia Pacific held the largest market share of over 54.0% in 2023.

What trends are affecting the solar energy industry?

Detailed firmographic data, investment patterns, and regional hubs show emerging trends such as photovoltaics, electrification, and distributed solar power generation impacting the industry’s future landscape. This report was last updated in July 2024.

What is the global solar PV panels market size?

The global solar PV panels market size was estimated at USD 170.25 billion in 2023 and is projected to reach USD 287.13 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030.

How will solar impact the energy industry?

The industry remains optimistic about the role of solar in achieving energy dominance and meeting rising electricity demand. State-level initiatives and corporate demand will gain more relevance and drive solar development, potentially mitigating the impact of federal mandates.

How big is the solar energy industry?

Industry Growth: The solar energy industry includes over 62500 companies, growing by 1.21% last year, reflecting its expanding market presence and potential. Manpower & Employment Growth: The industry employs 5.2 million people globally, with 288000 new employees added last year, indicating substantial workforce expansion.

What factors influence the competitiveness of solar PV panel industry?

The high degree of forward integration, security of raw material feedstock, technology sourcing, skilled manpower, and strong R&D are among the prominent factors governing the competitiveness of solar PV panel industry. Globally, rising renewable energy demand in addition to growing energy security concerns is driving market growth.

Guess what you want to know

-

Liechtenstein Solar Panel Industry Cluster

Liechtenstein Solar Panel Industry Cluster

-

Is solar panel a cyclical industry

Is solar panel a cyclical industry

-

Solar panel industry stocks

Solar panel industry stocks

-

Samoa New Energy Building Solar Panel Components Research and Development

Samoa New Energy Building Solar Panel Components Research and Development

-

Solar panel industry recommendation

Solar panel industry recommendation

-

Papua New Guinea solar panel sales

Papua New Guinea solar panel sales

-

EU solar panel installation north

EU solar panel installation north

-

How much does solar photovoltaic silicon panel equipment cost

How much does solar photovoltaic silicon panel equipment cost

-

Zambia Customized Solar Panel Factory

Zambia Customized Solar Panel Factory

-

Photovoltaic rooftop solar panel size

Photovoltaic rooftop solar panel size

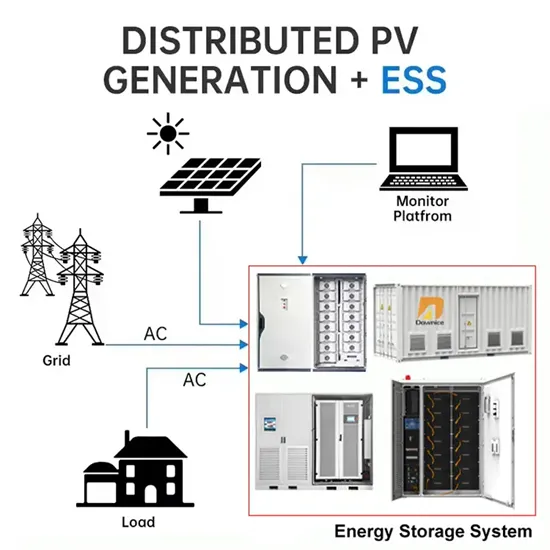

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

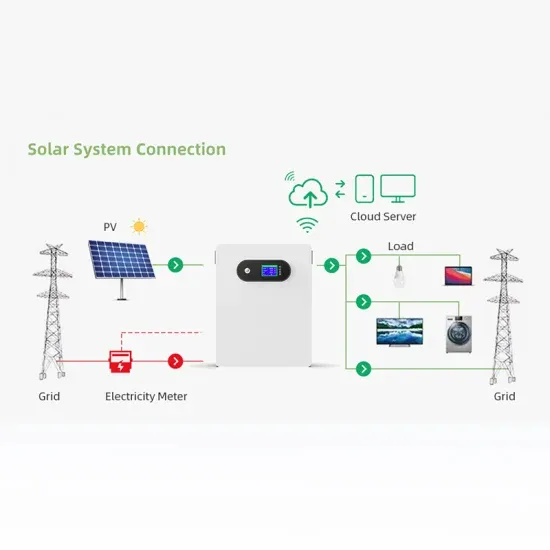

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.