5G Technology Metrics Explained: Base Station, Uplink, and User

Get a detailed breakdown of 5G hardware specs, including antenna sizes, power, gain, and SNR for base stations, uplink CPEs, and user equipment.

Get a quote

Modular Communications Transceiver for 4G/5G Distributed

ABSTRACT This application report describes the methodology to construct modular 4G/5G distributed antenna systems (DAS) and base stations (BTS). It provides an example of an

Get a quote

Optimization of 5G base station deployment based on quantum

In previous research on 5 G wireless networks, the optimization of base station deployment primarily relied on human expertise, simulation software, and algorithmic optimization. The

Get a quote

5G NR Base Station types

BS type 1-C requirements are applied at the BS antenna connector (port A) for a single transmitter or receiver with a full complement of transceivers for the configuration in the normal operating

Get a quote

Machine Learning and Analytical Power Consumption

Abstract—The energy consumption of the fifth generation (5G) of mobile networks is one of the major concerns of the telecom industry. However, there is not currently an accurate and

Get a quote

What is a 5G Base Station?

5G base stations operate by using multiple input and multiple output (MIMO) antennas to send and receive more data simultaneously compared to previous generations of

Get a quote

An introduction to 5G New Radio architecture

Base stations are the core of the 5G network and critical for the implementation of 5G NR architectures. Source: Nokia Mobile communication

Get a quote

Coordination of Macro Base Stations for 5G Network with User

The coordination among the communication equipment and the standard equipment in 5G macro BSs is developed to reduce both the energy consumption and the electricity costs.

Get a quote

Research and Implementation of 5G Base Station Location

The application requirements of 5G have reached a new height, and the location of base stations is an important factor affecting the signal. Based on factors such as base station

Get a quote

What is a 5G base station?

A 5G Base Station, also Known as A GNB (Next-Generation Nodeb), is a fundamental component of the fifth-generation (5G) Wireless Network Infrastructure. It serves

Get a quote

Optimal capacity planning and operation of shared

A bi-level optimization framework of capacity planning and operation costs of shared energy storage system and large-scale integrated 5G base stations is proposed to

Get a quote

5G Communication Signal Based Localization with a Single Base

With the growing demand for high accuracy indoor localization, the fifth generation (5G) wireless communication technology based localization attracts increasin

Get a quote

Mobile Communication Network Base Station Deployment Under 5G

With the advance of 5G technology, the complexity of network design has increased significantly due to the density of base station deployment and the reduction of the

Get a quote

5G NR Base Station Classes: Type 1-C, Type 1-H, Type 1-O,

Learn about the different classes of 5G NR base stations (BS), including Type 1-C, Type 1-H, Type 1-O, and Type 2-O, and their specifications.

Get a quote

An optimal dispatch strategy for 5G base stations equipped with

Moreover, as BSCs are predominantly situated at communication tower sites, they not only enhance the backup power capacity for communication loads but also share the

Get a quote

Multi-objective cooperative optimization of communication base station

Due to the characteristics of 5G communications, regarding power consumption and the count of base stations, 5G communication base stations exhibit a marked superiority

Get a quote

5G Base Station Growth: How Many Are Active? | PatentPC

More countries, companies, and telecom providers are racing to build 5G base stations, ensuring faster speeds, lower latency, and better connectivity. But how many 5G base stations are

Get a quote

Mobile Communication Network Base Station Deployment Under

With the advance of 5G technology, the complexity of network design has increased significantly due to the density of base station deployment and the reduction of the

Get a quote

The optimal 5G base station location of the wireless sensor

However, due to the small coverage and high building cost of 5 G base stations, communication developers must spend a lot on the building process. Therefore, how to meet

Get a quote

5G System Overview

Coordinated by Alain Sultan, MCC. Introduction The Fifth Generation of Mobile Telephony, or 5G, or 5GS, is the system defined by 3GPP from Release 15, functionally frozen

Get a quote

5G Communication Signal Based Localization with a Single Base Station

With the growing demand for high accuracy indoor localization, the fifth generation (5G) wireless communication technology based localization attracts increasin

Get a quote

Collaborative optimization of distribution network and 5G base stations

In this paper, a distributed collaborative optimization approach is proposed for power distribution and communication networks with 5G base stations. Firstly, the model of 5G

Get a quote

5G NR Base Station Classes: Type 1-C, Type 1-H,

Learn about the different classes of 5G NR base stations (BS), including Type 1-C, Type 1-H, Type 1-O, and Type 2-O, and their specifications.

Get a quote

5G Base Station Architecture

Non-Standalone (NSA) Base Stations use Multi-RAT Dual Connectivity (MR-DC) to provide user plane throughput across both the 4G and 5G air interfaces. This requires an eNode B and

Get a quote

6 FAQs about [5g single base station communication capacity]

What are the different types of 5G NR base stations?

This article describes the different classes or types of 5G NR Base Stations (BS), including BS Type 1-C, BS Type 1-H, BS Type 1-O, and BS Type 2-O. 5G NR (New Radio) is the latest wireless cellular standard, succeeding LTE/LTE-A. It adheres to 3GPP specifications from Release 15 onwards. In 5G NR, the Base Station (BS) is referred to as a gNB.

How does a 5G base station work?

5G base stations operate by using multiple input and multiple output (MIMO) antennas to send and receive more data simultaneously compared to previous generations of mobile networks. They are designed to handle the increased data traffic and provide higher speeds by operating in higher frequency bands, such as the millimeter-wave spectrum.

How much data does 5G generate a day?

With millions of base stations in operation, 5G networks generate an enormous amount of data. It’s estimated that 5G base stations worldwide produce more than 500 petabytes of data daily. This data includes network traffic, user behavior, and real-time analytics from connected devices. For telecom providers, managing this data is a major challenge.

What frequency bands do 5G base stations use?

Utilization of Frequency Spectrum: 5g Base Stations Operate in specific Frequency Bands Allocated for 5G Communication. These bands include Sub-6 GHz Frequencies for Broader Coverage and Millimeter-Wave (Mmwave) Frequencies for Higher Data Rates.

Why is 5G better than 4G?

Because 5G operates at higher frequencies, it requires a much denser network of base stations. In urban environments, this means installing 10 times more base stations per square kilometer compared to 4G. This presents both opportunities and challenges. On one hand, denser networks lead to better speeds and connectivity.

How many 5G base stations are there in the United States?

While China leads in sheer numbers, the U.S. is making steady progress. By late 2023, the country had between 150,000 and 200,000 active 5G base stations. The deployment strategy in the U.S. is different from China’s, as it relies on private investment rather than government-led initiatives. Is this article too long?

Guess what you want to know

-

Does Zimbabwe have a 5G communication base station

Does Zimbabwe have a 5G communication base station

-

National 5G communication green base station construction

National 5G communication green base station construction

-

Company producing 5g base station communication power supply

Company producing 5g base station communication power supply

-

Communication 5g base station format energy method

Communication 5g base station format energy method

-

Lesotho 5G communication base station inverter project

Lesotho 5G communication base station inverter project

-

Huawei 5G base station communication energy storage cabinet cost price

Huawei 5G base station communication energy storage cabinet cost price

-

Power consumption of a single 5G base station

Power consumption of a single 5G base station

-

5g mobile communication base station wind and solar complementarity

5g mobile communication base station wind and solar complementarity

-

Latvia 5G communication high-voltage power base station

Latvia 5G communication high-voltage power base station

-

Kenya 5G communication base station energy storage system

Kenya 5G communication base station energy storage system

Industrial & Commercial Energy Storage Market Growth

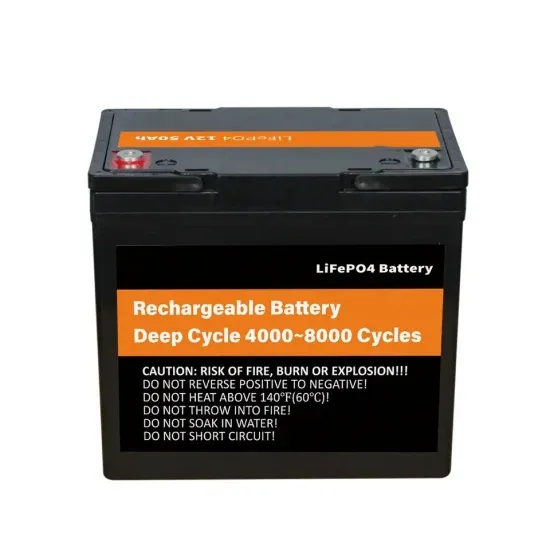

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.