summary of lithium battery energy storage foreign trade analysis

Lithium-Ion Battery Energy Storage SystemMarket Size and Share Analysis The Global Lithium-Ion Battery Energy Storage System market is anticipated to rise at a considerable rate

Get a quote

Addressing Tariffs and Trade in Energy Storage Projects

The investigations target active anode materials of the type used in lithium-ion batteries for Battery Energy Storage Systems, electric vehicles, consumer electronics, medical

Get a quote

Leading Foreign Trade Sales Company of Battery Factory,

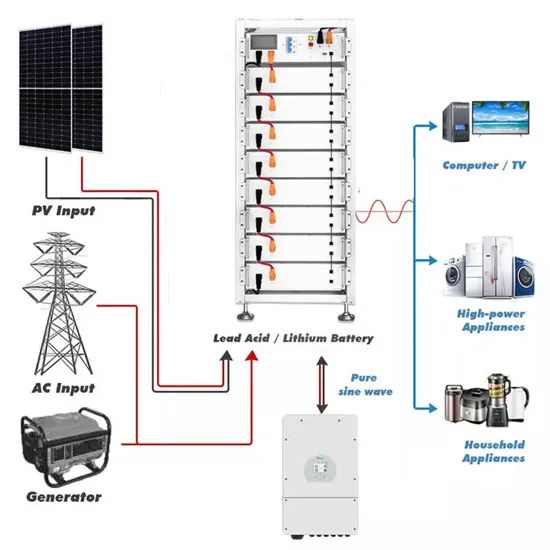

We are a foreign trade sales company for battery factories, specializing in industrial valve-regulated batteries, lithium batteries, lead-acid batteries, energy storage batteries, and more.

Get a quote

Energy Storage Foreign Trade Products: Trends, Challenges, and

Think renewable energy developers, international traders, policymakers, or even curious investors. These folks want actionable insights—not fluff—about cross-border trade in battery

Get a quote

The Battery Storage Market Is Set to Grow Ninefold by 2040

Battery storage is rapidly expanding worldwide, lowering costs and stabilizing renewable energy supply as countries move away from fossil fuels.

Get a quote

Battery Tariffs 2025: Impact on U.S. Energy and Trade

Explore how 2025 battery tariffs affect U.S. imports, energy storage, EV production, and sourcing strategies amid rising China tariffs and trade shifts.

Get a quote

How America Can Leverage Its Battery Oversupply for Global Gains

1 day ago· US battery oversupply offers an opportunity to expand into new markets, counter Chinese dominance, and secure long-term energy competitiveness.

Get a quote

What does foreign trade energy storage battery include?

Regulatory frameworks significantly influence the foreign trade of energy storage batteries, as compliance with international and local standards is vital. Entities must ensure

Get a quote

Global Trade Disruption: What New US Tariffs Mean

A significant cost escalation for Chinese-made LFP battery cells, which are central to US energy storage deployment. These cells now face a

Get a quote

SURVEY ON THE CURRENT STATUS OF FOREIGN TRADE ENERGY STORAGE

Is battery energy storage a new phenomenon? Against the backdrop of swift and significant cost reductions, the use of battery energy storage in power systems is increasing. Not that energy

Get a quote

Tariffs: Analysis spells out extent of challenge for US

New analysis from Clean Energy Associates (CEA) and Wood Mackenzie highlights the challenges facing the US battery storage market due

Get a quote

Global Trade Disruption: What New US Tariffs Mean for the Battery

A significant cost escalation for Chinese-made LFP battery cells, which are central to US energy storage deployment. These cells now face a combined tariff of 64.9%, rising to

Get a quote

Addressing Tariffs and Trade in Energy Storage Projects

Two major areas of international trade that will remain causes of concern for energy storage projects are the application of tariffs and supply chain integrity.

Get a quote

How to Master Energy Storage Foreign Trade: A 2025 Guide for

Well, here''s the thing – the global energy storage market is projected to hit $50 billion by Q4 2025, with cross-border trade accounting for 63% of lithium-ion battery transactions. But why are

Get a quote

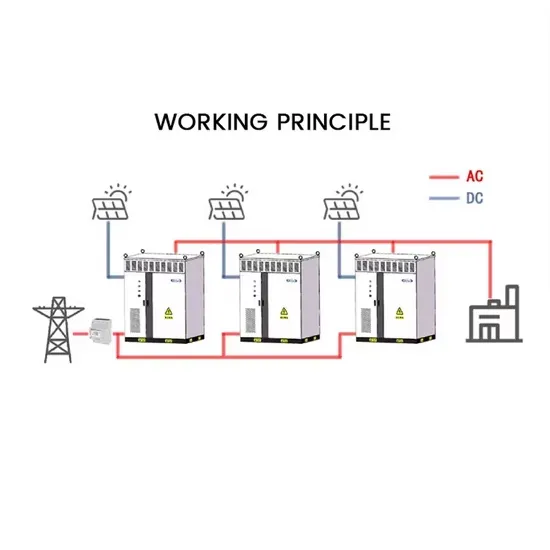

The Rise of Foreign Trade Energy Storage Companies: Powering

Why Energy Storage Is the New "Oil" in Global Trade Remember when oil ruled the world economy? Today, energy storage systems (ESS) are becoming the backbone of

Get a quote

US and EU Tighten Grip on Lithium Batteries, Putting Pressure on

If this policy is implemented as scheduled, it will be challenging for Chinese lithium battery manufacturers to maintain a competitive edge in the North American market. After

Get a quote

National Blueprint for Lithium Batteries 2021-2030

Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary grid storage, critical to

Get a quote

Energy Storage Battery Foreign Trade Docking: A Gateway to

Why Energy Storage Batteries Are Redefining Global Trade Let''s face it: the world is hungry for reliable energy solutions. With countries racing to meet renewable energy targets

Get a quote

China unveils measures to bolster new-type energy storage

Chinese authorities unveiled several measures on Monday to promote the new-type energy storage manufacturing sector, as part of efforts to accelerate the development of

Get a quote

Battery laws in the top EV producing countries

Governments have realised the need to control resources required for future clean energy production. As EVs and batteries play a vital role in meeting the

Get a quote

Tariff Volatility Reshapes Battery Storage Landscape: CEA''s

A mid-quarter update from Clean Energy Associates (CEA) reveals how recent shifts in U.S. trade policy are significantly altering the economics of battery energy storage

Get a quote

Addressing Tariffs and Trade in Energy Storage Projects

Two major areas of international trade that will remain causes of concern for energy storage projects are the application of tariffs and supply

Get a quote

China aims to nearly double battery storage by 2027 in $35 billion

2 hours ago· China is looking to almost double its so-called new energy storage capacity to 180 gigawatts (GW) by 2027, according to an industry plan announced by authorities on Friday.

Get a quote

Behind China''s Export Ban on Critical Battery

Therefore, the news that the Chinese Ministry of Commerce has proposed an unprecedented export ban on technologies critical to producing

Get a quote

6 FAQs about [New energy storage lithium battery foreign trade]

Will China impose tariffs on lithium-ion EV batteries?

An interesting issue will be the imposition of tariffs. There are existing tariffs pursuant to Section 301 of the Trade Act of 1974 on some Chinese-origin lithium-ion EV batteries and non-lithium-ion battery parts, which were increased to 25% in September 2024.

Is China still a supplier of lithium battery cells?

China remains a primary supplier of lithium battery cells for the U.S. market. In December 2024, lithium battery imports from China exceeded $1.9 billion, according to U.S. trade records. However, changes under the 2025 tariff framework have added new barriers to this trade.

How many lithium batteries did the US import in 2024?

This marks a significant increase compared to the average 20.8% rate recorded in 2024. Recent trade data shows that the U.S. imported approximately $1.9 billion lithium batteries from China in 2024. With the implementation of Trump’s China tariffs in 2025, these imports now face a much higher cost structure.

Which international trade issues will remain a concern for energy storage projects?

Two major areas of international trade that will remain causes of concern for energy storage projects are the application of tariffs and supply chain integrity.

What are China's new tariffs on lithium-ion cells & components?

Starting in 2025, new Chinese tariffs on imported lithium-ion cells and components—especially those used in energy storage systems—have reached levels as high as 104%, according to updated trade filings. This marks a significant increase compared to the average 20.8% rate recorded in 2024.

Which stationary energy storage products are affected by battery tariffs?

Stationary Energy Storage Products Affected by Battery Tariffs Large-format stationary energy storage systems like Tesla’s Powerwall and Megapack also face cost increases due to the latest tariffs. These products rely heavily on lithium battery cells sourced from Chinese suppliers.

Guess what you want to know

-

New Zealand container photovoltaic energy storage lithium battery foreign trade

New Zealand container photovoltaic energy storage lithium battery foreign trade

-

Cook Islands photovoltaic energy storage lithium battery foreign trade

Cook Islands photovoltaic energy storage lithium battery foreign trade

-

New lithium battery energy storage module group

New lithium battery energy storage module group

-

New Energy Energy Storage Lithium Battery Site Cabinet

New Energy Energy Storage Lithium Battery Site Cabinet

-

New Zealand lithium titanate battery energy storage container price

New Zealand lithium titanate battery energy storage container price

-

New Zealand Photovoltaic Energy Storage Battery Project

New Zealand Photovoltaic Energy Storage Battery Project

-

Energy storage lithium battery cells

Energy storage lithium battery cells

-

Lithium battery energy storage industry concentration area

Lithium battery energy storage industry concentration area

-

Tajikistan distributed energy storage lithium battery

Tajikistan distributed energy storage lithium battery

-

Vietnamese lithium battery energy storage companies

Vietnamese lithium battery energy storage companies

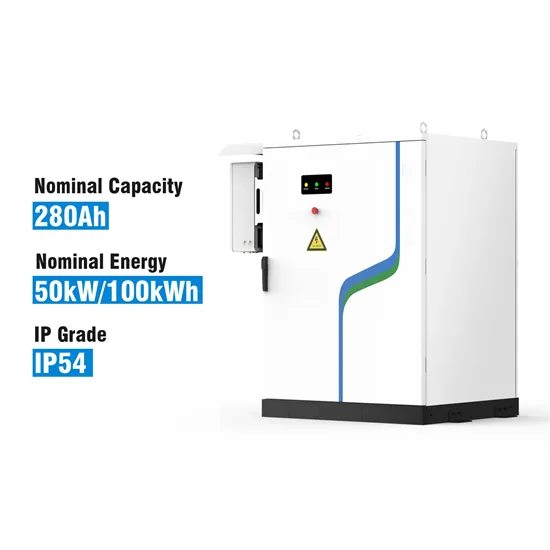

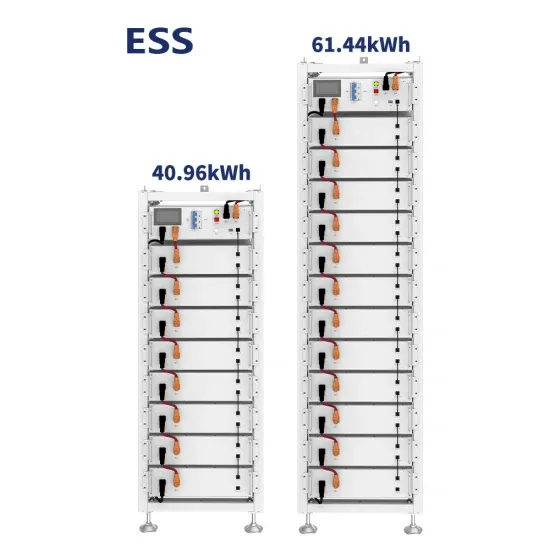

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.