Marubeni, VinGroup in ''first of a kind'' Vietnam BESS

In late 2022, VinGroup began construction of the country''s first lithium iron phosphate (LFP) battery gigafactory through a joint venture (JV)

Get a quote

How Battery Energy Storage Systems Can Transform Vietnam''s Energy

As Vietnam''s economy grows, the demand for energy is rising rapidly, putting significant pressure on the country''s infrastructure. This surge in demand has exposed

Get a quote

How is Vietnam''s energy storage lithium battery?

The energy storage lithium battery industry in Vietnam holds tremendous promise, blending economic growth with sustainability. As investments pour in, and policies evolve to

Get a quote

Marubeni, VinGroup in ''first of a kind'' Vietnam BESS project

In late 2022, VinGroup began construction of the country''s first lithium iron phosphate (LFP) battery gigafactory through a joint venture (JV) with Chinese battery maker

Get a quote

Vietnam considers battery energy storage systems

As the country strives to enhance its renewable energy capacity, battery energy storage systems will play a crucial role in ensuring a reliable

Get a quote

Vietnam Battery Companies

Get access to the business profiles of top 10 Vietnam Battery companies, providing in-depth details on their company overview, key products and services, financials, recent developments

Get a quote

About Us_Ritar International Group Limited

Its main business scope: lithium-ion batteries, lithium polymer batteries, fuel cells, power batteries, ultra-large capacity energy storage batteries,

Get a quote

Vietnam Energy Storage Lithium Battery: Powering the Future

Vietnam''s lithium battery market grew 42% YoY in 2023 – faster than a Grab bike delivery. But here''s the kicker: while global players dominate, local manufacturers like VinES are making

Get a quote

The Global Leading Battery Suppliers | Tianneng

Tianneng Battery is a global battery supplier of high-quality lithium and lead-acid batteries for electric vehicles and energy storage. We offer reliable supply,

Get a quote

Vietnam Battery Market Size, Share, Trends Analysis 2033

Vietnam Battery Market Report by Battery Technology (Lead-acid Battery, Lithium-ion Battery, and Others), Application (Automotive, Data Centers, Telecommunication, Energy Storage, and

Get a quote

Vietnam energy storage lithium battery wholesale

Who is hycom Power Battery Vietnam? Hycom Power Battery Vietnam specializes in the production of lithium-ion batteries for solar energy storage, electric bicycles, and backup power

Get a quote

Top 20 Lithium-ion Battery Manufacturers in Vietnam

Maxim Battery Vietnam is a leading provider of lithium-ion batteries for EVs, motorcycles, and energy storage systems. The company emphasizes product customization, allowing them to

Get a quote

As Vietnam embarks on renewables push, battery firms hungry

Under the landmark power strategy, Vietnam targets a total capacity of at least 2,700 MW and 30,650 MW for pumped storage hydropower and other battery storage sources

Get a quote

Vietnam Energy Storage Lithium-ion Batteries Market Share

The Vietnam Energy Storage Lithium-ion Batteries Market is segmented based on key factors such as product type, application, end-user, and distribution channel.

Get a quote

List of Battery companies in Vietnam

Dry Cell and Storage Battery JSC (PINACO) Dry Cell and Storage Battery Joint Stock Company (PINACO)was founded in 1976. It became a public company 2004 (Stock Code: PAC). Nearly

Get a quote

Vietnam Lithium-ion Battery Energy Storage Systems Market

Vietnam Lithium-ion Battery Energy Storage Systems Top Companies Market Share Vietnam Lithium-ion Battery Energy Storage Systems Competitive Benchmarking By Technical and

Get a quote

The Leading Energy Storage Companies

Lithium-ion batteries have long been the gold standard for energy storage, powering everything from electrical devices to electric cars. As the need for batteries continues

Get a quote

Vietnam Battery Market Transformation

Discover Vietnam''s battery sector growth, including BESS expansion, swappable EV systems, lithium-ion manufacturing, and government policies driving innovation.

Get a quote

Vietnam lithium battery producers-Ritar International Group Limited

Vietnam is witnessing the rapid growth of its lithium battery manufacturing industry, with several key producers playing significant roles. The following is an in-depth exploration of

Get a quote

Shire Oak Vietnam BESS Presentation

Due to their high energy densities, high power, near-100 percent efficiency, and minimal self-discharge, lithium-ion batteries are one of the fastest-growing energy storage technologies

Get a quote

Top 10 energy storage manufacturers in the world

Company profile: Since 2008, as one of top 10 household energy storage manufacturers in China, BYD energy storage has focused on the research and

Get a quote

Vietnam Lithium Batteries for Shared Energy Storage Market Size

The Vietnam Lithium Batteries for Shared Energy Storage Market features a mix of established local companies and international corporations, all striving to expand their

Get a quote

6 FAQs about [Vietnamese lithium battery energy storage companies]

Who is the leading lithium battery supplier in Vietnam?

Company Profile: According to Volza's lithium battery export data of Vietnam, Samsung Electronics Vietnam Co., Ltd. is the leading lithium battery supplier in Vietnam, accounting for 56% of the total with 15,696 shipments. It is a subsidiary of the globally renowned Samsung Group and has established a large-scale production base in Vietnam.

What are the trends & strategies for the Vietnam battery market?

Trends and Strategies for Future Success: With the Vietnam Battery Market poised for growth, a couple of notable trends have emerged. Increasing attention toward renewable energy solutions and electric vehicles is shaping company strategies.

What are the key players in the Vietnam battery market?

The market dynamics reflect a fairly consolidated nature, enabling established players to reinforce their positions while still allowing niche players to compete effectively. Major Players Overview: Key players in the Vietnam Battery Market include local and international names that bring varied strengths to the field.

Who makes Samsung lithium batteries?

Market Influence: The lithium batteries produced by Samsung Electronics Vietnam Co., Ltd. not only meet the production needs of Samsung in Vietnam but are also exported to many countries and regions around the world. In the international market, Samsung's lithium batteries have a high reputation and competitiveness.

Why should you invest in a lithium battery supply chain?

Global supply chain connections support extensive battery offerings. Offers advanced energy storage solutions to meet rising demands. Engages in strong R&D efforts to maintain competitive edge. Expanding product lines to include advanced lithium batteries presents growth opportunities.

Why is Samsung a good lithium battery brand?

In the international market, Samsung's lithium batteries have a high reputation and competitiveness. The brand influence and technological advantages of Samsung have enabled it to occupy an important position in the Vietnamese lithium battery market and have a positive impact on promoting the development of the local lithium battery industry.

Guess what you want to know

-

Recommended companies for lithium battery energy storage in Timor-Leste

Recommended companies for lithium battery energy storage in Timor-Leste

-

South African lithium battery energy storage companies

South African lithium battery energy storage companies

-

Germany energy storage lithium battery recommended company

Germany energy storage lithium battery recommended company

-

How much does a Japanese energy storage cabinet lithium battery cost

How much does a Japanese energy storage cabinet lithium battery cost

-

North Macedonia lithium battery energy storage cabinet assembly plant

North Macedonia lithium battery energy storage cabinet assembly plant

-

Which lithium battery for energy storage is cheap in Kuwait

Which lithium battery for energy storage is cheap in Kuwait

-

Vanuatu Energy Storage Low-Temperature Lithium Battery Plant

Vanuatu Energy Storage Low-Temperature Lithium Battery Plant

-

How much does energy storage lithium battery retail for

How much does energy storage lithium battery retail for

-

Panama s northwest deploys energy storage battery companies

Panama s northwest deploys energy storage battery companies

-

Mozambique lithium battery energy storage cabinet sales

Mozambique lithium battery energy storage cabinet sales

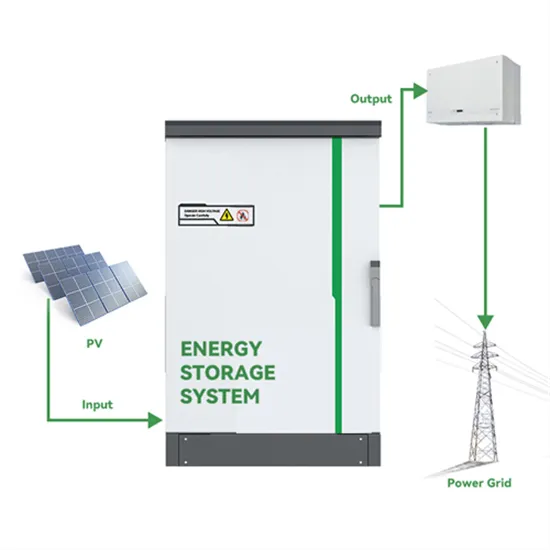

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.