U.S. Outdoor Power Equipment Market Size Worth USD 36.77

U.S. Outdoor Power Equipment Marke size estimated to reach USD 36.77 billion in 2034 and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

Get a quote

Natural gas in the United States

Natural gas production 1973-2022 U.S. natural gas monthly production, imports, and exports Discovered shale gas deposits as of June 2016 Natural gas

Get a quote

U.S. Outdoor Power Equipment Market Size Report,

The U.S. outdoor power equipment market is anticipated to grow rapidly over the forecast timeline owing to breakthroughs in battery systems and the use of

Get a quote

Portable Power Station Market: Global Industry Analysis

The increased demand for reliable power sources for outdoor activities and emergency preparedness, along with advancements in battery technology, is

Get a quote

Lawn & Outdoor Equipment Stores in the US

Expert industry market research on the Lawn & Outdoor Equipment Stores in the US (2015-2030). Make better business decisions, faster with IBISWorld''s industry market research reports,

Get a quote

U.S. Outdoor Power Equipment Market | Industry Report, 2030

The U.S. outdoor power equipment market size was valued at USD 12.89 billion in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2030. The growing demand for

Get a quote

U.S. Outdoor Power Equipment Market Size, Share,

The outdoor power equipment (OPE) market refers to the industry that manufactures, distributes, and sells a wide range of tools and machines

Get a quote

Power Supply Unit (PSU) Market 2024

The Global PSU Market size was valued at US$ 15.67 billion in 2024 and is projected to reach US$ 23.38 billion by 2030, at a CAGR of 6.9% during the forecast period 2024-2030. The

Get a quote

U.S. Outdoor Power Equipment Market | Industry

The U.S. outdoor power equipment market size was valued at USD 12.89 billion in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2030. The

Get a quote

Outdoor Power Supply Market Analysis

The Outdoor Power Supply market is poised for significant growth, driven by the increasing need for reliable and resilient power solutions in outdoor environments.

Get a quote

Computer Power Supplies Market 2024

The United States Computer Power Supplies market size was valued at US$ 3.67 billion in 2024 and is projected to reach US$ 5.23 billion by 2030, at a CAGR of 6.1% during the forecast

Get a quote

Outdoor Power Equipment Market Share: Top Brands

As of June 2023, the leading retailer in the outdoor power equipment industry is Home Depot, with 27% unit share and 29% dollar share.

Get a quote

U.S. Outdoor Power Equipment Market Size Report, Share,

The U.S. outdoor power equipment market is anticipated to grow rapidly over the forecast timeline owing to breakthroughs in battery systems and the use of GPS navigation, smart sensors, and

Get a quote

Outdoor Living Products: United States

Description Outdoor Living Products: United States This report forecasts to 2023 US outdoor living products demand in nominal US dollars at the manufacturer level. Total

Get a quote

Outdoor Power Supply Market by Applications – Detailed View: United

The United States outdoor power supply market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 6% through 2028. The market is driven by the rising adoption of...

Get a quote

Outdoor Power Equipment Market Size With Recession Impact, Producing

The Outdoor Power Equipment market experienced a huge change under the influence of COVID-19 and Russia-Ukraine War, the global market size of Outdoor Power

Get a quote

U.S. Outdoor Power Equipment Market Size, Share, Report 2030

The outdoor power equipment (OPE) market refers to the industry that manufactures, distributes, and sells a wide range of tools and machines designed to perform

Get a quote

Outdoor Power Supply Market Size, Share | 2025 To 2033

The market for outdoor power supplies is anticipated to rise as a result of factors like rising urbanization, disposable income, and infrastructure development, as well as rising

Get a quote

United States Forest Products Annual Market Review and

Presented are data and information on the current state of the United States economy and wood products markets, and near-term prospects. This report is supported by conventional

Get a quote

2025 Industry Statistics

Market Size & Industry Statistics The total U.S. industry market size for Lawn and Garden Equipment and Supplies Retailers: Industry statistics cover all companies in the

Get a quote

Outdoor Power Supply Market by Applications – Detailed View:

The United States outdoor power supply market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 6% through 2028. The market is driven by the rising adoption of...

Get a quote

Five charts on key US electricity and power

Electricity production trends from January through April broadly matched those of power generation, although clean electricity output outpaced

Get a quote

US Outdoor Power Equipment Market Size, Trends, Share 2033

Reports Description US Outdoor Power Equipment Market was valued at USD 60,141.8 Million in 2024 and is expected to reach USD 1,17,626.4 Million by 2033, at a CAGR of 6.74% during

Get a quote

Outdoor Power Supply Market Size, Share | 2025 To 2033

US Outdoor Power Equipment Market was valued at USD 60,141.8 Million in 2024 and is expected to reach USD 1,17,626.4 Million by 2033, at a CAGR of 6.74% during the

Get a quote

U.S. Outdoor Power Equipment Market | Industry

Market Size & Trends The U.S. outdoor power equipment market size was valued at USD 12.89 billion in 2023 and is anticipated to grow at a CAGR of 6.7%

Get a quote

Outdoor Power Equipment Market Share: Top Brands & Retailers

As of June 2023, the leading retailer in the outdoor power equipment industry is Home Depot, with 27% unit share and 29% dollar share. Despite being industry leader last

Get a quote

US Outdoor Power Equipment Market Size, Trends, Share 2033

US Outdoor Power Equipment Market was valued at USD 60,141.8 Million in 2024 and is expected to reach USD 1,17,626.4 Million by 2033, at a CAGR of 6.74% during the forecast

Get a quote

6 FAQs about [Which market in the United States is producing outdoor power supplies ]

Which segment dominated the outdoor power equipment market in 2023?

The residential segment held a larger share in the U.S. outdoor power equipment market in 2023, owing to increasing sales of products such as lawn movers, chainsaws, and trimmers to homeowners.

Which country has the largest outdoor power equipment market in 2023?

The U.S. accounted for 25.33% of the revenue share in the global outdoor power equipment market in 2023. The country is witnessing a shift towards greener and more efficient offerings to comply with government regulations and lower the emissions caused by conventional gas-powered equipment.

Why is outdoor power equipment so popular?

The current trends of remote and hybrid working models, as well as flexible working hours among businesses in the U.S., have ensured that people have more free time on their hands to indulge in gardening and landscaping, thus strengthening the U.S. market demand for outdoor power equipment.

Who makes outdoor power equipment?

The U.S. market for outdoor power equipment is populated with several global and country manufacturers, leading to a high frequency of product launches. For instance, in February 2023, Ariens, a brand of AriensCo, launched the RAZOR walk-behind mower.

What are the different types of outdoor power equipment?

There is a significant demand for different types of outdoor power equipment such as lawn mowers, chainsaws, and blowers among the U.S. population, due to which companies are increasingly focusing on launching advanced products in the market.

Is there a threat to outdoor power equipment?

The threat of substitutes is very low, as outdoor power equipment are undergoing technological developments to further improve their functioning and efficiency. The end-user base is significantly large, consisting of both households and commercial establishments.

Guess what you want to know

-

Is there a market for outdoor DC power supplies

Is there a market for outdoor DC power supplies

-

Market Trends of Outdoor Power Supplies

Market Trends of Outdoor Power Supplies

-

Slovenian companies producing outdoor power supplies

Slovenian companies producing outdoor power supplies

-

Market demand for outdoor energy storage power supplies

Market demand for outdoor energy storage power supplies

-

What are the outdoor wind power base station companies in the United States

What are the outdoor wind power base station companies in the United States

-

Specialized in the production of outdoor power supplies

Specialized in the production of outdoor power supplies

-

Iran makes outdoor power supplies

Iran makes outdoor power supplies

-

Entrepreneurs in Equatorial Guinea who make outdoor power supplies

Entrepreneurs in Equatorial Guinea who make outdoor power supplies

-

What are the low-power outdoor power supplies

What are the low-power outdoor power supplies

-

Does Huawei have outdoor power supplies in Syria How much does it cost

Does Huawei have outdoor power supplies in Syria How much does it cost

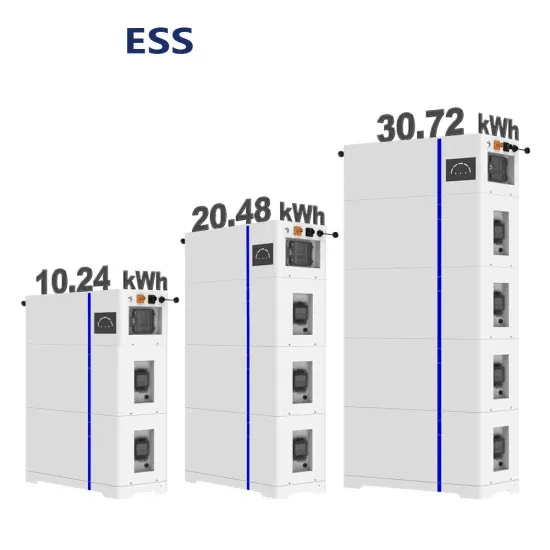

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

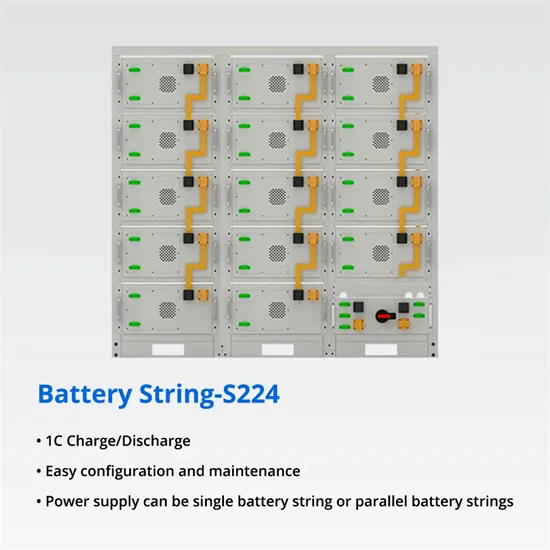

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.