Abuja Energy Storage Power Station Investment Opportunities in

Summary: Explore how the Abuja Energy Storage Power Station project creates lucrative opportunities for investors in renewable energy integration, grid stabilization, and sustainable

Get a quote

Plans for BESS assembly plant in Nigeria

The two companies say their planned BESS assembly plant has the potential to transform Nigeria''s energy landscape. Nigeria''s rapidly increasing demand for battery storage

Get a quote

The start-up tackling Nigeria''s reliable power

Less than half of the population of Nigeria has access to a reliable electricity supply. Start-up ICE Commercial Power is working to connect

Get a quote

Energy Storage Power Station Investment Insights: Breaking

3 days ago· Discover the true cost of energy storage power stations. Learn about equipment, construction, O&M, financing, and factors shaping storage system investments.

Get a quote

Nigeria Energy Storage Market (2025-2031) | Value & Analysis

6Wresearch actively monitors the Nigeria Energy Storage Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

Get a quote

Nigeria dithers as battery storage investment soars

Systems that capture energy and store it for later use, either to supply power to an off-grid application or to complement a peak demand, are

Get a quote

Overview and key findings – World Energy Investment 2024 –

Global energy investment is set to exceed USD 3 trillion for the first time in 2024, with USD 2 trillion going to clean energy technologies and infrastructure. Investment in clean energy has

Get a quote

Nigeria dithers as battery storage investment soars

Systems that capture energy and store it for later use, either to supply power to an off-grid application or to complement a peak demand, are the emerging energy sector

Get a quote

Climate Fund Managers and Microsoft Invest USD 18 Million in

The investment by CFM and Microsoft''s Climate Innovation Fund will support the construction of facilities and the deployment of a Battery Energy Storage Solution to connect

Get a quote

A Comprehensive Guide For Foreign Investors Doing Business In Nigeria

The guide will assist you in having a realistic view of Nigeria''s power and renewable energy sector and providing a framework for potential future investment, while avoiding

Get a quote

A Comprehensive Guide For Foreign Investors Doing Business In

The guide will assist you in having a realistic view of Nigeria''s power and renewable energy sector and providing a framework for potential future investment, while avoiding

Get a quote

New Energy Storage System Links Flywheels And Batteries

1 day ago· The latest example is the Illinois investment firm Magnetar Finance, which has just surged $200 million in funding towards the flywheel energy storage innovator Torus Energy.

Get a quote

NIGERIA''S LITHIUM BO

Introduction As global demand for renewable energy sources surges, Nigeria finds itself at a pivotal moment in its mining history. With vast untapped mineral resources, including lithium,

Get a quote

These are the top five energy technology trends of 2025

3 days ago· Despite US policy pivots, globally things are moving fast and there is a race between countries to establish a technology and manufacturing edge. Global energy investment in

Get a quote

Nigeria Energy | Invest in Nigeria

New for this year, Nigeria Energy Investors Club will bring together investors from the Middle East and Africa and aims to drive sustainable finance for Nigeria and help move the

Get a quote

INVESTMENT OPPORTUNITIES IN THE NIGERIAN

Federal Govt. has established the Nigeria Bulk Electricity Trading Co. Ltd as a credible and creditworthy offtaker of power including renewables. The off-taker is supported by World Bank

Get a quote

Nigeria''s Energy Transition Plan and the power sector

The energy transition plan is commendable with its strategy to move away from fossil fuel sources such as oil, coal and gas (which is the

Get a quote

Scaling Nigeria''s utility solar and energy storage

But, I digress. My objective for today''s piece is to examine the possibilities of scaling up Nigeria''s utility solar, with its naturally linked energy storage infrastructure. Utility

Get a quote

Abuja Energy Storage Power Station Investment Opportunities in Nigeria

Summary: Explore how the Abuja Energy Storage Power Station project creates lucrative opportunities for investors in renewable energy integration, grid stabilization, and sustainable

Get a quote

Why Nigeria''s power grid is failing | Daily Nation

Nigeria''s national power grid is prone to frequent collapses, with the resulting power shortages proving an obstacle to economic growth and investment.

Get a quote

Tinubu says Nigeria-Grid Battery Energy Storage System to

President Bola Tinubu has disclosed that the Nigeria-Grid Battery Energy Storage System will benefit from a planned $500 million facility from the African Development Bank

Get a quote

6 FAQs about [Nigeria energy storage power station investors]

Is Nigeria staking a claim on the energy sector investment frontier?

Systems that capture energy and store it for later use, either to supply power to an off-grid application or to complement a peak demand, are the emerging energy sector investment frontier, but Nigeria is staking a claim.

What are the power generation stations in Nigeria?

Below is a list of the power generation stations in Nigeria: 1. Kainji power station reservoir. Kainji power station is hydro-electric powered. It has an installed generating capacity of 760MW. It was completed by 1968 and is located at Niger state. 2. Jebba hdro power station reservoir Jebba power station is hydro-electric powered.

Does Nigeria need a large-scale battery storage system?

However, the use case for large-scale battery storage is glaringly obvious in Nigeria. From food preservation to local clinics, and rural electrification and small businesses, power storage systems should factor significantly in government’s policy plans.

What is the growth rate of Nigeria battery market?

Analysts at Data Bridge Market Research say the Nigeria battery market is growing with a compound annual growth rate (CAGR) of 6.3 percent in the forecast period of 2020 to 2027 and is expected to reach $119.65 million by 2027 mostly through increasing adoption at the household level.

Where are batteries made in Nigeria?

Nigeria’s battery manufacturing market is ennobled by imports from China and India. Its biggest battery manufacturing plant, Union Autoparts Mfg. Co. Limited, in Nnewi, Anambra State, lies desolate. Batteries used in power back-up systems are mostly imported or assembled in Nigeria.

Why are investment dollars shifting from large-scale utilities to battery-based energy storage?

Investment dollars are shifting from large-scale utilities for battery-based energy storage systems since Tesla provided a proof of concept for the commercialisation of electric cars and advanced battery technology. Nigeria’s battery manufacturing market is ennobled by imports from China and India.

Guess what you want to know

-

Photovoltaic power station energy storage price in Nigeria

Photovoltaic power station energy storage price in Nigeria

-

Nigeria 400MW energy storage power station

Nigeria 400MW energy storage power station

-

Sudan Independent Energy Storage Power Station

Sudan Independent Energy Storage Power Station

-

UAE grid-side energy storage power station

UAE grid-side energy storage power station

-

How many kilowatts does a 1-megawatt energy storage power station have

How many kilowatts does a 1-megawatt energy storage power station have

-

Comprehensive conversion efficiency of energy storage power station

Comprehensive conversion efficiency of energy storage power station

-

Side energy storage power station construction

Side energy storage power station construction

-

Peru Energy Storage Photovoltaic Power Station

Peru Energy Storage Photovoltaic Power Station

-

Profit model of station-side energy storage power station

Profit model of station-side energy storage power station

-

Brazil Hybrid Energy Storage Power Station

Brazil Hybrid Energy Storage Power Station

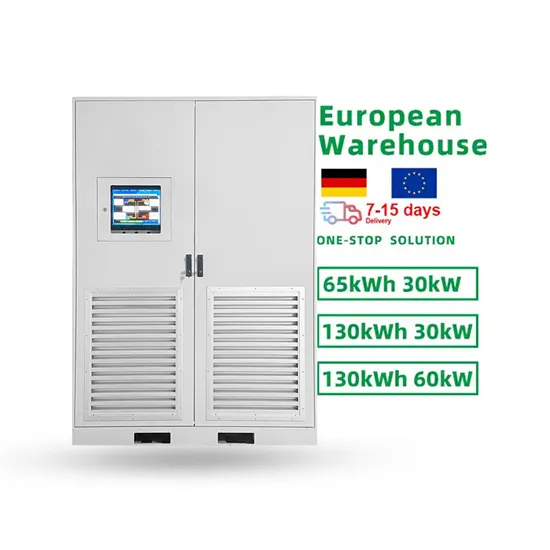

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.