Global Lithium-ion Battery Market: Powering the Future of

"The global lithium-ion battery market is rapidly growing as demand for electric vehicles, smartphones, and renewable energy storage increases. These...

Get a quote

Lithium is Driving the EV Boom: Demand to

With governments globally pushing for greener grids, the need for reliable, efficient energy storage has surged, further solidifying lithium''s critical role in

Get a quote

Global battery industry

Battery power storage capacity worldwide 2030, by segment Cumulative capacity of battery energy storage systems worldwide in 2030, by segment (in gigawatt-hours)

Get a quote

Status of battery demand and supply – Batteries and Secure Energy

In the past five years, over 2 000 GWh of lithium-ion battery capacity has been added worldwide, powering 40 million electric vehicles and thousands of battery storage projects.

Get a quote

Fact Sheet | Energy Storage (2019) | White Papers | EESI

Much of the price decrease is due to the falling costs of lithium-ion batteries; from 2010 to 2016 battery costs for electric vehicles (similar to the technology used for storage) fell

Get a quote

Status of battery demand and supply – Batteries and

In the past five years, over 2 000 GWh of lithium-ion battery capacity has been added worldwide, powering 40 million electric vehicles and thousands of

Get a quote

Battery market forecast to 2030: Pricing, capacity, and supply and demand

The battery market is a critical piece of our global energy future, and it''s growing at an unprecedented rate. The electrification of the transportation industry, the use of battery

Get a quote

Lithium Supply in the Energy Transition

Lithium Supply in the Energy Transition By Kevin Brunelli, Lilly Lee, and Dr. Tom Moerenhout An increased supply of lithium will be needed to meet future expected demand growth for lithium

Get a quote

EV Slowdown Countered by Energy Storage Boom

Global energy storage installations — including residential, commercial and utility scale — account for a growing share of total battery demand, rising from 6% in 2020 to an

Get a quote

Fact Sheet: Lithium Supply in the Energy Transition

Rare cases of sponsored projects are clearly indicated. An increased supply of lithium will be needed to meet future expected demand growth for lithium-ion batteries for

Get a quote

Advancing energy storage: The future trajectory of lithium-ion

Energy storage technologies improve grid stability by capturing surplus energy during low-demand and releasing it during peak demand. This supports intermittent renewable

Get a quote

Lithium-ion battery demand forecast for 2030 | McKinsey

Battery energy storage systems (BESS) will have a CAGR of 30 percent, and the GWh required to power these applications in 2030 will be comparable to the GWh needed for

Get a quote

How Lithium-Ion Batteries Are Saving The Grid: ''Vital To Our Future''

Electric vehicles account for the largest share of global lithium-ion battery demand, according to the International Energy Agency.

Get a quote

Battery market forecast to 2030: Pricing, capacity, and

The battery market is a critical piece of our global energy future, and it''s growing at an unprecedented rate. The electrification of the transportation industry, the

Get a quote

Energy Storage Rides a Wave of Growth but Uncertainty Looms:

In this report, our lawyers outline key developments and emerging trends that will shape the energy storage market in 2025 and beyond.

Get a quote

Advancing energy storage: The future trajectory of lithium-ion battery

Energy storage technologies improve grid stability by capturing surplus energy during low-demand and releasing it during peak demand. This supports intermittent renewable

Get a quote

Renewable Energy Storage Facts | ACP

Energy storage allows us to store clean energy to use at another time, increasing reliability, controlling costs, and helping build a more resilient grid. Get the

Get a quote

Lithium-ion battery capacity to grow steadily to 2030

We expect investments in lithium-ion batteries to deliver 6.5 TWh of capacity by 2030, with the US and Europe increasing their combined market share to nearly 40%.

Get a quote

Fact Sheet: Lithium Supply in the Energy Transition

Rare cases of sponsored projects are clearly indicated. An increased supply of lithium will be needed to meet future expected demand

Get a quote

Lithium is Driving the EV Boom: Demand to Quadruple by 2030

With governments globally pushing for greener grids, the need for reliable, efficient energy storage has surged, further solidifying lithium''s critical role in the energy transition.

Get a quote

Global Li-ion battery demand 2022-2030| Statista

The global demand for lithium-ion battery cells is forecast to increase from approximately *** gigawatt-hours in 2022 to ***** gigawatt-hours

Get a quote

Electric vehicle batteries – Global EV Outlook 2025 – Analysis

Electric cars remain the main driver of battery demand, but demand for trucks nearly doubled Battery demand in the energy sector, for both EV batteries and storage applications, reached

Get a quote

Lithium-ion battery capacity to grow steadily to 2030

The Indian government estimates it will need 120 GWh of lithium-ion battery capacity by 2030 to power EVs and for stationary energy storage — an achievable target if projects advance as

Get a quote

S&P Global: Annual battery cell production passes 10

While oversupply remains a feature of the lithium-ion battery production landscape, large production volumes are accelerating innovation

Get a quote

National Blueprint for Lithium Batteries 2021-2030

This document outlines a U.S. national blueprint for lithium-based batteries, developed by FCAB to guide federal investments in the domestic lithium-battery manufacturing value chain that will

Get a quote

Battery Energy Storage Growing on U.S. Grid, But Facing Some

Historic amounts of energy storage, primarily lithium-ion battery systems, are being added to the U.S. grid, driven by a need to balance renewable generation and to meet load

Get a quote

6 FAQs about [Energy storage capacity and lithium battery demand]

Will a lithium-ion battery supply increase?

Rare cases of sponsored projects are clearly indicated. An increased supply of lithium will be needed to meet future expected demand growth for lithium-ion batteries for transportation and energy storage.

Are lithium-ion batteries the future of energy storage?

While lithium-ion batteries have dominated the energy storage landscape, there is a growing interest in exploring alternative battery technologies that offer improved performance, safety, and sustainability .

How much lithium-ion battery capacity will India need by 2030?

The Indian government estimates it will need 120 GWh of lithium-ion battery capacity by 2030 to power EVs and for stationary energy storage — an achievable target if projects advance as announced.

What is the market share of lithium-ion batteries in 2030?

While energy storage and portable electronics are the other two key applications of lithium-ion batteries, the automotive and transport segment will have a market share of 93% in 2030. As of the end of the March quarter, global lithium-ion battery capacity stands at 2.8 TWh.

Will lithium-ion EV battery demand grow?

As seen in FIGURE 2, lithium-ion EV battery demand is projected to grow dramatically in the coming years. For EVs, the leading battery technology is expected to be lithium-based, which offer high energy, high power, and long lifetimes compared to other currently available battery systems.

How many GWh will a lithium ion battery consume in 2022?

We tracked 30 battery markets in major regions and found that in 2022 the world will consume or demand 420 GWh of Li -ion batteries for all applications. By 2030 that will rise to 2,722 GWh. Stationary battery storage isn’t likely to account for more than 15% of all battery energy capacity.

Guess what you want to know

-

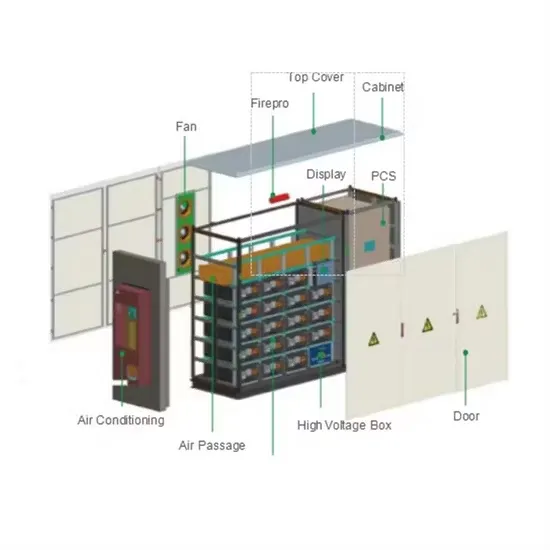

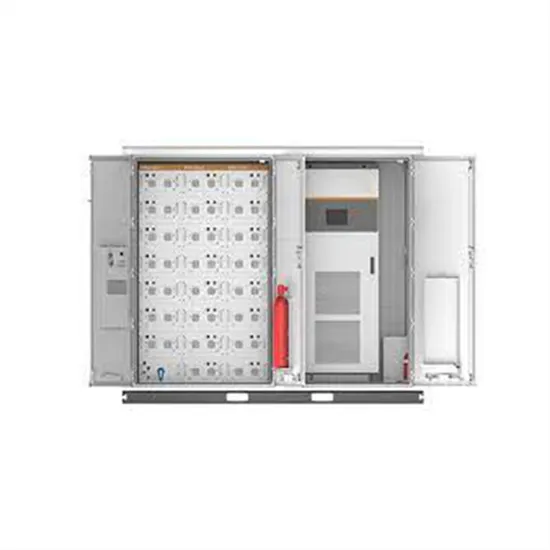

Large capacity and high power energy storage lithium iron phosphate battery

Large capacity and high power energy storage lithium iron phosphate battery

-

Lithium battery energy storage system capacity

Lithium battery energy storage system capacity

-

2025 Energy Storage Lithium Battery Demand GWH

2025 Energy Storage Lithium Battery Demand GWH

-

Lithium battery energy storage cabinet assembly manufacturer

Lithium battery energy storage cabinet assembly manufacturer

-

Somalia Huijue lithium battery energy storage station

Somalia Huijue lithium battery energy storage station

-

Cooling methods for industrial and commercial lithium battery energy storage

Cooling methods for industrial and commercial lithium battery energy storage

-

Battery energy storage capacity installed in Vietnam

Battery energy storage capacity installed in Vietnam

-

What is the maximum battery energy storage capacity now

What is the maximum battery energy storage capacity now

-

Lithium battery energy storage system liquid cooling

Lithium battery energy storage system liquid cooling

-

New Zealand lithium titanate battery energy storage container price

New Zealand lithium titanate battery energy storage container price

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.