Global Energy Storage Market to Grow 15-Fold by 2030

However, companies are already scaling up operations to capture the upside." Rapidly evolving battery technology is driving the energy storage

Get a quote

What''s Driving Lithium Demand in 2025 and Beyond?

Lithium demand in 2025 is expanding under the combined weight of EV growth, surging energy storage deployment, and sustained policy support. Supply remains

Get a quote

The battery industry has entered a new phase –

Battery deployment continues to break records as prices fall The global battery market is advancing rapidly as demand rises sharply and prices

Get a quote

Advancing energy storage: The future trajectory of lithium-ion battery

By bridging the gap between academic research and real-world implementation, this review underscores the critical role of lithium-ion batteries in achieving decarbonization,

Get a quote

Outlook for battery and energy demand – Global EV Outlook 2024

Stationary storage will also increase battery demand, accounting for about 400 GWh in STEPS and 500 GWh in APS in 2030, which is about 12% of EV battery demand in the same year in

Get a quote

Rebalancing Supply and Demand: Lithium Market Expected to Recover by 2025

In 2024, global demand for lithium-ion batteries in energy storage is expected to reach 256.41 GWh, and this will rise to 355.22 GWh in 2025 and 463.23 GWh in 2026. Lithium carbonate

Get a quote

Advancing energy storage: The future trajectory of lithium-ion

By bridging the gap between academic research and real-world implementation, this review underscores the critical role of lithium-ion batteries in achieving decarbonization,

Get a quote

Batteries for Stationary Energy Storage 2025-2035:

Demand for Li-ion battery storage will continue to increase over the coming decade to facilitate increasing renewable energy penetration and afford

Get a quote

Key Trends Shaping Battery Energy Storage in 2025

Demand for energy storage continues to escalate, the global battery energy storage (BESS) landscape is poised for significant installation

Get a quote

Global battery demand hits ''historic 1TWh milestone''

March 20, 2025: The global battery market has entered a new phase after demand hit the "historic milestone" of one terawatt-hour annually last year, according to new analysis published by the

Get a quote

InfoLink: 222 GWh more energy storage worldwide in 2025

With the Americas expected to add 55 GWh of energy storage in 2025, up a third on last year, lithium extraction-related energy needs are set to drive more than 3 GWh of

Get a quote

Emerging Trends Shaping the Global Battery Market in 2025

Lithium-ion battery demand alone is projected to surge from 700 GWh in 2022 to 4.7 TWh by 2030, with electric vehicles driving 4,300 GWh of this growth. This rapid expansion

Get a quote

Global Demand for Energy Storage Expected to Exceed 100

Carbon neutrality targets in both Europe and the United States are significant drivers in the demand for lithium-ion batteries in both transportation and stationary storage sectors.

Get a quote

Battery 2030: Resilient, sustainable, and circular

Battery energy storage systems (BESS) will have a CAGR of 30 percent, and the GWh required to power these applications in 2030 will be comparable to the GWh needed for all applications

Get a quote

Global Demand for Energy Storage Expected to Exceed 100 GWh in 2025

Carbon neutrality targets in both Europe and the United States are significant drivers in the demand for lithium-ion batteries in both transportation and stationary storage sectors.

Get a quote

Narada Power to Expand Data Center Lithium Battery Capacity by 1 GWh

11 hours ago· Currently, Narada has 1.5 GWh of data center lithium battery capacity. Based on ongoing negotiations, the company plans to expand capacity by another 1 GWh next year,

Get a quote

Surge in Demand for Energy Storage Cells in 2025: From

According to GGII, global shipments of lithium batteries for data center energy storage are expected to exceed 69 GWh by 2027, growing to 300 GWh by 2030, with a

Get a quote

Li-ion Battery Market Demonstrates Strong Growth,

Rates of growth are expected to increase year-on-year; with battery shipments rising by 23% in 2024 and a year-on-year growth rate of 26%

Get a quote

Electric vehicle batteries – Global EV Outlook 2025 –

Demand was largely driven by growth in EV sales, as demand for EV batteries grew to over 950 GWh – 25% more than in 2023. Electric cars remain the

Get a quote

Global Energy Storage to Hit 94 GW in 2025, Says BNEF

BloombergNEF forecasts a record 94 GW (247 GWh) of utility-scale storage in 2025—a 35% rise—driven by China''s storage mandates. US tariffs, policy shifts and LFP

Get a quote

India''s lithium-ion battery storage demand to reach 54

Demand for lithium-ion battery storage in India is expected to expand to 54 gigawatt-hours (GWh) by fiscal year 2027 from currently around

Get a quote

Li-ion Battery Market Demonstrates Strong Growth, Driven by Energy

Rates of growth are expected to increase year-on-year; with battery shipments rising by 23% in 2024 and a year-on-year growth rate of 26% forecast for 2025.

Get a quote

Emerging Trends Shaping the Global Battery Market

Lithium-ion battery demand alone is projected to surge from 700 GWh in 2022 to 4.7 TWh by 2030, with electric vehicles driving 4,300 GWh of

Get a quote

U.S. Battery Storage Hits a New Record Growth in 2024

The U.S. battery storage market achieved unprecedented growth in 2024, fueled by the need for renewable energy integration and improved

Get a quote

Surge in Demand for Energy Storage Cells in 2025: From

The project plans to establish a research institute for new lithium batteries and production lines for 10 GWh of new energy storage lithium batteries, 400,000 consumer lithium

Get a quote

Electric vehicle batteries – Global EV Outlook 2025 – Analysis

Demand was largely driven by growth in EV sales, as demand for EV batteries grew to over 950 GWh – 25% more than in 2023. Electric cars remain the principal factor behind EV battery

Get a quote

U.S. Solar and Battery Storage Boom in 2025 | Shale

Solar power and battery storage are expected to lead new U.S. generating capacity additions in 2025, according to the Energy Information

Get a quote

Rebalancing Supply and Demand: Lithium Market

In 2024, global demand for lithium-ion batteries in energy storage is expected to reach 256.41 GWh, and this will rise to 355.22 GWh in 2025 and 463.23 GWh

Get a quote

Global Battery Market Trends 2025: Growth Drivers, Supply

By 2025, the EV battery segment alone is expected to account for 60–70% of total lithium-ion battery demand, as governments worldwide implement stricter emissions

Get a quote

6 FAQs about [2025 Energy Storage Lithium Battery Demand GWH]

Will lithium-ion battery demand increase in 2025?

In 2020, global sales of EVs reached 1.5 million units, with a corresponding lithium-ion battery demand of 65 GWh. Projections indicate a substantial increase to 137 GWh in 2025 and 245 GWh in 2030, emphasizing the pivotal role of lithium-ion batteries in the automotive industry.

When will lithium ion batteries be used in energy storage?

In 2024, global demand for lithium-ion batteries in energy storage is expected to reach 256.41 GWh, and this will rise to 355.22 GWh in 2025 and 463.23 GWh in 2026. Lithium carbonate inventories began to climb at the end of 2023.

Will the lithium market recover by 2025?

In summary, despite challenges such as oversupply and price pressures, the lithium market is poised for recovery by 2025, driven by supply adjustments, the gradual exit of unprofitable producers, and increasing demand from electric vehicles and energy storage systems.

How big will energy storage be in 2025?

BloombergNEF forecasts a record 94 GW (247 GWh) of utility-scale storage in 2025—a 35% rise—driven by China’s storage mandates. US tariffs, policy shifts and LFP dominance will drive growth to 220 GW/972 GWh by 2035. The global energy storage sector is on track for another record year in 2025 as utility-scale projects expand into new regions.

What drove EV battery demand in 2023?

Demand was largely driven by growth in EV sales, as demand for EV batteries grew to over 950 GWh – 25% more than in 2023. Electric cars remain the principal factor behind EV battery demand, accounting for over 85%.

Will lithium demand grow 26% in 2025?

Adamas Intelligence, a battery metals and electric vehicle consultancy in Toronto, predicts global lithium demand will grow 26% year-over-year in 2025, reaching 1.46 million tons of LCE, up from an estimated 1.15 million tons in 2024. The largest contributor to lithium demand comes from electric vehicles (EVs).

Guess what you want to know

-

Energy storage capacity and lithium battery demand

Energy storage capacity and lithium battery demand

-

Huawei s energy storage lithium battery source factory

Huawei s energy storage lithium battery source factory

-

Russian lithium battery energy storage container exports

Russian lithium battery energy storage container exports

-

How much does energy storage lithium battery retail for

How much does energy storage lithium battery retail for

-

Factory lithium battery energy storage

Factory lithium battery energy storage

-

Energy storage lithium battery price introduction

Energy storage lithium battery price introduction

-

Somalia Huijue lithium battery energy storage station

Somalia Huijue lithium battery energy storage station

-

Timor-Leste energy storage lithium battery direct sales

Timor-Leste energy storage lithium battery direct sales

-

Lithium battery energy storage price per watt

Lithium battery energy storage price per watt

-

Benin Household Rooftop Power Station Energy Storage Lithium Battery Market

Benin Household Rooftop Power Station Energy Storage Lithium Battery Market

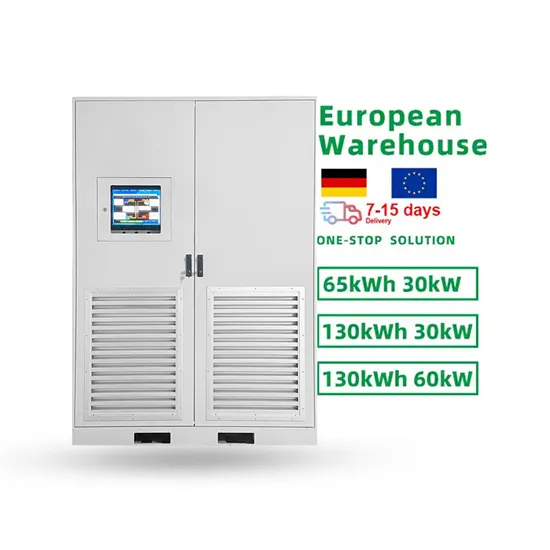

Industrial & Commercial Energy Storage Market Growth

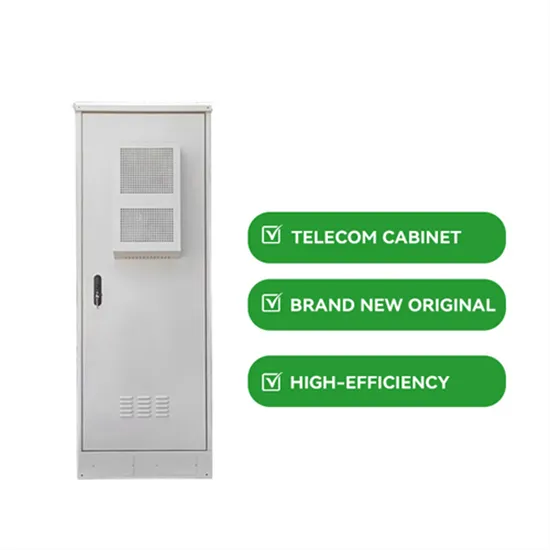

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.