Battery Costs in 2020-2030: How Much Have Prices Dropped for

The price of batteries is one of the biggest factors affecting the growth of electric vehicles (EVs) and energy storage. Over the past decade, battery prices have fallen drastically, making EVs

Get a quote

BESS costs could fall 47% by 2030, says NREL

Research firm Fastmarkets recently forecast that average lithium-ion battery pack prices using lithium iron phosphate (LFP) cells will fall to US$100/kWh by 2025, with nickel

Get a quote

How Much Do Lithium-Ion Batteries Cost? An Insight into

Lithium-ion batteries are crucial for various applications, including electric vehicles (EVs) and renewable energy storage systems. Understanding their pricing dynamics is

Get a quote

A Comprehensive Guide to Lithium Battery Types and

Compare types of lithium battery like LFP, NMC, and LTO for energy density, safety, and cycle life. Find the best fit for EVs, energy storage,

Get a quote

Best solar batteries for your home in 2025

The Villara VillaGrid battery stands out with its industry-leading, 20-year warranty, made possible by its special lithium titanium-oxide LTO battery chemistry. Unlike more

Get a quote

Lithium ion battery cell price

The data includes an annual average and quarterly average prices of different lithium ion battery chemistries commonly used in electric vehicles and renewable energy storage.

Get a quote

Battery market forecast to 2030: Pricing, capacity, and supply and

The battery market is a critical piece of our global energy future, and it''s growing at an unprecedented rate. The electrification of the transportation industry, the use of battery

Get a quote

Lithium Battery Energy Storage Cost Price List: What You Need

According to BloombergNEF''s 2023 report, lithium-ion battery pack prices have plunged 89% since 2010 - now averaging $139/kWh. But wait, there''s more: Let''s play

Get a quote

Global Energy Storage Market Records Biggest Jump

The growth in LFP''s market share is made possible by a scale-up in manufacturing capacity led by Chinese battery makers. Battery makers

Get a quote

How much is the price of energy storage lithium battery

The price landscape of energy storage lithium batteries is shaped by multifaceted influences, ranging from raw material costs to technological

Get a quote

Battery Costs in 2020-2030: How Much Have Prices Dropped for

Back in 2020, the cost of lithium-ion battery packs had fallen to $137 per kilowatt-hour (kWh). This was a massive drop from a decade earlier, when battery costs were over $1,000 per kWh. The

Get a quote

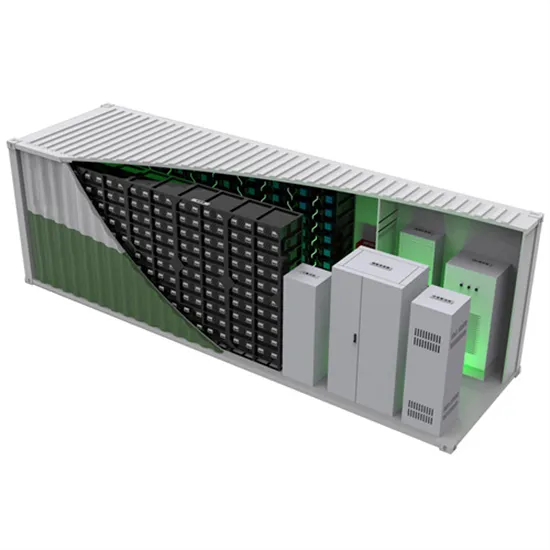

The Ultimate Guide to Battery Energy Storage

Maximize your energy potential with advanced battery energy storage systems. Elevate operational efficiency, reduce expenses, and amplify

Get a quote

Lithium Battery Costs: Key Drivers Behind Pricing Trends

What are the key raw materials affecting lithium battery cost? The cost of raw materials accounts for 40–60% of a lithium battery''s total price.

Get a quote

Lithium-ion_Methodology

For both lithium-ion NMC and LFP chemistries, the SB price was determined based on values for EV battery pack and storage rack, where the storage rack includes the battery pack cost along

Get a quote

NMC vs LFP vs LTO Batteries: EVs & Energy Storage Comparison

Compare NMC, LFP, and LTO batteries for EVs & energy storage. This guide covers energy density, safety, lifespan, and cost analysis for each battery type.

Get a quote

Lithium Battery Costs: Key Drivers Behind Pricing Trends

What are the key raw materials affecting lithium battery cost? The cost of raw materials accounts for 40–60% of a lithium battery''s total price. Here''s a breakdown of the

Get a quote

How Much Do Lithium-Ion Batteries Cost? An Insight into Advanced Energy

Lithium-ion batteries are crucial for various applications, including electric vehicles (EVs) and renewable energy storage systems. Understanding their pricing dynamics is

Get a quote

Energy Storage Cost and Performance Database

The U.S. Department of Energy''s (DOE) Energy Storage Grand Challenge is a comprehensive program that seeks to accelerate the development,

Get a quote

How much is the price of energy storage lithium battery

The price landscape of energy storage lithium batteries is shaped by multifaceted influences, ranging from raw material costs to technological advancements, regulatory

Get a quote

Utility-Scale Battery Storage | Electricity | 2021 | ATB

The 2021 ATB represents cost and performance for battery storage across a range of durations (2–10 hours). It represents lithium-ion batteries only at this

Get a quote

Energy storage battery price composition table

Base year costs for utility-scale battery energy storage systems (BESS) are based on a bottom-up cost model using the data and methodology for utility-scale BESS in (Ramasamy et al., 2021).

Get a quote

How Much Does a Lithium-Ion Battery Cost in 2024?

Solar Energy Storage Lithium batteries that store surplus solar energy, typically cost between $6800 and $10,700, excluding installation costs. The rule of thumb here is that the more

Get a quote

How much does it cost to build a battery energy

To produce this benchmark, Modo Energy surveyed various market participants in Great Britain. We received 30 responses, covering 2.8 GW of battery energy

Get a quote

BESS costs could fall 47% by 2030, says NREL

Research firm Fastmarkets recently forecast that average lithium-ion battery pack prices using lithium iron phosphate (LFP) cells will fall to

Get a quote

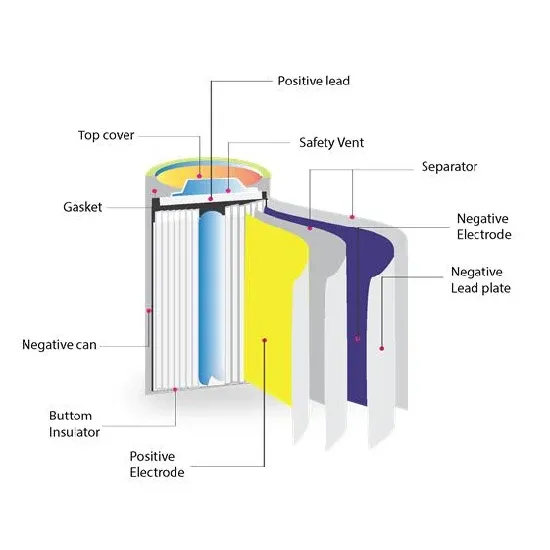

Lithium-ion Battery (LFP and NMC)

Lithium-ion can refer to a wide array of chemistries, however, it ultimately consists of a battery based on charge and discharge reactions from a lithiated metal

Get a quote

Battery market forecast to 2030: Pricing, capacity, and

The battery market is a critical piece of our global energy future, and it''s growing at an unprecedented rate. The electrification of the transportation industry, the

Get a quote

Li-Ion Cell Price: What You Need to Know in 2025

A lithium-ion (Li-ion) cell is a type of rechargeable battery cell known for its high energy density, lightweight design, and rechargeability.

Get a quote

6 FAQs about [Price composition of lithium batteries for energy storage]

How much will lithium ion batteries cost in 2025?

Research firm Fastmarkets recently forecast that average lithium-ion battery pack prices using lithium iron phosphate (LFP) cells will fall to US$100/kWh by 2025, with nickel manganese cobalt (NMC) hitting the same threshold in 2027.

Why is Bess so expensive compared to a lithium-ion battery?

A big driver of the fall in BESS costs will be a decline in the costs of the battery cells and packs themselves, which can make up half the cost of a lithium-ion BESS.

What is a lithium phosphate battery?

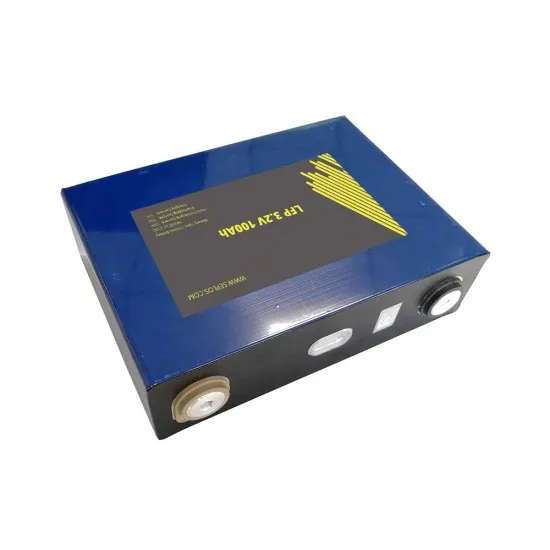

Lithium iron phosphate (LFP) and lithium nickel manganese cobalt oxide (NCM) are two types of rechargeable batteries commonly used in electric vehicles and renewable energy storage. with minor processing Average price of battery cells per kilowatt-hour in US dollars, not adjusted for inflation.

How many GWh will a lithium ion battery consume in 2022?

We tracked 30 battery markets in major regions and found that in 2022 the world will consume or demand 420 GWh of Li -ion batteries for all applications. By 2030 that will rise to 2,722 GWh. Stationary battery storage isn’t likely to account for more than 15% of all battery energy capacity.

Is a lithium battery cheaper than a lead-acid battery?

Initially, no. A lithium battery costs 3x more upfront, but its 10-year lifespan (vs. 3–4 years for lead-acid) makes it 50% cheaper long-term. How do electric vehicles affect lithium battery pricing?

Will lithium-ion battery price decrease through 2050?

The national laboratory is forecasting price decreases, most likely starting this year, through to 2050. Image: NREL. The US National Renewable Energy Laboratory (NREL) has updated its long-term lithium-ion battery energy storage system (BESS) costs through to 2050, with costs potentially halving over this decade.

Guess what you want to know

-

Latest price of lithium energy storage batteries

Latest price of lithium energy storage batteries

-

What is the approximate price of lithium batteries for energy storage in Greece

What is the approximate price of lithium batteries for energy storage in Greece

-

Unit price of energy storage lithium batteries

Unit price of energy storage lithium batteries

-

Energy Storage Lithium Price Trend

Energy Storage Lithium Price Trend

-

Export of industrial energy storage lithium batteries

Export of industrial energy storage lithium batteries

-

Barbados energy storage lithium battery manufacturer price

Barbados energy storage lithium battery manufacturer price

-

Container photovoltaic energy storage lithium battery price

Container photovoltaic energy storage lithium battery price

-

What is the price of energy storage cabinet batteries

What is the price of energy storage cabinet batteries

-

Energy storage lithium battery price introduction

Energy storage lithium battery price introduction

-

Energy storage lithium iron phosphate battery 1ah price

Energy storage lithium iron phosphate battery 1ah price

Industrial & Commercial Energy Storage Market Growth

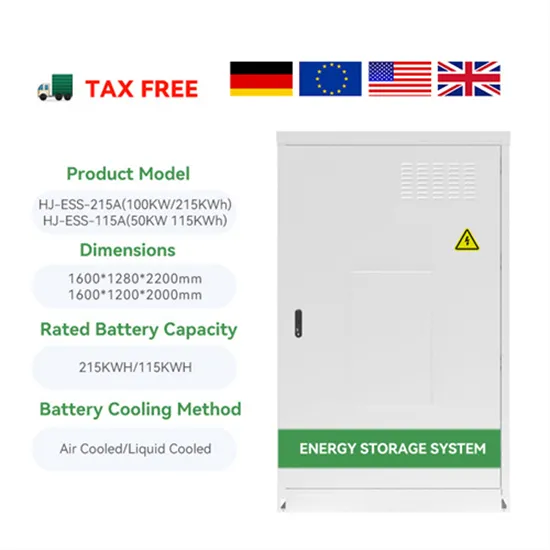

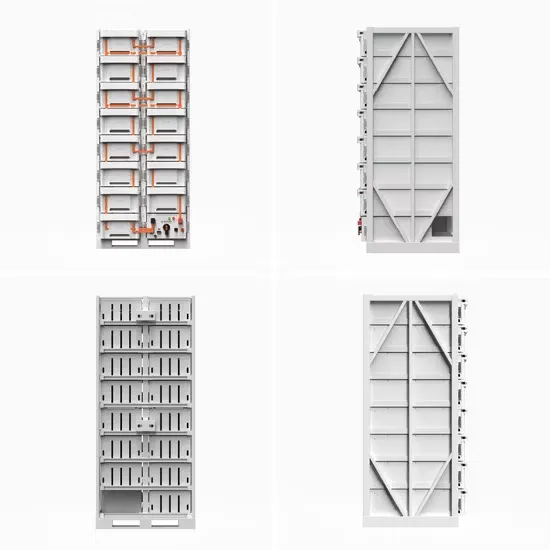

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

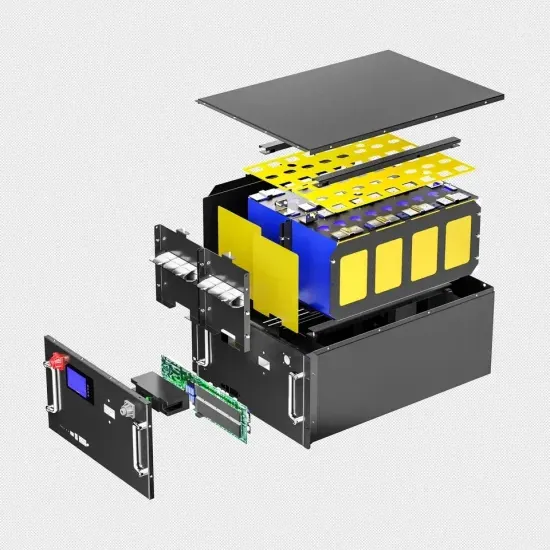

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.