Analysis of market dynamics and price trends of energy storage lithium

The energy storage lithium battery market is expected to continue to face potential pressure from rising material prices in 2025, but battery monomer prices are expected to

Get a quote

Lithium Price Forecast 2025: Market Outlook & Recovery Trends

Explore the 2025 lithium price forecast, key market insights, and why lithium prices are set to recover amid strong EV demand and future supply constraints.

Get a quote

Energy storage: Lithium Prices Fell, Highlighting its Economics;

The economics of lithium have gained attention as its price continues to decline, leading to a flourishing industry. The rapid decrease in lithium prices has resulted in domestic

Get a quote

BESS costs could fall 47% by 2030, says NREL

The US National Renewable Energy Laboratory (NREL) has updated its long-term lithium-ion battery energy storage system (BESS) costs through to 2050, with costs potentially

Get a quote

Where will lithium-ion battery prices go in 2025?

According to Taipei-based intelligence provider TrendForce, the prolonged decline in the prices of Chinese electric vehicle (EV) and energy storage system (ESS) batteries

Get a quote

Storage is booming and batteries are cheaper than ever. Can it

Lithium-ion batteries are still the most economical solution for most situations, even without considering their trend downward pricing trend, but it takes a village, as they say-

Get a quote

Lithium-Ion Battery Pack Prices See Largest Drop Since 2017,

These conditions resulted in falling battery prices and lower battery margins, forcing many battery manufacturers to enter new markets, including energy storage, while also

Get a quote

Lithium ion battery cell price

Average price of battery cells per kilowatt-hour in US dollars, not adjusted for inflation. The data includes an annual average and quarterly average prices of different lithium

Get a quote

How Lithium Battery Prices Are Changing In 2025

Prices in 2025 continue a downward trend from previous years, making lithium batteries more affordable. Lower costs help buyers in sectors

Get a quote

Energy storage costs

Small-scale lithium-ion residential battery systems in the German market suggest that between 2014 and 2020, battery energy storage systems (BESS) prices fell by 71%, to USD 776/kWh.

Get a quote

Where will lithium-ion battery prices go in 2025?

After tumbling to record low in 2024 on the back of lower metal costs and increased scale, lithium-ion battery prices are expected to enter a period of stabilization.

Get a quote

Analysis of market dynamics and price trends of energy storage lithium

In November 2024, the global energy storage lithium battery market continued to perform strongly, especially driven by the demand for large-scale energy storage systems

Get a quote

The price of batteries has declined by 97% in the last

But to balance these intermittent sources and electrify our transport systems, we also need low-cost energy storage. Lithium-ion batteries are the

Get a quote

Battery prices collapsing, grid-tied energy storage

We are in the midst of a year-long acceleration in the decline of battery cell prices – a trend that is reminiscent of recent solar cell price

Get a quote

Storage is booming and batteries are cheaper than

Lithium-ion batteries are still the most economical solution for most situations, even without considering their trend downward pricing trend,

Get a quote

Understanding Lithium Prices: Past, Present, and Future

Learn the dynamics of lithium prices, delve into historical trends, current market conditions, predictions, and factors affecting the market.

Get a quote

2025 Lithium Price Predictions: What to Know as an Investor

The lithium market has been turned into one of the most important players in the transition toward clean energy, powering everything from electric vehicles down to energy

Get a quote

Battery Prices Stabilize in November, Slight Increase Expected in

The demand for ESS batteries was driven by China''s end-of-year rush to connect energy storage systems to the grid, as well as strong overseas demand for grid-scale energy

Get a quote

Analysis of market dynamics and price trends of energy storage

The energy storage lithium battery market is expected to continue to face potential pressure from rising material prices in 2025, but battery monomer prices are expected to

Get a quote

Cost Projections for Utility-Scale Battery Storage: 2023

In this work we describe the development of cost and performance projections for utility-scale lithium-ion battery systems, with a focus on 4-hour duration systems. The projections are

Get a quote

Energy Storage: 10 Things to Watch in 2024

This report highlights the most noteworthy developments we expect in the energy storage industry this year. Prices: Both lithium-ion battery

Get a quote

Battery price per kwh 2025| Statista

The cost of lithium-ion batteries per kWh decreased by 20 percent between 2023 and 2024. Lithium-ion battery price was about 115 U.S. dollars per kWh in 202.

Get a quote

How Lithium Battery Prices Are Changing In 2025

Prices in 2025 continue a downward trend from previous years, making lithium batteries more affordable. Lower costs help buyers in sectors like transportation, renewable

Get a quote

Lithium prices remain low, while cell prices drop further

The downward trend of lithium spodumene concentrate prices will also affect lithium carbonate prices. Lithium carbonate prices will continue to face pressure with the subsequent

Get a quote

6 FAQs about [Energy Storage Lithium Price Trend]

What are battery cost projections for 4 hour lithium-ion systems?

Battery cost projections for 4-hour lithium-ion systems, with values normalized relative to 2022. The high, mid, and low cost projections developed in this work are shown as bolded lines. Figure ES-2.

Are lithium-ion batteries still economical?

Lithium-ion batteries are still the most economical solution for most situations, even without considering their trend downward pricing trend, but it takes a village, as they say- and ours should be doing all it can to ensure storage stays an economical solution for the foreseeable future.

How have Lithium prices changed over the past decade?

Lithium prices have seen dramatic changes over the past decade. From 2010 to 2015, prices remained relatively stable, with minor fluctuations due to steady demand and supply conditions. However, from 2015 onwards, prices began to soar, driven by the booming EV market and increased demand for renewable energy storage solutions.

What is the lithium market outlook?

Despite short-term oversupply, the lithium market outlook indicates a widening deficit. By 2030, the supply of lithium (lithium carbonate and lithium hydroxide) is projected to reach 373Kt, while demand is expected to hit 472Kt (with 81% of this demand driven by EVs and grid battery storage), creating a shortfall of 97Kt of lithium.

Will lithium ion battery prices go down in 2025?

After tumbling to record low in 2024 on the back of lower metal costs and increased scale, lithium-ion battery prices are expected to enter a period of stabilization. The rapid decrease in lithium ion battery prices seen in previous years is likely to be slowed down in 2025 due to an uptick in battery material costs.

Is lithium a future for EVs and energy-storage systems?

As EV adoption and energy-storage installations increase, global demand for lithium is expected to surpass supply, setting the stage for a price recovery. A shortfall of 97Kt is projected by 2030, increasing to 621Kt by 2040. Lithium will remain indispensable for EVs and energy-storage systems.

Guess what you want to know

-

Energy Storage Lithium Price Trend

Energy Storage Lithium Price Trend

-

Energy storage inverter price trend

Energy storage inverter price trend

-

Energy storage cabinet price trend analysis

Energy storage cabinet price trend analysis

-

Guyana lithium energy storage power supply price

Guyana lithium energy storage power supply price

-

Energy Storage Power Station Battery Price Trend

Energy Storage Power Station Battery Price Trend

-

Energy storage lithium iron phosphate battery 1ah price

Energy storage lithium iron phosphate battery 1ah price

-

Benin lithium energy storage power supply price

Benin lithium energy storage power supply price

-

Ecuador energy storage lithium battery BMS price

Ecuador energy storage lithium battery BMS price

-

Madagascar lithium energy storage power supply sales price

Madagascar lithium energy storage power supply sales price

-

Barbados energy storage lithium battery wholesale price

Barbados energy storage lithium battery wholesale price

Industrial & Commercial Energy Storage Market Growth

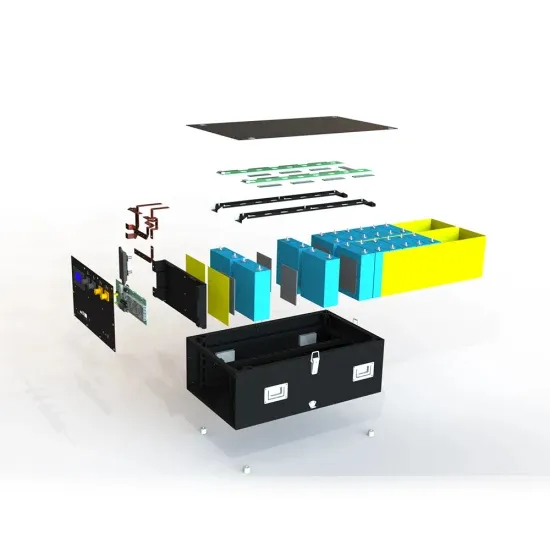

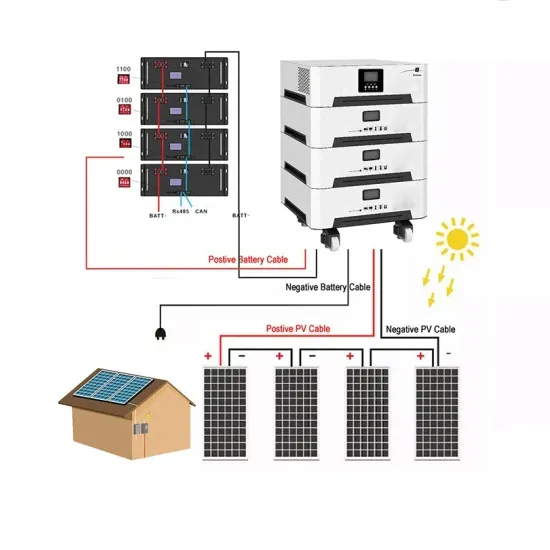

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.