Enabling renewable energy with battery energy

These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable

Get a quote

BESS Market Data & Insights | Pexapark

With benchmark BESS tolling prices, co-located PPA prices for hybrid projects and analytics to model expected revenues for standalone assets, you can confidently price, structure and

Get a quote

U.S. Solar Photovoltaic System and Energy Storage Cost

U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks, With Minimum Sustainable Price Analysis: Q1 2022 Vignesh Ramasamy,1 Jarett Zuboy,1 Eric

Get a quote

A Deep Dive Into Battery Supply Chain and Pricing

In this pv magazine webinar, CEA discuses battery energy storage system (BESS) pricing and the associated market drivers behind those price trends. A five-year outlook for DC

Get a quote

Storage is booming and batteries are cheaper than

The U.S. energy storage market is stronger than ever, and the cost of the most commonly used battery chemistry is trending downward each

Get a quote

BESS prices in US market to fall a further 18% in 2024, says CEA

After coming down last year, the cost of containerised BESS solutions for US-based buyers will come down a further 18% in 2024, Clean Energy Associates (CEA) said.

Get a quote

The Rise of Solar PV and Battery Storage''s Prominence in

Newsletter Over the past five years the pairing of solar photovoltaics (PV) with battery-energy-storage systems (BESS) has moved from demonstration projects to being a

Get a quote

The developing BESS market 2024

The developing BESS market 2024 Battery energy storage systems (BESS) are playing an increasingly integral role in the transition to a lower-carbon global economy. Below, we

Get a quote

Grid-Scale Battery Storage: Costs, Value, and

Bottom-up: For battery pack prices, we use global forecasts; For Balance of System (BoS) costs, we scale US benchmark estimates to India using comparison with component level solar PV

Get a quote

BESS are becoming more attractive – pv magazine International

We have seen prices for fully installed systems fall by about 40% since 2022. With falling prices and rising revenues, the two key elements for building a profitable business case

Get a quote

What is the Cost of BESS per MW? Trends and 2025 Forecast

As of most recent estimates, the cost of a BESS by MW is between $200,000 and $450,000, varying by location, system size, and market conditions. This translates to around

Get a quote

The German PV and Battery Storage Market

The German PV and Battery Storage Market The first of its kind, this study offers an overview of the photovoltaics and battery storage market in Germany. It

Get a quote

Solar''s exponential growth disrupts global energy

Think tank Climate Energy Finance (CEF) says global energy markets are being reshaped by solar''s disruption, which is happening at

Get a quote

Profitability of battery energy storage system coupled with

Despite the current cost barriers, this study highlights the potential for PV + BESS integration as BESS prices are expected to decrease, and renewable energy technologies

Get a quote

Global Energy Storage Market Records Biggest Jump Yet

The global energy storage market almost tripled in 2023, the largest year-on-year gain on record. Growth is set against the backdrop of the lowest-ever prices, especially in

Get a quote

Cost, shipping, energy density drive move to 5MWh

Clean Energy Associates (CEA) has released its latest pricing survey for the battery energy storage system (BESS) supply landscape,

Get a quote

The Real Cost of Commercial Battery Energy Storage

With fluctuating energy prices and the growing urgency of sustainability goals, commercial battery energy storage has become an

Get a quote

BESS prices in US market to fall a further 18% in

After coming down last year, the cost of containerised BESS solutions for US-based buyers will come down a further 18% in 2024, Clean

Get a quote

Understanding BESS Price per MWh in 2025: Market Trends and

Understanding BESS Price per MWh in 2025: Market Trends and Cost Drivers When evaluating battery energy storage system (BESS) prices per MWh, think of it like buying a high

Get a quote

Utility-Scale Battery Storage | Electricity | 2024 | ATB | NREL

This inverse behavior is observed for all energy storage technologies and highlights the importance of distinguishing the two types of battery capacity when discussing the cost of

Get a quote

Behind the numbers: BNEF finds 40% year-on-year drop in BESS

BNEF analyst Isshu Kikuma discusses trends and market dynamics impacting the cost of energy storage in 2024 with ESN Premium. Get live updates from the Energy Storage

Get a quote

Updated report and data illustrate distributed solar pricing and

Figure 3. Long-Trend in U.S. Median Installed Prices. These prices represent the up-front price paid by the customer for stand-alone PV systems, prior to receipt of any

Get a quote

BESS are becoming more attractive – pv magazine

We have seen prices for fully installed systems fall by about 40% since 2022. With falling prices and rising revenues, the two key elements for

Get a quote

Battery Energy Storage System Market Size, Trends & Regional

The global battery energy storage system market growth is attributed to the global shift toward renewable energy integration, coupled with the need for grid stability to support increasing

Get a quote

6 FAQs about [Photovoltaic Energy Storage BESS Price Trend]

Is a PV + Bess system economically feasible?

While the PV + BESS system demonstrates profitability compared to the load-only system, none of the buildings exhibit economic feasibility for the PV + BESS system in comparison to the PV-only system, utilizing the BESS control strategy employed in this study combined with current costs.

Is high cost of energy a barrier to PV & Bess adoption?

Using Thailand's Time-of-Use (TOU) tariff structure and peak shaving framework, system sizing, design, and performance were analyzed through Levelized Cost of Energy (LCOE) metrics. The findings reveal that the current high cost of BESS remains the primary obstacle to the widespread adoption of PV + BESS systems.

How much does a BEC PV cost?

The study indicates that the highest BEC PV of BESS required for BESS integration to be profitable is 237 USD/kWh, while the average BEC PV hovers around 200 USD/kWh. Based on the current BESS cost of $250–400 USD/kWh, the PV + BESS is still not economically viable.

Do technical and economic factors influence the break-even cost of PV & Bess systems?

Sensitivity analyses exploring the influence of technical and economic factors on the break-even cost of PV + BESS systems. Battery Energy Storage Systems (BESS) are crucial for enhancing energy efficiency and reliability in behind-the-meter (BTM) applications across residential, commercial, and industrial sectors.

Does Bess integrate with PV systems?

Through an analysis of the break-even cost trend of BESS when integrates with PV systems, and an examination of various factors including PV size, BESS capacity, BESS degradation, and load profiles, several key insights are identified.

Does the size of a PV system affect Bess?

Impact of PV Size: The profitability of PV-only systems and the break-even cost of BESS are significantly influenced by the size of the PV installation. While increasing PV size generally increase opportunities for BESS integration, the degree of economic advantage varies depending on the building type.

Guess what you want to know

-

Somalia BESS energy storage price trend

Somalia BESS energy storage price trend

-

Which photovoltaic energy storage price trend is best

Which photovoltaic energy storage price trend is best

-

Cambodia photovoltaic power generation energy storage battery price company

Cambodia photovoltaic power generation energy storage battery price company

-

Price of BESS Mobile Energy Storage Vehicle in Iraq

Price of BESS Mobile Energy Storage Vehicle in Iraq

-

Photovoltaic Huijue power generation panel energy storage cabinet price

Photovoltaic Huijue power generation panel energy storage cabinet price

-

Replacement price of photovoltaic energy storage cabinet

Replacement price of photovoltaic energy storage cabinet

-

Kyrgyzstan energy storage cabinet price trend

Kyrgyzstan energy storage cabinet price trend

-

Moldova photovoltaic solar energy storage cabinet price

Moldova photovoltaic solar energy storage cabinet price

-

Energy storage cabinet price trend analysis

Energy storage cabinet price trend analysis

-

What is the approximate price of a photovoltaic energy storage vehicle

What is the approximate price of a photovoltaic energy storage vehicle

Industrial & Commercial Energy Storage Market Growth

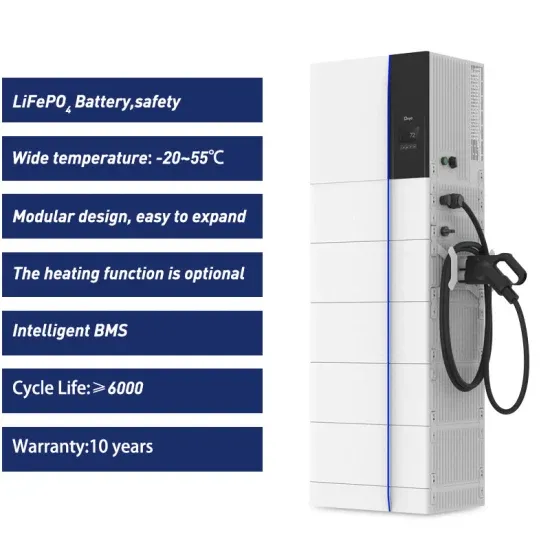

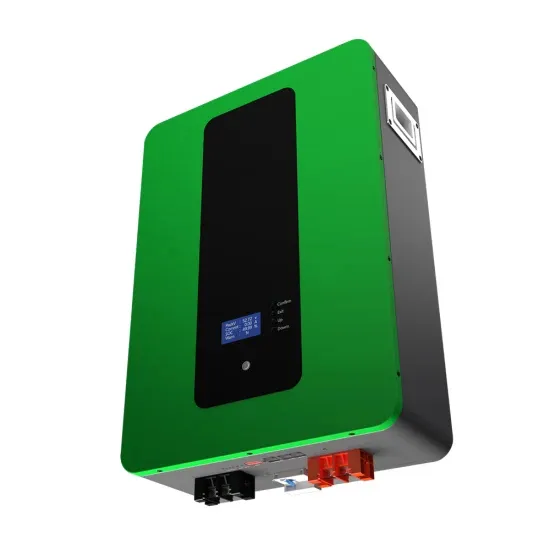

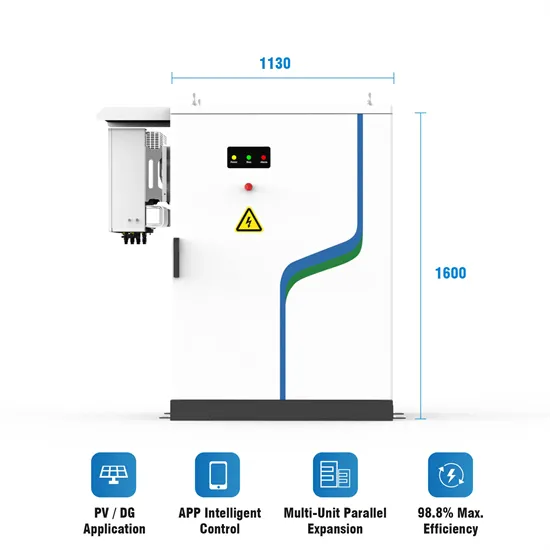

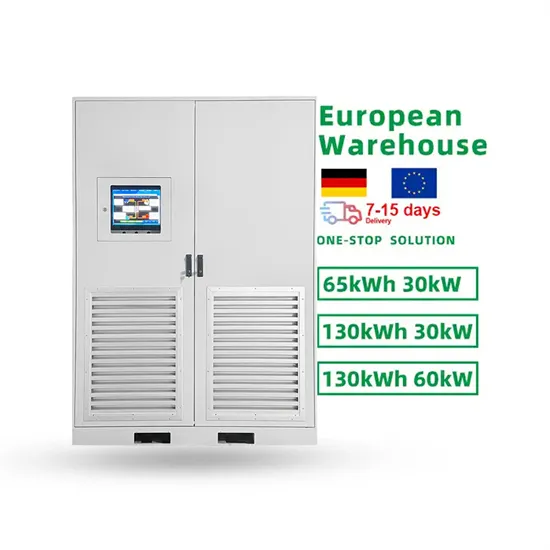

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.