Lithium-ion Battery Procurement Strategies: Evidence from the

Electric and hybrid vehicle diffusion is nowadays promising but still limited, also due to the high costs of key components such as lithium-ion batteries (LIBs). A significant

Get a quote

Power Drill Cordless | Step-by-Step B2B Procurement Guide

1 day ago· How international buyers source power drill cordless products?This guide covers the complete procurement process for efficient global trade.

Get a quote

Invest in American Lithium Battery Company

At Lithium Battery Company (LBC), we are shaping the future of energy storage with advanced lithium-ion battery solutions for mobility, energy, and industrial

Get a quote

Global Lithium Supply Chain: From Extraction to Battery

A disruption in Chinese refining capacity could paralyze global battery production regardless of upstream mining availability. Similarly, geopolitical tensions could weaponize

Get a quote

Top 10 Global EV/REEV Battery Pack Suppliers –

In this blog, we explore the top 10 global battery pack suppliers—industry leaders who are shaping the future of mobility and energy

Get a quote

Global li-ion battery shipments will exceed 3.5 TWh in 2029

The latest '' Li-ion Battery and Manufacturing Equipment – 2024 '' report from Interact Analysis states that global shipments of Li-ion batteries surged by 38.8% year-on-year in 2023,

Get a quote

Lithium-Ion Battery Procurement Strategies: Evidence from

In particular, this contribution presents a preliminary approach supporting the analysis of make or buy strategies for battery pack supply. The authors adopt a logistics perspective and focus on

Get a quote

How to Overcome Supply Chain Challenges in Battery Procurement

One of the most significant challenges in the battery industry is the volatility of raw material prices, especially for key components like lithium, cobalt, and nickel.

Get a quote

Lithium Titanate Oxide Battery Market Size & Share Analysis

3 days ago· Lithium Titanate Oxide Battery Market Size & Share Analysis - Growth Trends and Forecast (2025 - 2030) The Lithium Titanate Oxide Battery Market Report is Segmented by

Get a quote

RMIS

The EU is expected to expand its production base for battery raw materials and components over 2022-2030, and improve its current position and global share. However, dependencies and

Get a quote

National Blueprint for Lithium Batteries 2021-2030

Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary grid storage, critical to

Get a quote

Grevol partners with worlds biggest lithium cell manufacturer, CATL

Ltd. (CATL), a global leader in lithium-ion battery development and manufacturing, for long-term cell procurement. The latter is known to supply to global auto-giants like Tesla,

Get a quote

Comparison of lithium-ion battery supply chains – a life cycle

The increasing number of electric vehicles worldwide leads to various challenges, especially in terms of battery supply chains. New battery production

Get a quote

Top 10 Global EV/REEV Battery Pack Suppliers – LEAPENERGY

In this blog, we explore the top 10 global battery pack suppliers—industry leaders who are shaping the future of mobility and energy with cutting-edge technology, mass

Get a quote

2021 2024 FOUR YEAR REVIEW SUPPLY CHAINS FOR

grow more than five-fold globally and six-fold domestically by 2035. Advanced batteries are supported by a complex, multi-tiered supply chain that includes minerals extraction and

Get a quote

Global Lithium Ion Batteries tenders from government and private

Latest global Lithium Ion Batteries tenders from various sectors and industries. The information on Lithium Ion Batteries tenders and bids is sourced aggregated from newspapers,

Get a quote

Availability of Lithium

Part 1: Availability of Lithium 1.1 Global Supply You operate in a market where the availability of lithium shapes your ability to deliver advanced battery packs for electric vehicles

Get a quote

The Lithium-Ion (EV) battery market and supply chain

Roland Berger, founded in 1967, is the only leading global consultancy of German heritage and European origin. With 2,400 employees working in 36 countries, we have successful

Get a quote

What to Expect from Rack Battery Prices Amid Global Supply

Rack battery prices in 2025 face 15–25% volatility due to dynamic supply chain shifts. Lithium carbonate spot prices hover at ¥125,000/ton (+18% YoY), while cobalt contracts

Get a quote

TENDER DOCUMENT FOR PROCUREMENT OF LITHIUM

E-Bids are invited through the electronic tendering process and the Tender Document can be downloaded from the e-Tender Central Public Procurement Portal (CPPP) of Government of

Get a quote

How to Overcome Supply Chain Challenges in Battery

One of the most significant challenges in the battery industry is the volatility of raw material prices, especially for key components like lithium,

Get a quote

Lithium-Ion Batteries – Market Intelligence | ProcurementIQ

Research and analysis on Lithium-Ion Batteries including benchmarks, forecasts, risk analysis, supplier identification and more.

Get a quote

Battery Tariffs 2025: Impact on U.S. Energy and

Explore how 2025 battery tariffs affect U.S. imports, energy storage, EV production, and sourcing strategies amid rising China tariffs and trade shifts.

Get a quote

Forklift Battery Market 2025: Trends, Technology, ROI, and U.S.

Forklift Battery Market Outlook: Global and U.S. Trends The global forklift battery market is projected to grow at a compound annual growth rate (CAGR) of 7–8% from 2023

Get a quote

4 FAQs about [Global procurement of lithium battery packs]

How is the US positioned to compete in the lithium market?

cell production as the market continues to develop.Lithium RefiningLithium extraction and refining are other areas of the supply chain where the U.S. is well-positioned to compete given its substantial lithium reserves, and firms are taki

How much money has LPO committed to a battery project?

has committed approximately $5 billion to approximately 40 projects.Since the start of 2022, the Loan Program Office’s (LPO) Advanced Technology Vehicle Manufacturing (ATVM) Loan Program has closed approximately $5.5 billion of battery-related loans,

Where do lithium batteries come from?

In Europe, Serbia is a likely source of lithium minerals for conversion to chemicals, and Norway a reliable source of flake and refined graphite. Figure 3 – Projection of production capacity for battery-grade processed raw materials and cells in 2030

Can lithium be economically developed?

tion. Only a subset of capacity can likely be economically developed.A pipeline of domestic projects is developing to tap these resources, including first-of-a-kind deployments to extract and refine lithium from unconventional brine and clay resources, scaling production on domestic

Guess what you want to know

-

Are lithium batteries all small battery packs

Are lithium batteries all small battery packs

-

Secondary lithium battery packs and lithium batteries

Secondary lithium battery packs and lithium batteries

-

Production of lithium battery packs for communication base stations

Production of lithium battery packs for communication base stations

-

UK lithium battery packs by 2025

UK lithium battery packs by 2025

-

Top production of lithium battery packs

Top production of lithium battery packs

-

Are there any lithium battery packs for sale in Vietnam

Are there any lithium battery packs for sale in Vietnam

-

How wide should the nickel strip be for lithium battery packs

How wide should the nickel strip be for lithium battery packs

-

Are lithium battery packs for photovoltaic energy storage cabinets expensive

Are lithium battery packs for photovoltaic energy storage cabinets expensive

-

Lithium-ion batteries and lithium battery packs

Lithium-ion batteries and lithium battery packs

-

Is it better to use lithium iron phosphate or lithium in Moldova lithium battery packs

Is it better to use lithium iron phosphate or lithium in Moldova lithium battery packs

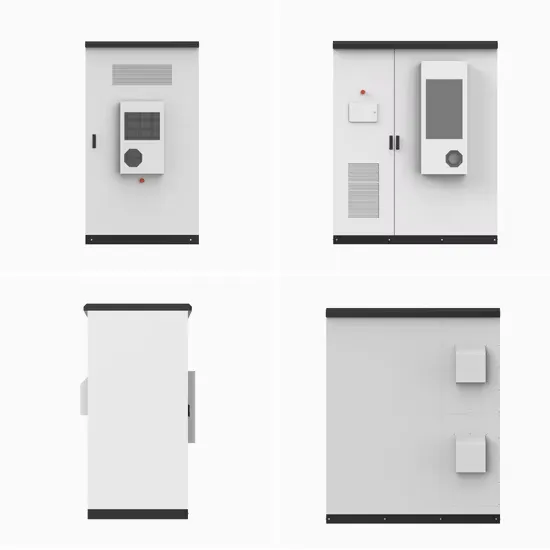

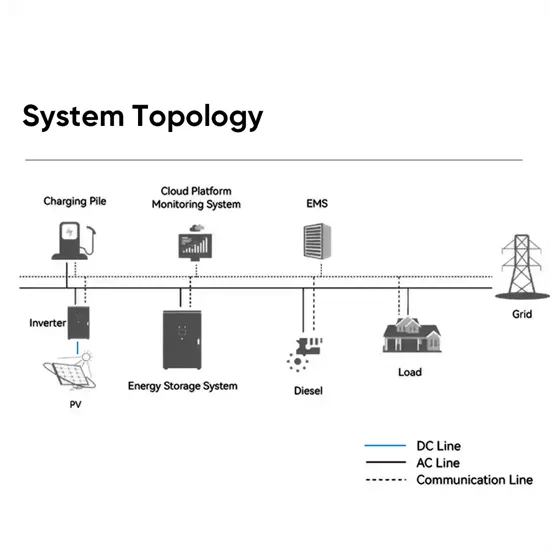

Industrial & Commercial Energy Storage Market Growth

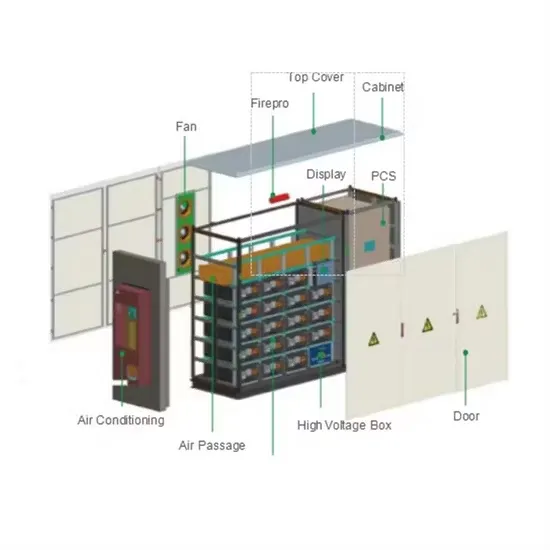

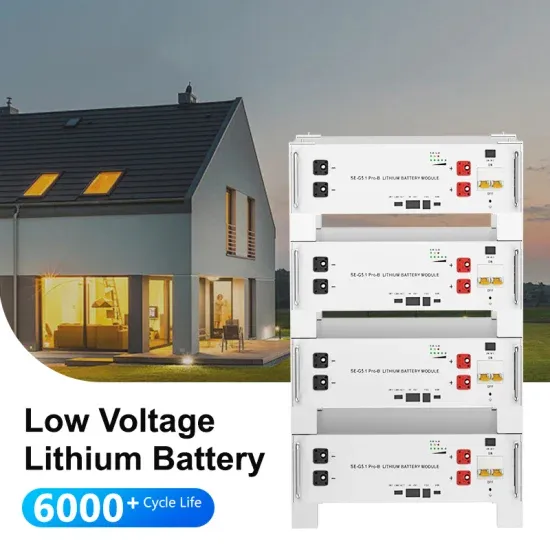

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.