Powering Afghanistan s Future Local Energy Storage Battery

This article explores the role of local battery manufacturers in supporting solar and wind projects, improving grid resilience, and meeting industrial and household energy demands. Discover

Get a quote

Technology Strategy Assessment

This technology strategy assessment on sodium batteries, released as part of the Long-Duration Storage Shot, contains the findings from the Storage Innovations (SI) 2030 strategic initiative.

Get a quote

Sodium-Ion Batteries for Stationary Energy Storage

Sodium-ion batteries are rapidly gaining traction as a sustainable, scalable, and cost-effective solution for stationary energy storage.

Get a quote

Afghanistan energy storage challenges

All these challenges in the energy sector in Afghanistan place constraints on business capacity and industrial production, and lead to suboptimal energy usage at the household level.

Get a quote

Sodium-ion Batteries in Grid Storage: Current Projects and

This project focuses on improving the performance, lifespan, and safety of sodium-ion batteries, making them suitable for large-scale energy storage applications.

Get a quote

World''s largest sodium-ion battery goes into operation

The project represents the first phase of the Datang Hubei Sodium Ion New Energy Storage Power Station, which consists of 42 battery energy

Get a quote

''World''s largest'' sodium-ion battery energy storage

This is currently the world''s largest sodium-ion battery energy storage project and marks a new stage in the commercial operation of sodium

Get a quote

''The bar is going up & up'': Sodium-ion firm Natron Energy closes

1 day ago· US sodium-ion battery firm Natron Energy has ceased trading, putting an end to its two domestic gigafactories.

Get a quote

Afghanistan Sodium Ion Energy Storage Battery Manufacturer

As an emerging Afghanistan sodium ion energy storage battery manufacturer, our primary audience includes renewable energy developers, industrial operators, and government

Get a quote

Sodium-ion push speeds up in China, US: 30GWh

The plot of land readied for Natron Energy''s sodium-ion production facility. Image: Natron Energy / Business Wire. US firm Natron Energy has

Get a quote

Afghanistan''s Energy Storage Landscape: Opportunities,

Let''s face it – when you think of Afghanistan, energy storage isn''t the first thing that comes to mind. But here''s the kicker: this war-torn nation sits on energy opportunities that

Get a quote

China switches on first large-scale sodium-ion battery

The 10 MWh sodium ion battery energy storage station features 210 Ah sodium ion battery cells that can be charged to 90% in 12 minutes, according to the company. The

Get a quote

Powering Afghanistan''s Future: Energy Storage Solutions and

The country''s energy storage capacity remains below 15% of regional benchmarks [1], while its manufacturing sector relies on welding techniques unchanged since the 1980s. Let''s explore

Get a quote

World''s largest sodium-ion battery goes into operation

The first phase of Datang Group''s 100 MW/200 MWh sodium-ion energy storage project in Qianjiang, Hubei Province, was connected to the grid.

Get a quote

Natron Energy''s $1.4B Battery Dream Short-Circuits

Natron Energy shuts down, ending its $1.4B gigafactory plans and highlighting supply chain challenges in sodium-ion battery production.

Get a quote

Afghanistan''s Energy Storage Hydropower Stations: The

Welcome to Afghanistan''s energy paradox, where raging rivers meet 21st-century storage solutions. The combination of energy storage technology and hydropower stations

Get a quote

Afghanistan Energy Storage Power Station: Lighting Up the

It''s like a energy storage version of the Silk Road! Building storage stations here isn''t for the faint-hearted. Engineers face: Here''s where it gets clever: Farmers can pay for

Get a quote

Sodium-ion technology: the future of energy storage

Sodium-ion technology offers a promising, competitive alternative to commercial lithium-ion batteries for various applications. Sodium-ion batteries offer advantages in terms of

Get a quote

Domestic Manufacturing of Sodium-Ion Batteries | ARPA-E

For both product architectures, Natron uses a sodium-ion cell containing Prussian blue electrodes. This cell chemistry provides intrinsically higher power, longer cycle life, and

Get a quote

Sineng Electric launches world''s largest sodium-ion

Sineng Electric''s 50 MW / 100 MWh sodium-ion battery energy storage system project in China''s Hubei province is the first phase of a larger

Get a quote

Sodium-ion Batteries in Grid Storage: Current Projects and

Sodium-ion batteries (SIBs) are emerging as a promising alternative to lithium-ion batteries for large-scale energy storage applications, particularly in grid storage. With the

Get a quote

Pioneering energy storage projects based on sodium-ion battery

Explore our pioneering energy storage projects that leverage cutting-edge sodium-ion battery technology. We are setting new standards in energy storage efficiency and profitability,

Get a quote

6 FAQs about [Afghanistan Sodium Ion Energy Storage Project]

What is a Technology Strategy assessment on sodium batteries?

This technology strategy assessment on sodium batteries, released as part of the Long-Duration Storage Shot, contains the findings from the Storage Innovations (SI) 2030 strategic initiative.

What is sodium ion technology?

Sodium-ion technology offers a promising, competitive alternative to commercial lithium-ion batteries for various applications. Sodium-ion batteries offer advantages in terms of sustainability as well as readily available and environmentally friendly raw materials. They also score highly in terms of safety and temperature resilience.

Are sodium batteries a good choice for energy storage?

Much of the attraction to sodium (Na) batteries as candidates for large-scale energy storage stems from the fact that as the sixth most abundant element in the Earth’s crust and the fourth most abundant element in the ocean, it is an inexpensive and globally accessible commodity.

What is a sodium ion battery?

Sodium-ion batteries (NaIBs) were initially developed at roughly the same time as lithium-ion batteries (LIBs) in the 1980s; however, the limitations of charge/discharge rate, cyclability, energy density, and stable voltage profiles made them historically less competitive than their lithium-based counterparts .

Are sodium-ion batteries a drop-in technology?

Both the functional principle and the manufacturing and process chains are almost identical to those of the well-known lithium-ion technology. For this reason, sodium-ion batteries are referred to as a drop-in technology – a high entry-level technology readiness level (TRL) therefore enables promising application scenarios in the future.

Are sodium ion batteries sustainable?

Sodium-ion batteries offer advantages in terms of sustainability as well as readily available and environmentally friendly raw materials. They also score highly in terms of safety and temperature resilience. Both the functional principle and the manufacturing and process chains are almost identical to those of the well-known lithium-ion technology.

Guess what you want to know

-

Sodium-one sodium ion energy storage project

Sodium-one sodium ion energy storage project

-

Sodium ion energy storage battery project

Sodium ion energy storage battery project

-

Home sodium ion energy storage

Home sodium ion energy storage

-

Afghanistan lithium battery energy storage project

Afghanistan lithium battery energy storage project

-

Afghanistan s 100 billion energy storage project

Afghanistan s 100 billion energy storage project

-

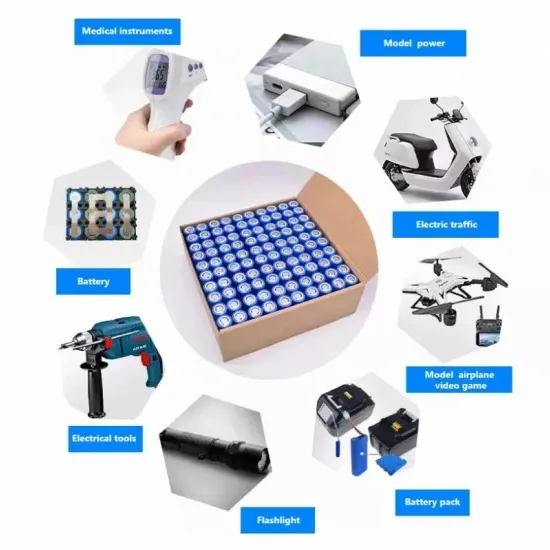

Sodium ion energy storage products

Sodium ion energy storage products

-

Huawei Congo Mobile Energy Storage Project

Huawei Congo Mobile Energy Storage Project

-

Huawei Guatemala Battery Energy Storage Project

Huawei Guatemala Battery Energy Storage Project

-

New Energy Storage Project Team

New Energy Storage Project Team

-

Myanmar lithium battery energy storage investment project

Myanmar lithium battery energy storage investment project

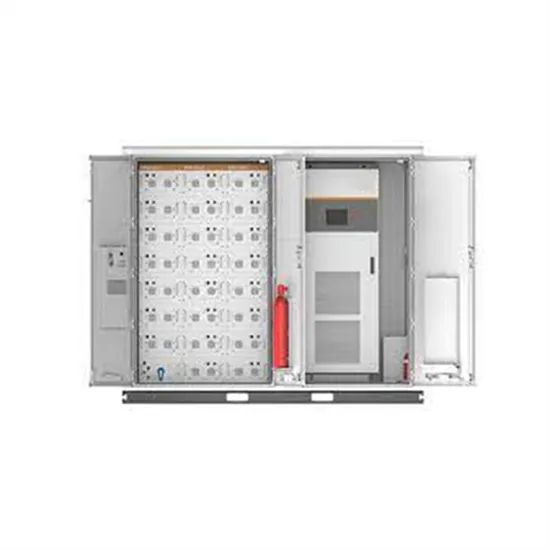

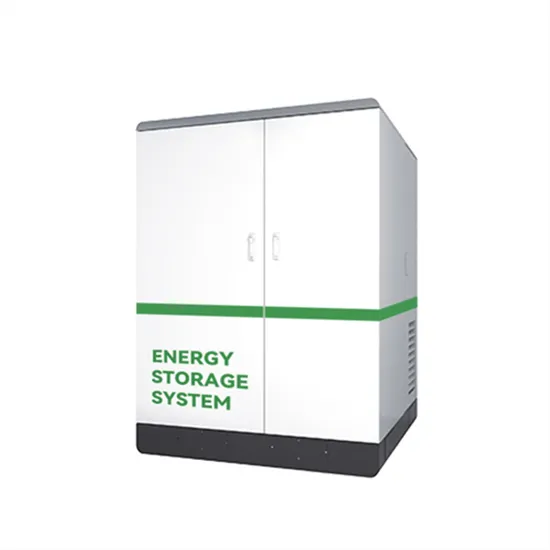

Industrial & Commercial Energy Storage Market Growth

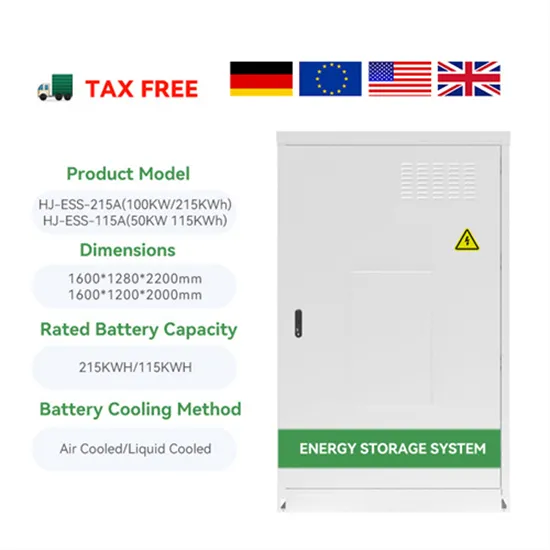

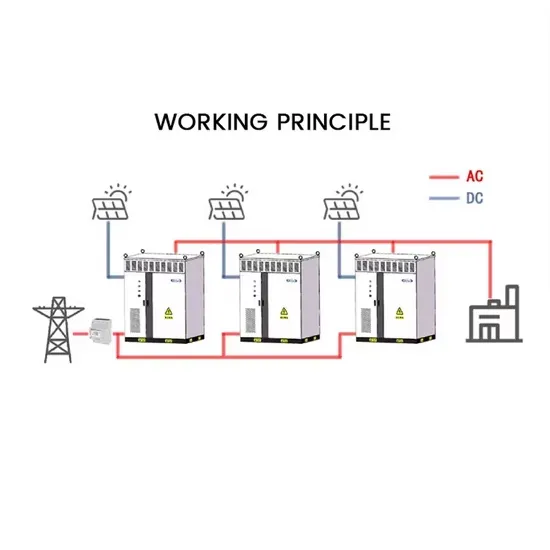

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

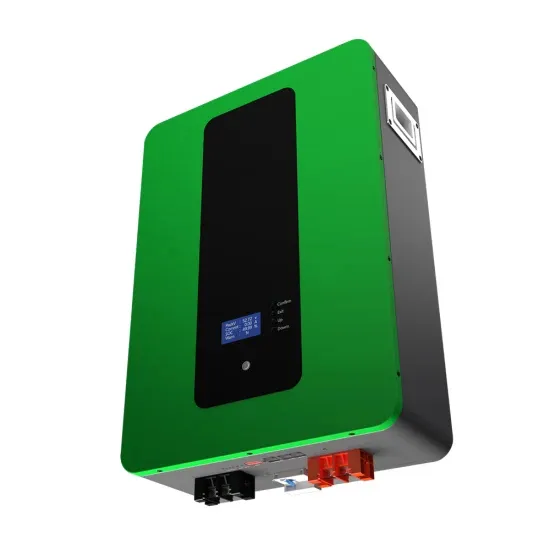

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.