Chinese investment in Afghanistan''s lithium sector: A

The leading candidate to step forward is China, which has long pursued strategic dominance in the lithium-dependent battery storage

Get a quote

Powering Afghanistan s Future Local Energy Storage Battery

This article explores the role of local battery manufacturers in supporting solar and wind projects, improving grid resilience, and meeting industrial and household energy demands. Discover

Get a quote

Lithium battery afghanistan

Lithium battery afghanistanThe global energy landscape will change more in the next 10 years than in the previous hundred. As the world''s energy sector moves away from

Get a quote

Afghanistan''s Lithium: Sovereignty vs. Foreign Exploitation

Afghanistan''s lithium, vital for large-capacity batteries in EVs and clean-energy storage systems, along with its deposits of copper, nickel, cobalt, and rare earth elements, are...

Get a quote

The Race For Lithium: Afghanistan''s Mineral Wealth Attracts

China has long pursued strategic dominance in the lithium-dependent battery storage segment of the green energy revolution. With the US withdrawal from Afghanistan,

Get a quote

Afghanistan liquid cooled energy storage lithium battery spot

Is Afghanistan a potential epicenter for lithium extraction? The narrative of Afghanistan as a potential epicenter for lithium extraction introduces a new dimension to the international race

Get a quote

CONTRIBUTION OF LITHIUM RESOURCES IN AFGHANISTAN

Since affordable and clean energy is target number seven of the United Nations'' 17 sustainable development goals, this paper will examine prior studies on the significance

Get a quote

North Carolina BESS marks tiny step for Duke Energy in

Duke Energy''s 11MW/11MWh battery storage project, despite modest size, is thought to be the largest project of its type in North Carolina.

Get a quote

Battery Energy Storage Systems Report

This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Get a quote

Consortium for Battery Innovation | » Case studies

About the case study This hybrid energy storage (ESS) system made of advanced lead and lithium batteries is currently the largest of its kind in Poland. Strategically situated to enhance

Get a quote

Afghanistan''s Lithium Treasure: China''s Key To EV Dominance –

Often referred to as the "Saudi Arabia of Lithium," Afghanistan''s estimated lithium reserves are pegged at around 2.3 million tons, making it a highly coveted prospect for countries vying for...

Get a quote

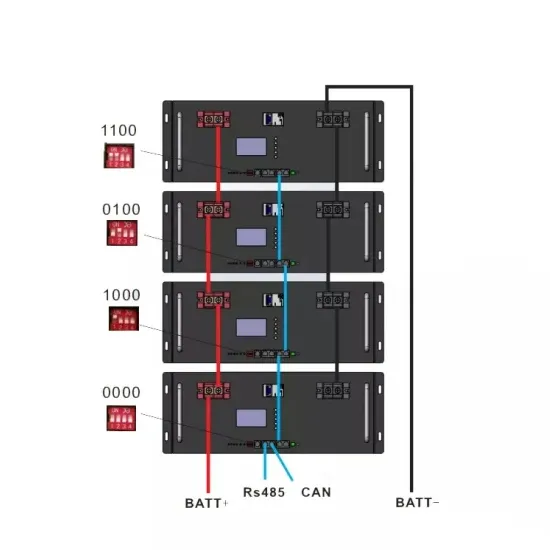

Sunpal Energy Supports Afghan Customer with 500kW+461kWh

Sunpal Energy has successfully assisted a customer in Afghanistan with the installation of a 500kW solar photovoltaic (PV) system integrated with a 461kWh 1C high

Get a quote

CONTRIBUTION OF LITHIUM RESOURCES IN

Now, the following is required in order to utilize Afghanistan''s lithium reserves: The only way to utilize the lithium reserves is to extract them while the Afghan people are in charge, with the

Get a quote

Chinese investment in Afghanistan''s lithium sector: A

Chinese dominance across critical mineral supply chains poses a strategic challenge to the U.S. and Europe''s green energy transition. The lithium found in Afghanistan is

Get a quote

Kabul Power Plant Energy Storage Project Key Solutions for

Summary: Discover how energy storage systems are transforming Kabul''s power infrastructure. This article explores the latest technologies, challenges, and opportunities in Afghanistan''s

Get a quote

Afghanistan''s Energy Future: How Lithium Batteries Are

Whether it lights up classrooms, clinics, or charging stations for e-scooters – that''s Afghanistan''s story to write. With better energy storage, maybe they''ll finally get the pen.

Get a quote

Battery energy storage system

A rechargeable battery bank used in a data center Lithium iron phosphate battery modules packaged in shipping containers installed at Beech Ridge Energy

Get a quote

The Race For Lithium: Afghanistan''s Mineral Wealth Attracts Battery

China has long pursued strategic dominance in the lithium-dependent battery storage segment of the green energy revolution. With the US withdrawal from Afghanistan,

Get a quote

Google to help fund non-lithium LDES projects in Arizona with

2 days ago· A render of Google''s planned Redhawk Phase 2 data centre in Arizona. Image: Google / Stone Applications, LLC / Mesa. Tech giant Google has announced a partnership

Get a quote

Battery Energy Storage Systems: Main Considerations for Safe

This webpage includes information from first responder and industry guidance as well as background information on battery energy storage systems (challenges & fires), BESS

Get a quote

Power battery storage Afghanistan

Search all the latest and upcoming battery energy storage system (BESS) projects, bids, RFPs, ICBs, tenders, government contracts, and awards in Afghanistan with our comprehensive

Get a quote

Sunpal Energy Supports Afghan Customer with 500kW+461kWh

Sunpal installed a 500kW solar PV and 461kWh high-voltage lithium battery energy storage system in Afghanistan, ensuring reliable and sustainable power supply.

Get a quote

6 FAQs about [Afghanistan lithium battery energy storage project]

Why is lithium important in Afghanistan?

The lithium found in Afghanistan is a crucial component of large-capacity batteries for electric vehicles and clean-energy storage systems. Copper, nickel, cobalt, and rare earth elements are also found in Afghanistan, all of which are crucial to the energy transition.

Does Afghanistan need a lithium monopoly?

Afghanistan must limit dependence on investments driven mainly by external strategic interests. Maintaining control over its lithium reserves is equally critical, necessitating a robust national framework for extraction and processing.

Will Beijing make a high-risk lithium play in Afghanistan?

It seems unlikely Beijing would make an aggressive, high-risk lithium play in Afghanistan when other projects in its pipeline are easier to develop and in less risky jurisdictions. Afghanistan’s significant but largely unexploited mineral reserves are valued at an estimated $1-3 trillion.

What resources does Afghanistan have?

A 2019 Afghan mining sector map estimated that the country’s reserves include critical resources for the energy transition, like 2.3 billion metric tons (MTs) of iron ore, 30 million MTs of copper, and 1.4 million MTs of rare earth materials.

How can Afghanistan achieve sustainable growth?

Currently, he is an Albrecht Fellow at the World Trade Center Institute and holds an MBA in finance from I.K. Gujral University in India. For sustainable growth, Afghanistan must maintain control over its resources while seeking investments that promote local development.

How does the Taliban make money mining in Afghanistan?

This income was sourced through a combination of direct mining income, collecting quasi royalties and protection payments from miners, and transit tolls. However, as things currently stand, the Taliban cannot commercialize Afghanistan’s mining sector, including lithium, without outside help.

Guess what you want to know

-

North Africa lithium battery energy storage peak shaving project

North Africa lithium battery energy storage peak shaving project

-

Uganda Energy Storage Lithium Battery Project

Uganda Energy Storage Lithium Battery Project

-

EU lithium battery energy storage project

EU lithium battery energy storage project

-

Nanya lithium battery energy storage project construction

Nanya lithium battery energy storage project construction

-

Costa Rica lithium battery energy storage project

Costa Rica lithium battery energy storage project

-

Mexico lithium battery energy storage system project

Mexico lithium battery energy storage system project

-

Bahrain lithium battery energy storage project

Bahrain lithium battery energy storage project

-

Myanmar lithium battery energy storage investment project

Myanmar lithium battery energy storage investment project

-

Huawei Bulgaria lithium battery energy storage project

Huawei Bulgaria lithium battery energy storage project

-

Bangladesh lithium battery energy storage project

Bangladesh lithium battery energy storage project

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.