Middle East Solar Inverter Industry Report 2025 | Market Size

Middle East and Africa Solar Inverter Market size will be USD 210.24 million in 2024 and will expand at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2031.

Get a quote

Sungrow PV Inverter & Battery Energy Storage System

Sugrow provides comprehensive portfolio, which includes PV inverters and battery energy storage systems. Sungrow PV inverters are designed with cutting-edge technology to maximize solar

Get a quote

Middle East And Africa Solar PV Inverter Market

The report includes an in-depth analysis of the Middle East And Africa Solar PV Inverter Market, including market size and trends, product mix, applications,

Get a quote

Middle East And Africa Photovoltaic Solar Inverter Market

Governments in the region are increasingly investing in solar energy infrastructure to reduce dependence on fossil fuels. Favorable policies and incentives, such as tax rebates

Get a quote

Middle East and Africa Solar PV Inverters Market Size and

The demand for solar PV inverters in MIDDLE EAST AND AFRICA is driven by several key factors, including renewable energy targets, cost reductions, and technological

Get a quote

Middle East and Africa Solar PV Inverters Market Size & Share

Middle East and Africa Solar PV Inverters analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a

Get a quote

EMEA (Europe, Middle East and Africa) Solar Photovoltaic (PV) Inverters

In this report, the EMEA Solar Photovoltaic (PV) Inverters market is valued at USD XX million in 2016 and is expected to reach USD XX million by the end of 2022, growing at a CAGR of XX%

Get a quote

Sellers in Middle East | PV Companies List

List of Middle Eastern solar sellers. Directory of companies in Middle East that are distributors and wholesalers of solar components, including which brands they carry.

Get a quote

Middle East & Africa Pv Inverter Market Size & Outlook

Horizon Databook provides a detailed overview of continent-level data and insights on the Middle East & Africa pv inverter market, including forecasts for subscribers.

Get a quote

Middle East & Africa Solar Inverters Market

Strategic insights for the Middle East & Africa Solar Inverters provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances.

Get a quote

Middle East And Africa Solar PV Inverter Market Growth, Size,

The report includes an in-depth analysis of the Middle East And Africa Solar PV Inverter Market, including market size and trends, product mix, applications, and supplier analysis.

Get a quote

Top 10 Inverter Manufacturers In The UAE

Welion has been in the renewable energy field for more than 12 years, first established in 2012. The manufacturer focused on distributing its products in

Get a quote

حجم سوق محولات الطاقة الشمسية الكهروضوئية في منطقة الشرق الأوسط

تحميل PDF مجاني الآن Home Market Analysis Energy & Power Research Power Equipment Research Middle East and Africa Solar PV Inverters Market سوق محولات الطاقة الشمسية الكهروضوئية في الشرق الأوسط وأفريقيا

Get a quote

Middle East and Africa Solar PV Inverters Market Analysis

In the Middle East, countries such as Saudi Arabia, the United Arab Emirates, and Jordan are leading the solar PV inverters market. These countries have implemented ambitious

Get a quote

Solar Inverters | Hybrid Inverters | Energy storage inverters

Solis is one of the world''s largest and most experienced manufacturers of solar inverters supplying products globally for multinational utility companies, commercial & industrial rooftop

Get a quote

Sineng Electric secures PV inverter supply contract in Saudi Arabia

Sineng Electric has been awarded a 2.6GW supply contract for Saudi Arabia''s PIF4 project, a landmark renewable energy initiative in the Kingdom.

Get a quote

Middle East and Africa Solar PV Inverters Market 2025 to Grow at

The Middle East and Africa (MEA) solar PV inverter market is experiencing robust growth, driven by increasing renewable energy adoption, supportive government policies promoting solar

Get a quote

Middle East Solar PV Inverters Market (2025

Market Forecast by Countries (Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, Oman, Turkey and Rest of Middle East), By Type (Central Inverters, String Inverters, Hybrid Inverters), By

Get a quote

Middle East And Africa Photovoltaic Solar Inverter Market

The Middle East and Africa photovoltaic solar inverter market is poised for significant growth due to several factors. The increasing demand for renewable energy driven

Get a quote

Middle East and Africa Solar PV Inverters Market Size

Middle East and Africa Solar PV Inverters analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a

Get a quote

Middle East and Africa Solar PV Inverters Market

In the Middle East, countries such as Saudi Arabia, the United Arab Emirates, and Jordan are leading the solar PV inverters market. These countries have

Get a quote

Middle East & Africa Pv Inverter Market Size & Outlook

Horizon Databook provides a detailed overview of continent-level data and insights on the Middle East & Africa pv inverter market, including forecasts for

Get a quote

Wholesaler and solutions provider in Photovoltaics

Solarity Jordan is a distributor and solutions provider of photovoltaic (PV) systems offering a complete assortment of solar modules and inverters.

Get a quote

Guess what you want to know

-

Huawei Middle East solar photovoltaic panels

Huawei Middle East solar photovoltaic panels

-

Middle East System Solar Photovoltaic Manufacturer

Middle East System Solar Photovoltaic Manufacturer

-

Middle East solar power generation can be used for a whole day

Middle East solar power generation can be used for a whole day

-

Solar photovoltaic panels in the Middle East

Solar photovoltaic panels in the Middle East

-

Middle East rooftop flat panel solar panel purchase

Middle East rooftop flat panel solar panel purchase

-

Solar PV power prices in Estonia

Solar PV power prices in Estonia

-

Onsite Energy 0 Solar PV

Onsite Energy 0 Solar PV

-

Microinverter prices in the Middle East

Microinverter prices in the Middle East

-

Can home inverters be connected to solar energy

Can home inverters be connected to solar energy

-

East Asia s wind solar and storage multi-energy complementarity

East Asia s wind solar and storage multi-energy complementarity

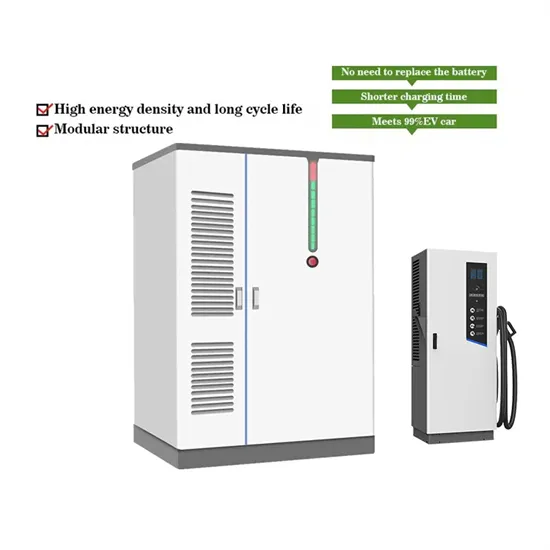

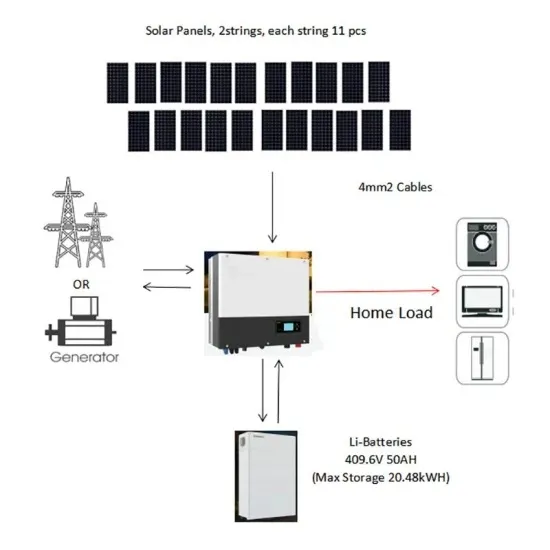

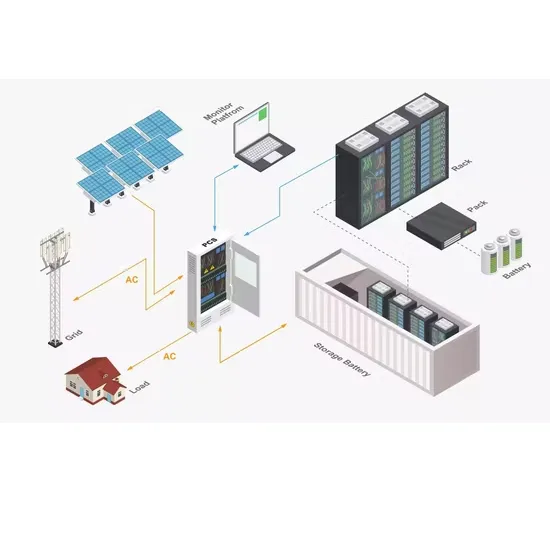

Industrial & Commercial Energy Storage Market Growth

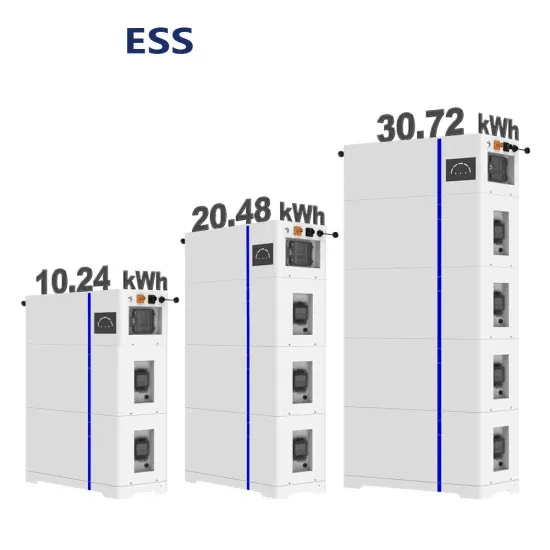

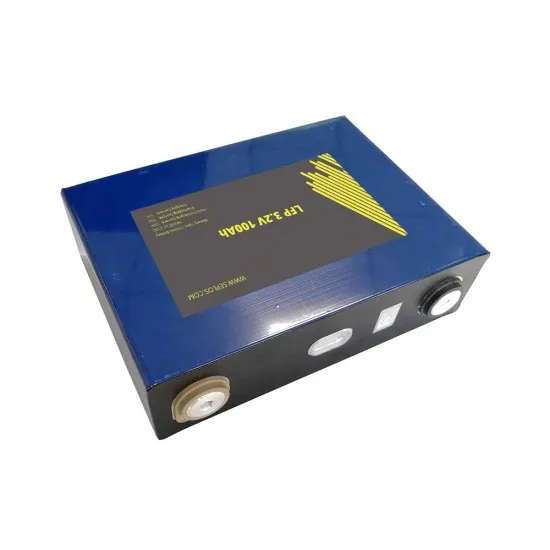

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

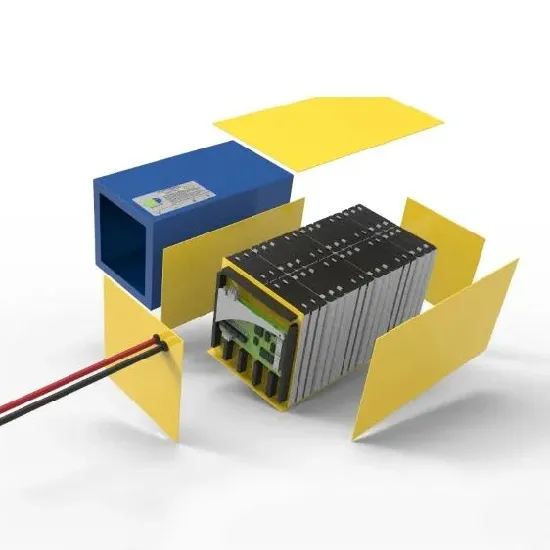

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.