Powering the Future: Energy Storage Solutions in the

The horizon of energy storage in the Middle East is radiant with possibilities. Innovations in long-duration energy storage solutions, like those

Get a quote

Portable Energy Storage (PES) Market''s Consumer Landscape:

The global Portable Energy Storage (PES) market is anticipated to experience substantial growth in the coming years, driven by the increasing demand for portable power

Get a quote

Why battery storage investment is vital to the Middle

By David Cullerier Head of Business Development – Flexible Generation As the world embraces sustainable and low-carbon energy

Get a quote

Global Energy Storage Market Records Biggest Jump

The global energy storage market almost tripled in 2023, the largest year-on-year gain on record, and that growth is expected to continue.

Get a quote

Middle East and Africa energy storage outlook 2025

The report includes scenario analyses for Saudi Arabia, UAE, Israel, and South Africa and a broader overview of trends across the rest of

Get a quote

Conferences Brochure

The Middle East Energy Conferences in Dubai is a pivotal gathering for global energy leaders and innovators to explore crucial themes shaping the future of the energy sector. This dynamic

Get a quote

Why battery storage investment is vital to the Middle East''s clean

Investing in battery storage is crucial for a successful energy transition in the Middle East, as it enables the realisation of the full benefits of renewable energy.

Get a quote

Middle East and Africa energy storage outlook 2025

The report includes scenario analyses for Saudi Arabia, UAE, Israel, and South Africa and a broader overview of trends across the rest of the MEA region.

Get a quote

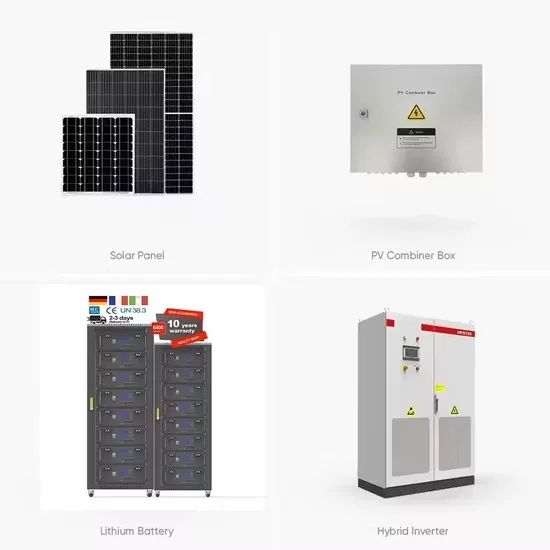

Middle East Energy | Product Sector | Battery & Energy Storage

The exhibition features industry leaders presenting the latest lithium-ion technologies, flow batteries, and hybrid systems that are transforming how energy is stored, managed, and

Get a quote

Energy Storage System Market Size, Share & Trends

Energy Storage System Market is projected to register a CAGR of 12.48% to reach USD 34.8 Billion by the end of 2035, Global Energy Storage System

Get a quote

Middle East And Africa Portable Household Energy Storage

Several factors influence the growth and development of the portable household energy storage market in the Middle East and Africa. Economic conditions and disposable

Get a quote

MENA region''s solar energy capacity to exceed 180 GW by 2030:

The share of solar energy in the Middle East and North Africa''s (MENA) energy mix has grown significantly in recent years. Solar capacity in the region rose 23 percent in 2023 to

Get a quote

Middle East Battery Energy Storage Systems Market Size and

The future of the battery energy storage market in Middle East is intrinsically linked to clean energy deployment and electrification trends. As the country accelerates toward net

Get a quote

MEA Battery Energy Storage System Market

Middle-East and Africa Battery Energy Storage System analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry

Get a quote

Middle East: Energy Transition Unlocks Huge Market

Saudi Arabia will become the main force in energy storage construction in the Middle East. At present, SunGrow, Huawei, BYD, and

Get a quote

ACWA Power wind and battery storage plant to power

Signing of the agreement between the International Finance Corporation and ACWA Power. Image: Future Investment Initiative. ACWA

Get a quote

Why battery storage investment is vital to the Middle

Investing in battery storage is crucial for a successful energy transition in the Middle East, as it enables the realisation of the full benefits of

Get a quote

10 Exciting Up-and-Coming Renewable Energy Projects in the Middle East

Explore 10 renewable energy projects in the Middle East, showcasing solar, wind, and battery storage advancements set for 2025. Read more here.

Get a quote

Middle East Battery Energy Storage Systems Market Report, 2033

The UAE battery energy storage systems (BESS) market held the largest share of 34.85 % of the Middle East market in 2024. The battery energy storage systems (BESS) market in the Middle

Get a quote

The Future of Battery Market in the Middle East & Africa

Through country-by-country spotlights, technology insights, and practical guidance on entering the market, this report ofers a compact yet comprehensive overview for exhibitors, investors, and

Get a quote

middle east Archives

Riyadh-based Tdafoq Energy will distribute Indian firm Delectrik Systems'' vanadium redox flow battery products in Gulf Cooperation Council (GCC) markets and set up

Get a quote

Unlocking the Potential of the Solar Photovoltaic (PV) Market

A Middle East Energy report emphasises the critical role of modern grid systems in facilitating distributed generation. Smart grids enable the integration of multiple power generation

Get a quote

Mobile Energy Storage in Middle East – Market Trends, Use

In tandem, the need for mobile energy storage in Middle East has skyrocketed. Harsh climates, remote sites, and grid‑stability challenges make Portable Energy Storage System solutions

Get a quote

Middle East: Energy Transition Unlocks Huge Market Potential for Energy

Saudi Arabia will become the main force in energy storage construction in the Middle East. At present, SunGrow, Huawei, BYD, and SmartPropel Energy have won bids for

Get a quote

Guess what you want to know

-

Middle East high power energy storage equipment prices

Middle East high power energy storage equipment prices

-

Middle East centralized energy storage power station

Middle East centralized energy storage power station

-

Middle East Hybrid Energy Storage Power Generation Project

Middle East Hybrid Energy Storage Power Generation Project

-

Huawei East Africa Portable Energy Storage Power Supply

Huawei East Africa Portable Energy Storage Power Supply

-

Middle East energy storage high power supply brand

Middle East energy storage high power supply brand

-

Middle East Power Station Energy Storage

Middle East Power Station Energy Storage

-

Heishan Wind Power Energy Storage System Manufacturing Plant

Heishan Wind Power Energy Storage System Manufacturing Plant

-

Singapore portable energy storage power supply manufacturer

Singapore portable energy storage power supply manufacturer

-

East Asia Energy Storage Power Generation

East Asia Energy Storage Power Generation

-

Timor-Leste portable energy storage power supply customization

Timor-Leste portable energy storage power supply customization

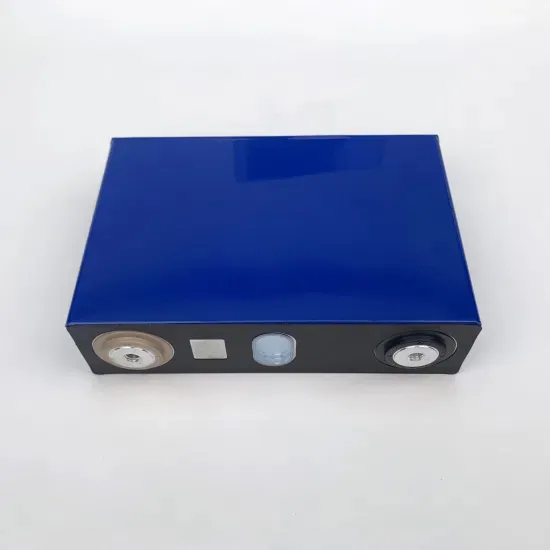

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.