The state of battery storage (BESS) in Latin America:

The opportunities for battery energy storage systems are growing rapidly in Latin America. Below are some key details for those who want to

Get a quote

Argentina''s 1st BESS tender awards 667 MW of projects

Argentina''s government said on Monday it has awarded contracts for 667 MW of capacity in its first tender dedicated to battery energy storage systems (BESS), exceeding its

Get a quote

New energy storage projects in south america

Despite Chile''''s pipeline of nearly 8 GW in battery energy storage systems (BESS), a potential flattening of its duck curve and increased interconnection delays could lead to less profitable

Get a quote

Latin America''s Energy Storage Boom: Market & Outlook 2025

The webinar was replete with insights and worth a listen/watch. One of the clearest takeaways from the webinar is that each of the top 8 BESS markets in Latin America are all

Get a quote

The Battery Energy Storage System (BESS) Market in

Key takeaways: The BESS market is projected to grow from $50+ billion in 2024 to as much as $150 billion in 2030. Energy shifting has grown to

Get a quote

The state of battery storage (BESS) in Latin America: A sleeping

The opportunities for battery energy storage systems are growing rapidly in Latin America. Below are some key details for those who want to understand and succeed in the

Get a quote

''Brazil could have $3.8bn battery energy storage market by 2030''

Demand for battery energy storage system (BESS) components grew 89% in Brazil from 2023 to 2024 and most of the resulting systems are likely to be installed in 2025.

Get a quote

South America Battery Energy Storage System Market 2025

The battery energy storage system (BESS) market in South America is experiencing significant growth, propelled by the region''s escalating demand for grid stability,

Get a quote

Italy: BESS wins nearly 600MW in 2027 capacity market

The BESS figure is a big jump on the CM auctions for 2025 and 2026 delivery years, which saw 80-90MW of BESS capacity awarded contracts in each. The CM and a new

Get a quote

2025 Battery Energy Storage Systems (BESS) Market

Comprehensive analysis of the 2025 Battery Energy Storage Systems (BESS) market, focusing on key players U.S., China, and Germany.

Get a quote

''Brazil could have $3.8bn battery energy storage

That demand, part of a BESS market which could be worth more than BRL 22.5 billion ($3.79 billion) by 2030, was recorded by Brazilian

Get a quote

Chile launches an energy storage project which is the largest one

On 17 April, France''s Engie Group launched the BESS Coya Porject in María Elena, Antofagasta Region, Chile, which is currently the largest energy storage system in Latin

Get a quote

Chile: BESS as an answer to solar curtailment, grid constraints

With solar project owners needing to find a solution to make their projects financially viable, battery energy storage systems (BESS) are emerging as key enablers.

Get a quote

Perspective on Energy Storage Systems developments in

investments for capacity additions are in renewable. The production of renewable energy is intermittent, variable, and non-dispatchable.

Get a quote

US deployed 11.9GW of storage in 2024, 18.2GW

PV arrays at Gemini Solar + Storage. CATL provided the BESS containers and IHI Terrasun served as system integrator. The project was one

Get a quote

Chile: BESS as an answer to solar curtailment, grid

With solar project owners needing to find a solution to make their projects financially viable, battery energy storage systems (BESS) are

Get a quote

Latin America Battery Energy Storage System Market Analysis

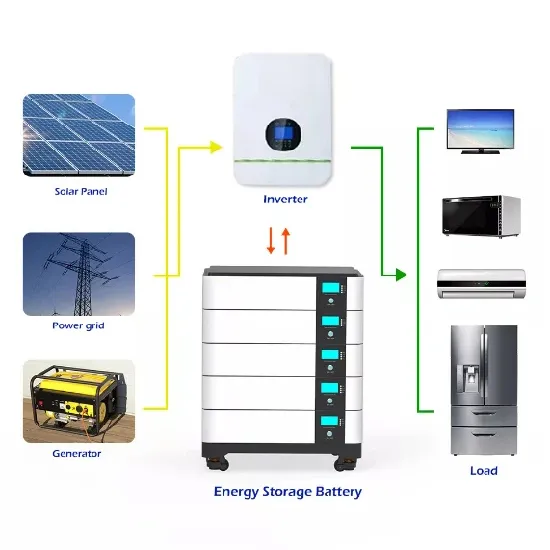

BESS refers to a technology that stores electrical energy in batteries for later use. It plays a crucial role in enhancing the reliability and flexibility of the power grid, allowing for efficient

Get a quote

China reaches over 70GW of BESS, DC block prices ''stable''

A BESS project in China deployed by Hyperstrong, the largest system integrator in the domestic market. Image: Hyperstrong. China has reached well over 70GW of installed

Get a quote

''Brazil could have $3.8bn battery energy storage

Demand for battery energy storage system (BESS) components grew 89% in Brazil from 2023 to 2024 and most of the resulting systems are

Get a quote

Perspective on Energy Storage Systems developments in

The Role of BESS in Facilitating the Energy Transition The production of renewable energy is intermittent, variable, and non-dispatchable.

Get a quote

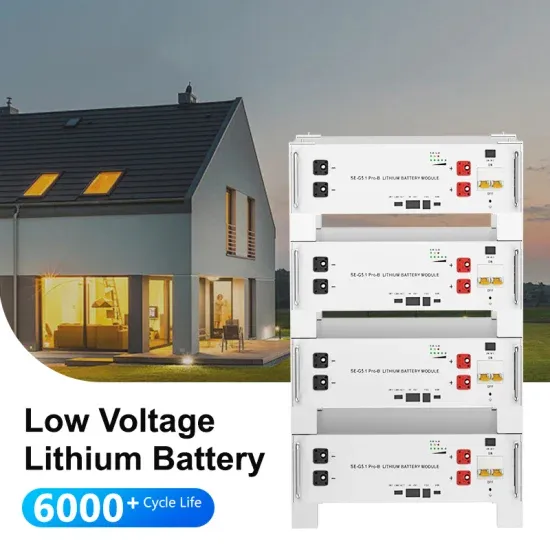

Residential Battery Storage | Electricity | 2024 | ATB

As with utility-scale BESS, the cost of a residential BESS is a function of both the power capacity and the energy storage capacity of the system, and both must

Get a quote

Brazil power storage sector seeks support | Latest Market News

Lower battery prices and increases to intermittent power generation could boost battery energy storage systems (BESS) in Brazil, reaching roughly 7.2GW of installed capacity by 2040 or

Get a quote

Latin America Battery Energy Storage System Market

BESS refers to a technology that stores electrical energy in batteries for later use. It plays a crucial role in enhancing the reliability and flexibility of the power

Get a quote

6 FAQs about [BESS Energy Storage Capacity Prices in South America]

What's happening in Chile's Bess market?

The current wave of excitement around Chile’s BESS market started in October 2022, when the Chilean government passed legislation that incentivised the deployment of energy storage. The bill allows standalone energy storage systems to receive income from dispatching their energy and power in the country’s National Electric System market.

Should Bess storage be paired with large solar assets?

The Dominican Republic’s National Energy Commission (CNE) issued a resolution in February 2023 that requires BESS storage to be paired with large solar assets. However, the renumeration is not yet clear and developers are concerned about interconnection delays for their BESS assets.

Does Colombia have a power purchase agreement for hybrid solar & Bess projects?

As of now, Colombia’s reliability charge (Cargo por Confiabilidad) has encouraged hybrid solar + BESS projects to progress. Large energy companies have expressed that there are no Power Purchasing Agreements (PPAs) available specifically for stand-alone storage projects, making it harder to finance those projects.

Should energy storage be a luxury asset in Chile?

Having energy storage in Chile is no longer a luxury asset but has become an “absolute necessity”, explains Alejandro McDonough, business development manager of Americas area sales at Wärtsilä Energy Storage and Optimisation (Wärtsilä ES&O).

Will a PPA add Bess in Puerto Rico?

Under ASAP, IPPs with existing PPAs with Puerto Rico’s Power Authority (PREPA) would add BESS at their locations “on an accelerated basis,” leading to an estimated 380 MW of additional contracted BESS capacity by 2026. 3 Peru has no existing BESS regulation and is currently evaluating how to move forward with battery storage projects.

How will Bess be compensated in 2021?

Colombia’s BESS tender in 2021, won by Canadian Solar, was a good step forward, but there is still no clear regulation on how stand-alone BESS will be compensated. Regulators are debating whether to handle storage as a transmission or generation asset, given its flexibility.

Guess what you want to know

-

Liquid Cooling Energy Storage Container Prices in South America

Liquid Cooling Energy Storage Container Prices in South America

-

South Africa Huijue s annual energy storage battery capacity

South Africa Huijue s annual energy storage battery capacity

-

India Energy Storage Project Capacity BESS

India Energy Storage Project Capacity BESS

-

North America Mobile Energy Storage Power Generation BESS

North America Mobile Energy Storage Power Generation BESS

-

South Korean energy storage power generation company BESS

South Korean energy storage power generation company BESS

-

Industrial energy storage in South America

Industrial energy storage in South America

-

BESS price for independent energy storage capacity

BESS price for independent energy storage capacity

-

Grid-side energy storage capacity BESS enterprise

Grid-side energy storage capacity BESS enterprise

-

What is the capacity of the BESS model of the energy storage power station

What is the capacity of the BESS model of the energy storage power station

-

Energy storage prices for energy storage power stations in North America

Energy storage prices for energy storage power stations in North America

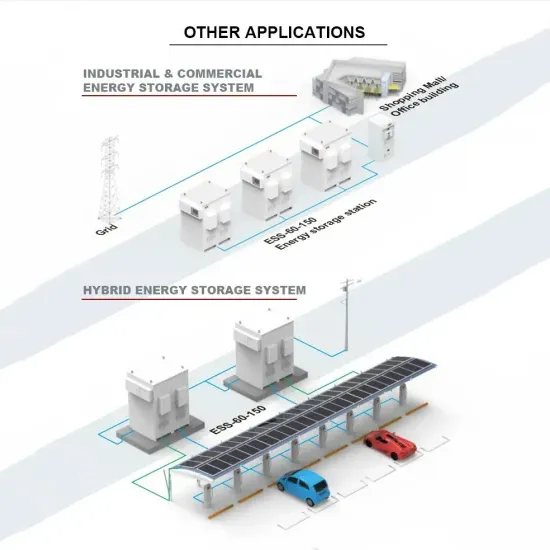

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

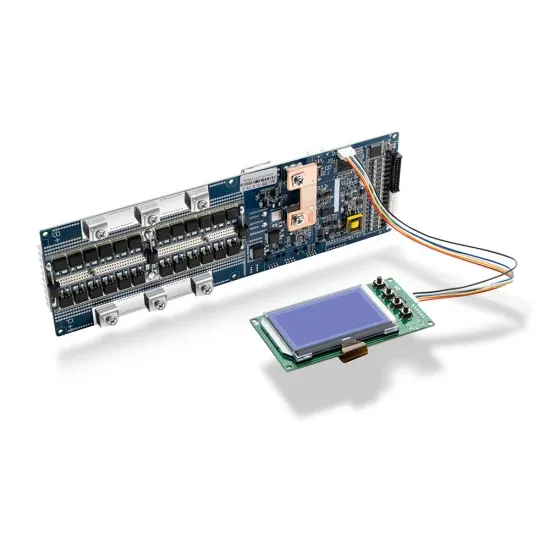

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.