Reviving Syria''s Petroleum Sector: Pathways to Economic and

The industry was dominated by the state-owned Syrian Petroleum Company (SPC), alongside foreign companies operating under production-sharing agreements. These

Get a quote

With a foreign investment valued at $7 billion, the Syrian

These projects represent a model of effective public-private partnership, integrating both conventional and renewable power solutions to support Syria''s energy

Get a quote

Syria signs $7 billion energy deal with Qatari consortium

Syria on Thursday signed a $7 billion energy agreement with a consortium of American, Qatari, and Turkish companies to deliver 5,000 megawatts of electricity, aiming to significantly boost

Get a quote

Turkish, Qatari, US firms sign $7 billion energy deal in

Turkish conglomerates Kalyon Holding and Cengiz Holding, Qatar-based UCC, and U.S.-based Power International have signed an

Get a quote

Energy Storage Power Station G

The company relies on a well-trained team of foreign trade employees and links with hundreds of manufacturing companies. With the business purpose of "reputation first, customer first, and

Get a quote

How about energy storage foreign trade | NenPower

How about energy storage foreign trade Energy storage foreign trade refers to the international exchange of products and services related to energy storage technologies. 1.

Get a quote

Which energy storage companies export to the United States?

Numerous energy storage companies orchestrate exports to the United States, primarily fueled by the country''s escalating demand for efficient energy management solutions.

Get a quote

Syria signs $7 billion power deal with Qatar''s UCC Holding-led

Syria has signed a memorandum of understanding with a consortium of international companies led by Qatar''s UCC Holding to develop major power generation

Get a quote

Syria

Syria registered more than 4 billion USD in trade deficit in 2021, and exports reached almost 1 billion USD compared with more than 5 billion USD of imports. Syrian exports mainly to Saudi

Get a quote

Syria Signs $7 billion Power Deal with Qatar''s UCC

Syria has signed a memorandum of understanding with a consortium of international companies led by Qatar''s UCC Holding to develop

Get a quote

UCC Holding

With a foreign investment valued at $7 billion, the Syrian government has signed a strategic MOU with a consortium of international companies led by UCC Holding to develop

Get a quote

Understanding Import and Export Regulations in Syria: A

This comprehensive guide explores Syria''s complex trade environment, focusing on key aspects such as import and export regulations, customs procedures, tariffs, and the

Get a quote

Syria Offshore Energy Storage Market (2025-2031) | Companies

Market Forecast By Type (Lithium-Ion Batteries, Hydrogen Storage, Flywheel Energy Storage, Compressed Air Energy Storage), By Application Area (Wind Energy Storage, Offshore

Get a quote

Syria''s $7 Billion energy deal for economic recovery

On May 29, 2025, President Ahmad al-Sharaa witnessed the signing of a $7 billion memorandum of understanding in Damascus, marking the largest post-war infrastructure

Get a quote

With a foreign investment valued at $7 billion, the

These projects represent a model of effective public-private partnership, integrating both conventional and renewable power solutions to

Get a quote

Solar Energy in Syria

Energy Equipment Imports: Customs and Monopoly The quality crisis challenges borrowers faced was not isolated from the dynamics of the import market. A limited group of

Get a quote

Syria Signs $7 billion Power Deal with Qatar''s UCC Holding-led

Syria has signed a memorandum of understanding with a consortium of international companies led by Qatar''s UCC Holding to develop major power generation

Get a quote

Syria Signs Landmark $7 Billion Energy Investment Agreement

This agreement reflects the Syrian government''s ongoing commitment to attracting high-impact international investment, fostering strategic alliances, and accelerating the reconstruction of

Get a quote

Syria signs $7 billion deal to secure electricity

Meanwhile, Turkish Energy Minister Alparslan Bayraktar stated on May 22 that his country intends to annually export two billion cubic meters of natural gas necessary to operate

Get a quote

Turkish, Qatari, US firms sign $7 billion energy deal in Syria

Turkish conglomerates Kalyon Holding and Cengiz Holding, Qatar-based UCC, and U.S.-based Power International have signed an energy investment agreement worth $7

Get a quote

Syrian Energy Storage Power Station Foreign Trade Export

Summary: Explore how Syrian energy storage solutions are reshaping global power infrastructure. This article analyzes export trends, industry applications, and why storage systems have

Get a quote

Syria signs $7 billion deal to secure electricity

Meanwhile, Turkish Energy Minister Alparslan Bayraktar stated on May 22 that his country intends to annually export two billion cubic meters of

Get a quote

How about energy storage foreign trade company | NenPower

The global landscape of energy storage is rapidly evolving, reflecting both technological advancements and shifting economic dynamics. A nuanced exploration of

Get a quote

How is Shenzhen Energy Storage Company''s foreign trade?

The landscape of foreign trade for Shenzhen Energy Storage Company exemplifies the complexities and opportunities inherent in international markets. Initially, the growing

Get a quote

Syria

Electricity imports and exports Unlike other energy commodities such as coal, oil and natural gas, electricity trade between countries is relatively limited as it is more technically complex and

Get a quote

Syria signs $7 billion energy deal with Qatari consortium

Syria on Thursday signed a $7 billion energy agreement with a consortium of American, Qatari, and Turkish companies to deliver 5,000 megawatts of electricity, aiming to significantly boost its...

Get a quote

Guess what you want to know

-

Uruguay Energy Storage Power Station Company

Uruguay Energy Storage Power Station Company

-

Energy storage power station investment company

Energy storage power station investment company

-

Solar power station energy storage battery company

Solar power station energy storage battery company

-

Ethiopia Energy Storage Power Station Manufacturer Direct Sales Company

Ethiopia Energy Storage Power Station Manufacturer Direct Sales Company

-

Huawei 24h power station energy storage system partner company

Huawei 24h power station energy storage system partner company

-

Large Energy Storage Power Station Company

Large Energy Storage Power Station Company

-

Ukrainian Energy Storage Power Station Company

Ukrainian Energy Storage Power Station Company

-

Energy Storage Power Station Operating Company

Energy Storage Power Station Operating Company

-

Uruguay Energy Storage Photovoltaic Power Station Company

Uruguay Energy Storage Photovoltaic Power Station Company

-

Ghanaian company s own power station energy storage

Ghanaian company s own power station energy storage

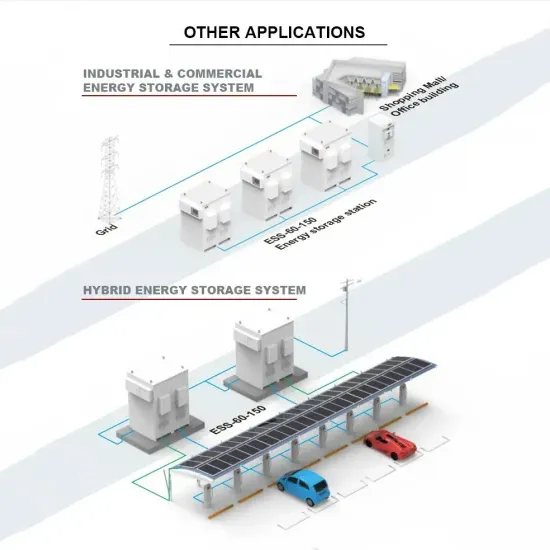

Industrial & Commercial Energy Storage Market Growth

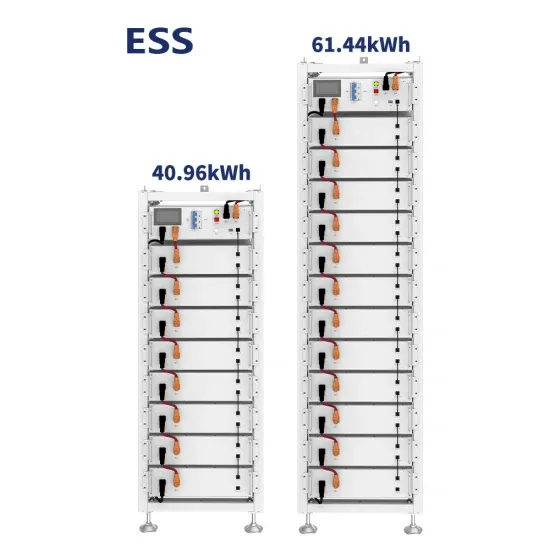

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.