Predictive-Maintenance Practices For Operational Safety of

This article advocates the use of predictive maintenance of operational BESS as the next step in safely managing energy storage systems. Predictive maintenance involves monitoring the

Get a quote

Top 14 Battery Storage Companies in Argentina (2025) | ensun

The company specializes in energy solutions, offering high-quality products and expert advice on energy generation and storage. They provide efficient systems, including hybrid solutions and

Get a quote

Detailed Report on Argentina''s Electrochemical Energy Storage

Argentina''s electrochemical energy storage market is in its early stages but is poised for rapid growth, driven primarily by lithium-ion battery systems. The market is fueled

Get a quote

Argentina''s Oversubscribed Energy Storage Tender Signals

The first large-scale battery energy storage tender in Argentina is catching the attention of the international community as an unequivocal step towards modernizing power

Get a quote

Argentina Residential Energy Storage: Powering Homes Through Energy

Remember – in Argentina''s energy market, having storage is like having a good Malbec cellar: it keeps getting better with time!

Get a quote

Argentina''s Energy Storage Revolution: Challenges,

Argentina holds 21% of global lithium reserves—enough to produce 54 million EV batteries. But wait, there''s a plot twist: only 8% of this "white gold" currently supports domestic energy

Get a quote

Lithium batteries, made in Argentina: Can they

Argentina will start operations at the first lithium battery cell factory in Latin America before the end of the year. The country aims to boost its

Get a quote

What is Maintenance-Free Battery?

A maintenance-free battery is a kind of lead-acid battery that has sealed tops and doesn''t require water or electrolytes during its operational life.

Get a quote

Energy Storage

AES is the world leader in lithium-ion-based energy storage, both through our business project and joint venture, Fluence. We pioneered the technology over one decade ago, and today

Get a quote

AGM Batteries: Are They Truly Maintenance Free? Lifespan and

AGM batteries are maintenance-free because they recombine gases produced during use back into liquid. Their sealed design prevents acid leaks and mess. The charging

Get a quote

Argentina Receives 1.3GW of BESS Proposals for First-Ever

The initiative aims to deploy 500 MW of battery energy storage systems (BESS) in the Greater Buenos Aires Area (GBA), but the submitted capacity has far exceeded

Get a quote

Home Battery Storage Guide 2025: Lithium vs AGM

In this guide, we''ll break down everything you need to know about home battery storage in 2025, including the pros and cons of lithium batteries

Get a quote

Argentina Receives 1.3GW of BESS Proposals for First-Ever 500MW Energy

The initiative aims to deploy 500 MW of battery energy storage systems (BESS) in the Greater Buenos Aires Area (GBA), but the submitted capacity has far exceeded

Get a quote

A Review on the Recent Advances in Battery

Nonetheless, in order to achieve green energy transition and mitigate climate risks resulting from the use of fossil-based fuels, robust energy storage

Get a quote

Detailed Report on Argentina''s Electrochemical

Argentina''s electrochemical energy storage market is in its early stages but is poised for rapid growth, driven primarily by lithium-ion battery

Get a quote

Argentina to launch call for energy storage proposals

Argentina is set to launch a call for expressions of interest for energy storage projects as it looks to reach 20% renewable energy in 2025.

Get a quote

Lithium batteries, made in Argentina: Can they compete globally?

Argentina will start operations at the first lithium battery cell factory in Latin America before the end of the year. The country aims to boost its position in the region''s electric

Get a quote

Argentina''s First Battery Energy Storage Systems

Argentina has taken a decisive step toward modernizing its power infrastructure, drawing international attention with its first large-scale battery

Get a quote

Unlocking Solar Freedom: 12V Lithium Batteries for Sustainable

4 days ago· Learn how 12V lithium batteries optimize solar performance and enable reliable off-grid living. Explore their role in energy storage, backup systems, and sustainable solar setups

Get a quote

Argentina''s Energy Storage Tender | LondianESS Manufactured

The Argentinian Ministry of Energy has launched the "AlmaGBA" Battery Energy Storage System (BESS) tender, aiming to deploy 500MW (4-hour duration, totaling 2GWh) to

Get a quote

Lithium-ion is long-duration energy storage (LDES)

3 days ago· These techs could leverage low raw material costs to store energy cheaply and decouple power output (MW) from energy capacity (MWh) to pay for only as much power

Get a quote

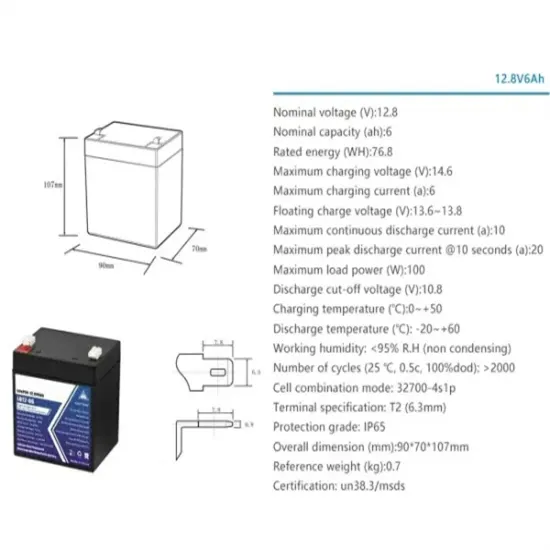

7Ah LiFePO4 Battery 12V Cycle Maintenance Free Home Energy Storage

2 days ago· 【Lightweight & Eco-friendly】 THISSENERGYSYSTEM LiFePO4 battery provides more than 4000 cycles and 10 years of life. Size: 12V 7AH. 【Original automotive grade lithium

Get a quote

Argentina''s First Energy Storage Tender Secures 1.35 GW of Bids

This week, the Argentinian government opened bids for the AlmaGBA tender, initiated in February 2025 to procure 500 MW of battery energy storage system (BESS)

Get a quote

Argentina Launches $500M Battery Storage Tender to

Argentina has opened a $500 million battery storage tender aimed at adding 500 MW of new energy storage capacity in the Buenos Aires

Get a quote

Argentina Residential Energy Storage: Powering Homes Through

Remember – in Argentina''s energy market, having storage is like having a good Malbec cellar: it keeps getting better with time!

Get a quote

Argentina''s Oversubscribed Energy Storage Tender

The first large-scale battery energy storage tender in Argentina is catching the attention of the international community as an unequivocal step

Get a quote

Argentina''s First Battery Energy Storage Systems Tender Draws

Argentina has taken a decisive step toward modernizing its power infrastructure, drawing international attention with its first large-scale battery energy storage tender.

Get a quote

6 FAQs about [Argentina energy storage batteries are maintenance-free]

How many MW of battery energy storage will be deployed in Buenos Aires?

The initiative aims to deploy 500 MW of battery energy storage systems (BESS) in the Greater Buenos Aires Area (GBA), but the submitted capacity has far exceeded expectations—reaching a combined 1,347 MW

Can battery energy storage modernize Argentina's grid?

Argentina’s ambitious push toward grid modernization through battery energy storage has received an enthusiastic response, with CAMMESA (Compañía Administradora del Mercado Mayorista Eléctrico) confirming the submission of 27 project proposals from 15 companies under its AlmaGBA program.

Why is Argentina a good stance on energy storage?

In Argentina, the stance provides a good lesson to the European stakeholders, especially in the commercial and industrial segments of energy storage. Emerging markets can present both local and foreign players by developing tenders that are investment appropriate and clear technically and financially secured.

Will Argentina integrate new electricity storage infrastructure into urban distribution networks?

This national and international open call, part of Resolution SE 67/2025, marks Argentina’s first large-scale effort to integrate new electricity storage infrastructure into urban distribution networks.

Will a 1.3 GW battery storage tender lead to a more robust energy future?

Make sure that these groundbreaking projects end successfully and the fruits of their experience help form a more robust energy future—not only in Latin America, but everywhere. Argentina’s 1.3 GW battery storage tender marks a transformative leap toward grid resilience and clean energy leadership in Latin America.

Can energy storage be a reliable source of energy?

As the opportunity to build energy storage as a reliable source in grids and to decarbonize becomes critical on a global stage, the oversubscribed tender launched by Argentina demonstrates the demand for scalable and bankable C&I energy storage systems projects, as well as the efficiency of collaborating with the government in their realization.

Guess what you want to know

-

Belgian energy storage batteries are maintenance-free

Belgian energy storage batteries are maintenance-free

-

Austria energy storage batteries are maintenance-free

Austria energy storage batteries are maintenance-free

-

Argentina installs energy storage batteries

Argentina installs energy storage batteries

-

Can photovoltaic energy storage batteries be placed indoors

Can photovoltaic energy storage batteries be placed indoors

-

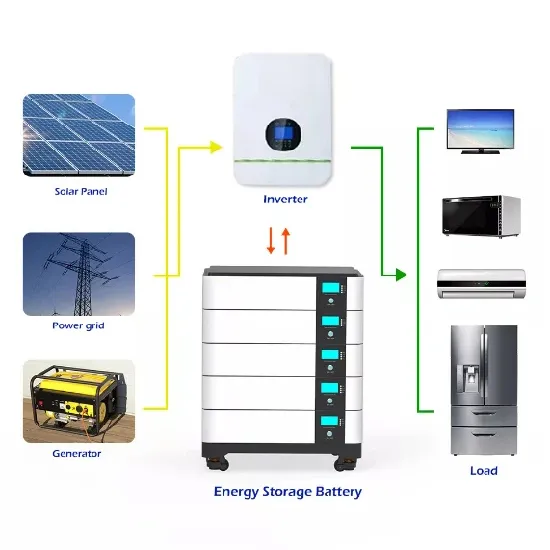

Energy storage cabinet batteries have lithium batteries

Energy storage cabinet batteries have lithium batteries

-

UK emergency energy storage batteries

UK emergency energy storage batteries

-

Advantages and disadvantages of high-voltage and low-voltage energy storage batteries

Advantages and disadvantages of high-voltage and low-voltage energy storage batteries

-

Various types of energy storage batteries

Various types of energy storage batteries

-

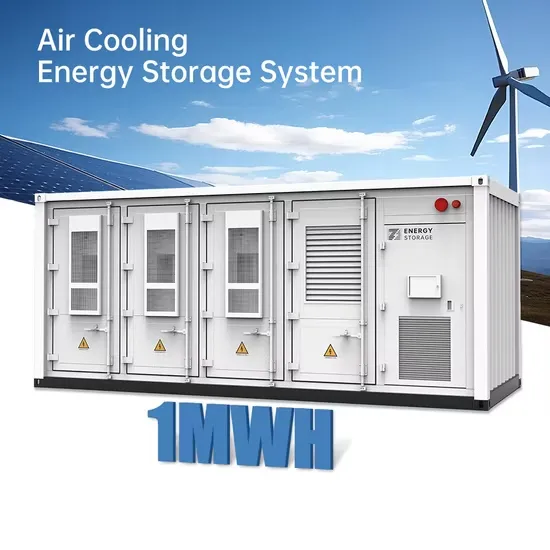

Charging voltage and current of energy storage container batteries

Charging voltage and current of energy storage container batteries

-

Recommended company for energy storage lithium batteries in Portugal

Recommended company for energy storage lithium batteries in Portugal

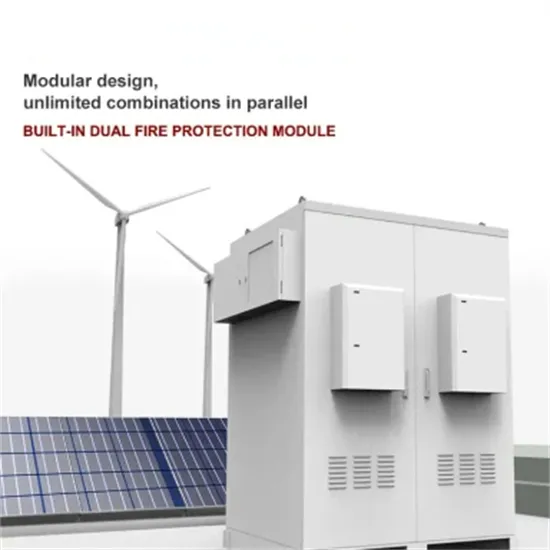

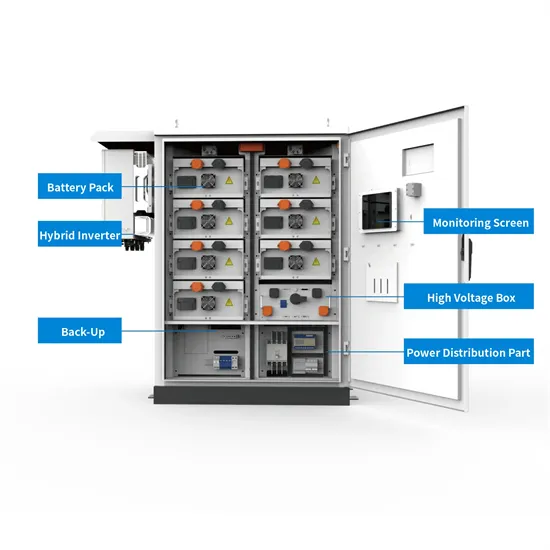

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.