New Berkeley Lab study shows that plummeting costs of solar,

Japan faces a significant energy security risk as it imports nearly all the fuel used in its power sector, with clean electricity accounting for only 24% of the total in 2019. A new

Get a quote

Japan: Large-scale battery storage opportunities in an evolving

Sho''s colleague, Eku Energy Japan managing director Kentaro Ono, explains that the METI subsidy covers up to 30% of the Capex cost for large-scale BESS. The Tokyo

Get a quote

BESS costs increased to 76,000 yen/kWh in FY2023

The majority of the increase was driven by the increase in the cost of the batteries themselves. That portion of the overall system cost has

Get a quote

Price of Large Energy Storage Batteries in Japan: Trends,

If you''re researching the price of large energy storage batteries in Japan, you''re likely part of a growing crowd. Think industrial project managers, renewable energy startups,

Get a quote

NGK sodium-sulfur batteries: Japan project, Duke

NGK Insulators'' proprietary battery tech features in a large-scale project that has just come online in Japan, as a pilot begins in the US.

Get a quote

Japan: Large-scale battery storage opportunities in an evolving

The energy storage market is experiencing a wave of significant growth in Japan, as ESN Premium hears from Eku Energy and BloombergNEF.

Get a quote

How much does it cost to build a battery energy

How much does it cost to build a battery in 2024? Modo Energy''s industry survey reveals key Capex, O&M, and connection cost benchmarks for BESS projects.

Get a quote

Battery Storage In Japan – Policy Deep Dive

Now that we''ve covered the benefits of battery storage and Japan''s growing interest, let''s dive into the Japanese government''s detailed policies on this promising technology.

Get a quote

Japan scales up batteries but companies worry rule changes may

3 days ago· Investors are pouring billions of dollars into Japan''s nascent electricity storage market as power demand is growing after a long decline, but changes proposed to smooth the

Get a quote

Energy storage cost – analysis and key factors to

This article provides an analysis of energy storage cost and key factors to consider. It discusses the importance of energy storage costs in the context of

Get a quote

Japan Incentivizes Battery Storage Projects Amid Growing Demand

By 2030, official estimates show variable renewable energy reaching 20% of Japan''s power mix. Noting the demand case and ever-growing renewables curtailment

Get a quote

Japan poised for a battery boom

With residential, commercial, and industrial batteries expected to balloon in the years ahead – and grid-scale systems beginning to appear – harmonizing Japan''s split

Get a quote

Is the Japanese energy storage market moving forward?

With multiple revenue streams supporting renewable energy, and extremely high demand for electricity, it may not be surprising that Japan is now ramping up investment in

Get a quote

Is the Japanese energy storage market moving forward?

With multiple revenue streams supporting renewable energy, and extremely high demand for electricity, it may not be surprising that Japan is

Get a quote

Cost Projections for Utility-Scale Battery Storage: 2023 Update

Executive Summary In this work we describe the development of cost and performance projections for utility-scale lithium-ion battery systems, with a focus on 4-hour duration

Get a quote

Top five energy storage projects in Japan

Global energy storage capacity was estimated to have reached 36,735MW by the end of 2022 and is forecasted to grow to 353,880MW by 2030. Japan had 1,671MW of

Get a quote

The 2035 Japan Report: Plummeting Costs of Solar, Wind, and

This study shows that, due to the decreasing costs of solar, wind (especially offshore), and battery technology, Japan can achieve a 90% clean electricity share by 2035.

Get a quote

BESS costs increased to 76,000 yen/kWh in FY2023 including

The majority of the increase was driven by the increase in the cost of the batteries themselves. That portion of the overall system cost has increased by 33.3% from 36,000

Get a quote

Japan''s Shift from Lithium to Sodium Batteries: A Strategic Pivot

As the demand for energy storage evolves, Japan is faced with the challenge of diversifying its battery technology to enhance energy security, reduce costs, and address

Get a quote

Japan Battery Market Report | Industry Analysis, Size

Japan Battery Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The Japan Battery Market report segments the

Get a quote

Japan to Give New Subsidies for Domestic EV Battery

The government will support 12 projects for storage batteries or those for their parts, materials or production equipment by up to ¥350 billion

Get a quote

Japan''s Shift from Lithium to Sodium Batteries: A

As the demand for energy storage evolves, Japan is faced with the challenge of diversifying its battery technology to enhance energy security,

Get a quote

Comprehensive review of energy storage systems technologies,

Battery, flywheel energy storage, super capacitor, and superconducting magnetic energy storage are technically feasible for use in distribution networks. With an energy density

Get a quote

The 2035 Japan Report: Plummeting Costs of Solar, Wind, and Batteries

This study shows that, due to the decreasing costs of solar, wind (especially offshore), and battery technology, Japan can achieve a 90% clean electricity share by 2035.

Get a quote

Real Cost Behind Grid-Scale Battery Storage: 2024 European

The rapidly evolving landscape of utility-scale energy storage systems has reached a critical turning point, with costs plummeting by 89% over the past decade. This dramatic shift

Get a quote

Microsoft Word

There exist a number of cost comparison sources for energy storage technologies For example, work performed for Pacific Northwest National Laboratory provides cost and performance

Get a quote

Japan Energy Storage Policies and Market Overview

Japan''s energy storage policies, market statistics, and trends—from METI''s strategic plans and subsidy programs to deployment challenges.

Get a quote

6 FAQs about [Japan s energy equipment costs and energy storage batteries]

Why are Japanese companies investing in battery energy storage systems?

Sign up here. That is creating surging interest in battery energy storage systems (BESS) to smooth mismatches in supply and demand. Since December 2023, companies have announced investments of at least $2.6 billion in Japanese battery storage projects, according to calculations by Reuters.

How much battery power does Japan have?

As of March, Japan had 0.23 GW of grid-connected BESS, according to METI. By comparison, China has 75 GW and the U.S. has installed nearly 26 GW of battery storage capacity, according to the Energy Institute.

Should you buy a battery storage system in Japan?

In addition, Japan’s capacity market is currently limited to battery storage systems lasting 3 hours, and the uncertainty of its overall revenue stack may make investors cautious about purchasing large-scale battery storage systems.

How big is Japan's battery storage market?

In the commercial space, Japan’s battery storage market was valued at USD 593.2 million in 2023 and is projected to reach USD 4.15 billion by 2030. While commercial installations currently dominate revenues, industrial adoption is expected to scale faster. Utility-scale storage is also gaining ground.

What is Japan's storage battery industry strategy?

The “Storage Battery Industry Strategy” document from METI sets out three key targets: Boost Domestic Manufacturing: Japan aims to ramp up its domestic production of automotive storage batteries to 100 GWh by 2030, with a long-term goal of reaching 150 GWh annually. This move highlights the potential for foreign companies to invest in Japan.

How much will Japan's energy storage system cost in 2023?

The $593 million worth of commercial energy storage systems recorded in Japan in 2023 could balloon to $4.15 billion by 2030, InfoLink reckons, with “industrial adoption expected to scale faster,” according to the data company.

Guess what you want to know

-

Energy storage equipment costs in Tunisia

Energy storage equipment costs in Tunisia

-

What equipment contains energy storage batteries

What equipment contains energy storage batteries

-

Energy storage equipment costs in Morocco

Energy storage equipment costs in Morocco

-

Equipment used for energy storage batteries

Equipment used for energy storage batteries

-

Energy storage equipment investment costs

Energy storage equipment investment costs

-

Advantages and Disadvantages of Instant Energy Storage Batteries

Advantages and Disadvantages of Instant Energy Storage Batteries

-

What are the equipment of electric energy storage vehicles

What are the equipment of electric energy storage vehicles

-

How much does energy storage module equipment cost in Uzbekistan

How much does energy storage module equipment cost in Uzbekistan

-

Myanmar power station energy storage equipment

Myanmar power station energy storage equipment

-

Which company is better for energy storage lithium batteries in Luxembourg

Which company is better for energy storage lithium batteries in Luxembourg

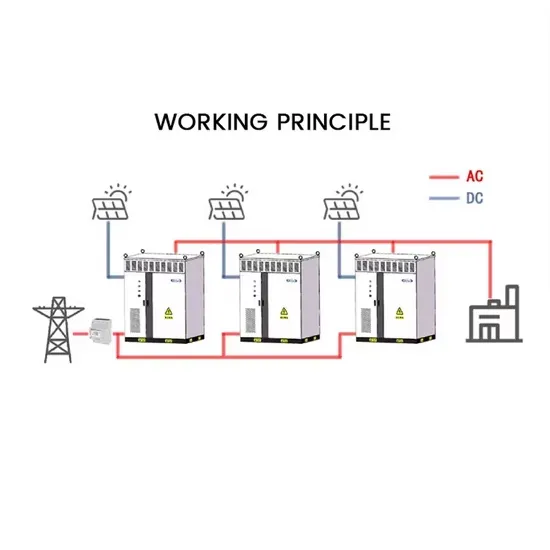

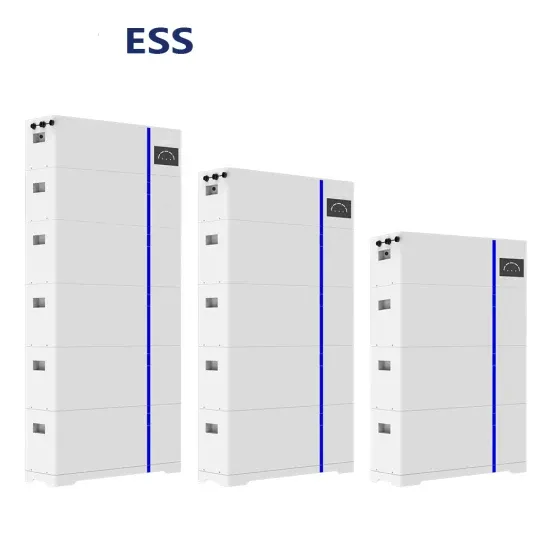

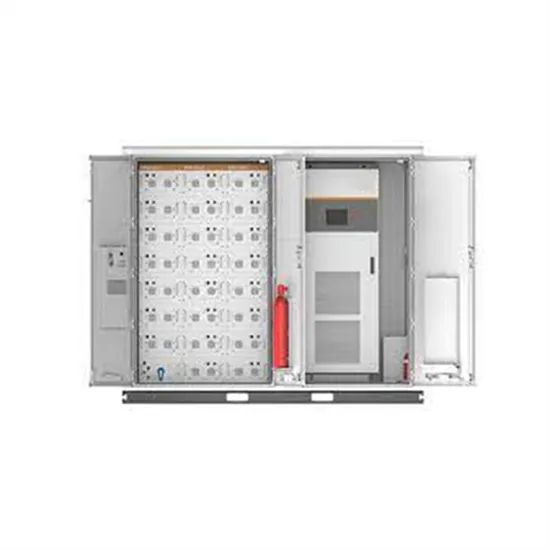

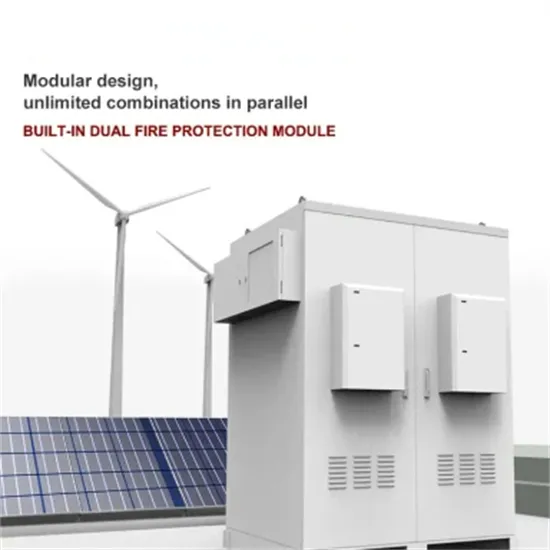

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.