Energy Transition in Asia-Pacific: Opportunities in 2025

The 2025 NDC updates offer Asia-Pacific countries a prime opportunity to lure investors and accelerate their energy transition pace.

Get a quote

Energy Outlook and Energy-Saving Potential in East Asia

Additionally, transitioning from coal-based power generation to a combination of gas and renewable energy, using Carbon Capture Storage (CCS) for coal and gas power, is vital.

Get a quote

Beyond tripling: Keeping ASEAN''s solar & wind momentum

Beyond tripling: Keeping ASEAN''s solar & wind momentum Southeast Asian nations require stronger policy support to stimulate solar and wind development, creating a

Get a quote

Asia is building the backbone of its renewable future with energy storage

From Southeast Asia to India and Australia, landmark policies, first-of-their-kind projects and bold investment decisions show that energy storage is no longer a niche

Get a quote

Pumped hydro energy storage and 100 % renewable electricity

East Asia has abundant wind, solar, and off-river pumped hydro energy resources. The identified pumped hydro energy storage potential is 100 times more than required to

Get a quote

Asia is building the backbone of its renewable future with energy

From Southeast Asia to India and Australia, landmark policies, first-of-their-kind projects and bold investment decisions show that energy storage is no longer a niche

Get a quote

Energy storage systems in the Asia Pacific region

Market dynamics, technical developments and regulatory policies that could be decisive for energy storage deployment in Australia, Mainland China,

Get a quote

Southeast Asia''s emerging energy storage opportuniti

Southeast Asia''s emerging energy storage opportunities Southeast Asia''s emerging energy storage opportunities Southeast Asia | There has been an uptick in energy storage investment

Get a quote

Low-cost, low-emission 100% renewable electricity in Southeast Asia

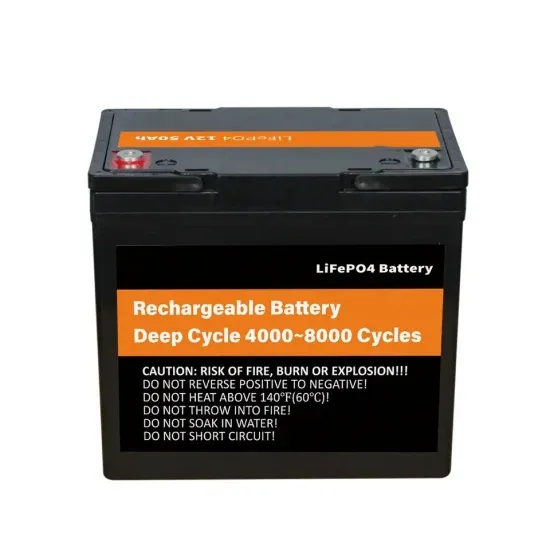

The features of STORES include large storage potential, high technology maturity and a long service life. Energy generation, storage and transmission are co-optimised based

Get a quote

IET Renewable Power Generation

Through an empirical case study for East Asia, the capacity demand and economic justification of long-term energy storage are analysed as well as the factors that affect the long

Get a quote

Energy storage systems in the Asia Pacific region

Market dynamics, technical developments and regulatory policies that could be decisive for energy storage deployment in Australia, Mainland China, Malaysia, Singapore, South Korea,

Get a quote

Preliminary analysis of long‐term storage requirement in enabling

Integrating a high penetration of renewable energy for developing sustainable and low‐carbon electric energy system is becoming a common trend around the world. Many

Get a quote

Energy Outlook and Energy-Saving Potential in East Asia

This report was prepared by the Working Group for Analysis of Energy Saving Potential in East Asia under an energy research project conducted by the Economic Research Institute for

Get a quote

OVERVIEW ENERGY STORAGE MARKET IN SOUTHEAST ASIA

Southeast Asian energy storage power supply manufacturers Here are some key energy storage power supply manufacturers in Southeast Asia:Sembcorp: One of Asia''s largest battery

Get a quote

Opportunities and challenges in Southeast Asia''s

Despite the challenges, Indonesia launched the Cirata floating solar power plant in West Java at the end of 2023 with a capacity of 192MW. It is the largest floating solar power

Get a quote

Pumped hydro energy storage and 100 % renewable electricity for East Asia

East Asia has abundant wind, solar, and off-river pumped hydro energy resources. The identified pumped hydro energy storage potential is 100 times more than required to

Get a quote

Annex: Regional Factsheets (Global Renewables Outlook)

China is world''s largest coal producer; ROK and Japan rely heavily on fossil-fuel imports. Air pollution and resource challenges; vast untapped renewable energy potential. PES: The total

Get a quote

Preliminary analysis of longâ term storage requirement in

In this study, we quantitatively analyse the role of long-term seasonal storage in enabling high VRE penetration. A generation expansion planning model is formulated to optimise the least

Get a quote

Storage in the energy transition in Asia-Pacific | PFI

As Asia gears up for a shift to renewable energy, energy storage has come to the fore. But the transition to cleaner power can be a bumpy ride. To navigate the uncertain

Get a quote

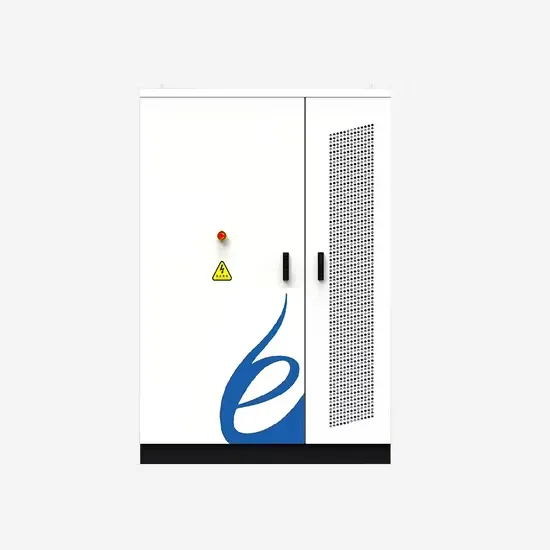

Sembcorp opens S-E Asia''s largest energy storage

Said by Sembcorp to be the largest in South-east Asia, it offers a solution to intermittent power generation, long a problem for countries as they

Get a quote

South-East Asia must harness regional power system

In this context, governments across South-East Asia, with the utilities that provide power to their citizens and businesses, are working hard

Get a quote

Southeast Asia''s largest energy storage system opens

SINGAPORE: The largest energy storage system in Southeast Asia opened on Jurong Island on Thursday (Feb 2), in another push for solar power

Get a quote

Energy Storage Comes into Focus as Asia Embraces Renewables

Energy storage is a rapidly growing sector in Asia as more renewables come online. This presents a range of new business opportunities

Get a quote

Green Horizon: East Asia''s Sustainable Energy Future

East Asia stands at a critical juncture for its energy future. This report provides a practical roadmap for transforming both power generation and industry together—because they''re

Get a quote

Pumped hydro energy storage and 100 % renewable electricity for East Asia

Off-river pumped hydro energy storage options, strong interconnections over large areas, and demand management can support a highly renewable electricity system at a

Get a quote

Southeast Asia Energy Outlook 2024

This sixth edition of the Southeast Asia Energy Outlook from the International Energy Agency (IEA) confirms that this region is poised to strengthen its position as an energy heavyweight.

Get a quote

6 FAQs about [East Asia Energy Storage Power Generation]

Does East Asia have pumped hydro energy?

East Asia has abundant wind, solar, and off-river pumped hydro energy resources. The identified pumped hydro energy storage potential is 100 times more than required to support 100% renewable energy in East Asia.

What is the future of energy in East Asia?

In APS and LCET, hydrogen, nuclear, solar PV and wind, and other renewable energy will increase. Coal Oil Natural gas Energy Outlook and Energy Saving 132 Potential East Asia 2023 Third, power generation is projected to grow slower in 2030–2050 than in 2000–2019. The share of coal power is projected to be 46.1% in BAU and 1.2% in LCET in 2050.

How much energy does East Asia use?

The rest of the primary energy supply came from hydropower at 10.9%, coal at 6.0%, biomass with 5.9%, and a smaller percentage of other renewables such as wind, solar photovoltaics, and biofuels. Energy Outlook and Energy Saving 278Potential East Asia 2023 7 6 5 4 3 2 1 0 Final energy consumption was about 14.1 Mtoe in 2020.

What are the major energy sources in East Asia?

Note: ‘Others’ include biomass, solar, wind, bioethanol and biodiesel. Source: Department of Energy, 2019. Hydro 1.2% Geothermal 15.4% Natural gas 6.1% Coal 27.8% Others 16.2% Oil 33.4% Energy Outlook and Energy Saving 304Potential East Asia 2023 Meanwhile, the country’s total electricity generation in 2019 reached 106.4 terawatt-hours (TWh).

What is the future of power generation in East Asia?

46Potential East Asia 2023 Thermal efficiency of power generation is projected to improve for coal-fired power plants, from 36.3% in 2019 to 48.4% in 2050.

Which energy technologies should be included in ASEAN's Energy Outlook modelling?

Thus, the Economic Research Institute for ASEAN and East Asia has considered including commercially available energy technologies such as carbon capture, utilisation, and storage; hydrogen; and ammonia fuels into the region’s energy outlook modelling. Professor Tetsuya Watanabe President, Economic Research Institute for ASEAN and East Asia

Guess what you want to know

-

Middle East Hybrid Energy Storage Power Generation Project

Middle East Hybrid Energy Storage Power Generation Project

-

East Asia Energy Storage Power Supply Customization

East Asia Energy Storage Power Supply Customization

-

Photovoltaic energy storage power generation in the Middle East

Photovoltaic energy storage power generation in the Middle East

-

Integrated energy storage and power generation

Integrated energy storage and power generation

-

Cambodia s photovoltaic power generation and energy storage requirements

Cambodia s photovoltaic power generation and energy storage requirements

-

Myanmar off-grid photovoltaic power generation and energy storage system

Myanmar off-grid photovoltaic power generation and energy storage system

-

Energy storage vs photovoltaic power generation which is more cost-effective

Energy storage vs photovoltaic power generation which is more cost-effective

-

American companies photovoltaic power generation and energy storage equipment

American companies photovoltaic power generation and energy storage equipment

-

Czech energy storage grid-connected power generation

Czech energy storage grid-connected power generation

-

Energy storage power generation measurement user side

Energy storage power generation measurement user side

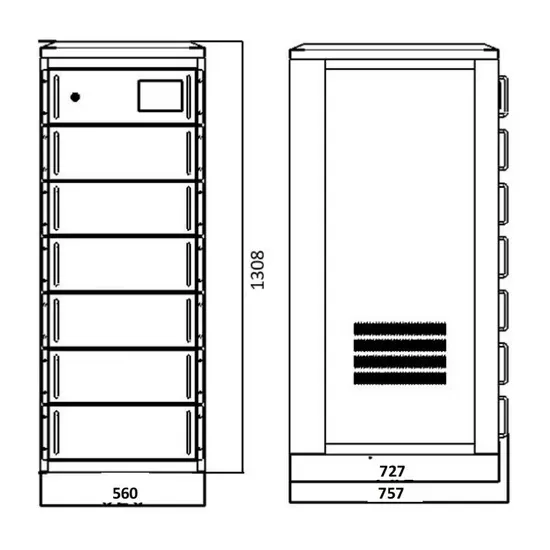

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.