From communication base station to emergency

Lead-acid batteries have built a solid power guarantee network in the field of communication base stations and emergency power supplies by virtue of their

Get a quote

Battery for Communication Base Stations Market Size and

The market is segmented by application (MSC, macro, micro, pico, and femto cell sites) and battery type (lead-acid, lithium-ion, and others), offering opportunities for specialized

Get a quote

Maintenance and care of lead-acid battery packs for solar communication

The battery pack is an important component of the base station to achieve uninterrupted DC power supply. Its investment is basically the same as that of the rack power supply equipment.

Get a quote

Pure lead-acid batteries for telecommunication application

Answers to these questions can be found in our free white paper "Pure lead batteries: More power - less energy consumption". Download whitepaper now for free!

Get a quote

Lead-acid Battery for Telecom Base Station

The Lead-acid Battery for Telecom Base Station market size, estimations, and forecasts are provided in terms of sales volume (KWh) and sales revenue ($ millions), considering 2023 as

Get a quote

Telecom Battery Backup System | Sunwoda Energy

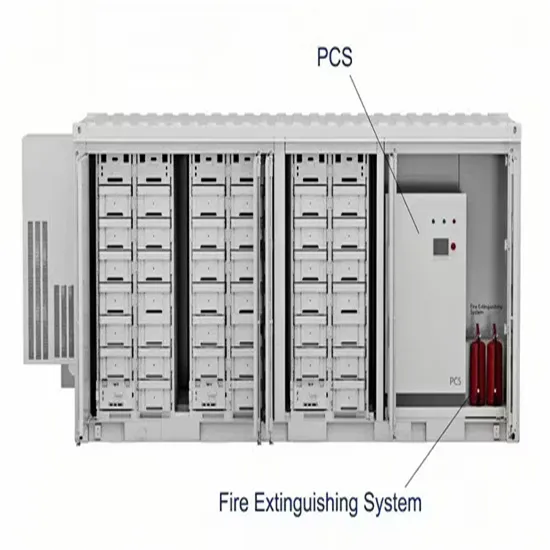

A telecom battery backup system is a comprehensive portfolio of energy storage batteries used as backup power for base stations to ensure a reliable and stable power supply.

Get a quote

From communication base station to emergency power supply lead-acid

Lead-acid batteries have built a solid power guarantee network in the field of communication base stations and emergency power supplies by virtue of their stability, reliability, adaptability to the

Get a quote

How Energy Storage Lead Acid Batteries Are Revolutionizing Telecom Base

This article delves into the various aspects of energy storage lead acid batteries, exploring their advantages, applications, and the future of telecom base stations.

Get a quote

10 อันดับ โรงงานผลิตแบตเตอรี่ของไทย

10 อันดับ โรงงานผลิตแบตเตอรี่ของไทยรวมถึง บริษัท พลังงานบริสุทธิ์ จำกัด (มหาชน),บริษัท ยัวซ่าแบตเตอรี่ ประเทศไทย จำกัด,บริษัท ไทย เอ็นเนอร์จีส

Get a quote

The Benefits of Maintenance-Free Lead Acid Batteries for Telecom Base

Telecom base stations are the backbone of modern communication infrastructure, requiring reliable and efficient power sources to operate continuously. In this context, maintenance-free

Get a quote

Battery Market in ASEAN

Thailand continues to be a net exporter of lead-acid batteries, with key export markets in ASEAN. However, as global demand shifts towards lithium-ion batteries, lead-acid battery exports have

Get a quote

Communication Base Station Energy Storage Battery Market

The Communication Base Station Energy Storage Battery market is experiencing robust growth, driven by the increasing deployment of 5G and other advanced wireless technologies. The

Get a quote

Global Lead-acid Battery for Telecom Base Station Market

In the past, communication base station backup energy storage was mainly lead-acid batteries, but they pollute the environment, are large in size, and have low energy density, and cannot

Get a quote

Battery specifications for communication base stations

These batteries offer reliable,cost-effective backup powerfor communication networks. They are significantly more efficient and last longer than lead-acid batteries. At the same time,they''re

Get a quote

Global Lead-acid Battery for Telecom Base Station Sales Market

The global Lead-acid Battery for Telecom Base Station market size was US$ million in 2024 and is forecast to a readjusted size of US$ million by 2031 with a CAGR of %during the forecast

Get a quote

Lead-acid Battery for Telecom Base Station Market''s Tech

The forecast period of 2025-2033 anticipates a steady expansion in the telecom base station lead-acid battery market. This growth will be influenced by the ongoing rollout of

Get a quote

Consumer Behavior and Communication Base Station Energy Storage Battery

The global Communication Base Station Energy Storage Battery market is experiencing robust growth, driven by the increasing deployment of 5G and other advanced communication

Get a quote

CTECHI 5G Telecom Base Station Battery 48V 50Ah

Application: 1. Instead of the lead acid battery to supply power to base station equipment. 2. Outdoor station / Distributed base station / Indoor macro station

Get a quote

Communication Base Station Lead-Acid Battery: Powering

In an era where lithium-ion dominates headlines, communication base station lead-acid batteries still power 68% of global telecom towers. But how long can this 150-year-old technology

Get a quote

Communication Base Station Power Backup Units

When typhoons knock out power grids or extreme temperatures strain energy systems, communication base station power backup units become the last line of defense for

Get a quote

Top Lithium Ion Battery Manufacturers in Thailand

Overview: Siam GS Battery has been a leading battery manufacturer in Thailand since 1970. While historically focused on automotive lead-acid batteries, it has ventured into lithium-ion

Get a quote

Communication Base Station Energy Storage Lithium Battery

Lithium batteries demonstrate distinct operational cost advantages over traditional lead-acid solutions in communication base station energy storage, particularly when evaluating long

Get a quote

How Energy Storage Lead Acid Batteries Are Revolutionizing

This article delves into the various aspects of energy storage lead acid batteries, exploring their advantages, applications, and the future of telecom base stations.

Get a quote

Tower base station energy storage battery

The communication base station backup power supply has a huge demand for energy storage batteries, which is in line with the characteristics of large-scale use of the battery by the ladder,

Get a quote

Top Lithium Ion Battery Manufacturers in Thailand

Overview: Siam GS Battery has been a leading battery manufacturer in Thailand since 1970. While historically focused on automotive lead-acid batteries, it has

Get a quote

GS Battery

The main purpose of the company was to manufacture automobile and pick-up batteries plus small sealed lead-acid batteries for cordless telephones as per the growing demand of GS

Get a quote

Lead-Acid Batteries in Telecommunications: Powering...

Lead-acid batteries, with their reliability and well-established technology, play a pivotal role in ensuring uninterrupted power supply for telecommunications infrastructure. This article

Get a quote

4 FAQs about [Thailand communication base station lead-acid battery]

Why are lead-acid batteries important in ASEAN?

The country ranks among the top automotive producers in ASEAN, making lead-acid batteries essential for vehicle applications. Additionally, lead-acid batteries are increasingly used for power backup in data centres, a sector experiencing significant growth.

Where do lead-acid batteries come from?

Lead-acid battery exports from Thailand and Malaysia remain strong. Exports are now declining as global markets shift towards lithium-based alternatives. The ASEAN battery market is highly competitive, with a mix of domestic and international manufacturers.

Are lithium ion batteries better than lead-acid batteries?

Lead-acid batteries still dominate due to affordability and use in automotive applications. Lithium-ion (Li-ion) batteries are gaining traction as cleaner and more efficient alternatives. Governments and manufacturers are pushing to expand energy storage solutions. Vietnam, Thailand, and Malaysia lead battery production in the region.

What is the difference between Li-ion and lead-acid batteries?

Li-ion batteries offer superior energy retention and are widely used in consumer electronics and electric vehicles (EVs). In contrast, lead-acid batteries are mostly used in the automotive sector for starting, lighting, and ignition applications.

Guess what you want to know

-

Belgian communication base station lead-acid battery bidding

Belgian communication base station lead-acid battery bidding

-

What s inside a lead-acid battery in a communication base station

What s inside a lead-acid battery in a communication base station

-

Somalia communication base station lead-acid battery cabinet in stock

Somalia communication base station lead-acid battery cabinet in stock

-

Malawi communication base station lead-acid battery equipment manufacturer

Malawi communication base station lead-acid battery equipment manufacturer

-

Kuwait Da Communication Base Station Lead-acid Battery

Kuwait Da Communication Base Station Lead-acid Battery

-

Third-party communication base station lead-acid battery equipment

Third-party communication base station lead-acid battery equipment

-

Tuvalu Communication Base Station Lead-Acid Battery 125kWh

Tuvalu Communication Base Station Lead-Acid Battery 125kWh

-

Malaysia small communication base station lead-acid battery

Malaysia small communication base station lead-acid battery

-

Burkina Faso communication base station lead-acid battery bidding

Burkina Faso communication base station lead-acid battery bidding

-

Communication base station lead-acid battery cooling chassis company

Communication base station lead-acid battery cooling chassis company

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.