Communication Base Station Energy Storage Lithium Battery

According to YH Research, the global market for Communication Base Station Energy Storage Lithium Battery should grow from US$ million in 2023 to US$ million by 2030, with a CAGR of

Get a quote

energy storage for communication base stations in brazil

This paper proposes an analysis method for energy storage dispatchable power that considers power supply reliability, and establishes a dispatching model for 5G base station energy

Get a quote

BRAZIL ENERGY COUNTRY PROFILE

This paper proposes an analysis method for energy storage dispatchable power that considers power supply reliability, and establishes a dispatching model for 5G base station energy

Get a quote

Brazil Energy Storage Market 2024-2030

Brazil is a leader in sustainable energy and has approximately 20GW of installed wind and solar power, but because of high import taxes and a lack of supportive policies, its

Get a quote

Brazil Energy Storage Market 2024-2030

The article provides a detailed examination of the top 10 energy storage companies operating in Brazil. Each company is profiled with a brief history, its global headquarters, and

Get a quote

Battery energy storage systems in Brazil: current regulatory and

Explore Brazil''s battery energy storage systems, focusing on current regulations, investment opportunities, and the role of these systems in the energy transition.

Get a quote

''Brazil could have $3.8bn battery energy storage

An unreliable grid is driving Brazilian energy storage demand. The world is set to have more than 760 GWh of energy storage capacity by 2030,

Get a quote

Lithium Battery for Communication Base Stations Market

The Lithium Battery for Communication Base Stations market presents a multitude of opportunities driven by technological advancements and the increasing demand for reliable

Get a quote

Communication Base Station Energy Storage Lithium Battery

Report Scope The Communication Base Station Energy Storage Lithium Battery market size, estimations, and forecasts are provided in terms of output/shipments (K Units) and revenue ($

Get a quote

Tech providers, contractors revealed for Brazil''s

Further details about Brazil''s largest battery storage project to date have been revealed including its integrators and equipment providers. The

Get a quote

What are the communication base station energy

These energy storage systems are pivotal in providing backup power to base stations and ensuring minimal service interruptions. Integrating

Get a quote

Brazil Battery for 5G Base Station Market Size 2026-2033 | Key

The Brazil Battery for 5G Base Station market is led by a mix of global multinationals and strong domestic players that collectively shape the industry landscape.

Get a quote

2024 Global energy storage system (ESS) shipment ranking

InfoLink Consulting has released its 2024 global energy storage system (ESS) shipment ranking, based on its Energy Storage Supply Chain Database. In 2024, global ESS

Get a quote

Top 10 energy storage companies in Brazil

The article provides a detailed examination of the top 10 energy storage companies operating in Brazil. Each company is profiled with a brief history, its global headquarters, and its primary

Get a quote

Demand Patterns in Communication Energy Storage Market:

The communication energy storage market is experiencing robust growth, driven by the increasing demand for reliable power backup in telecommunications infrastructure. The

Get a quote

Global energy storage cell, system shipment ranking 1H24

In terms of energy storage systems, InfoLink''s database shows that global energy storage system shipment stood at 90 GWh in the first half. The top five BESS integrators in the

Get a quote

Brazil Battery Energy Storage System Market (2025-2031)

The growing deployment of renewable energy and the need for grid stability and energy management solutions are driving the growth of the battery energy storage system market in

Get a quote

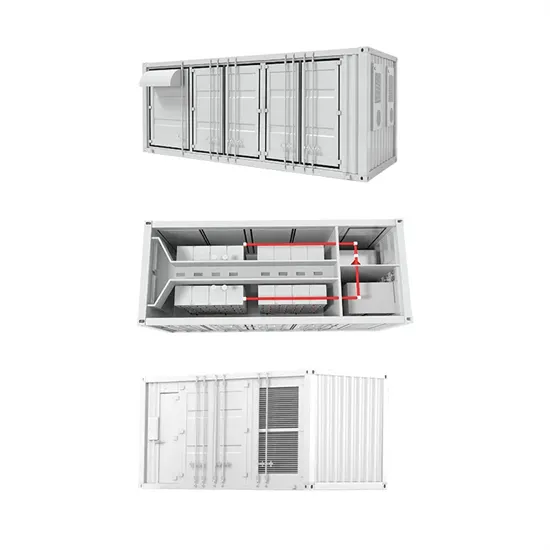

Base Station Energy Storage

Highjoule powers off-grid base stations with smart, stable, and green energy. Highjoule''s site energy solution is designed to deliver stable and reliable power for telecom base stations in off

Get a quote

Ranking of Brazilian industrial energy storage manufacturers

Our range of products is designed to meet the diverse needs of base station energy storage. From high-capacity lithium-ion batteries to advanced energy management systems, each

Get a quote

''Brazil could have $3.8bn battery energy storage market by 2030''

An unreliable grid is driving Brazilian energy storage demand. The world is set to have more than 760 GWh of energy storage capacity by 2030, led by Chinese and United

Get a quote

Tech providers, contractors revealed for Brazil''s largest BESS

Further details about Brazil''s largest battery storage project to date have been revealed including its integrators and equipment providers. The inauguration of the

Get a quote

Brazil Battery Energy Storage Systems Market Size and

Battery energy storage systems (BESS) are key enablers of grid flexibility, energy reliability, and renewable energy integration. These systems store electricity during low

Get a quote

Global Communication Base Station Energy Storage Lithium

These batteries are used to provide backup power to the base station during power outages or in areas where the power supply is unstable. The energy storage lithium battery is an important

Get a quote

a complete list of communication base station energy storage

A Study on Energy Storage Configuration of 5G Communication Base Station 5G base station has high energy consumption. To guarantee the operational reliability, the base station generally

Get a quote

Distribution network restoration supply method considers 5G base

In view of the impact of changes in communication volume on the emergency power supply output of base station energy storage in distribution network fault areas, this

Get a quote

Base station energy storage shipments

With the rapid growth of 5G technology, the increase of base stations not noly brings high energy consumption, but also becomes new flexibility resources for power system. For high energy

Get a quote

6 FAQs about [Brazil communication base station energy storage system ranking]

What is Brazil's largest battery storage project?

Further details about Brazil’s largest battery storage project to date have been revealed including its integrators and equipment providers. The inauguration of the 30MW/60MWh system took place last year, on the networks of transmission system operator (TSO) ISO CTEEP, as reported by Energy-Storage.news in November.

What are the top 10 energy storage companies in Brazil?

Due to various incentives and policies, Brazil's optical storage market has seen a rapid growth. The document presents a comprehensive list of the top 10 energy storage companies including Baterias Moura, BYD, Freedom Won, Blue Nova Energy, Intelbras, Huntkey, FIMER, SMA Solar, Sungrow, and SolarEdge.

Will Brazil install a battery energy storage system in 2024?

A study by Brazilian consultancy Greener has indicated that the country installed 269 MWh of energy storage capacity in 2024, growth of 29% from 2023. Demand for battery energy storage system (BESS) components grew 89% in Brazil from 2023 to 2024 and most of the resulting systems are likely to be installed in 2025.

What is driving Brazilian energy storage demand?

An unreliable grid is driving Brazilian energy storage demand. The world is set to have more than 760 GWh of energy storage capacity by 2030, led by Chinese and United States markets dominated by utility-scale systems.

Can Brazil be a big battery storage country?

With well-designed policies and regulations, Brazil has significant potential to follow in the footsteps of jurisdictions like California and Chile for large-scale battery storage, Germany for distributed and large-scale storage, and Australia for both pumped hydro and large-scale battery systems.

Can foreigners invest in battery storage businesses in Brazil?

Investment, incentives and taxation scenarios According to Brazilian law, there are no legal restrictions on direct foreign investment in the battery storage businesses or in the power sector (except in very specific segments or sectors of the economy).

Guess what you want to know

-

How to use small communication base station energy storage system

How to use small communication base station energy storage system

-

Government Photovoltaic Communication Base Station Energy Storage System

Government Photovoltaic Communication Base Station Energy Storage System

-

What is a wind power energy storage cabinet fan for a communication base station

What is a wind power energy storage cabinet fan for a communication base station

-

How much does the Latvian communication base station energy storage battery system cost

How much does the Latvian communication base station energy storage battery system cost

-

Transfer communication base station energy storage system

Transfer communication base station energy storage system

-

Are communication base station batteries energy storage batteries

Are communication base station batteries energy storage batteries

-

Luo Communication Base Station Energy Storage System

Luo Communication Base Station Energy Storage System

-

Iranian communication base station energy storage system

Iranian communication base station energy storage system

-

Replacement of equipment in the communication base station energy storage system

Replacement of equipment in the communication base station energy storage system

-

Installation of wind-solar hybrid energy storage cabinet for communication base station

Installation of wind-solar hybrid energy storage cabinet for communication base station

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.