Overview: energy storage market in Southeast Asia

Six countries have committed to achieving net zero goals in the future, and renewable energy will accelerate construction. In the meantime, you can learn

Get a quote

What Are The Implications Of $66/kWh Battery Packs In China?

China''s battery packs plummet in price again. Hydrogen prices didn''t decline and BNEF triples its estimates for future costs. The implications are huge.

Get a quote

What is the Cost of BESS per MW? Trends and 2025 Forecast

As of most recent estimates, the cost of a BESS by MW is between $200,000 and $450,000, varying by location, system size, and market conditions. This translates to around

Get a quote

Asia Pacific Lithium-Ion Stationary Battery Storage Market,

The Asia Pacific lithium-ion stationary battery storage market size exceeded USD 82.3 billion in 2024 and is expected to grow at a CAGR of 30.3% from 2025 to 2034, driven by the need to

Get a quote

Asia Pacific Battery Energy Storage System Market

The market size was estimated at 4.51 USD Billion in 2024 and is expected to reach 49.20 USD Billion by 2034, with a CAGR of 27.0% from 2025 to 2034.

Get a quote

How much does lithium battery energy storage cost per watt?

Specifically, the price ranges on average from $200 to $300 per watt, contingent upon system specifications and other components integrated into the overall energy storage

Get a quote

Asia-Pacific Energy Storage System Price Trends: What You

Let''s face it – the Asia-Pacific energy storage system price trends are hotter than a lithium battery on a summer day. From solar farms in Australia to EV factories in China, everyone''s asking:

Get a quote

The Ultimate Guide to Lithium-Ion Battery Banks for

As battery technology continues to evolve, lithium-ion batteries will remain at the forefront of home energy storage, offering greater efficiency,

Get a quote

How much does lithium battery energy storage cost

Specifically, the price ranges on average from $200 to $300 per watt, contingent upon system specifications and other components integrated into

Get a quote

China Battery Energy Storage System Manufacturers

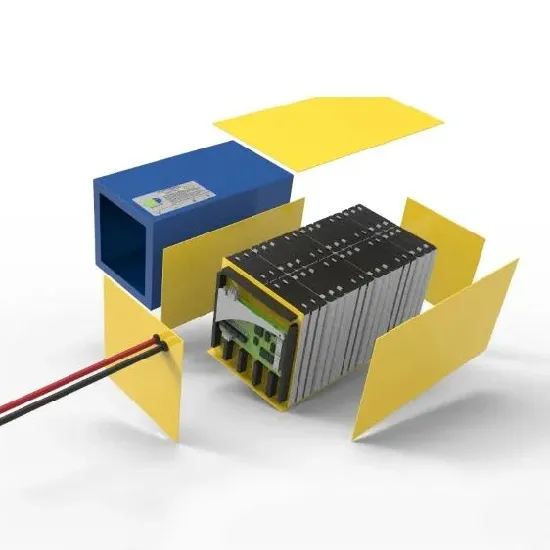

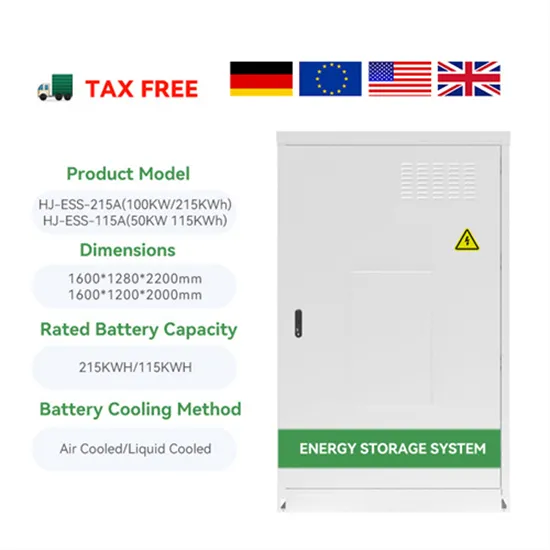

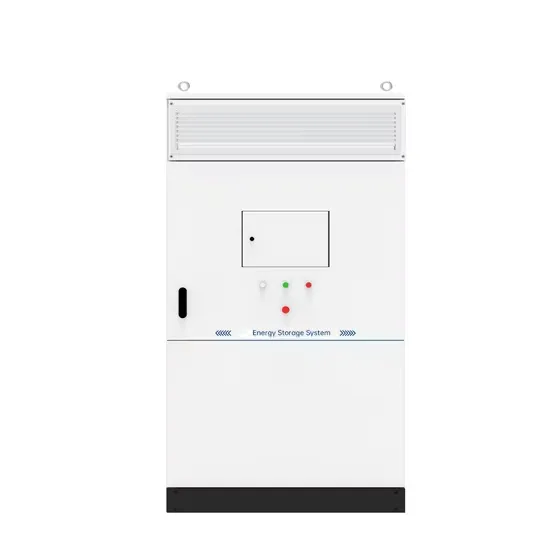

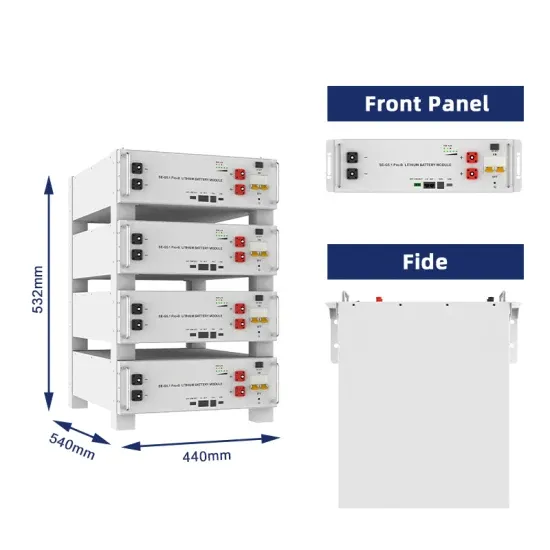

ESS Industrial Energy Storage System – 100kW / 215kWh Containerized BESS.High-performance lithium battery energy storage system designed for industrial and commercial applications.This

Get a quote

How much is the price of Hubei energy storage lithium battery

1. Hubei energy storage lithium battery prices vary significantly based on capacity, technology, and supplier, ranging from **100 to 1000 USD per kWh, 2. Factors influencing

Get a quote

Asia-Pacific Battery Energy Storage System Market

The Asia-Pacific Battery Energy Storage System Market is growing at a CAGR of greater than 15% over the next 5 years. BYD Company Limited, LG Chem Ltd, Contemporary

Get a quote

Analysts predict 30% reduction in Asia-Pacific

The Asia-Pacific region will continue to be the world''s leading centre of lithium-ion cell manufacturing for the next decade, but it won''t just be

Get a quote

Lithium-ion battery demand forecast for 2030 | McKinsey

Battery energy storage systems (BESS) will have a CAGR of 30 percent, and the GWh required to power these applications in 2030 will be

Get a quote

Lower costs spark surge in battery storage projects

In 2024, lithium-ion battery pack prices dropped to the lowest in eight years. Significantly lower raw material costs and more affordable battery technologies are driving

Get a quote

Top Lithium Battery Manufacturers in 2025: Who

Are you navigating the booming electric vehicle (EV) and energy storage markets and wondering which battery manufacturers are powering the

Get a quote

Asia Pacific Battery Energy Storage System Market Size, Share

The market size was estimated at 4.51 USD Billion in 2024 and is expected to reach 49.20 USD Billion by 2034, with a CAGR of 27.0% from 2025 to 2034. Key drivers include advancements

Get a quote

World''s largest 8-hour lithium battery wins tender in NSW

Ark Energy''s 275 MW/2,200 MWh lithium-iron phosphate battery to be built in northern New South Wales has been announced as one of the

Get a quote

Lower costs spark surge in battery storage projects

In 2024, lithium-ion battery pack prices dropped to the lowest in eight years. Significantly lower raw material costs and more affordable battery

Get a quote

Foreign companies bet on Japan''s battery storage market

Solar panels in the western Japanese city of Kitakyushu: As Japan integrates more renewables into its energy mix, the market for battery storage is forecast to grow.

Get a quote

Asia Pacific Lithium-Ion Stationary Battery Storage

The Asia Pacific lithium-ion stationary battery storage market size exceeded USD 82.3 billion in 2024 and is expected to grow at a CAGR of 30.3% from 2025 to

Get a quote

How much does energy storage lithium battery OEM charge?

1. The cost of energy storage lithium battery OEM services can vary significantly based on several factors, including specifications, production scale, and supplier demands. 2.

Get a quote

What Are The Implications Of $66/kWh Battery Packs In China?

Bids averaged $66.3/kWh, with 60 bids under $68.4/kWh. The tender, covering supply, system design, installation guidance, 20-year maintenance, and safety features,

Get a quote

Analysts predict 30% reduction in Asia-Pacific

The Asia-Pacific region will continue to be the world''s leading centre of lithium-ion cell manufacturing for the next decade, but it won''t just be price reductions in batteries that will

Get a quote

Market attractiveness analysis of battery energy storage systems

The study assesses the Battery Energy Storage Systems (BESS) market in Southeast Asia, highlighting its early stage and lack of policies, proposing a BESS market attractiveness index

Get a quote

Asia Pacific (APAC) grid-scale energy storage pricing 2024

This report analyses the cost of lithium-ion battery energy storage systems (BESS) within the APAC grid-scale energy storage segment, providing a 10-year price forecast by both

Get a quote

6 FAQs about [How much is the West Asia energy storage lithium battery]

What is battery energy storage system?

Battery Energy Storage system is defined as devices enabling energy from renewables, like solar and wind, to be stored and released when customers need power most. The Asia-Pacific battery energy storage system market is segmented by technology type, application, and geography.

What is the demand for battery energy storage systems in 2025?

Driven by strong growth in China and India, the commercial and industrial storage segment is expected to reach 9 GW by 2025. due to these, there is high demand for battery energy storage systems from the commercial and industrial sectors.

Will Australian batteries help keep energy prices down?

In December 2022, the Australian government announced that eight large batteries to store renewable energy would be built around Australia to support the grid and help keep energy prices down. Nearly USD 120 million in funding for the projects will be provided by the government-owned Australian Renewable Energy Agency (Arena).

Where are the new lithium ion batteries located?

The batteries will be located in Gnarwarre, Moorabool, and Mortlake in Victoria, Mount Fox and Western Downs in Queensland, Liddell in New South Wales, and Bungama and Blyth in South Australia. These batteries will range from 200-300 MWh each, have grid-forming inverter technology and are expected to come online by 2025.

Can a battery energy storage system be integrated into a primary energy grid?

As variable renewable energy sources such as wind and solar are inherently variable, so cannot be directly integrated into the primary energy grid without risking grid instability and need to be paired with Battery Energy Storage systems to store excess generation and stabilize the grid by providing frequency regulation and ancillary services.

How many energy storage opportunities are there in India?

The India Energy Storage Alliance (IESA) has estimated over 70 GW and 200 GWh of energy storage opportunities in India in the coming year, which is one of the highest in the world. Out of 70 GW, over 35 GW of demand is expected from newer applications like solar integration.

Guess what you want to know

-

How much does energy storage lithium battery retail for

How much does energy storage lithium battery retail for

-

Huawei North Asia lithium battery energy storage cabinet

Huawei North Asia lithium battery energy storage cabinet

-

How much is the EU energy storage lithium battery

How much is the EU energy storage lithium battery

-

West Asia 5kW home energy storage battery

West Asia 5kW home energy storage battery

-

How much does lithium battery energy storage cost

How much does lithium battery energy storage cost

-

North Asia Energy Storage Lithium Battery Manufacturer

North Asia Energy Storage Lithium Battery Manufacturer

-

How long can lithium battery energy storage containers be used

How long can lithium battery energy storage containers be used

-

How to choose lithium battery for solar energy storage cabinet

How to choose lithium battery for solar energy storage cabinet

-

How much does a Japanese energy storage cabinet lithium battery cost

How much does a Japanese energy storage cabinet lithium battery cost

-

How much does a lithium battery for energy storage cost in Kuwait

How much does a lithium battery for energy storage cost in Kuwait

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.