The Top Energy Storage Companies Revolutionizing Industry

Explore the top energy storage companies that are revolutionizing the industry with cutting-edge technologies. Learn how these innovators are shaping a greener, more

Get a quote

Chinese companies Tsingshan and BYD withdraw from lithium

Chinese companies BYD and Tsingshan decided to withdraw from lithium projects in Chile, a move that could be attributed to the challenging current international market scenario.

Get a quote

Top 15 Lithium Battery Manufacturers to Power Your

Preface The demand for lithium-ion batteries has increased dramatically in recent years because of their extensive use in electric vehicles,

Get a quote

Prevalon Energy and Innergex Ink Contracts for Advanced

Prevalon Energy has signed two major contracts with Innergex Renewable Energy Inc. to deploy cutting-edge Battery Energy Storage Systems (BESS) at the San Andrés and

Get a quote

Lithium Iron Phosphate Energy Storage Resonance: The Future''s

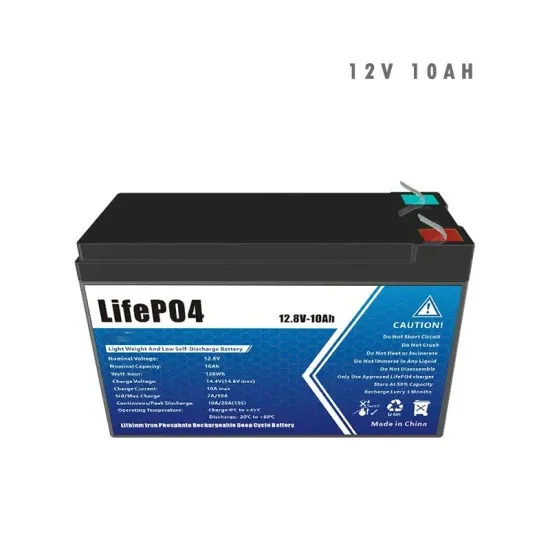

The Science of Stable Vibes: LiFePO4''s Party Trick Imagine a rock band where every member actually stays in tune. That''s essentially what happens in lithium iron phosphate (LiFePO4)

Get a quote

Energy Storage Efficiency in Lithium Iron Phosphate Batteries

The energy storage efficiency in Lithium Iron Phosphate (LFP) batteries market is in a growth phase, driven by increasing demand for electric vehicles and renewable energy

Get a quote

German Giant BASF Contemplates Establishment of Lithium

In a significant move in October, Tsingshan committed to a substantial investment of $233 million in a lithium iron phosphate plant, securing preferential access to locally sourced

Get a quote

Tsingshan plans $233 million lithium-related investment in Chile

China''s Tsingshan Holding Group will invest $233.2 million to set up a plant in Chile to produce lithium iron phosphate (LFP), used to power electric vehicles, Chilean

Get a quote

Prevalon Energy and Innergex Ink Contracts for Advanced Battery Storage

Prevalon Energy has signed two major contracts with Innergex Renewable Energy Inc. to deploy cutting-edge Battery Energy Storage Systems (BESS) at the San Andrés and

Get a quote

lifepo4 battery companies stock

As the world shifts toward sustainable energy solutions, lithium iron phosphate (LiFePO4) batteries have emerged as a cornerstone of the renewable energy storage

Get a quote

Lithium Iron Phosphate Battery Market Size, Share & Growth

3 days ago· The global lithium iron phosphate battery market size surpassed USD 17.08 billion in 2025 and is projected to witness a CAGR of over 17.3%, crossing USD 84.23 billion revenue

Get a quote

Top 12 LiFePO4 Battery Manufacturers in the World

The demand for lithium iron phosphate (LiFePO4) batteries has surged in recent years due to their exceptional safety, thermal stability, long lifespan, and eco

Get a quote

Seven bidders compete for Chile''s lithium mining contracts

Among the companies vying for contracts is a consortium formed by French mining firm Eramet, Chilean mining company Quiborax, and state-owned Codelco, according to local

Get a quote

Canadian Solar to deliver 912 MWh battery energy

Canadian Solar (NASDAQ: CSIQ) said the project will utilize its e-STORAGE SolBank 3.0 battery energy storage solution, featuring lithium-iron

Get a quote

Colbún chooses e-Storage for 912 MWh battery

The e-Storage division of PV manufacturer Canadian Solar has landed a 228 MW/912 MWh battery energy storage system (BESS) supply

Get a quote

Top 10 Companies in the Latin America Lithium Iron Phosphate

This analysis highlights the Top 10 Companies in the Latin America Lithium Iron Phosphate Battery Market —the key manufacturers and suppliers enabling the region''s energy

Get a quote

Canadian Solar to deliver 912 MWh battery energy storage

Canadian Solar (NASDAQ: CSIQ) said the project will utilize its e-STORAGE SolBank 3.0 battery energy storage solution, featuring lithium-iron-phosphate battery

Get a quote

Lithium ion energy storage system Portugal

Delong is a well-known lithium battery manufacturer with 13 years of production experience since 2011.We manufacture and support customized solutions for ternary lithium batteries, lithium

Get a quote

Colbún chooses e-Storage for 912 MWh battery project in Chile

The e-Storage division of PV manufacturer Canadian Solar has landed a 228 MW/912 MWh battery energy storage system (BESS) supply deal from Chilean energy

Get a quote

Chile''s Biwo gets green light for 20.6-MW BESS project at home

Chilean clean energy developer Biwo Renovables has received an environmental permit to install a 20.64-MW battery energy storage system (BESS) at a site in the region of

Get a quote

Lion Energy Lithium Power Generators

Lion Energy uses lithium iron phosphate (LiFePO4 or LFP) for most our main solar generators. What does this mean for you? Most lithium-ion batteries found in the market use compounds

Get a quote

Tsingshan plans $233 million lithium-related

China''s Tsingshan Holding Group will invest $233.2 million to set up a plant in Chile to produce lithium iron phosphate (LFP), used to power

Get a quote

Chile Lithium Iron Phosphate Batteries Market (2025-2031)

The Chile market for lithium iron phosphate (LiFePO4) batteries is witnessing significant growth driven by the expanding applications of these batteries in electric vehicles, renewable energy

Get a quote

The Leading Energy Storage Companies

Lithium-ion batteries have long been the gold standard for energy storage, powering everything from electrical devices to electric cars. As the need for batteries continues

Get a quote

German Giant BASF Contemplates Establishment of

In a significant move in October, Tsingshan committed to a substantial investment of $233 million in a lithium iron phosphate plant,

Get a quote

Lithium-rich Chile, already a global renewable energy leader,

Looking ahead, Boric said Chilean state-owned Codelco, currently the world''s largest copper producer, will be tasked with finding the best way forward for a state-owned

Get a quote

Top Lithium Iron Phosphate companies | VentureRadar

Lithium Werks designs, engineers and manufactures lithium iron phosphate batteries ranging from cells to large-scale energy storage systems under the following brands: Lithium Werks;

Get a quote

4 FAQs about [Chilean lithium iron phosphate portable energy storage company]

Does Chile have a lithium industry?

Chile’s government announced plans to take state control over its lithium industry earlier this year. It’s currently negotiating state control over SQM, which has a lithium contract that expires in 2030. In 2019 three companies selected for value-added lithium projects in Chile dropped out of planned investments.

How many jobs will a lithium plant create in Chile?

The plant in northern Chile is expected to be operational in May 2025 and will create 668 jobs when it reaches full capacity, the government of Chile, home to the world’s biggest lithium reserves, said in a statement.

Is boric negotiating a lithium deal in Chile?

It’s currently negotiating state control over SQM, which has a lithium contract that expires in 2030. In 2019 three companies selected for value-added lithium projects in Chile dropped out of planned investments. Boric is on his first visit to China since being elected in 2021.

Where does lithium come from?

And much of that lithium lies in Chile. Already accounting for over 26 percent of current production, a study published in early 2023 by the U.S. Geological Survey states that Chile’s borders contain over 36 percent of the globe’s economically recoverable lithium reserves.

Guess what you want to know

-

Gabon lithium iron phosphate portable energy storage customization

Gabon lithium iron phosphate portable energy storage customization

-

Lithuanian lithium iron phosphate portable energy storage manufacturer

Lithuanian lithium iron phosphate portable energy storage manufacturer

-

Lithium iron phosphate battery 5G energy storage base station

Lithium iron phosphate battery 5G energy storage base station

-

India lithium iron phosphate battery energy storage container

India lithium iron phosphate battery energy storage container

-

Lithium iron phosphate battery container energy storage

Lithium iron phosphate battery container energy storage

-

Hungarian lithium iron phosphate energy storage system

Hungarian lithium iron phosphate energy storage system

-

24v lithium iron phosphate energy storage battery

24v lithium iron phosphate energy storage battery

-

Large capacity and high power energy storage lithium iron phosphate battery

Large capacity and high power energy storage lithium iron phosphate battery

-

The main energy storage voltage of lithium iron phosphate battery

The main energy storage voltage of lithium iron phosphate battery

-

Lithium iron phosphate energy storage cabinet photovoltaic

Lithium iron phosphate energy storage cabinet photovoltaic

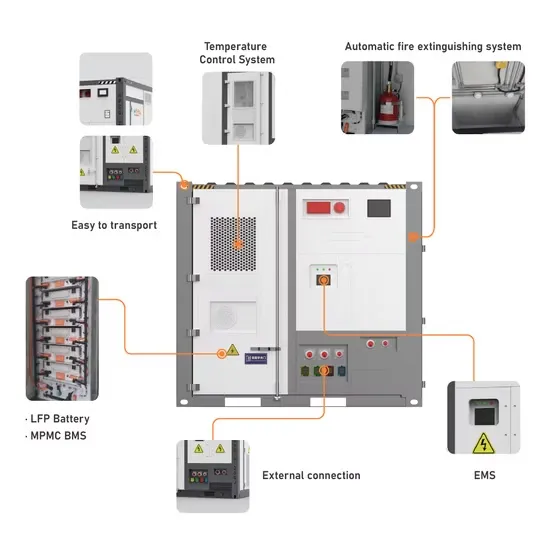

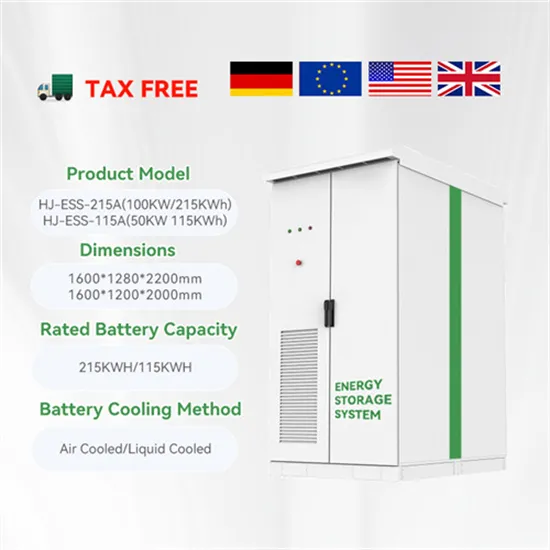

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.