5G regulation and law in Belgium | CMS Expert Guides

Overall, the 5G network appears to be better developed in the northern area of Belgium, in particular in Antwerp, Ghent and coastal cities, as

Get a quote

The Distributed Base Station (DBS) architecture

In this work, the Distributed Base Station (DBS) with Remote Radio Head (RRH) is considered as the envisioned architecture of the 5th Generation (5G)

Get a quote

5G regulation and law in Belgium | CMS Expert Guides

Overall, the 5G network appears to be better developed in the northern area of Belgium, in particular in Antwerp, Ghent and coastal cities, as well as in the periphery of

Get a quote

Enjoy the best 5G network on the go with the larger

Telenet/BASE provides outdoor 5G coverage to 95% of the households in Belgium, according to the measurements conducted in april 2024 on behalf of

Get a quote

The Rollout of 5G in Germany, Belgium, and The Netherlands

The success of 5G in Germany, Belgium, and The Netherlands hinges on a collaborative approach among governments, operators, tower companies, and the public. As

Get a quote

Déploiement de la 5G en Belgique

Les opérateurs déploient progressivement la 5G en Belgique. À ce jour, 87% des ménages bénéficient d''une couverture en extérieur et 68% en intérieur. Une étude montre que

Get a quote

Research and Implementation of 5G Base Station Location

The application requirements of 5G have reached a new height, and the location of base stations is an important factor affecting the signal. Based on factors such as base station

Get a quote

Evaluation and projection of 4G and 5G RAN energy footprints

Energy consumption of mobile cellular communications is mainly due to base stations (BSs) that constitute radio access networks (RANs). 5G technologies are expected to

Get a quote

Multi‐objective interval planning for 5G base station virtual

As an emerging load, 5G base stations belong to typical distributed resources [7]. The in‐depth development of flexi-bility resources for 5G base stations, including their internal energy

Get a quote

5G NR Base Station Classes: Type 1-C, Type 1-H,

Learn about the different classes of 5G NR base stations (BS), including Type 1-C, Type 1-H, Type 1-O, and Type 2-O, and their specifications.

Get a quote

La 5G en Belgique

La carte de la 5G en Belgique reprend l''ensemble des sites pour lesquels des permis 5G ont été accordés. Les communes s''étant positionnées par rapport à la 5G y sont également présentées.

Get a quote

5G base station rollout in the U.S. and China 2021| Statista

The United States (U.S.) and China are both rolling out ** infrastructure at a rapid rate, growing approximately *** times in size from 2019 to 2021.

Get a quote

Recent Developments in 5G Base Station Engineering –

Belgium has adopted an agile approach toward 5G base stations, with operators like Proximus, Orange Belgium, and Telenet spearheading advancements. The key innovation

Get a quote

Enjoy the best 5G network on the go with the larger range | BASE

Telenet/BASE provides outdoor 5G coverage to 95% of the households in Belgium, according to the measurements conducted in april 2024 on behalf of the BIPT (Belgian Institute for Postal

Get a quote

5G in Belgium: what do we need now to move forward?

In this session, we heard four user stories. Johnson & Johnson turned one of its sites into a 5G lab, BASF and Securitas are part of the 5G pilot projects, and imec has finalised (together with

Get a quote

Optimal positioning of 5G base stations in different cellular

In this paper, a highly adaptive multi-objective optimization framework is proposed for the optimal positioning of 5G base stations in different cellular networks, such as Urban

Get a quote

Prediction of Optimal Locations for 5G Base Stations in Urban

Deploying 5G networks in urban areas is crucial for meeting the increasing demand for high-speed, low-latency wireless communications. However, the complex

Get a quote

What is happening in Belgium?

Belgium has around 9,400 towers, a big part of which are held in a joint venture by two of the country''s MNOs – Orange Belgium and Proximus. The Brussels-based MWingz was set up in

Get a quote

Distribution network restoration supply method considers 5G base

This paper proposes a distribution network fault emergency power supply recovery strategy based on 5G base station energy storage. This strategy introduces Theil''s entropy

Get a quote

5G in Belgium | Complete Guide and Comparison with 4G

Find out all about 5G in Belgium: how it works, how it differs from 4G, coverage, speeds and tips for choosing the best package. Complete, up-to-date guide.

Get a quote

Load Forecasting of 5G Base Station in Urban Distribution Network

5G is the abbreviation of the 5th generation mobile communication technology. China is one of the earliest countries in the world to implement 5G commercially. The application of 5G network

Get a quote

5G roll-out in Belgium: network mapping and quality

BIPT has published 5G coverage maps showing the progress made by operators and highlighting the role of 5G in offsetting the saturation of 4G networks. Operators are

Get a quote

Janvier 2025 : où en sont les réseaux 5G en Belgique

La plupart des sites sont ce que l''on appelle de la 5G « light », mais le nombre de sites proposant la 5G complète progresse dans les villes. Attention, il s''agit ici d''une carte de

Get a quote

6 FAQs about [Distribution of 5G base station sites in Belgium]

Où se trouve la 5G en Belgique ?

Le sud de la province de Namur et la Province du Luxembourg restent toujours à l’arrière-plan du déploiement, contrairement au Brabant Wallon, au Hainaut et à la Province de Liège. Entre Bruxelles et Namur, le signal 5G est désormais quasi constant. Idem en province de Liège, où la 5G s’affiche dans la plupart des villes et des villages.

Quels sont les avantages de la 5G en Belgique ?

Les opérateurs déploient progressivement la 5G en Belgique. À ce jour, 87% des ménages bénéficient d’une couverture en extérieur et 68% en intérieur. Une étude montre que les performances réseau ont été améliorées, offrant des débits de téléchargement et de chargement plus élevés.

Quelle est la dernière région belge à autoriser le déploiement de la 5G ?

Bruxelles a d’aillleurs été la dernière région belge à autoriser le déploiement de la 5G, il y a à peine plus d’un an. L’occasion pour nous de comparer les efforts accomplis par les trois principaux opérateurs mobiles. Pourquoi pas quatre ? Parce que, à ce jour, Citymesh/Digi n’a pas encore communiqué sur ce déploiement. Première impression ?

Quelle est la densité de la couverture 5G en Flandre et en Wallonie ?

La couverture 5G affiche une belle densité tant en Flandre qu’en Wallonie, en dehors du sud Luxembourg (et encore). La plupart des sites sont ce que l’on appelle de la 5G « light », mais le nombre de sites proposant la 5G complète progresse dans les villes. Attention, il s’agit ici d’une carte de couverture en extérieur.

Comment les communes sont-elles positionnées par rapport à la 5G ?

La carte présente les communes qui se sont positionnées par rapport à la 5G. Elle est basée sur les données présentes dans OpenStreetMap. Cette carte est une initiative de Technopolice Belgique avec la contribution de Territoire sans 5G pour le positionnement des communes. Elle fait partie d'une carte plus générale sur le contrôle social.

Quelle est la différence entre la 3G et la 5G en Belgique ?

La Belgique aime prendre son temps, mais la 5G a pris sa vitesse de croisière dans le Royaume ! Entre 5G light et full, la couverture s’étend à mesure que la 3G disparaît. Telenet/BASE garde une longueur d’avance, mais le vrai bilan se fera quand la 5G aura atteint son plein potentiel. On fait le point.

Guess what you want to know

-

Communication 5G base station equipment distribution

Communication 5G base station equipment distribution

-

5G base station site distribution in Guyana

5G base station site distribution in Guyana

-

Panama 5G base station distribution box supplier

Panama 5G base station distribution box supplier

-

Distribution of 5G communication base station inverters in Tanzania

Distribution of 5G communication base station inverters in Tanzania

-

5G base station distribution of Croatian hybrid energy network

5G base station distribution of Croatian hybrid energy network

-

Albania distribution box 5g base station

Albania distribution box 5g base station

-

Yemen 5g base station power distribution photovoltaic bidding company

Yemen 5g base station power distribution photovoltaic bidding company

-

Does Ireland s 5G base station use lithium batteries

Does Ireland s 5G base station use lithium batteries

-

Honduras 5G Communication Tower Base Station Project

Honduras 5G Communication Tower Base Station Project

-

Nanya 5G communication base station inverter grid connection solution

Nanya 5G communication base station inverter grid connection solution

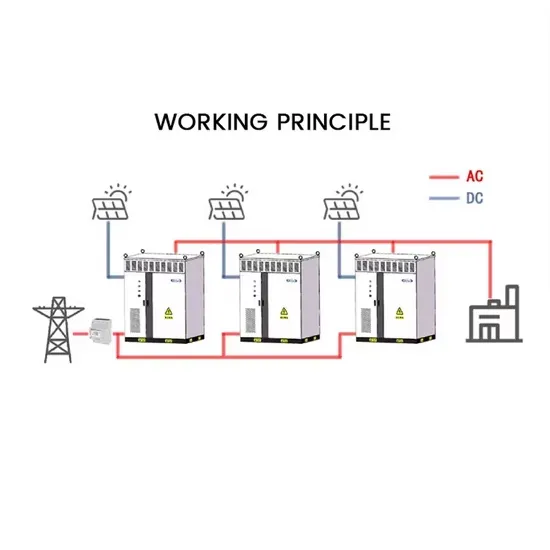

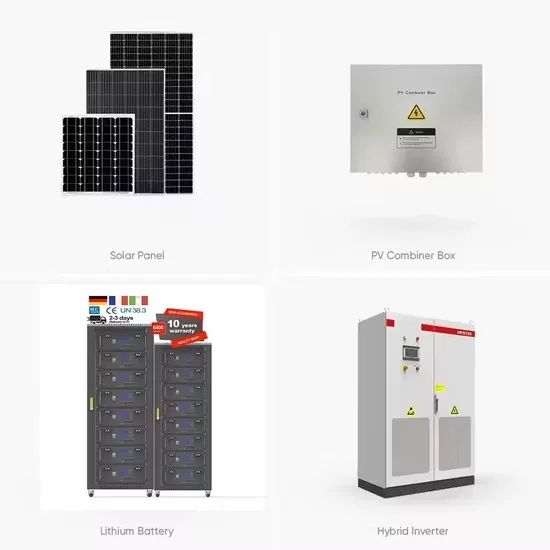

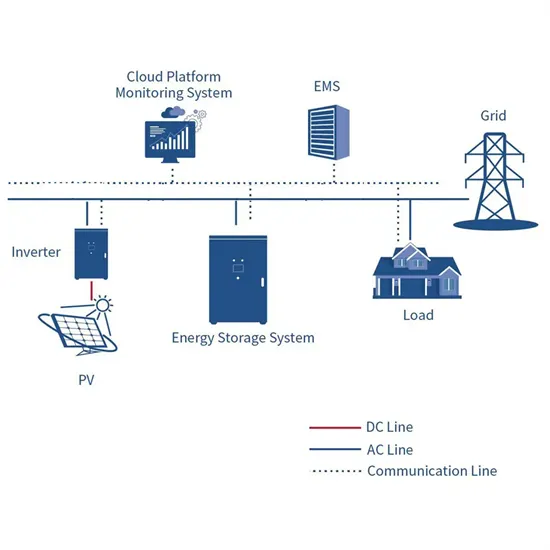

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing unprecedented growth, with demand increasing by over 350% in the past three years. Energy storage cabinets and lithium battery solutions now account for approximately 40% of all new commercial energy installations worldwide. North America leads with a 38% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 25-30%. Europe follows with a 32% market share, where standardized energy storage cabinet designs have cut installation timelines by 55% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 45% CAGR, with manufacturing innovations reducing system prices by 18% annually. Emerging markets are adopting commercial energy storage for peak shaving and energy cost reduction, with typical payback periods of 3-5 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $450/kWh for complete energy solutions.

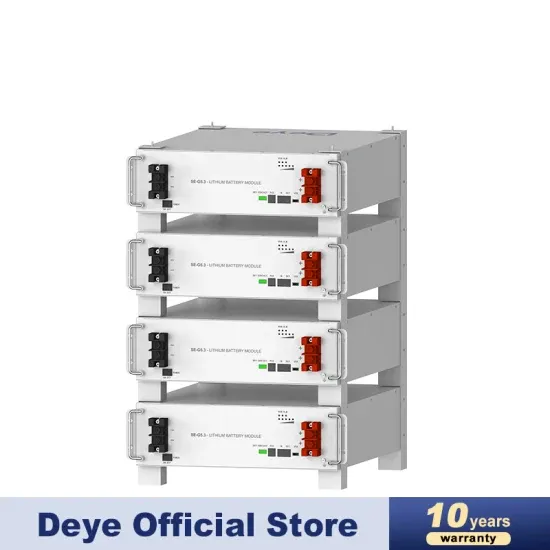

Energy Storage Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving energy storage cabinet and lithium battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 45% less energy loss, extending battery lifespan to 18+ years. Standardized plug-and-play designs have reduced installation costs from $900/kW to $500/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 35% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 25% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $400/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-6 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $22,000 and premium systems (200-500kWh) from $90,000, with flexible financing options available for businesses.